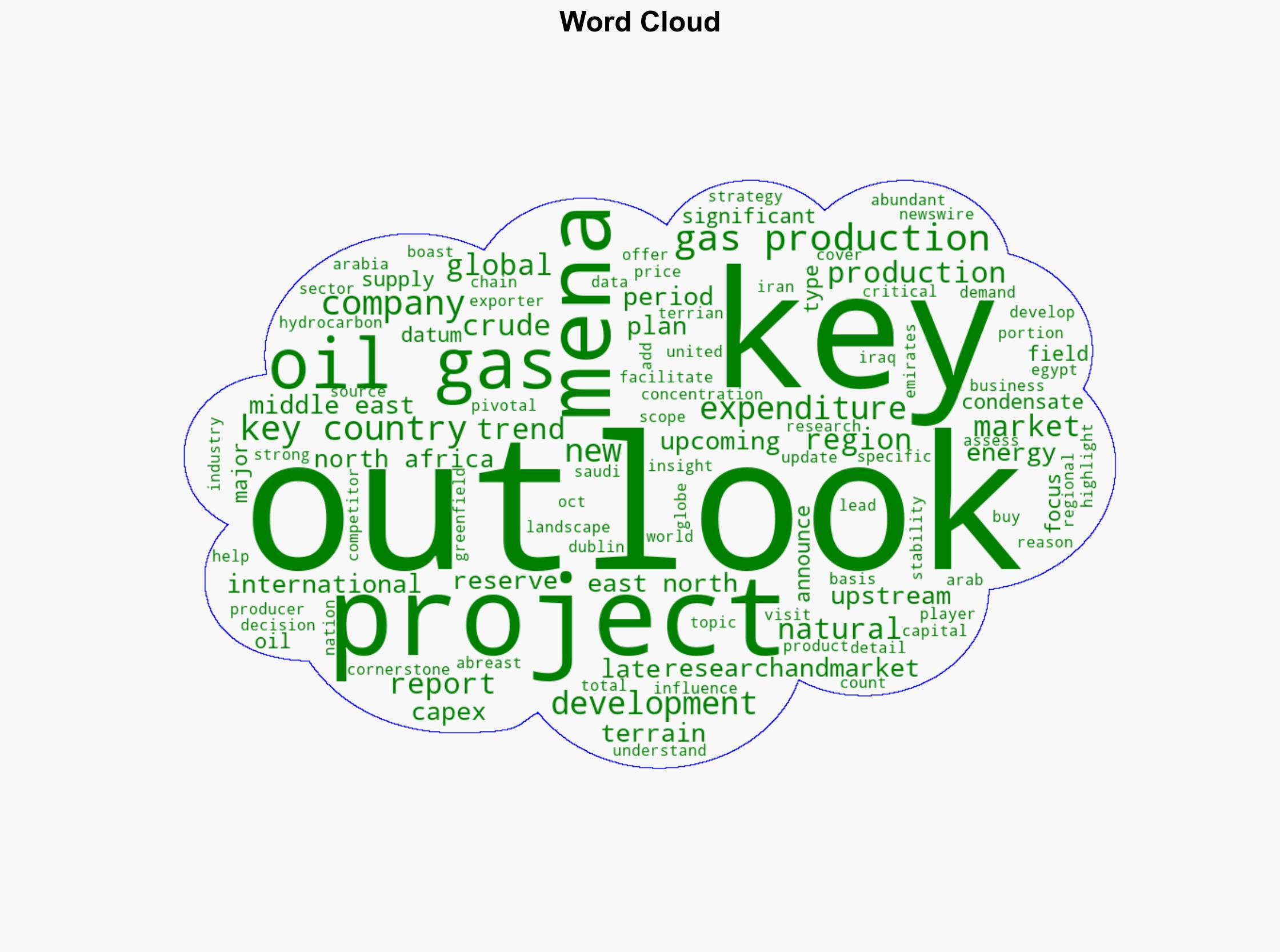

Middle East and North Africa Upstream Development Outlook 2025-2030 Explore Key Upcoming Crude and Gas Projects in MENA Region – GlobeNewswire

Published on: 2025-10-06

Intelligence Report: Middle East and North Africa Upstream Development Outlook 2025-2030 Explore Key Upcoming Crude and Gas Projects in MENA Region – GlobeNewswire

1. BLUF (Bottom Line Up Front)

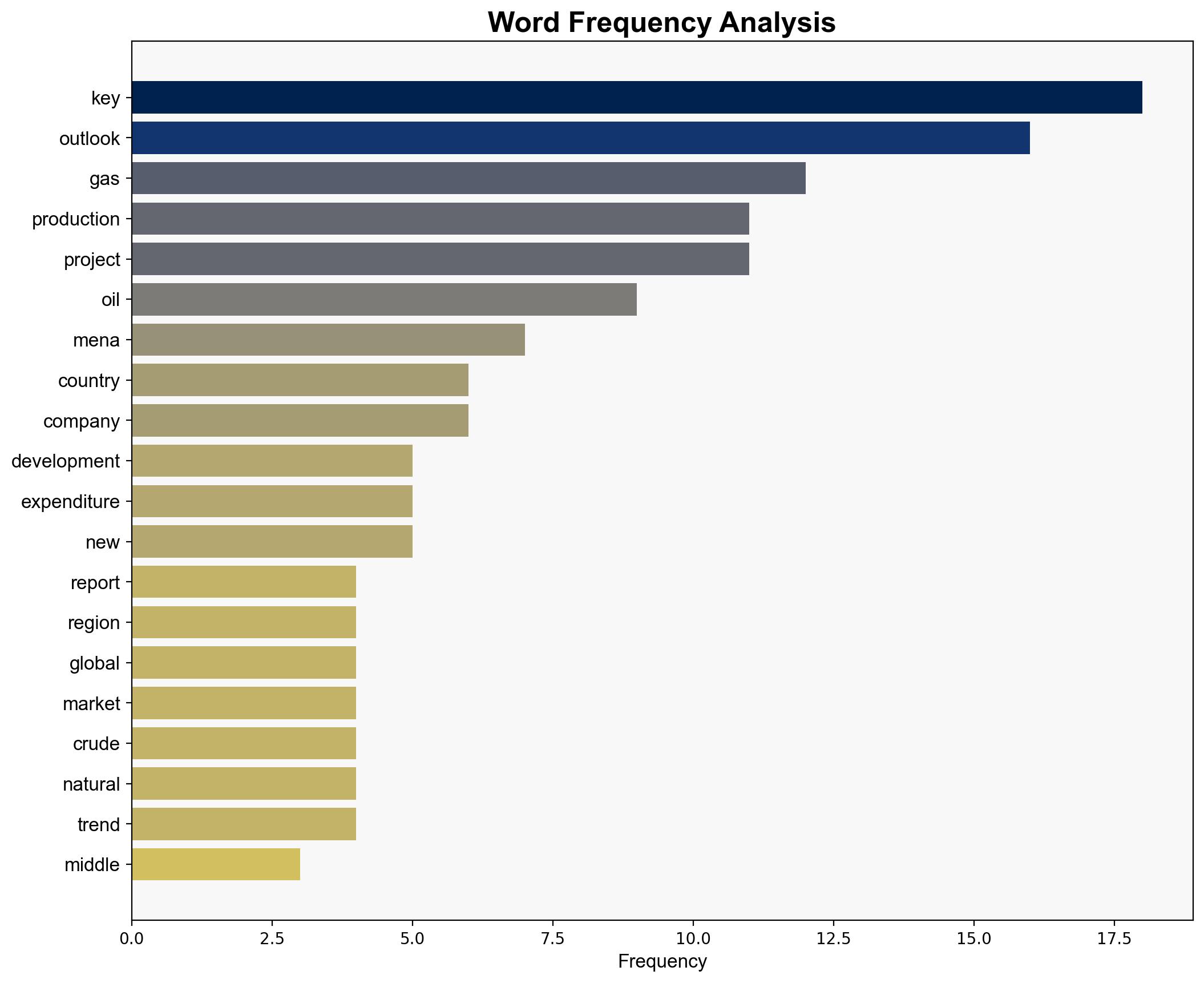

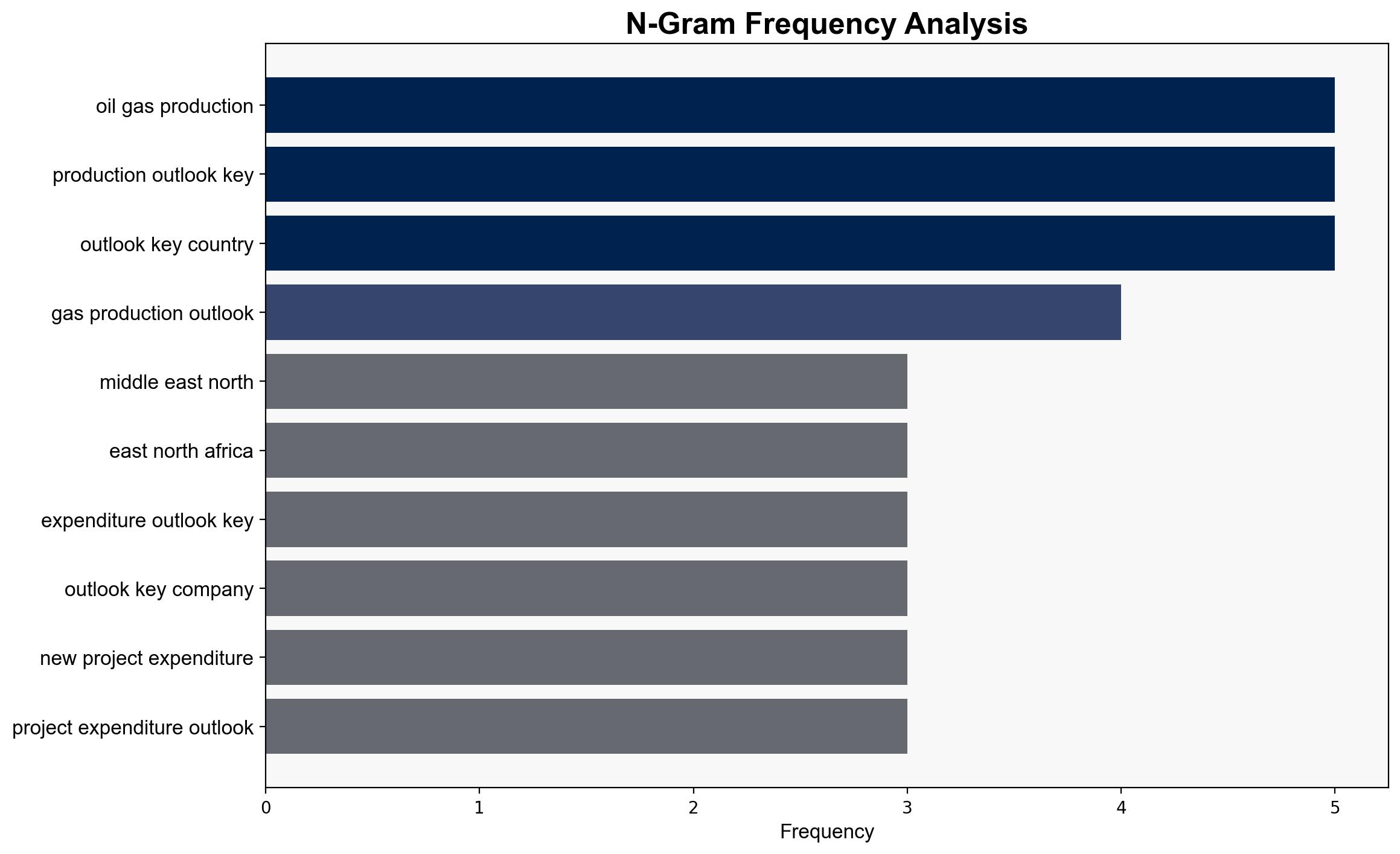

The most supported hypothesis is that the MENA region will continue to be a cornerstone of the global energy landscape due to its significant hydrocarbon reserves and upcoming projects. This will likely stabilize global energy supply chains and influence international energy prices. Confidence Level: High. Recommended action includes monitoring geopolitical developments and capital expenditure trends in the region to anticipate shifts in global energy dynamics.

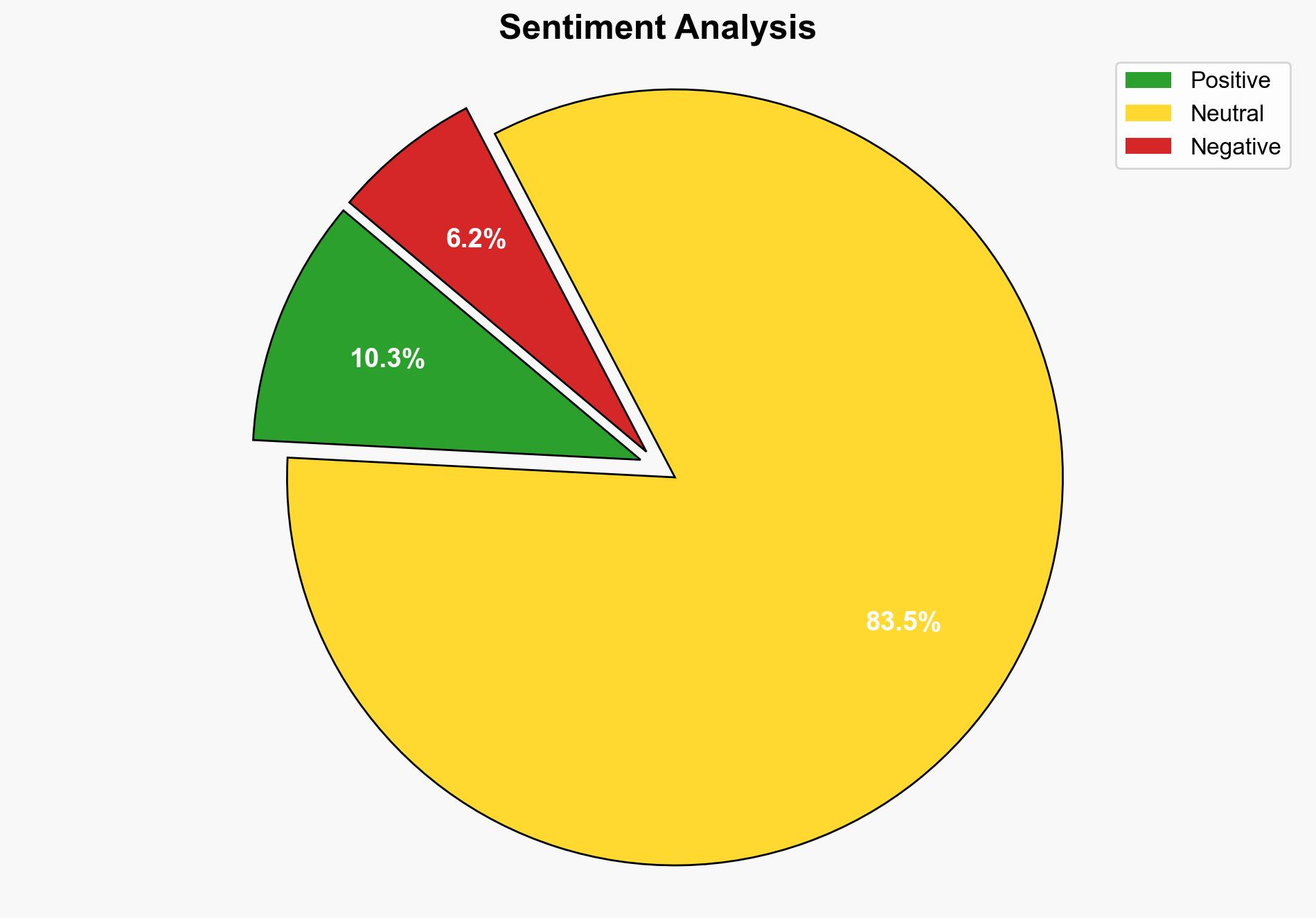

2. Competing Hypotheses

Hypothesis 1: The MENA region will maintain its pivotal role in global energy supply due to its abundant hydrocarbon reserves and upcoming projects, ensuring stability in international energy markets.

Hypothesis 2: Geopolitical tensions and economic challenges in the MENA region could disrupt planned projects, leading to volatility in global energy markets and potential supply shortages.

3. Key Assumptions and Red Flags

Assumptions:

– Hypothesis 1 assumes stable geopolitical conditions and successful implementation of planned projects.

– Hypothesis 2 assumes that geopolitical tensions or economic instability will significantly impact project timelines and outputs.

Red Flags:

– Lack of detailed information on potential geopolitical disruptions.

– Absence of data on the impact of technological advancements or environmental policies on project viability.

4. Implications and Strategic Risks

– Economic: Disruption in MENA projects could lead to increased global energy prices, affecting economic stability worldwide.

– Geopolitical: Escalation of regional conflicts could threaten energy infrastructure and supply routes.

– Cyber: Increased cyber threats targeting energy infrastructure could disrupt operations.

– Psychological: Market uncertainty could lead to speculative trading, further destabilizing prices.

5. Recommendations and Outlook

- Enhance monitoring of geopolitical developments in the MENA region to anticipate and mitigate potential disruptions.

- Invest in cybersecurity measures to protect energy infrastructure from potential cyber threats.

- Scenario Projections:

- Best Case: Stable geopolitical environment and successful project implementation lead to steady global energy prices.

- Worst Case: Regional conflicts and economic instability cause significant project delays, leading to energy shortages and price spikes.

- Most Likely: Mixed outcomes with some project delays but overall stability in energy supply due to diversified sources.

6. Key Individuals and Entities

– Saudi Arabia, Iraq, United Arab Emirates, Iran, and Egypt are pivotal players in the MENA energy market.

7. Thematic Tags

national security threats, cybersecurity, regional focus, energy markets, geopolitical stability