MONEYVAL Evaluates Anti-Money Laundering Efforts in Azerbaijan, Croatia, and Estonia

Published on: 2026-01-24

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

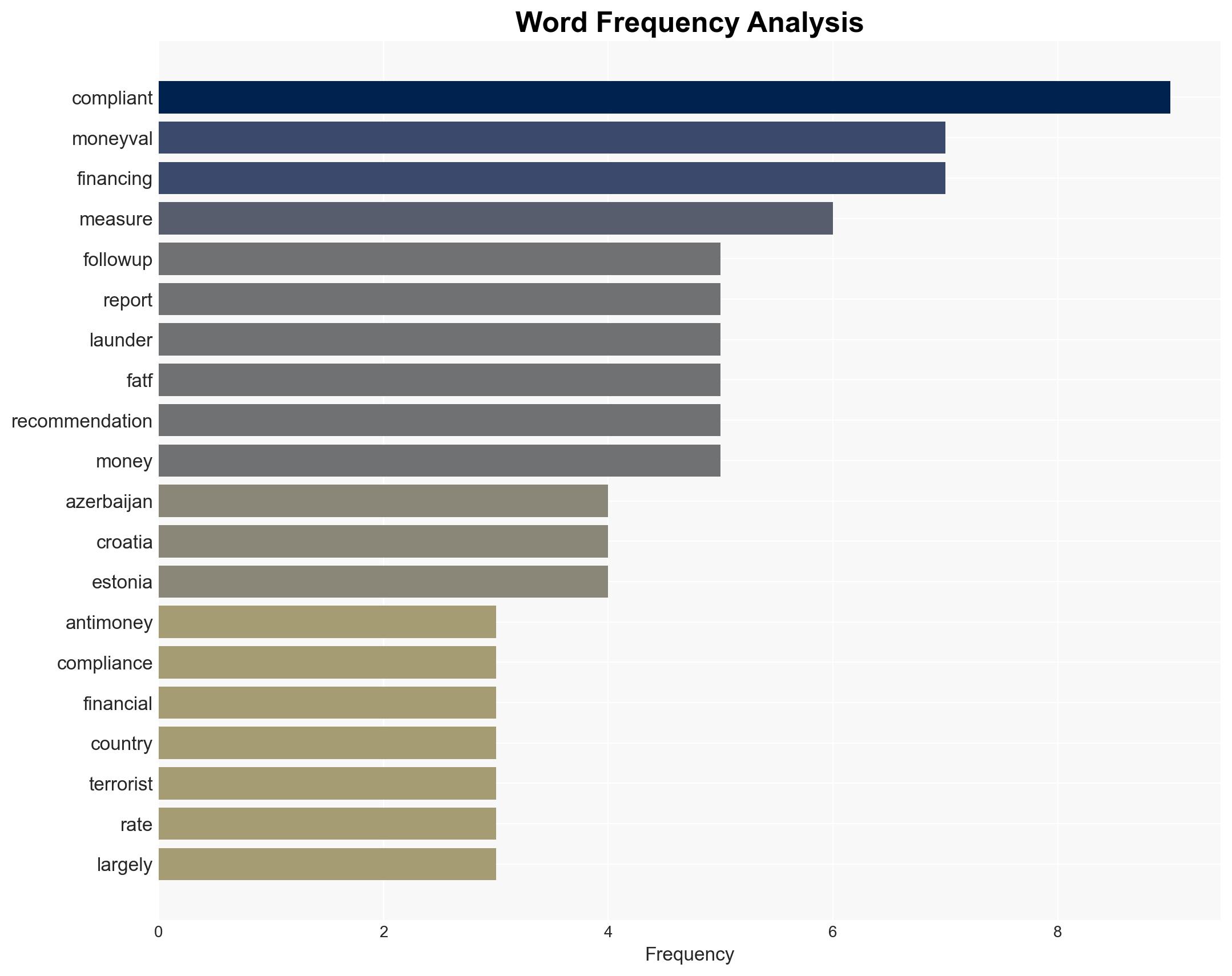

Intelligence Report: Money laundering and terrorist financing progress reports on Azerbaijan Croatia and Estonia

1. BLUF (Bottom Line Up Front)

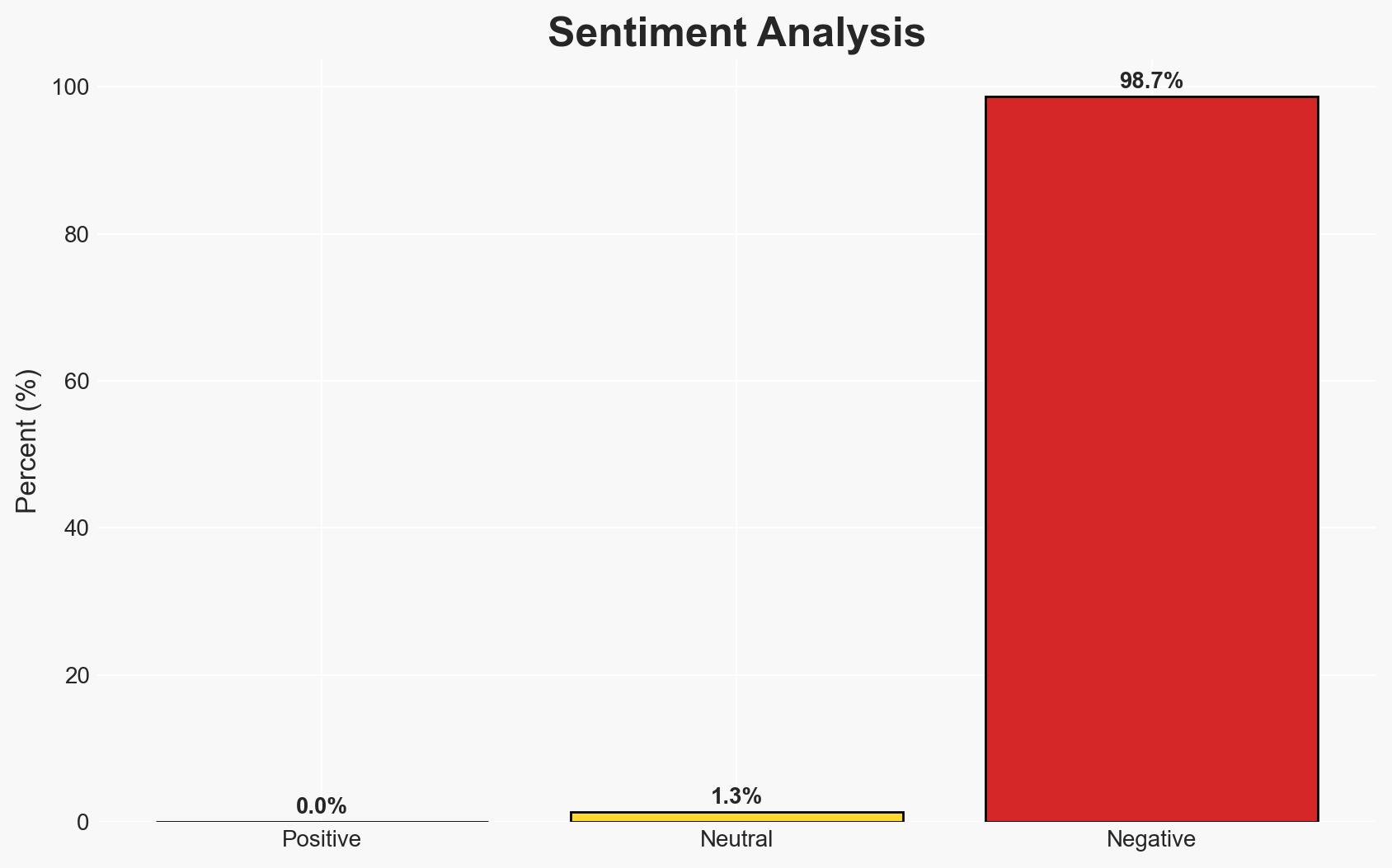

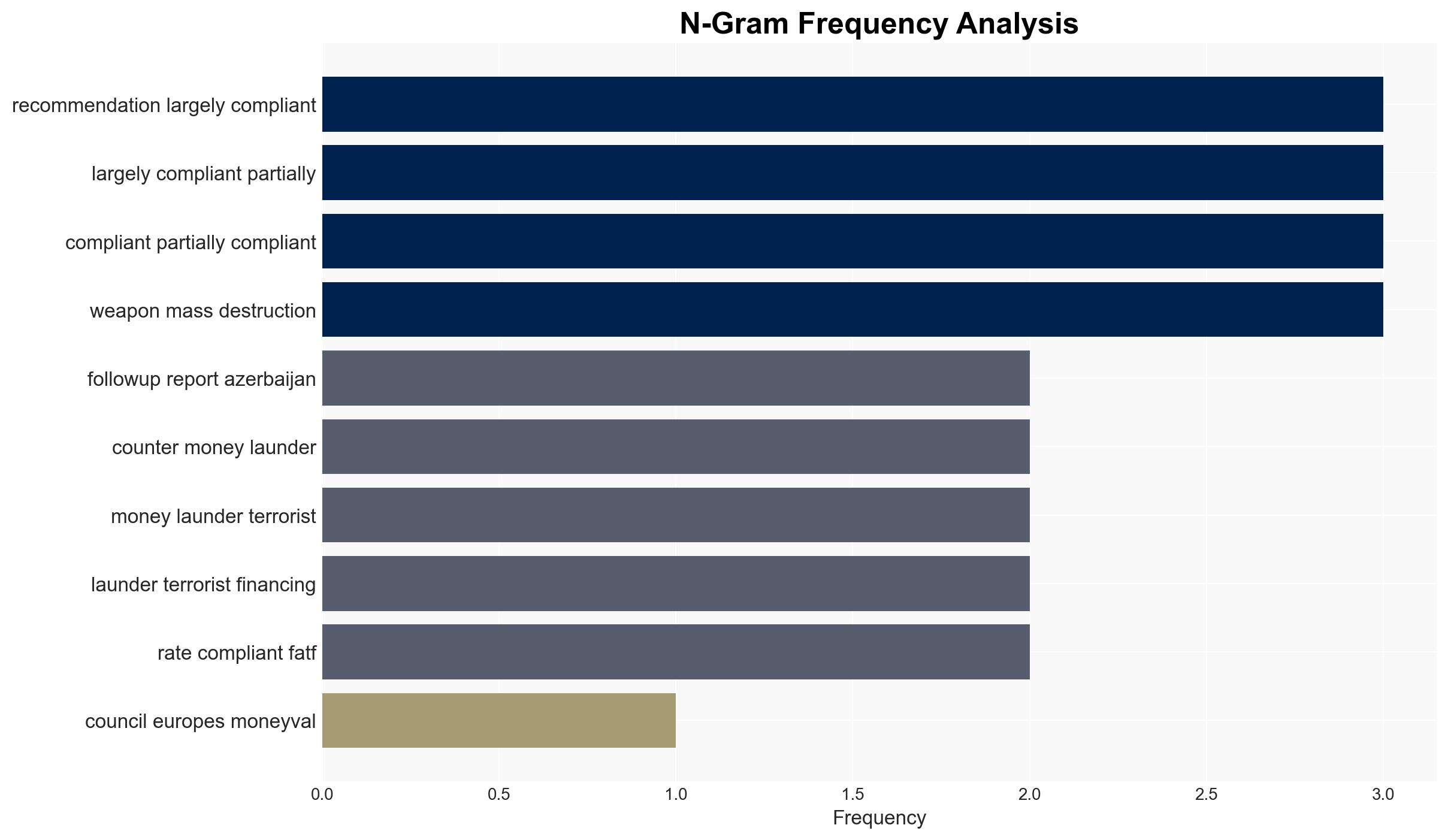

MONEYVAL’s follow-up reports indicate varying levels of progress in anti-money laundering (AML) and counter-terrorism financing (CTF) measures across Azerbaijan, Croatia, and Estonia. Azerbaijan shows significant improvement, while Croatia and Estonia have made progress but still face challenges. This assessment is made with moderate confidence due to existing information gaps and potential biases in reporting.

2. Competing Hypotheses

- Hypothesis A: Azerbaijan, Croatia, and Estonia are genuinely improving their AML and CTF frameworks, as evidenced by MONEYVAL’s upgraded compliance ratings. However, uncertainties remain regarding the depth and sustainability of these improvements.

- Hypothesis B: The reported improvements may be overstated or selectively highlighted by MONEYVAL, potentially influenced by political pressures or incomplete data, leading to an optimistic portrayal of compliance.

- Assessment: Hypothesis A is currently better supported given the specific upgrades in compliance ratings and detailed areas of improvement. However, ongoing monitoring is necessary to validate these improvements and address potential biases.

3. Key Assumptions and Red Flags

- Assumptions: MONEYVAL’s assessments are based on comprehensive and unbiased data; improvements in compliance will lead to reduced money laundering and terrorist financing activities; countries will continue to enhance their frameworks.

- Information Gaps: Detailed data on the implementation and enforcement of revised measures; independent verification of reported improvements; potential external influences on MONEYVAL’s assessments.

- Bias & Deception Risks: Possible cognitive bias in interpreting compliance upgrades; source bias from MONEYVAL due to political or diplomatic considerations; risk of countries overstating compliance improvements.

4. Implications and Strategic Risks

The progress reported by MONEYVAL could influence regional and international perceptions of Azerbaijan, Croatia, and Estonia’s financial systems, impacting their geopolitical and economic engagements.

- Political / Geopolitical: Improved compliance may enhance diplomatic relations and reduce international scrutiny, but failure to sustain progress could lead to reputational damage.

- Security / Counter-Terrorism: Enhanced AML/CTF measures could disrupt terrorist financing networks, but persistent deficiencies may continue to pose security risks.

- Cyber / Information Space: Increased regulatory compliance may deter cyber-enabled financial crimes, but could also drive illicit activities to more covert channels.

- Economic / Social: Strengthened financial systems could boost investor confidence and economic stability, though unresolved issues may hinder long-term growth.

5. Recommendations and Outlook

- Immediate Actions (0–30 days): Conduct independent audits to verify reported improvements; engage with MONEYVAL for detailed insights into compliance upgrades.

- Medium-Term Posture (1–12 months): Develop partnerships with international AML/CTF bodies; enhance domestic capabilities to monitor and enforce compliance.

- Scenario Outlook:

- Best: Sustained improvements lead to full compliance, enhancing regional security and economic prospects.

- Worst: Regressions in compliance lead to increased financial crime and international sanctions.

- Most-Likely: Gradual progress with periodic setbacks, requiring continuous international support and oversight.

6. Key Individuals and Entities

- Not clearly identifiable from open sources in this snippet.

7. Thematic Tags

Counter-Terrorism, anti-money laundering, counter-terrorism financing, compliance, financial regulation, geopolitical stability, economic impact, international relations

Structured Analytic Techniques Applied

- ACH 2.0: Reconstruct likely threat actor intentions via hypothesis testing and structured refutation.

- Indicators Development: Track radicalization signals and propaganda patterns to anticipate operational planning.

- Narrative Pattern Analysis: Analyze spread/adaptation of ideological narratives for recruitment/incitement signals.

Explore more:

Counter-Terrorism Briefs ·

Daily Summary ·

Support us