Largest US credit union leaked potentially sensitive information – TechRadar

Published on: 2025-09-03

Intelligence Report: Largest US credit union leaked potentially sensitive information – TechRadar

1. BLUF (Bottom Line Up Front)

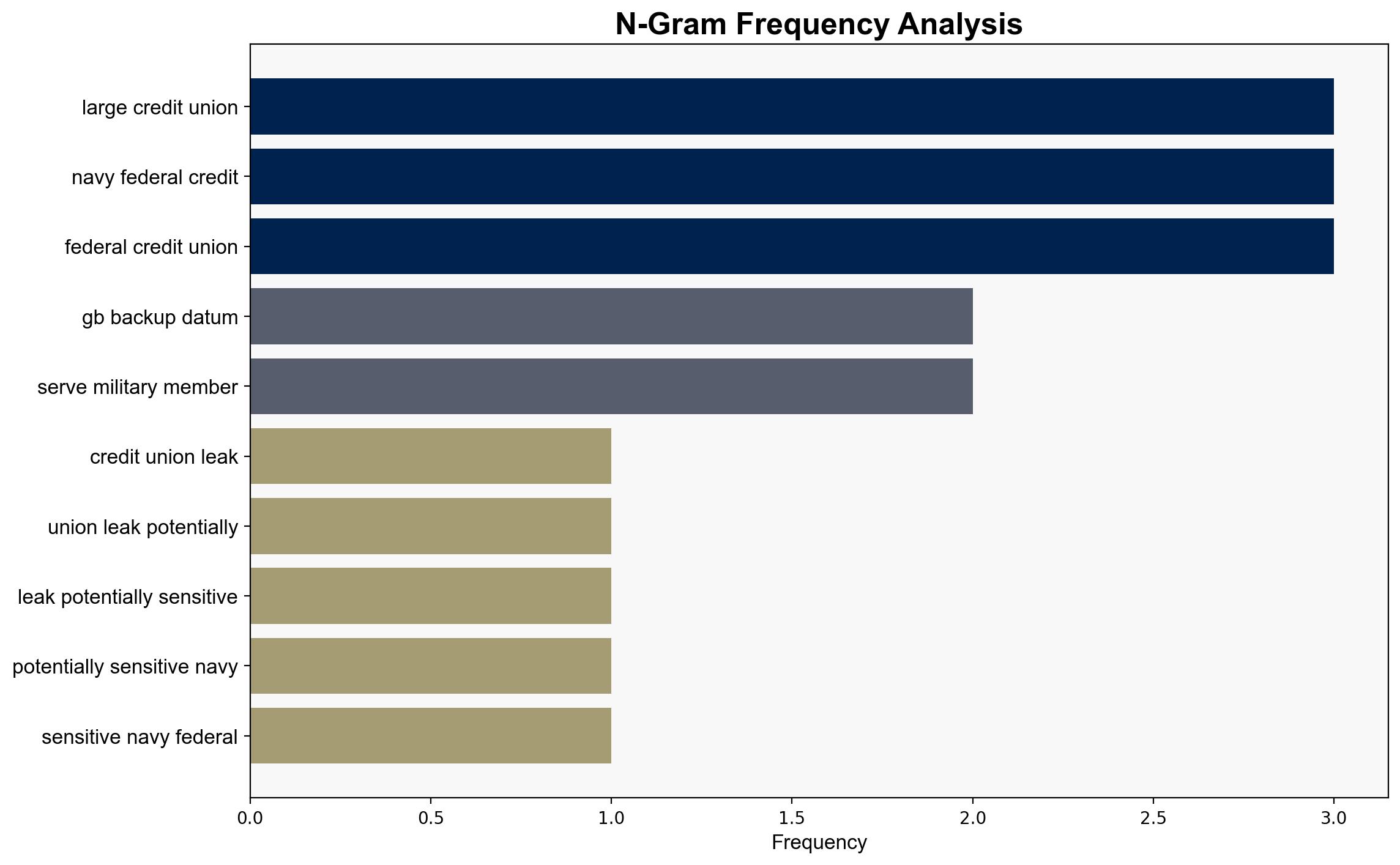

The most supported hypothesis is that the data leak at Navy Federal Credit Union (NFCU) was due to internal mismanagement rather than a deliberate external attack. This conclusion is drawn with moderate confidence based on the evidence of unsecured backup data. Immediate action should focus on enhancing internal cybersecurity protocols and conducting a comprehensive audit of data management practices.

2. Competing Hypotheses

1. **Internal Mismanagement Hypothesis**: The data leak resulted from inadequate internal cybersecurity practices and oversight, leading to unsecured backup data being exposed on the internet.

2. **External Compromise Hypothesis**: The data leak was a result of a targeted cyber attack by external actors who exploited vulnerabilities in NFCU’s systems to gain access to sensitive information.

Using ACH 2.0, the internal mismanagement hypothesis is better supported. Evidence includes the lack of encryption and password protection on the backup data, suggesting negligence rather than sophisticated intrusion techniques typically associated with external attacks.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that NFCU’s cybersecurity protocols were not robust enough to prevent such exposure. It is also assumed that external actors did not exploit the data before it was secured.

– **Red Flags**: The duration for which the data was exposed remains unknown, raising concerns about potential data exploitation. The lack of detailed information on whether any unauthorized access occurred is a significant blind spot.

4. Implications and Strategic Risks

The exposure of sensitive data poses risks of identity theft, financial fraud, and targeted phishing attacks against NFCU members. If exploited, this could lead to a loss of trust in NFCU, potential financial losses, and regulatory scrutiny. The incident highlights vulnerabilities in data management practices that could be exploited in future cyber operations.

5. Recommendations and Outlook

- Conduct a thorough audit of current data management and cybersecurity protocols to identify and rectify vulnerabilities.

- Implement advanced encryption and access control measures for all sensitive data.

- Enhance employee training on cybersecurity awareness to prevent future incidents.

- Scenario Projections:

- Best Case: Rapid implementation of security measures prevents any data misuse, restoring trust and preventing financial loss.

- Worst Case: Data is exploited, leading to widespread identity theft and significant financial and reputational damage to NFCU.

- Most Likely: Some data misuse occurs, but swift action mitigates major impacts, leading to moderate reputational damage.

6. Key Individuals and Entities

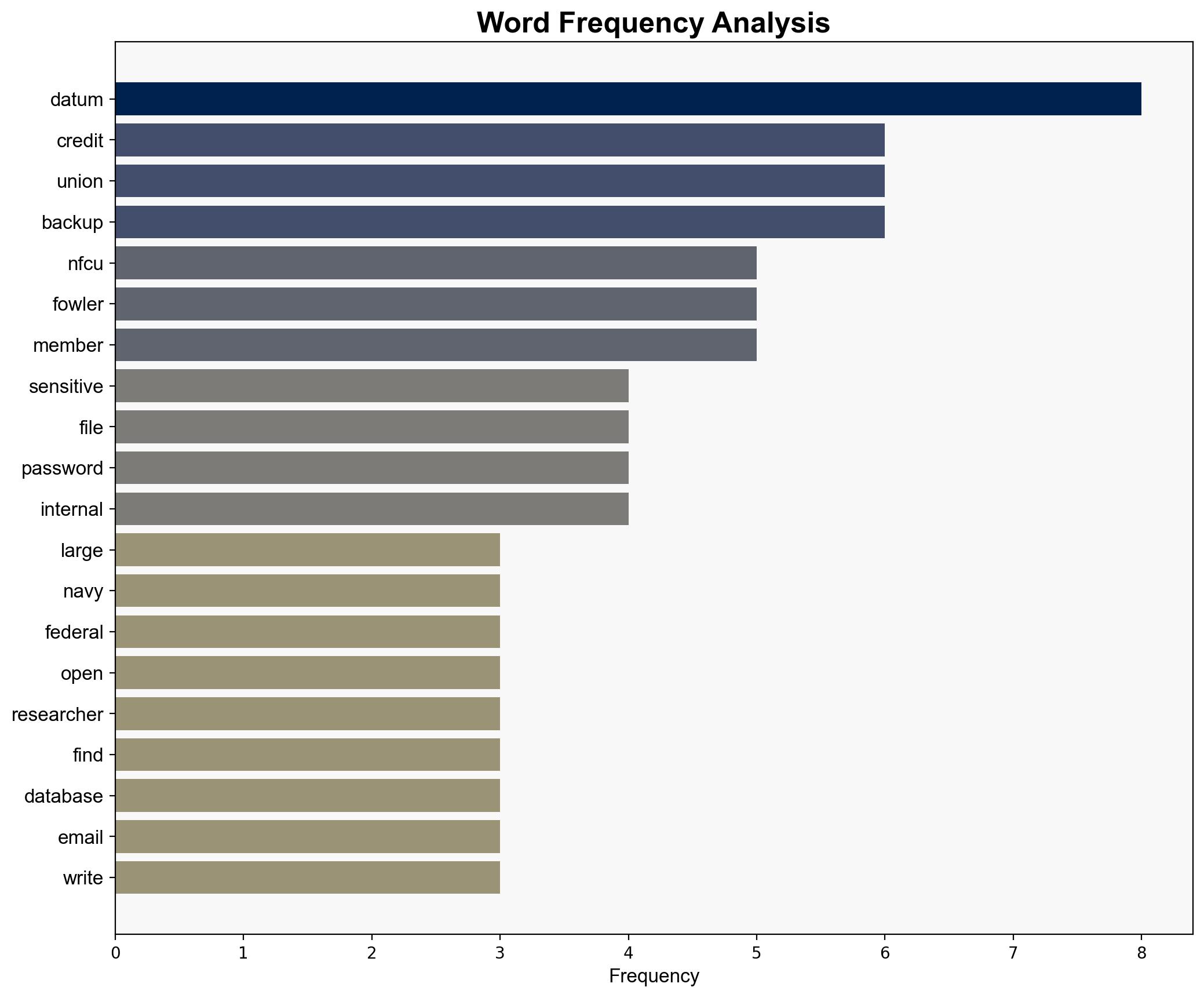

– Jeremiah Fowler, cybersecurity researcher who discovered the data exposure.

– Navy Federal Credit Union (NFCU), the entity responsible for the data management.

7. Thematic Tags

national security threats, cybersecurity, data breach, financial sector, internal security