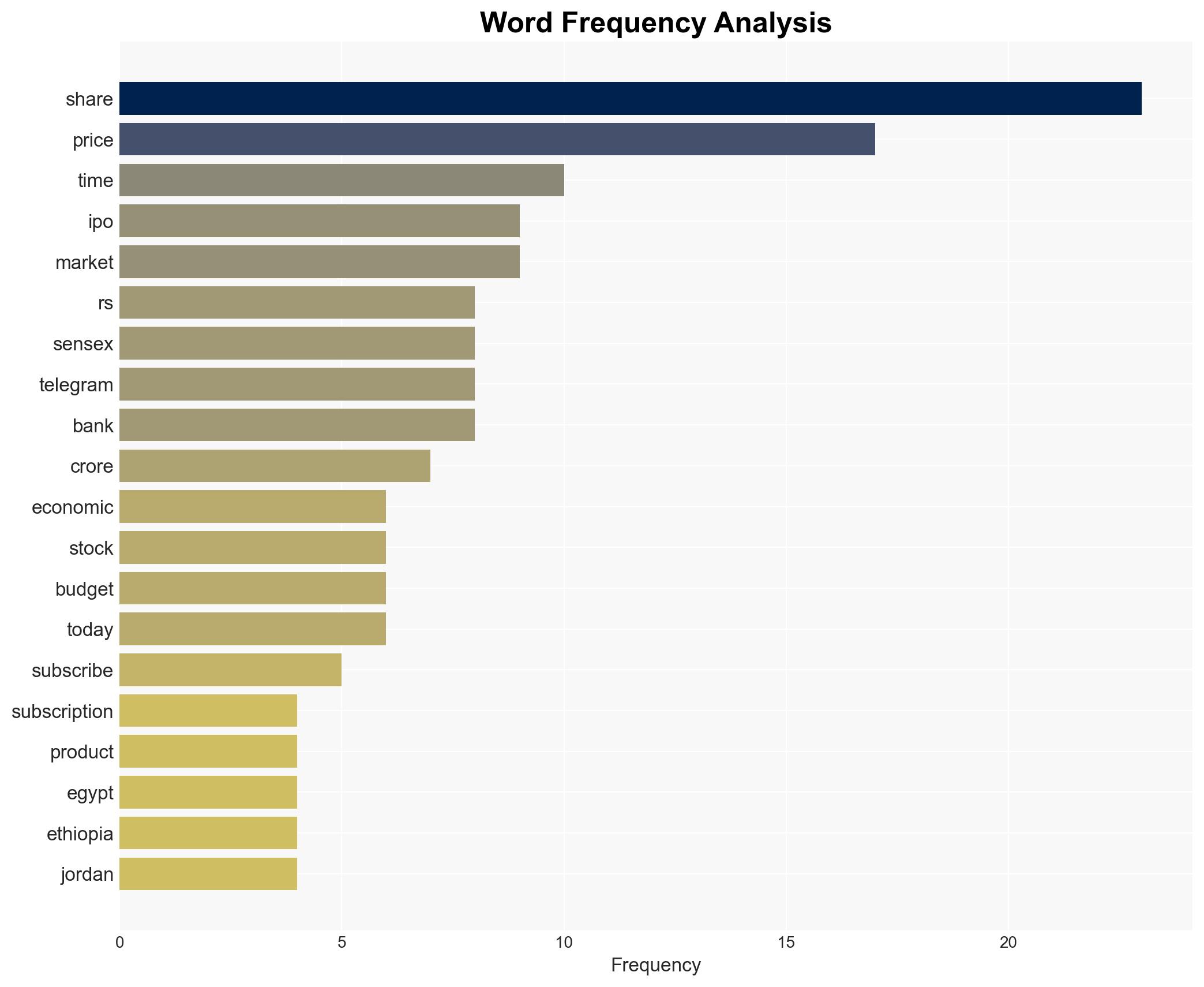

Mahamaya Lifesciences IPO listing today Check GMP ahead of debut – The Times of India

Published on: 2025-11-18

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Mahamaya Lifesciences IPO Analysis

1. BLUF (Bottom Line Up Front)

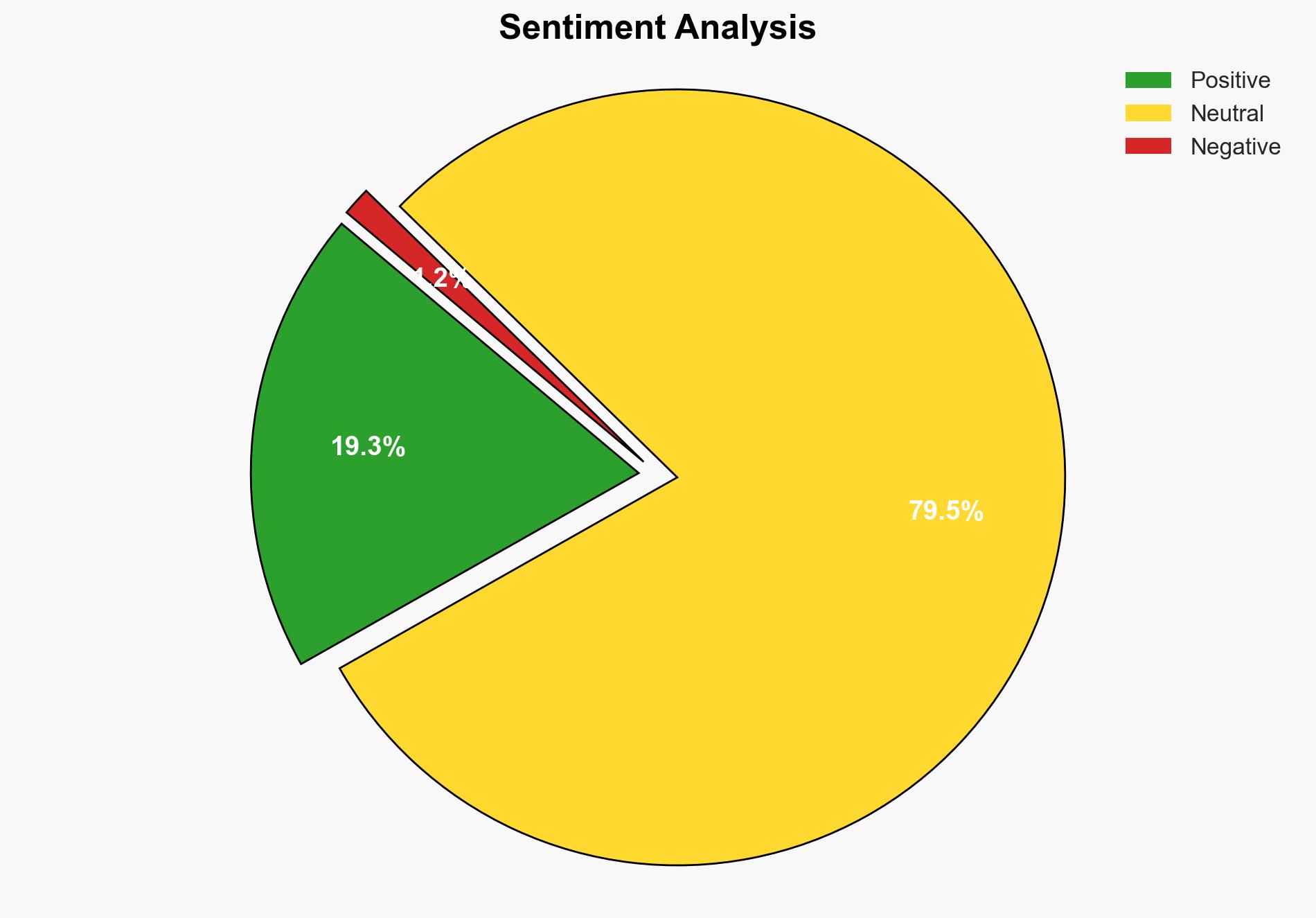

The Mahamaya Lifesciences IPO is expected to have a flat to moderately positive debut, reflecting cautious investor sentiment in the agrochemical sector. The most supported hypothesis is that the IPO’s modest subscription levels are due to sectoral challenges and high minimum investment thresholds. Confidence level: Moderate. Recommended action: Monitor post-listing performance and sectoral trends for potential investment opportunities.

2. Competing Hypotheses

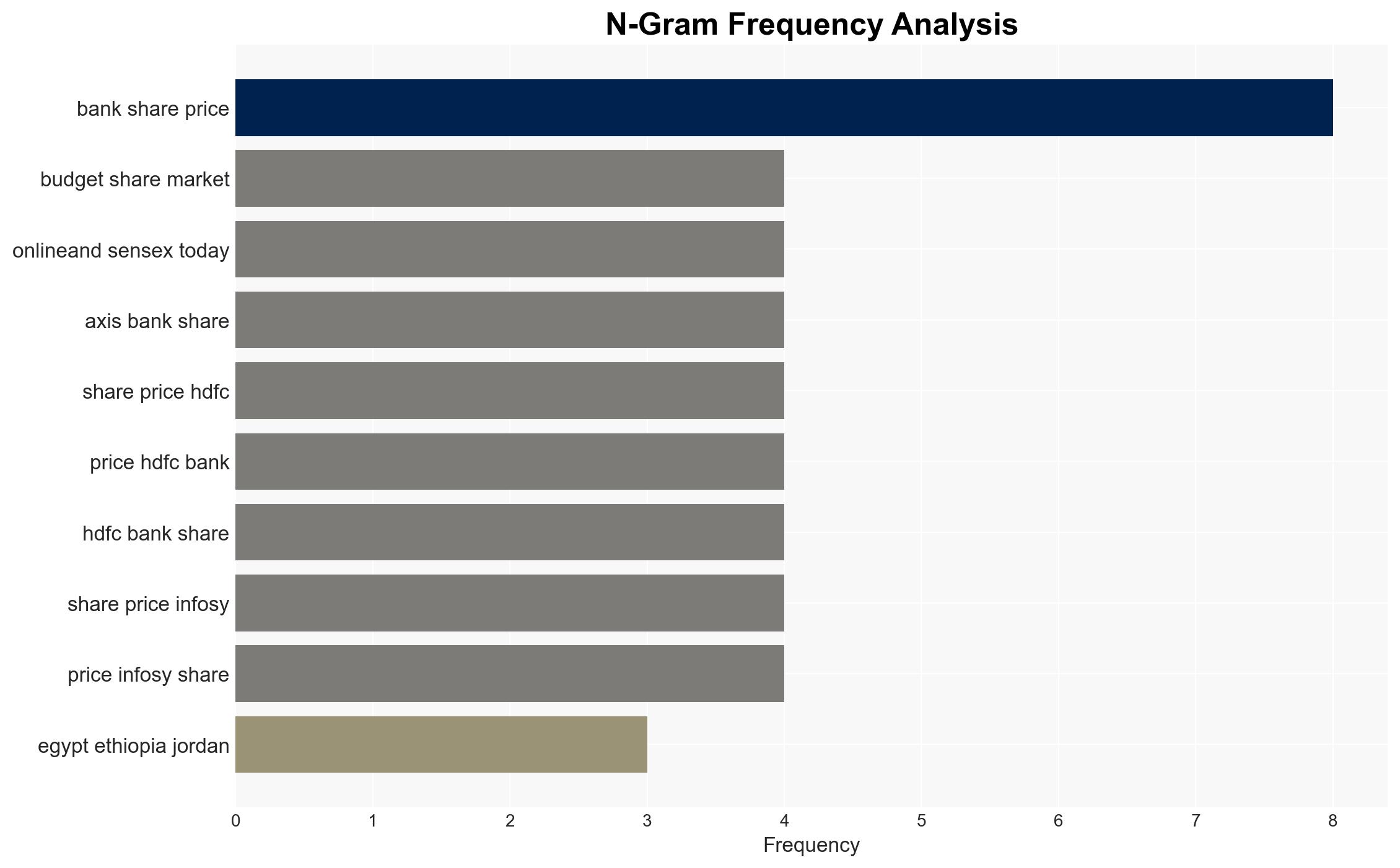

Hypothesis 1: The modest subscription levels are primarily due to sector-specific challenges, such as monsoon variability and input cost pressures, which have led to cautious investor sentiment.

Hypothesis 2: The high minimum investment size has limited participation from retail investors, resulting in lower overall subscription levels, despite potential interest in the company’s growth prospects.

Hypothesis 1 is more likely due to broader sectoral challenges impacting investor sentiment, as evidenced by recent uneven performance in the agrochemical sector.

3. Key Assumptions and Red Flags

Assumptions: The agrochemical sector’s challenges will persist in the short term. The company’s growth projections are accurate and achievable.

Red Flags: Over-reliance on sectoral performance without considering company-specific strengths. Potential overestimation of retail investor interest due to high investment thresholds.

4. Implications and Strategic Risks

The IPO’s performance could impact investor confidence in the agrochemical sector, potentially leading to reduced capital inflows. If the company fails to execute its growth plans, it could face financial strain, affecting its market position and investor returns. Additionally, geopolitical risks in countries where Mahamaya Lifesciences operates could impact its international sales and revenue.

5. Recommendations and Outlook

- Monitor the company’s execution of its growth plans, particularly the establishment of the new manufacturing plant.

- Assess the impact of sectoral challenges on the company’s financial performance and adjust investment strategies accordingly.

- Best-case scenario: Successful execution of growth plans leads to increased investor confidence and stock appreciation.

- Worst-case scenario: Continued sectoral challenges and poor execution result in financial underperformance and stock depreciation.

- Most-likely scenario: Moderate performance with potential for growth if sectoral conditions improve.

6. Key Individuals and Entities

No specific individuals are highlighted in the source text. Key entity: Mahamaya Lifesciences, an agrochemical company with a global footprint.

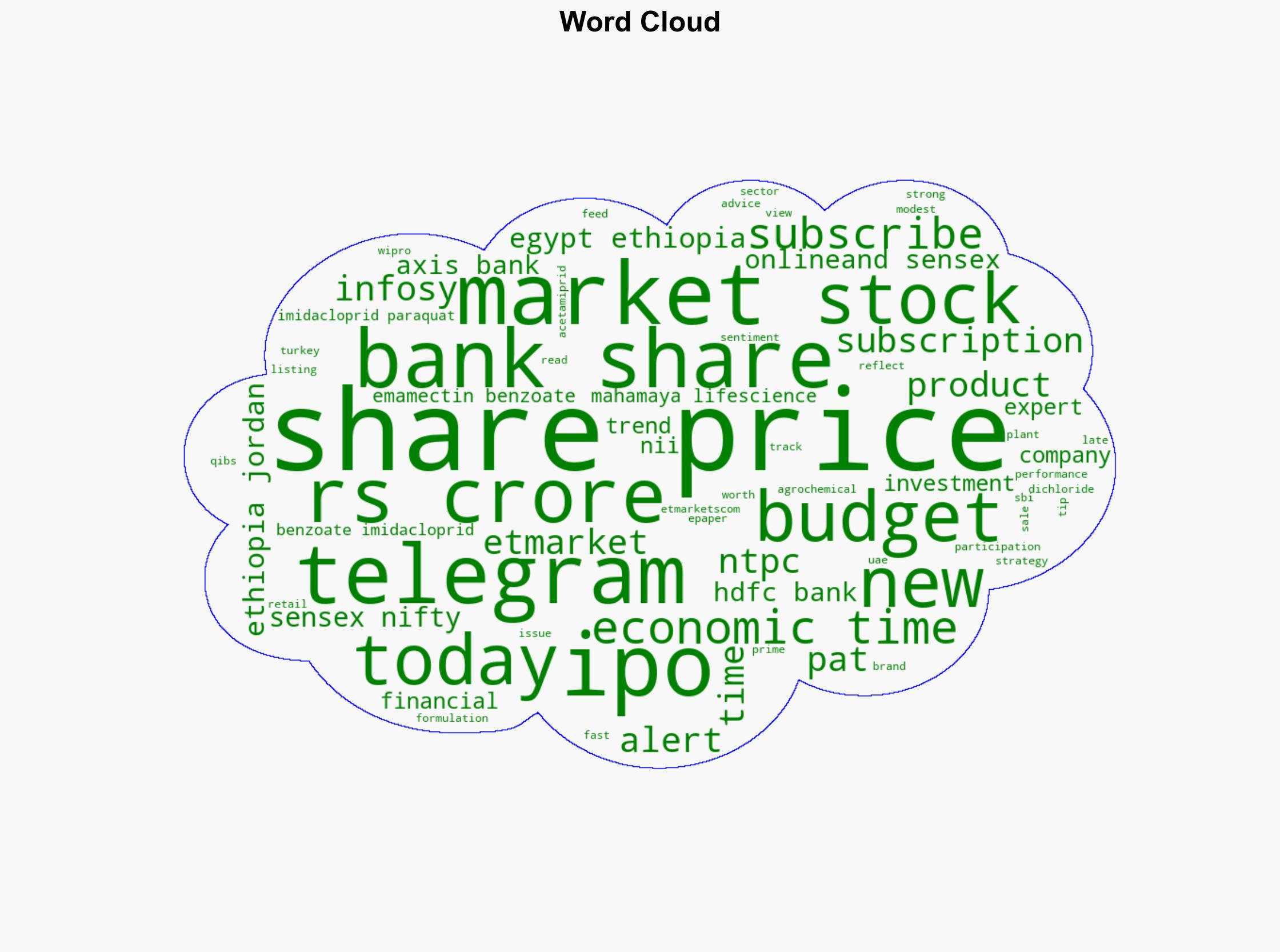

7. Thematic Tags

Regional Focus, Regional Focus: India, Middle East, Africa

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

Explore more:

Regional Focus Briefs ·

Daily Summary ·

Support us

·