Luxury Yacht-maker AzimutBenetti Posts Record Sales – WWD

Published on: 2025-09-03

Intelligence Report: Luxury Yacht-maker AzimutBenetti Posts Record Sales – WWD

1. BLUF (Bottom Line Up Front)

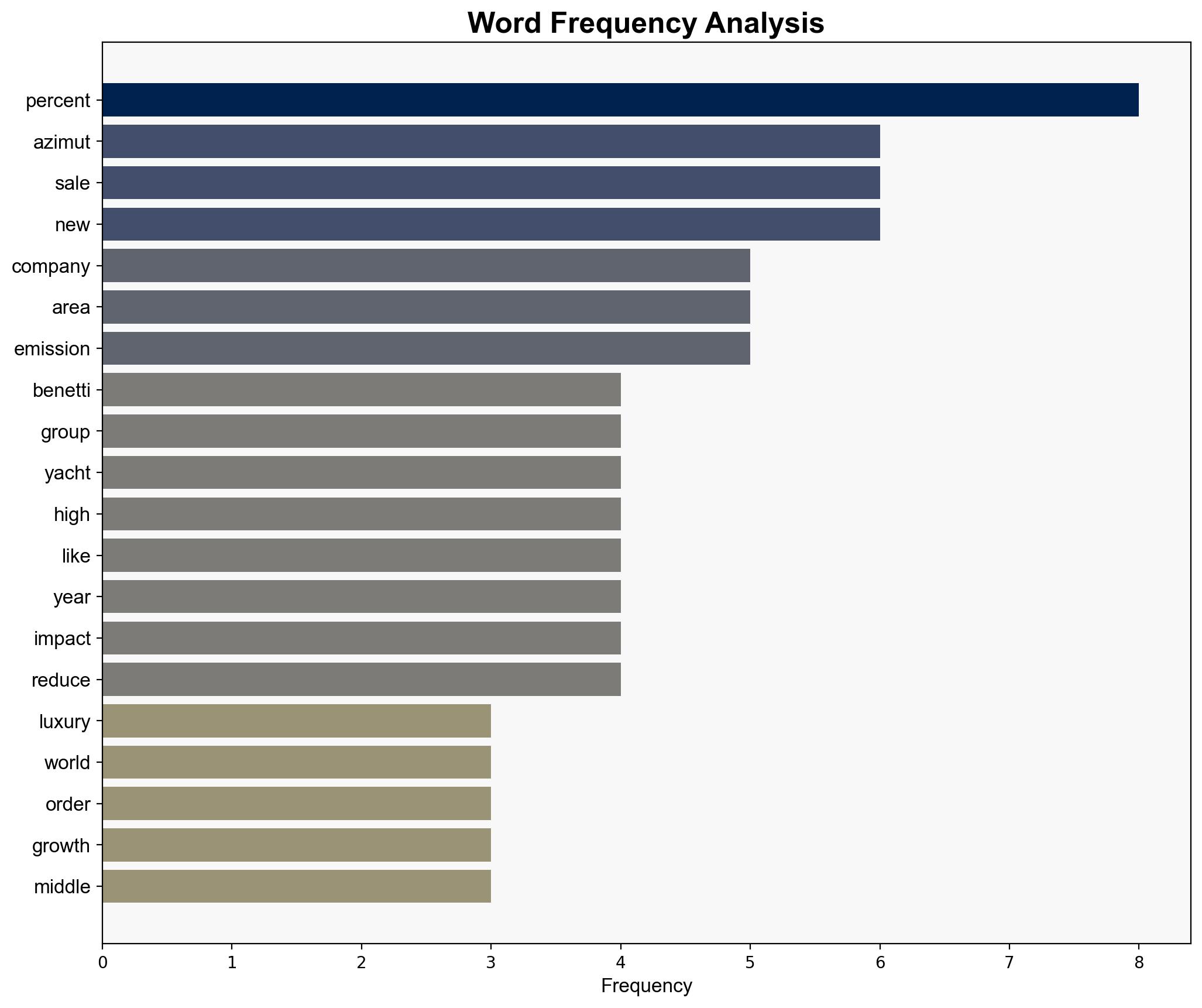

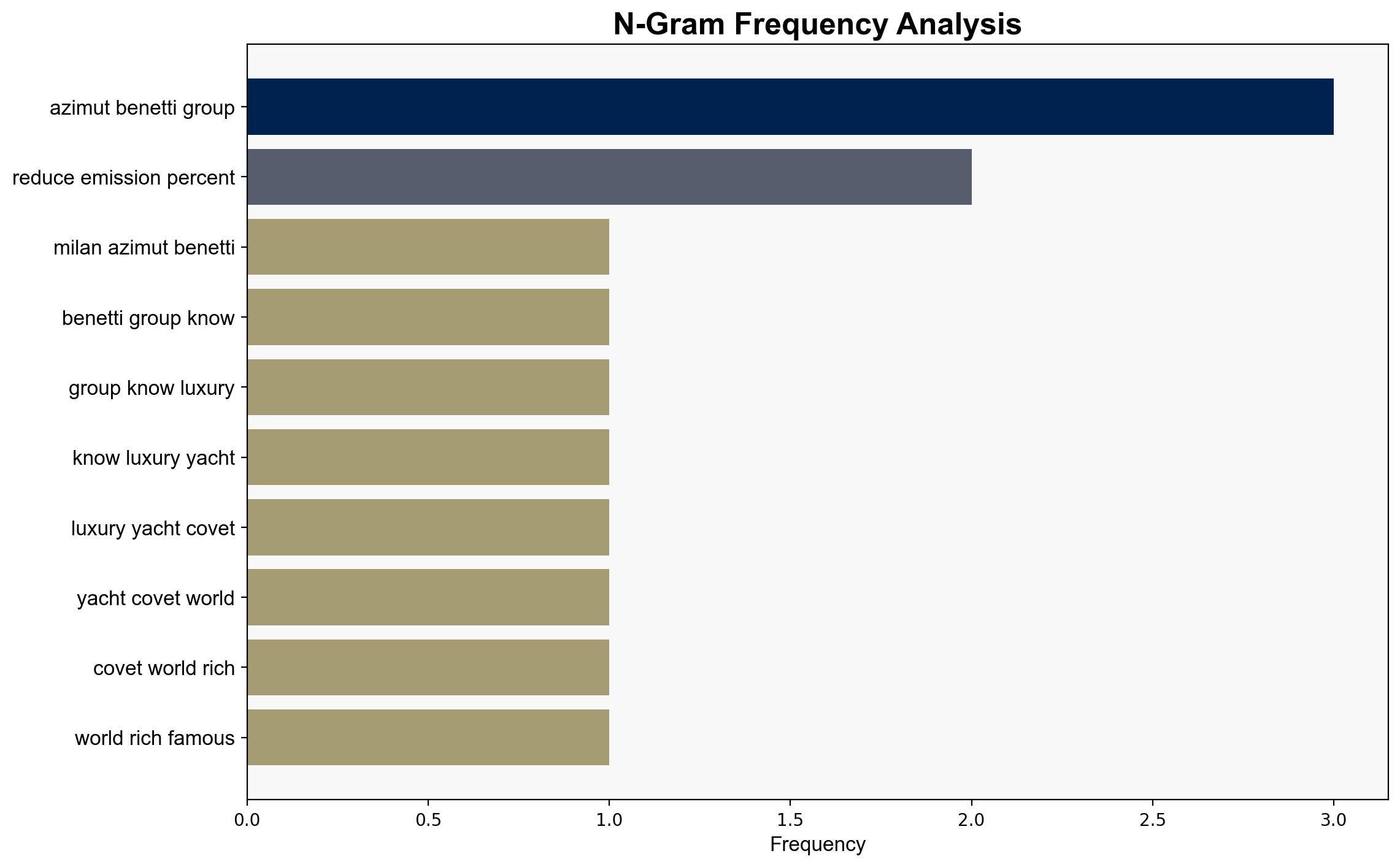

AzimutBenetti’s record sales are primarily driven by increased demand from Middle Eastern markets, with strategic expansion into Asia-Pacific regions. The most supported hypothesis suggests that geopolitical and economic factors, including regional wealth growth and strategic market penetration, are key drivers. Confidence level: Moderate. Recommended action: Monitor geopolitical shifts and trade policies impacting luxury goods markets.

2. Competing Hypotheses

1. **Hypothesis A**: AzimutBenetti’s sales surge is predominantly due to increased demand from Middle Eastern countries, driven by regional economic growth and wealth concentration.

2. **Hypothesis B**: The sales increase is largely due to AzimutBenetti’s strategic expansion into Asia-Pacific markets, leveraging local partnerships and dealer networks.

Using ACH 2.0, Hypothesis A is better supported by the evidence of rapid growth in Middle Eastern nations and the company’s forecast aligning with this trend. Hypothesis B is plausible but less supported by the current distribution of sales and order logs.

3. Key Assumptions and Red Flags

– **Assumptions**: Economic stability in Middle Eastern and Asia-Pacific regions will continue to drive luxury yacht demand. Tariffs and trade policies will not significantly disrupt sales.

– **Red Flags**: Potential over-reliance on Middle Eastern markets could expose the company to geopolitical risks. The impact of tariffs and trade policies remains uncertain, posing a risk to future sales.

4. Implications and Strategic Risks

– **Economic**: Continued economic growth in target regions could sustain demand, but economic downturns or policy changes could rapidly alter market dynamics.

– **Geopolitical**: Political instability or conflict in the Middle East could disrupt sales. Trade tensions, particularly involving tariffs, may impact profitability.

– **Technological**: Innovations in yacht technology, such as low-emission systems, could provide a competitive edge but require ongoing investment.

5. Recommendations and Outlook

- **Mitigate Risks**: Diversify market presence to reduce reliance on specific regions. Monitor geopolitical developments closely.

- **Exploit Opportunities**: Strengthen partnerships in Asia-Pacific to capitalize on emerging markets.

- **Scenario Projections**:

– **Best Case**: Continued growth in Middle Eastern and Asia-Pacific markets, leading to sustained sales increases.

– **Worst Case**: Geopolitical instability or economic downturns in key regions significantly impact sales.

– **Most Likely**: Moderate growth with potential fluctuations due to geopolitical and economic factors.

6. Key Individuals and Entities

– Paolo Vitelli, founder of Azimut.

– Giovanna Vitelli, chairman of the group.

– Saudi Arabian Public Investment Fund, minority shareholder.

– Italy’s Tamburi Investment Partner, minority shareholder.

7. Thematic Tags

geopolitical risks, luxury goods market, economic growth, regional expansion