Middle East Unrest Clouds Future of 35B Israel-Egypt Gas Deal – OilPrice.com

Published on: 2025-09-10

Intelligence Report: Middle East Unrest Clouds Future of 35B Israel-Egypt Gas Deal – OilPrice.com

1. BLUF (Bottom Line Up Front)

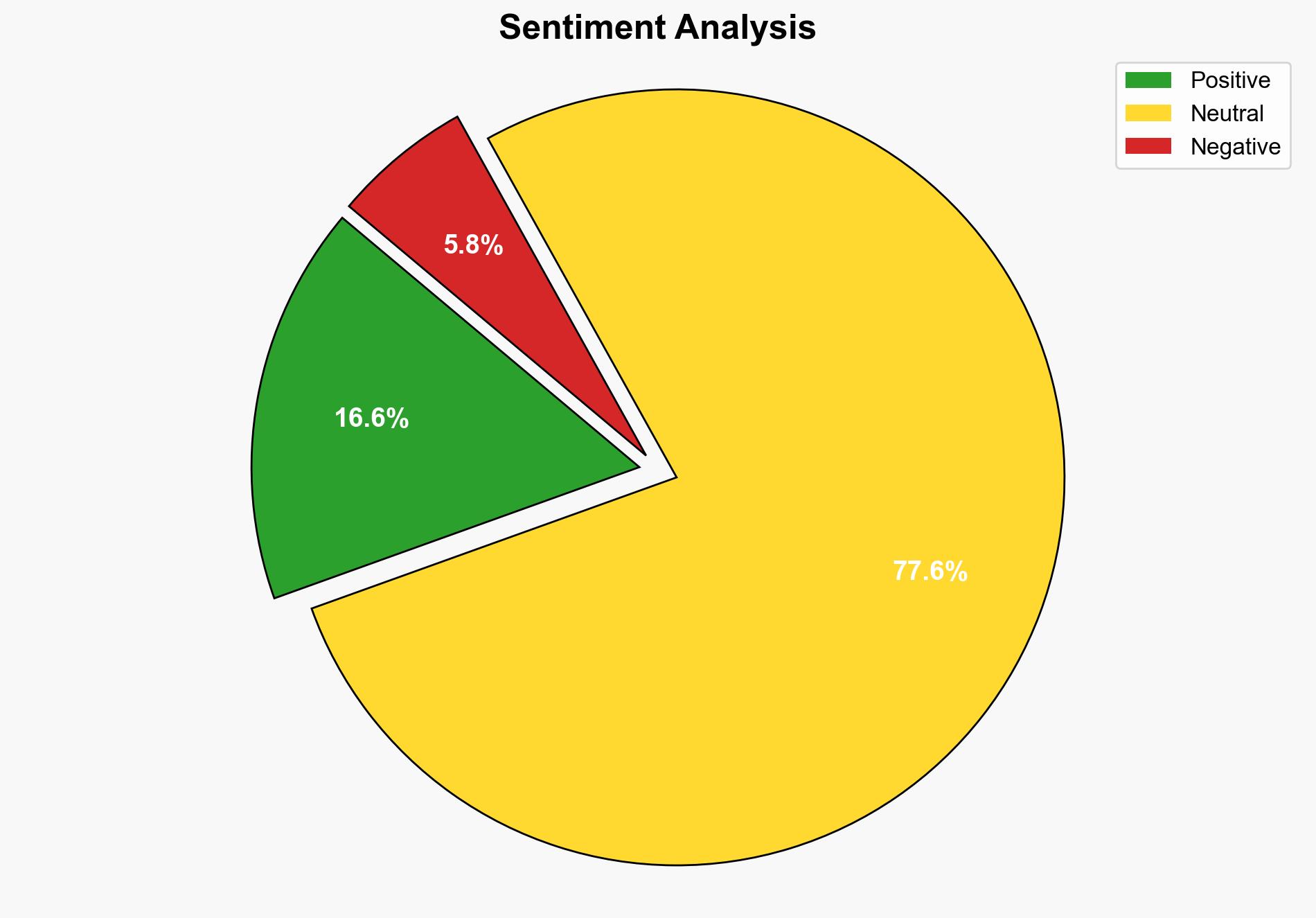

The most supported hypothesis is that geopolitical tensions and domestic challenges in Egypt will lead to increased instability in the Israel-Egypt gas deal. Confidence level: Moderate. It is recommended to monitor geopolitical developments closely and explore alternative energy partnerships to mitigate potential disruptions.

2. Competing Hypotheses

Hypothesis 1: The Israel-Egypt gas deal will face significant disruptions due to escalating regional tensions and Egypt’s domestic energy challenges.

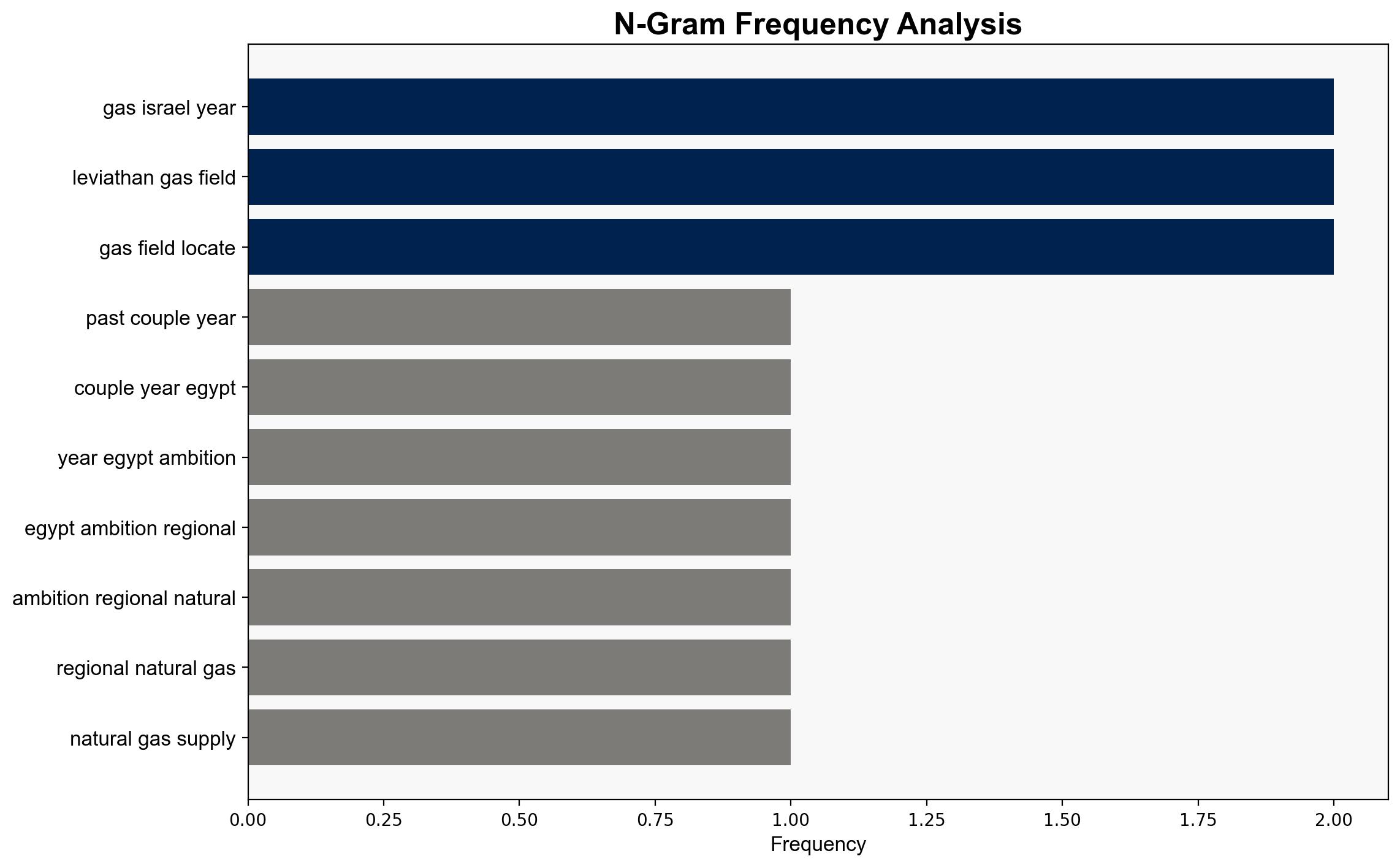

– **Supporting Evidence:** Escalating tensions in the Middle East, Egypt’s declining natural gas production, and increased reliance on Israeli imports.

Hypothesis 2: Despite regional unrest, the Israel-Egypt gas deal will continue with minor adjustments due to mutual economic benefits and strategic interests.

– **Supporting Evidence:** Strong economic incentives for both countries, existing infrastructure, and the strategic importance of energy cooperation.

3. Key Assumptions and Red Flags

– **Assumptions:** Stability in the region is critical for the continuation of the gas deal; Egypt can manage its domestic energy demand without significant external support.

– **Red Flags:** Potential for sudden geopolitical shifts, such as military actions or diplomatic breakdowns, which could rapidly alter the situation.

– **Blind Spots:** Over-reliance on current political dynamics without considering potential shifts in leadership or policy changes in either country.

4. Implications and Strategic Risks

– **Economic Risks:** Disruption in the gas deal could lead to increased energy costs and economic instability in Egypt.

– **Geopolitical Risks:** Escalating tensions could lead to broader regional conflicts, impacting global energy markets.

– **Strategic Risks:** Failure to secure alternative energy sources could weaken Egypt’s negotiating position and economic resilience.

5. Recommendations and Outlook

- Monitor geopolitical developments and adjust energy strategies accordingly.

- Explore alternative energy partnerships to reduce reliance on a single source.

- Scenario Projections:

- Best Case: Regional tensions ease, and the gas deal strengthens economic ties.

- Worst Case: Full-scale conflict disrupts energy supplies, leading to economic crises.

- Most Likely: Continued tensions with periodic disruptions, requiring strategic adjustments.

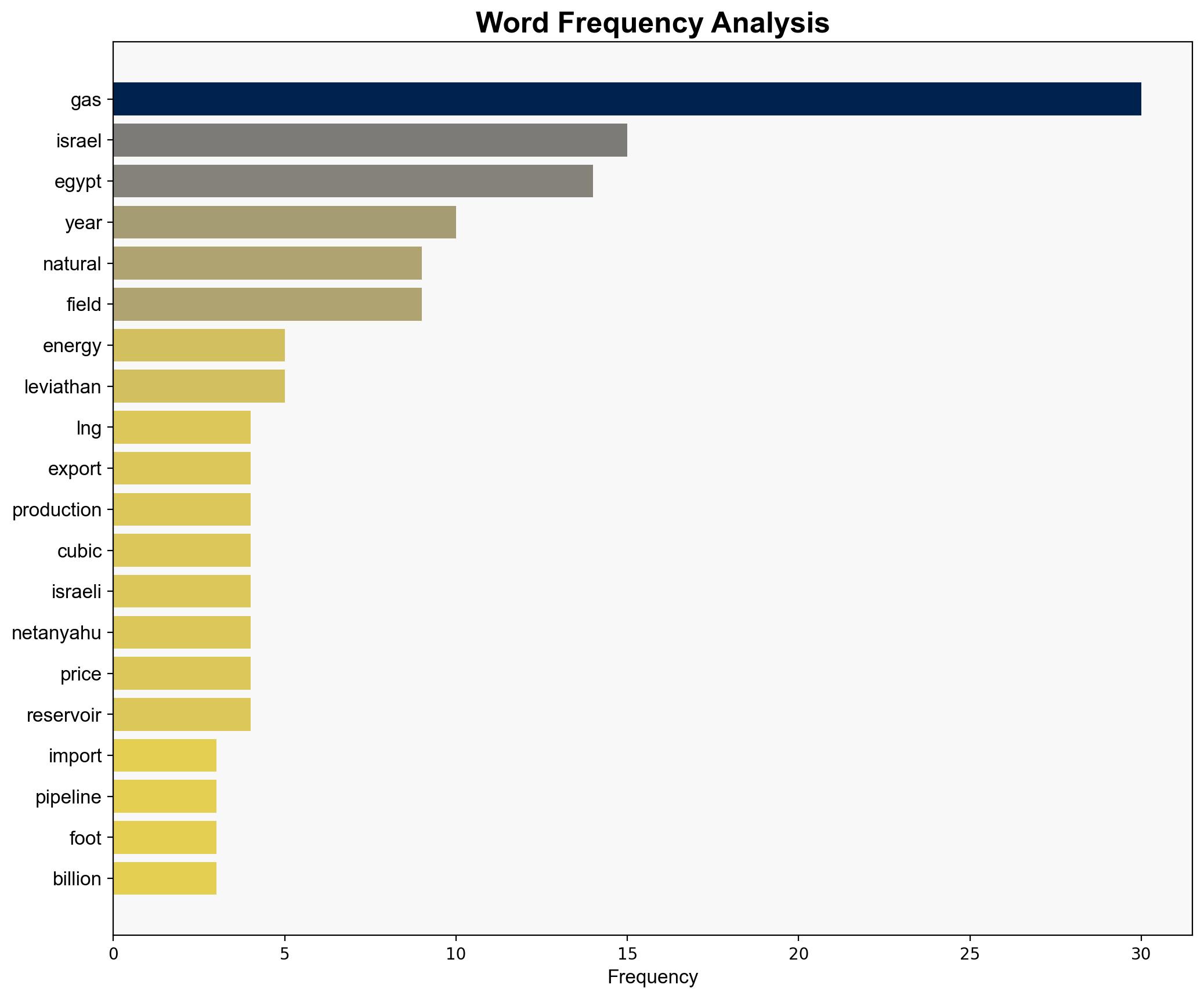

6. Key Individuals and Entities

– Benjamin Netanyahu

– Mostafa Madbouly

– NewMed Energy

– Chevron Corp

– Ratio Energy

7. Thematic Tags

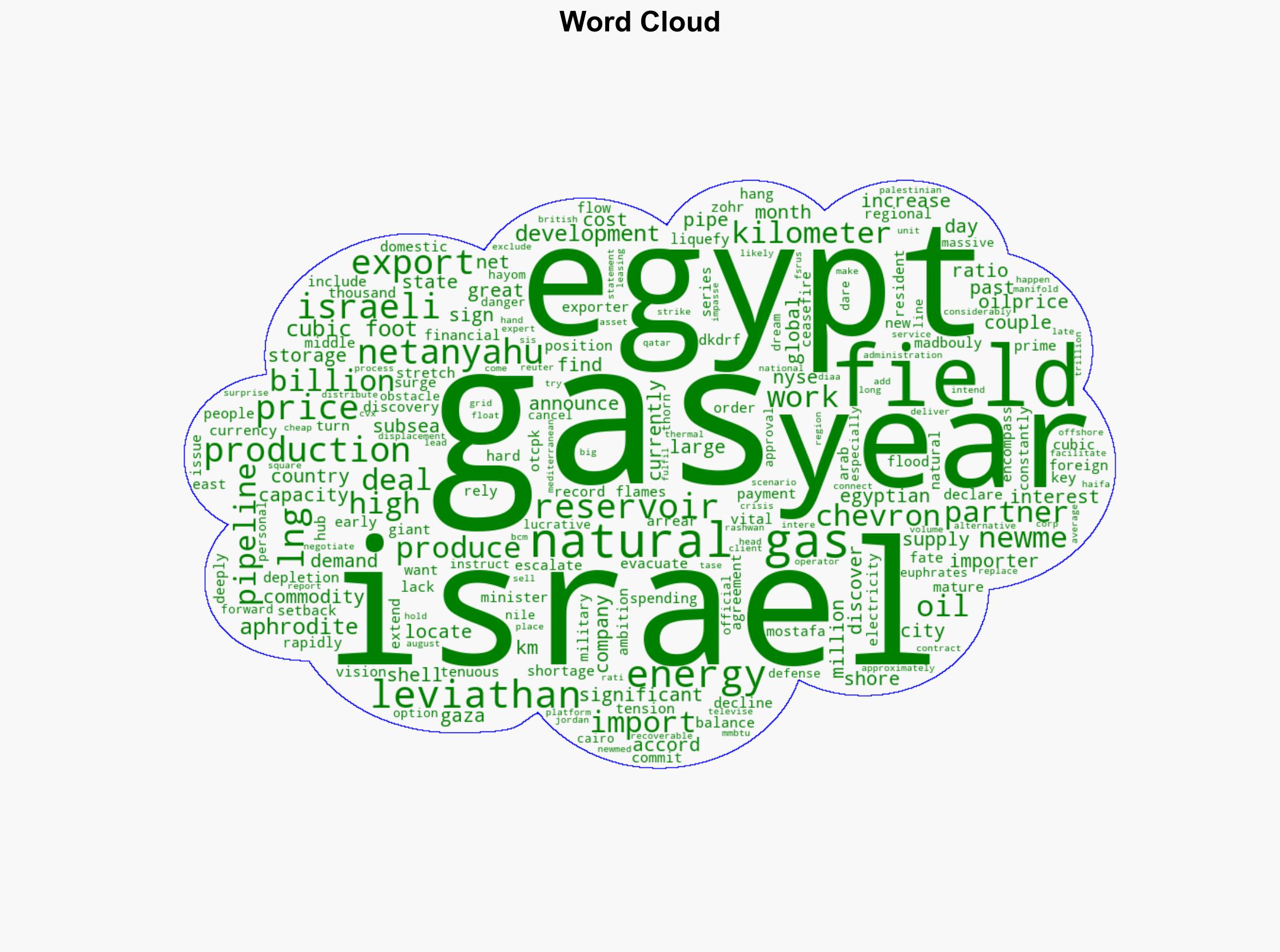

national security threats, energy security, regional instability, economic resilience