Major data breach at US credit union sees 172000 customers at risk – here’s how to stay safe – TechRadar

Published on: 2025-08-12

Intelligence Report: Major data breach at US credit union sees 172000 customers at risk – here’s how to stay safe – TechRadar

1. BLUF (Bottom Line Up Front)

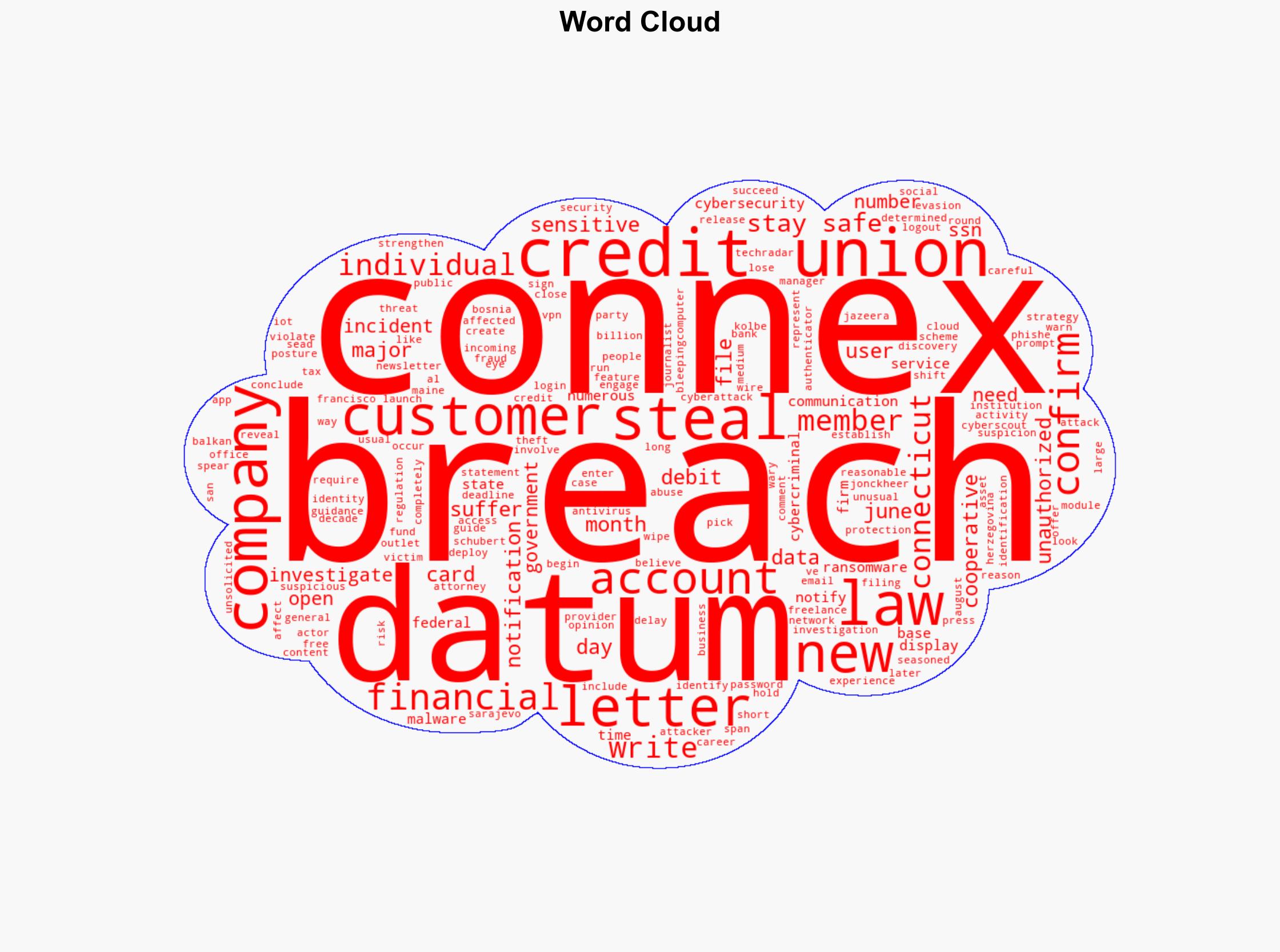

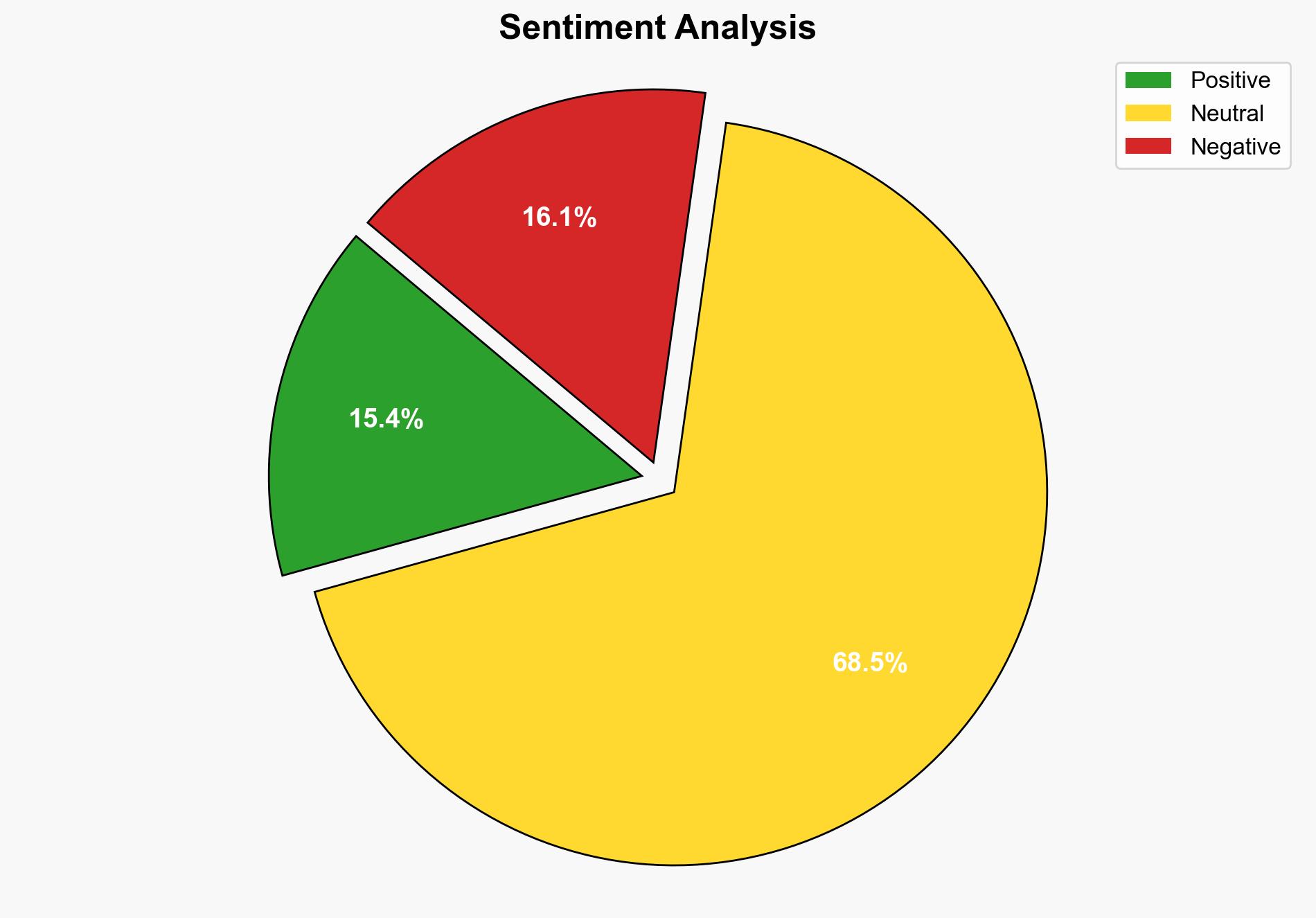

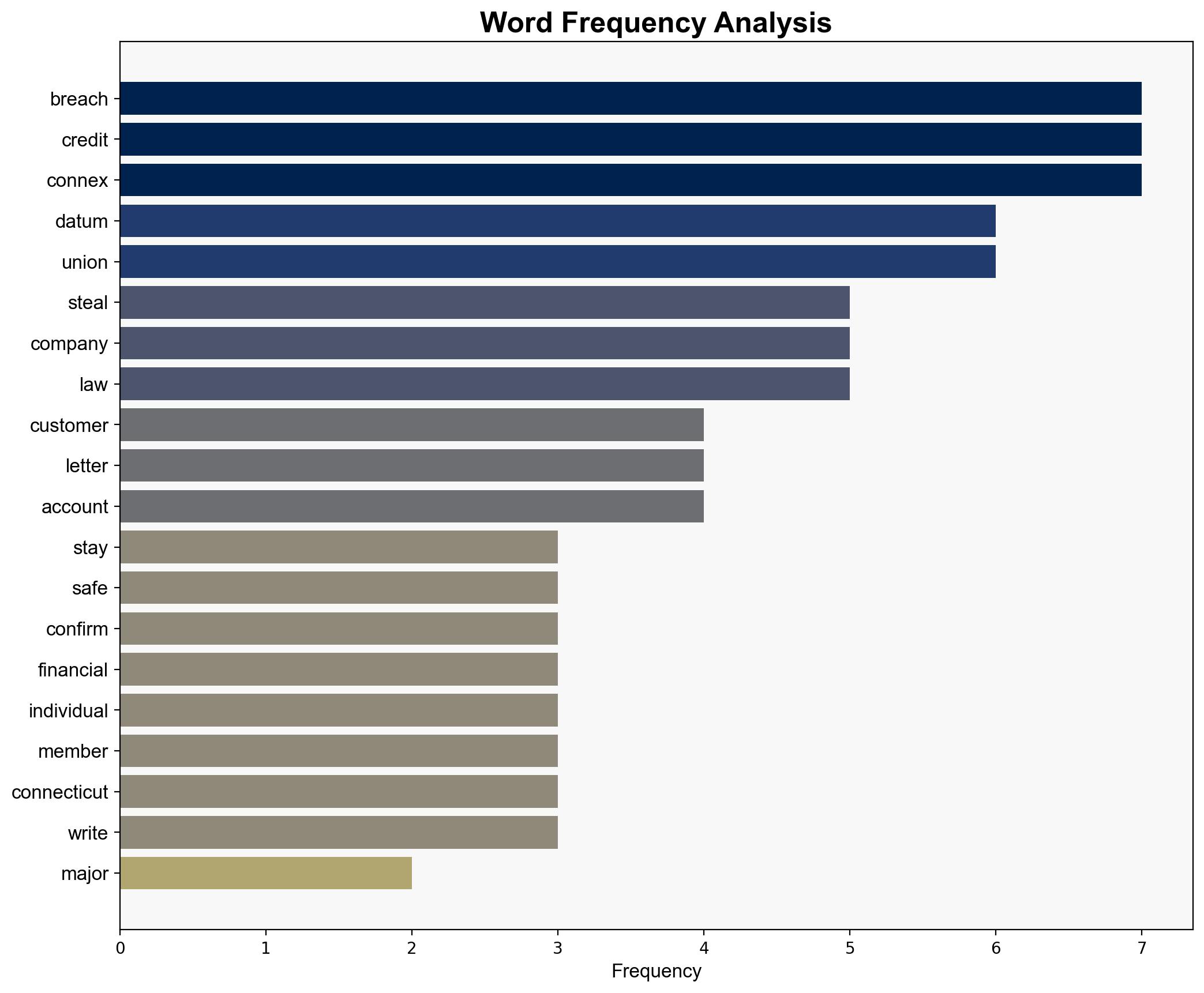

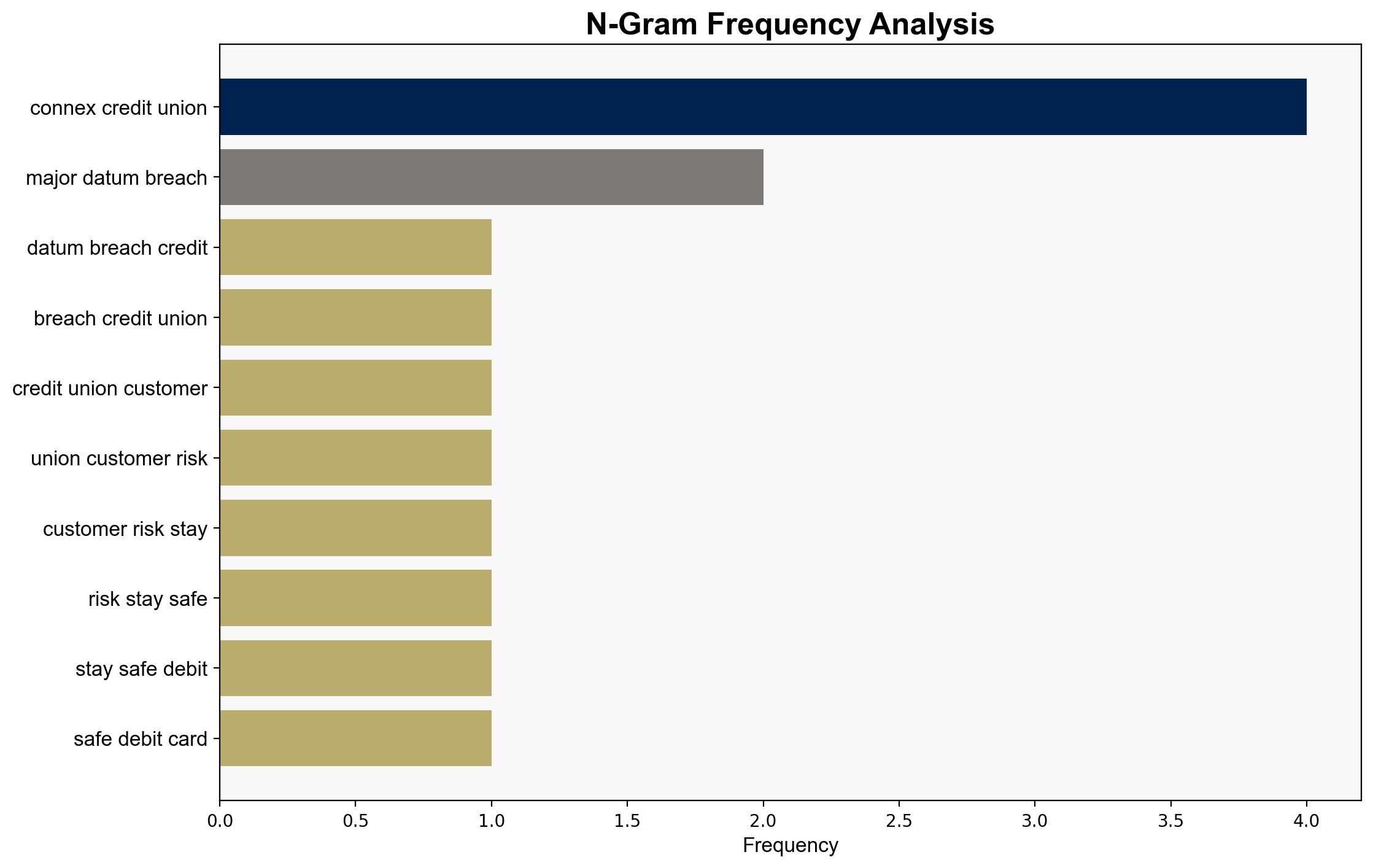

The data breach at Connex Credit Union poses significant risks to customer privacy and financial security. The most supported hypothesis is that the breach resulted from a targeted cyberattack exploiting existing vulnerabilities. Confidence level: Moderate. Recommended action includes immediate enhancement of cybersecurity measures and transparent communication with affected customers.

2. Competing Hypotheses

Hypothesis 1: The breach was a result of a sophisticated cyberattack targeting Connex Credit Union’s vulnerabilities, possibly orchestrated by a well-organized cybercriminal group.

Hypothesis 2: The breach occurred due to internal negligence or insufficient cybersecurity protocols, inadvertently exposing sensitive customer data to unauthorized access.

3. Key Assumptions and Red Flags

Assumptions:

– Hypothesis 1 assumes the attackers had specific knowledge of Connex’s systems and exploited known vulnerabilities.

– Hypothesis 2 assumes a lack of adequate cybersecurity measures or oversight within Connex.

Red Flags:

– Delay in notifying affected customers raises concerns about transparency and compliance with legal requirements.

– Lack of detailed information on the breach’s technical aspects suggests potential gaps in the investigation.

4. Implications and Strategic Risks

The breach could lead to financial losses for customers and damage to Connex’s reputation. If the breach was due to external actors, it may indicate a broader threat to financial institutions. Failure to address vulnerabilities could result in further attacks, impacting customer trust and regulatory compliance.

5. Recommendations and Outlook

- Enhance cybersecurity infrastructure, including regular audits and updates to security protocols.

- Improve incident response strategies to ensure timely notification and mitigation of breaches.

- Scenario Projections:

- Best: Swift implementation of security measures prevents future breaches, restoring customer trust.

- Worst: Continued vulnerabilities lead to additional breaches, resulting in regulatory penalties and financial losses.

- Most Likely: Incremental improvements in security reduce risk, but full trust recovery takes time.

6. Key Individuals and Entities

– Connex Credit Union

– Schubert Jonckheer & Kolbe (law firm investigating the breach)

7. Thematic Tags

national security threats, cybersecurity, counter-terrorism, regional focus