Middle East Conflict Drives Spike in War Risk Insurance Costs – gcaptain.com

Published on: 2025-06-23

Intelligence Report: Middle East Conflict Drives Spike in War Risk Insurance Costs – gcaptain.com

1. BLUF (Bottom Line Up Front)

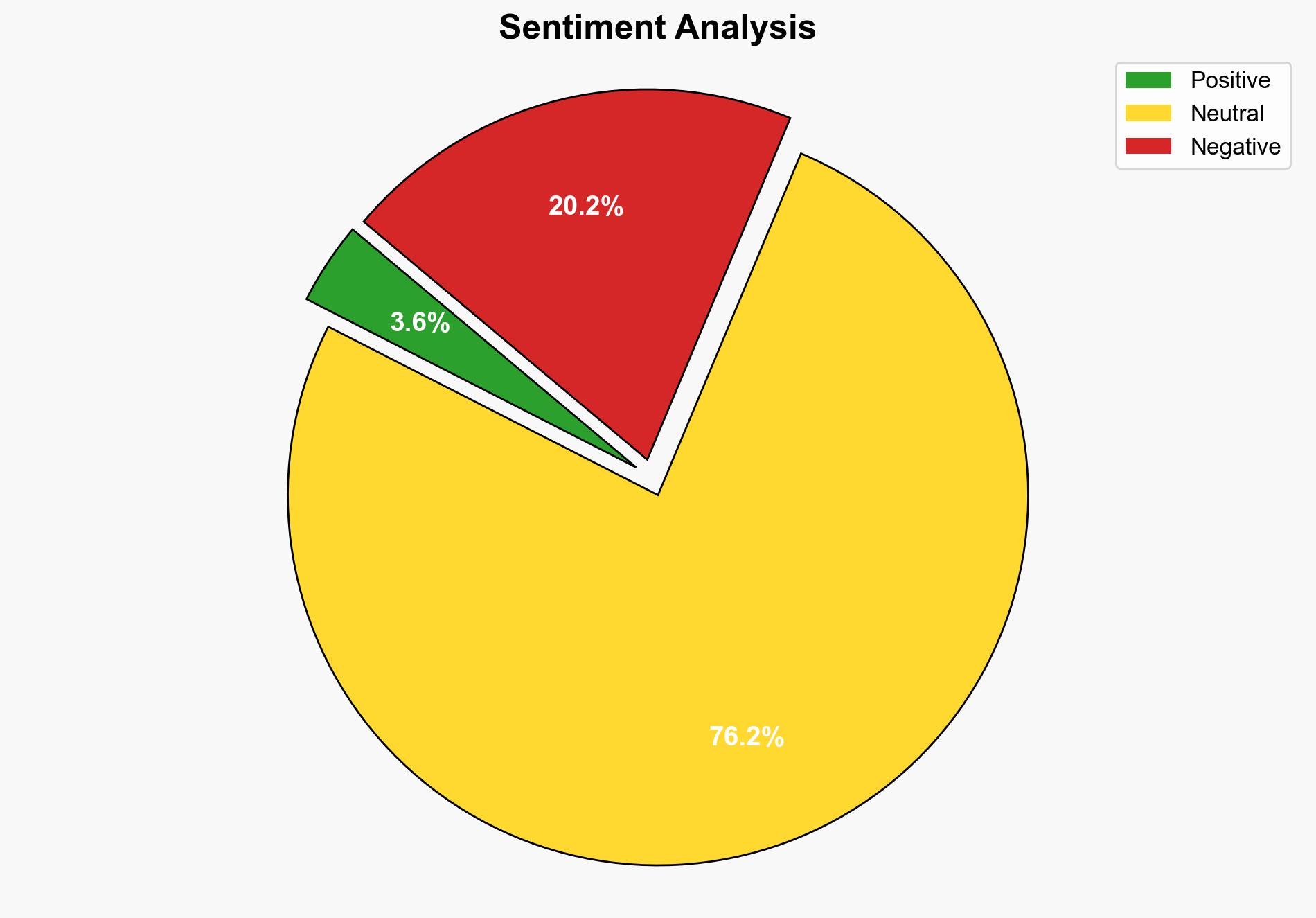

The recent escalation in Middle East tensions, particularly involving Israeli and Iranian actions, has significantly increased war risk insurance costs for shipments in the region. This development poses financial and operational challenges for global shipping and energy markets. Immediate attention to risk management and strategic planning is recommended to mitigate potential disruptions.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Causal Layered Analysis (CLA)

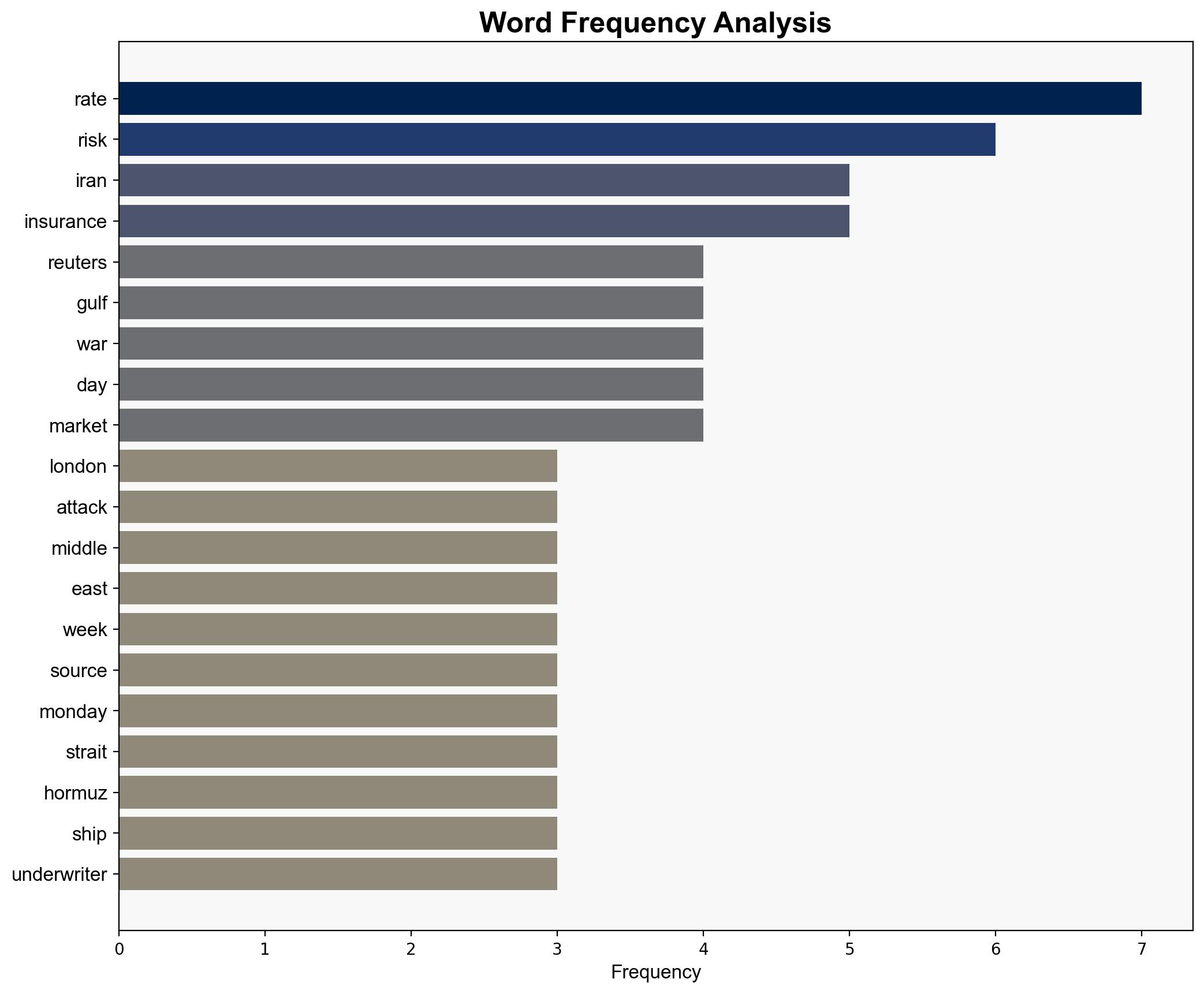

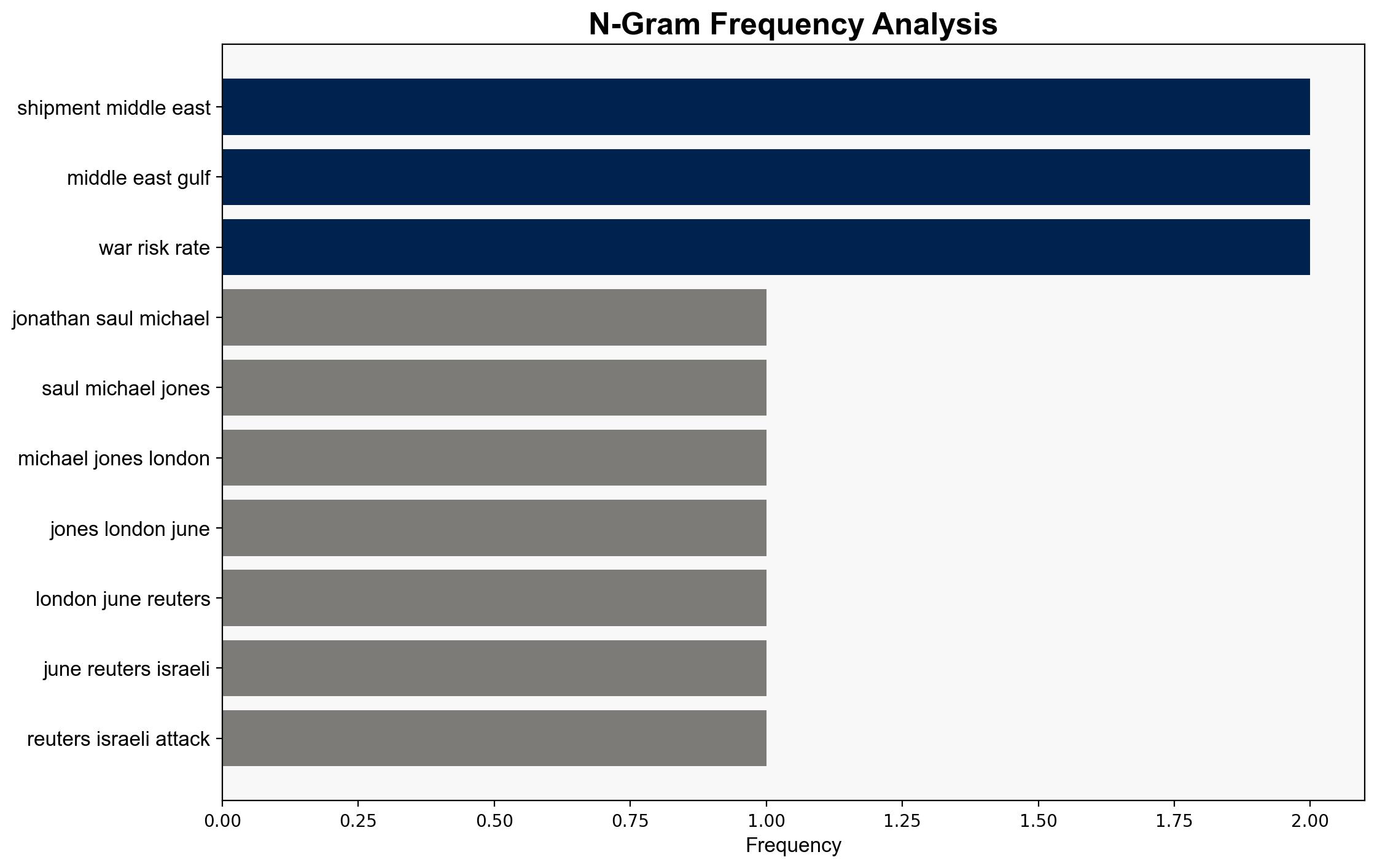

– **Surface Events**: Recent Israeli attacks and Iranian reprisals have heightened tensions, impacting insurance premiums.

– **Systemic Structures**: The strategic Strait of Hormuz remains a critical chokepoint for global oil and gas flows.

– **Worldviews**: Regional power dynamics and historical animosities continue to fuel instability.

– **Myths**: Perceptions of invulnerability and historical grievances drive nationalistic policies.

Cross-Impact Simulation

– Potential closure of the Strait of Hormuz could disrupt global energy supplies, affecting economies worldwide.

– Increased insurance costs may lead to higher shipping rates, impacting global trade and commodity prices.

Scenario Generation

– **Best Case**: De-escalation through diplomatic channels stabilizes the region, reducing insurance costs.

– **Worst Case**: Full-scale conflict leads to prolonged closure of key shipping routes, severely impacting global markets.

– **Most Likely**: Continued skirmishes maintain elevated insurance rates, with periodic disruptions in shipping.

3. Implications and Strategic Risks

The heightened insurance costs reflect broader geopolitical risks, including potential military confrontations and economic disruptions. The reliance on the Strait of Hormuz for oil transport underscores vulnerabilities in global energy security. Additionally, increased costs may strain shipping companies and economies dependent on Middle Eastern oil.

4. Recommendations and Outlook

- Enhance diplomatic efforts to reduce regional tensions and stabilize shipping routes.

- Encourage diversification of energy sources to reduce dependency on Middle Eastern oil.

- Develop contingency plans for potential disruptions in shipping and energy supplies.

- Monitor insurance market trends to anticipate and mitigate financial impacts on shipping operations.

5. Key Individuals and Entities

Jonathan Saul, Michael Jones, David Smith, Neil Roberts

6. Thematic Tags

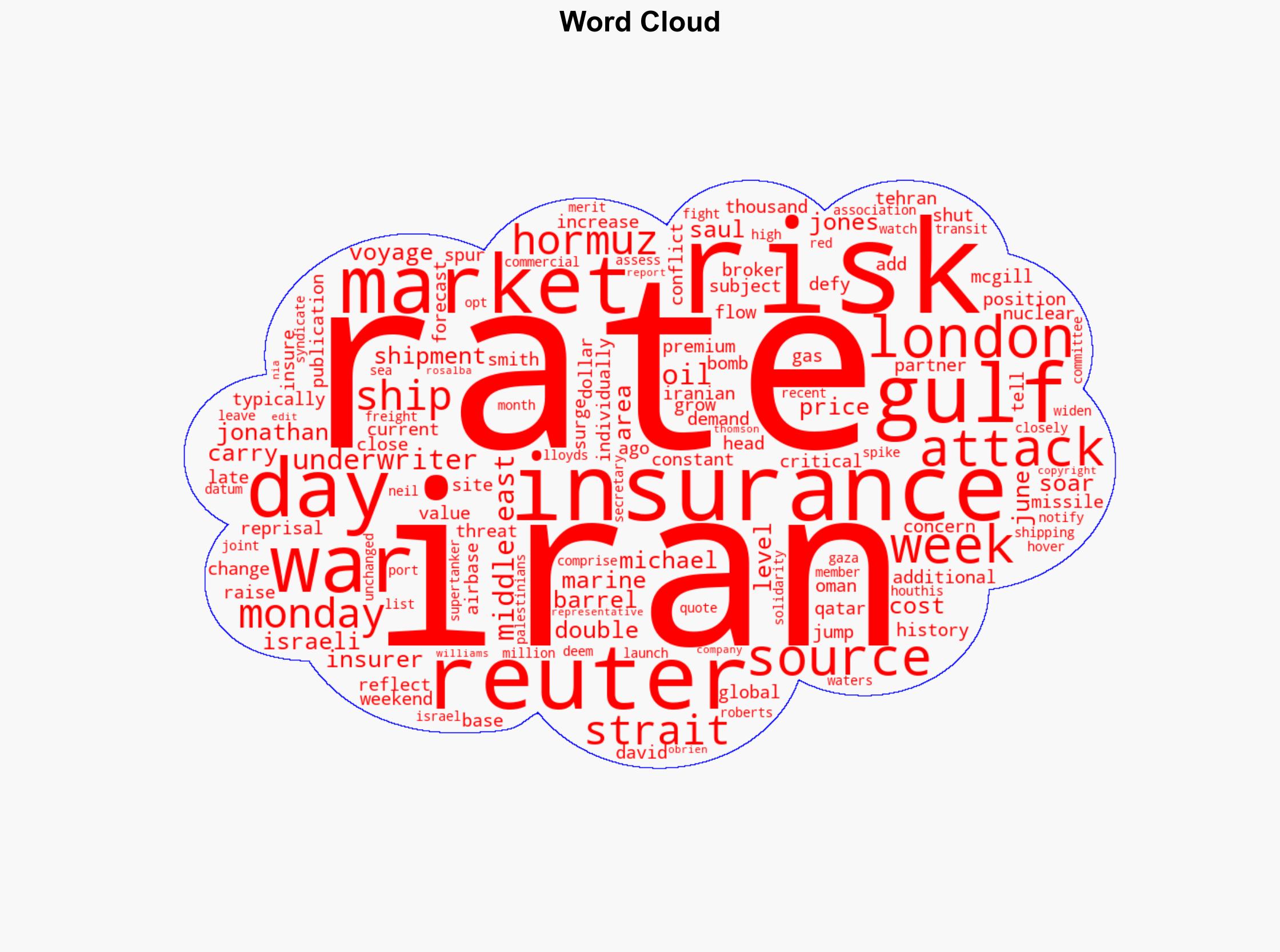

national security threats, geopolitical risks, energy security, shipping industry