Lenskart IPO opens today at Rs 382-402 price band – BusinessLine

Published on: 2025-10-31

Intelligence Report: Lenskart IPO opens today at Rs 382-402 price band – BusinessLine

1. BLUF (Bottom Line Up Front)

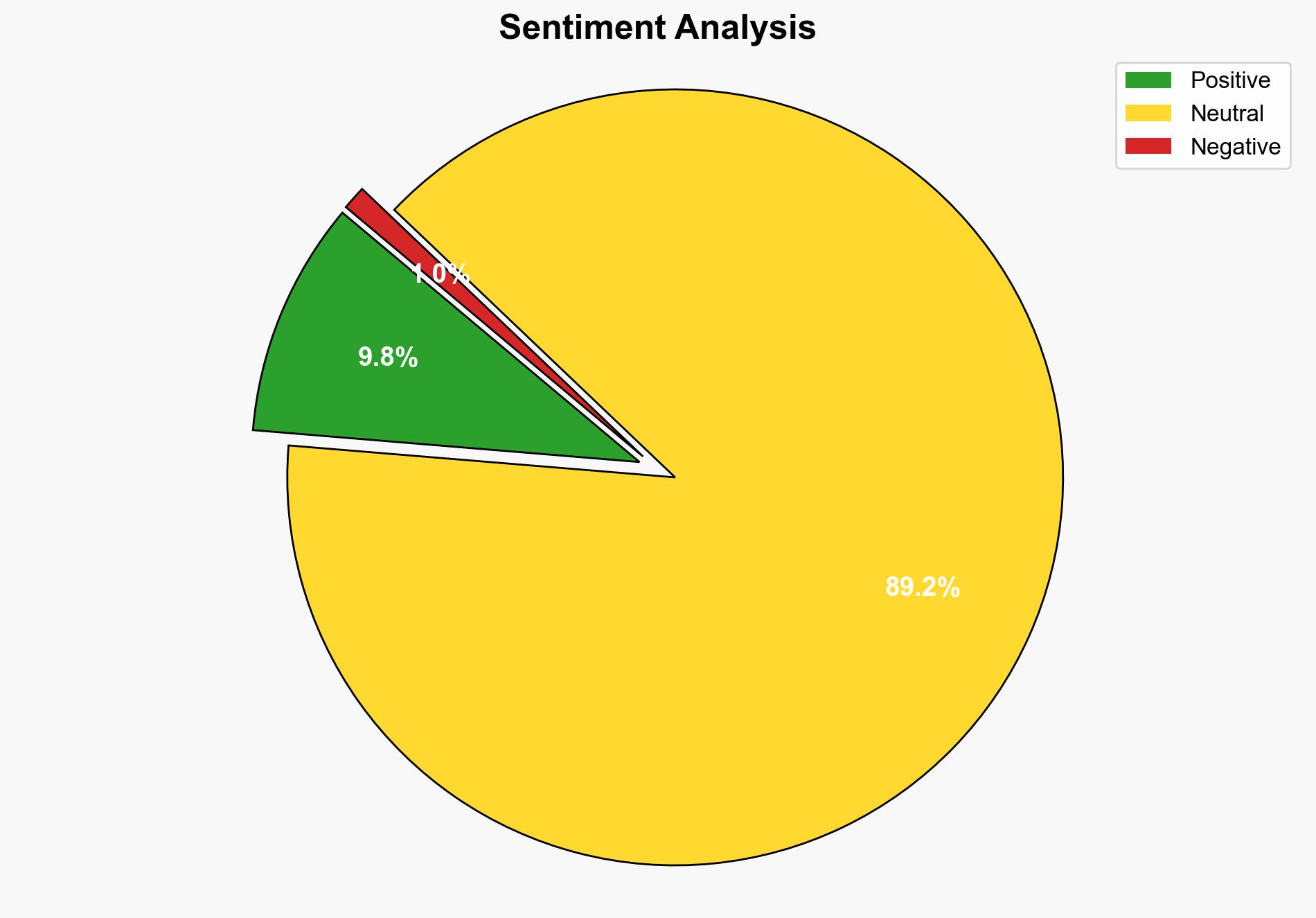

The Lenskart IPO is strategically positioned to leverage its market presence and attract significant investment from both domestic and international investors. The most supported hypothesis suggests a successful IPO driven by strong institutional backing and strategic use of proceeds. Confidence Level: Moderate. Recommended Action: Monitor post-IPO performance and investor sentiment to assess long-term viability.

2. Competing Hypotheses

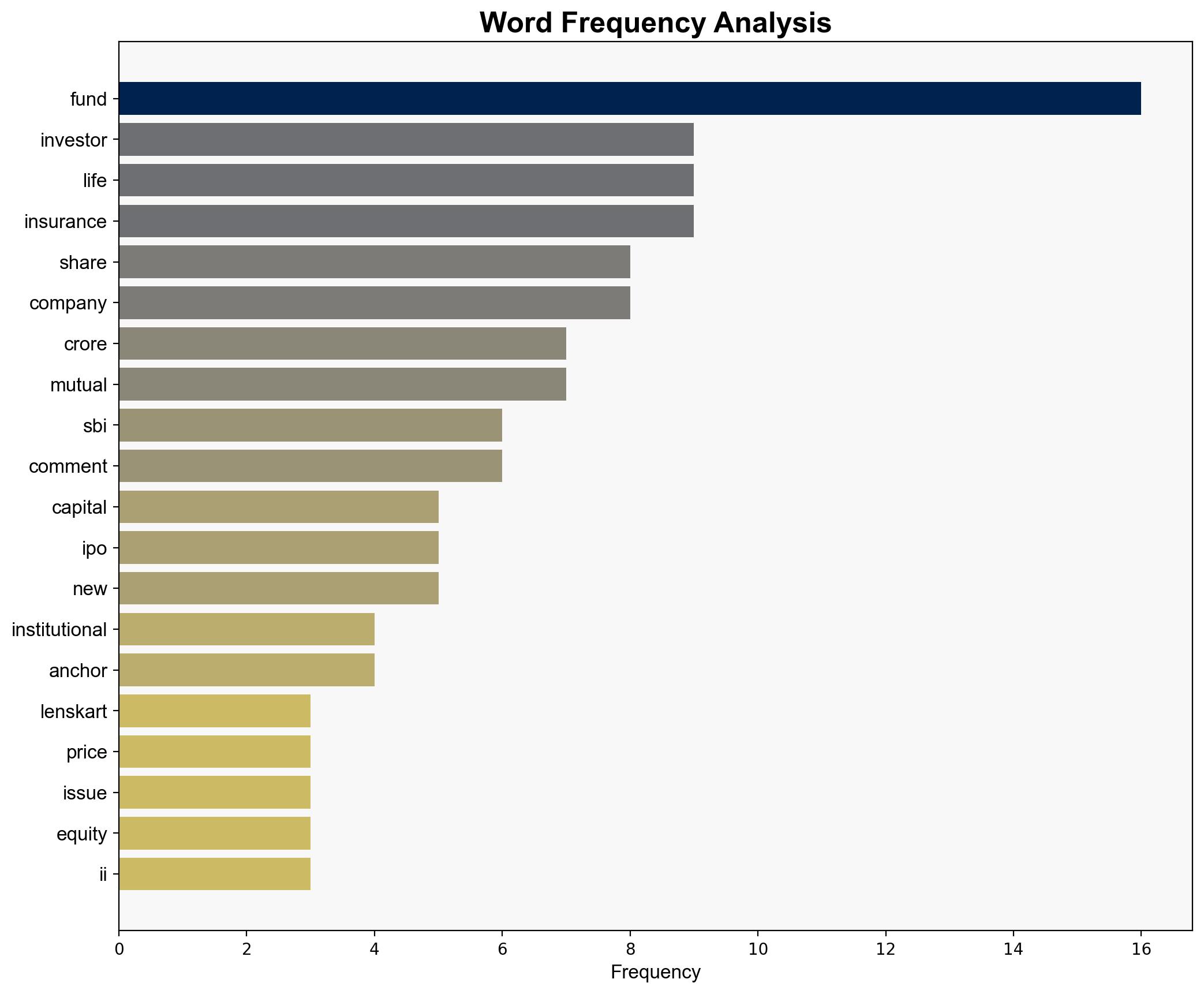

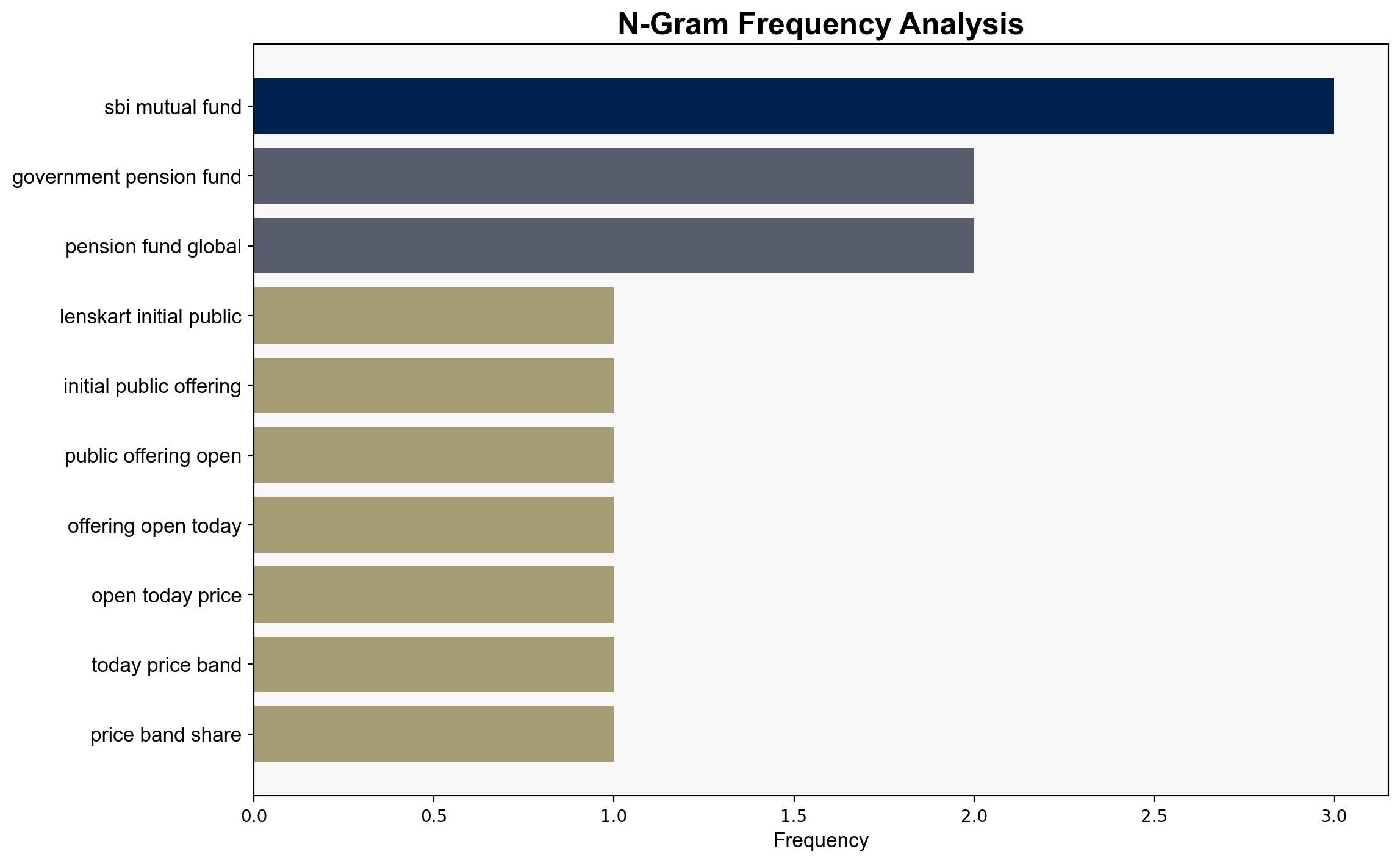

Hypothesis 1: The Lenskart IPO will be successful due to strong institutional investor interest and strategic allocation of proceeds towards growth initiatives.

– Supported by the participation of prominent domestic and international investors.

– Strategic use of funds for expansion and technology investment suggests growth potential.

Hypothesis 2: The IPO may face challenges due to market volatility and potential overvaluation concerns.

– Market conditions and valuation metrics could deter some investors.

– The presence of significant pre-IPO investments might indicate a peak valuation.

Using ACH 2.0, Hypothesis 1 is better supported due to the breadth of institutional support and clear strategic plans for the use of proceeds.

3. Key Assumptions and Red Flags

– Assumption: Institutional backing equates to IPO success.

– Red Flag: Potential overvaluation could lead to post-IPO price corrections.

– Blind Spot: Lack of detailed competitor analysis and market conditions.

– Cognitive Bias: Confirmation bias towards positive investor sentiment.

4. Implications and Strategic Risks

– Economic: Successful IPO could enhance Lenskart’s market position and influence in the eyewear sector.

– Geopolitical: International investor participation indicates global confidence in the Indian market.

– Psychological: Investor sentiment post-IPO will be crucial; negative performance could impact future fundraising.

5. Recommendations and Outlook

- Monitor market reactions and investor sentiment closely post-IPO.

- Scenario Projections:

- Best Case: Strong post-IPO performance leading to increased market share and growth.

- Worst Case: Market correction due to overvaluation concerns, impacting investor confidence.

- Most Likely: Moderate success with steady growth, contingent on effective use of proceeds.

6. Key Individuals and Entities

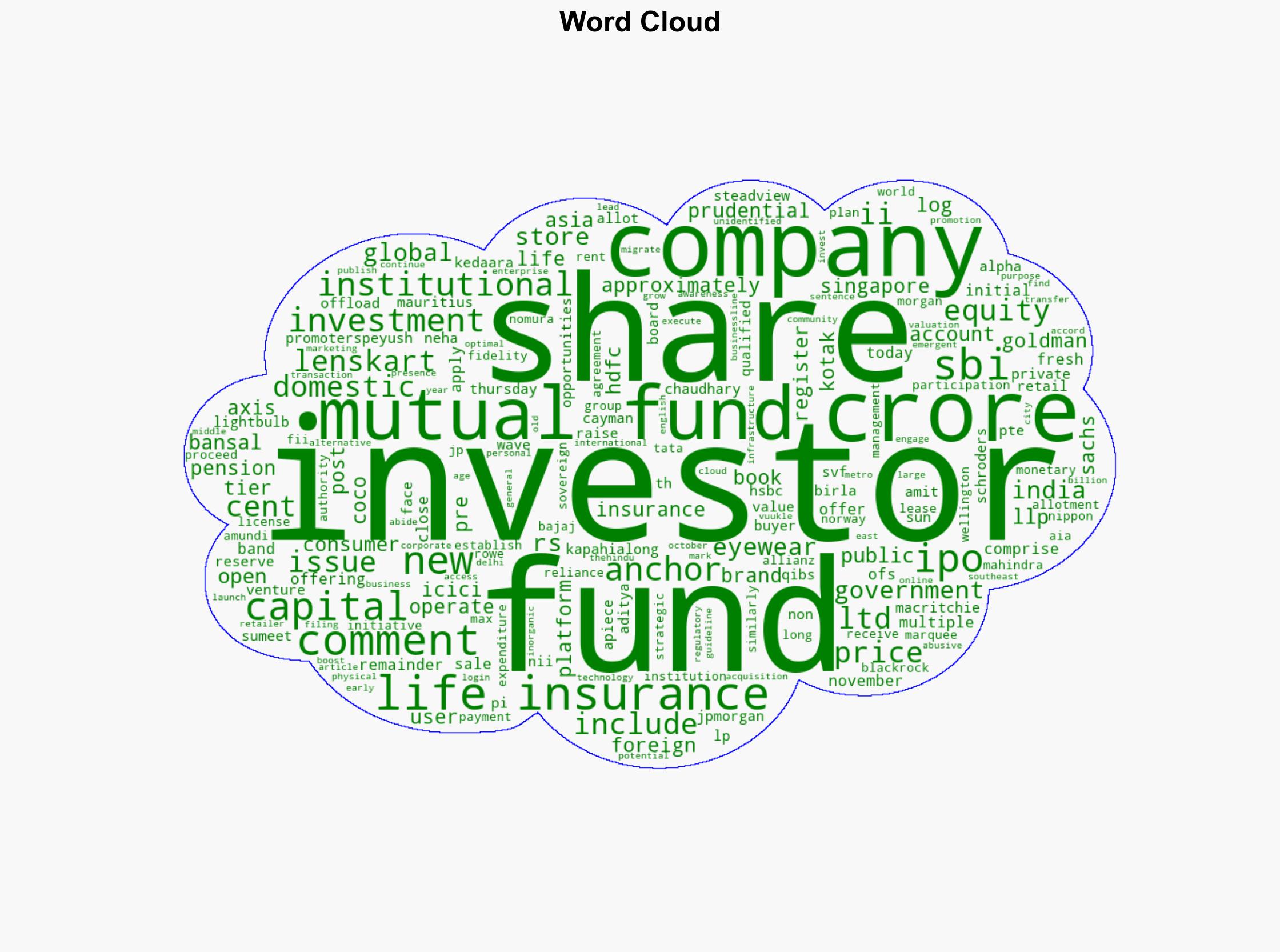

– Piyush Bansal, Neha Bansal, Amit Chaudhary, Sumeet Kapahi

– Prominent investors: SBI Mutual Fund, HDFC Mutual Fund, ICICI Prudential, Goldman Sachs, JP Morgan

7. Thematic Tags

economic growth, market analysis, investor sentiment, strategic investment