Multiple Australian pension funds hit by coordinated hacking media reports say – CNA

Published on: 2025-04-04

Intelligence Report: Multiple Australian Pension Funds Hit by Coordinated Hacking – CNA

1. BLUF (Bottom Line Up Front)

A coordinated cyber attack has targeted multiple major Australian pension funds, compromising member accounts and potentially leading to significant financial losses. The attack has prompted an immediate response from government agencies and affected organizations. Key recommendations include enhancing cybersecurity measures and ensuring rapid communication with affected members.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

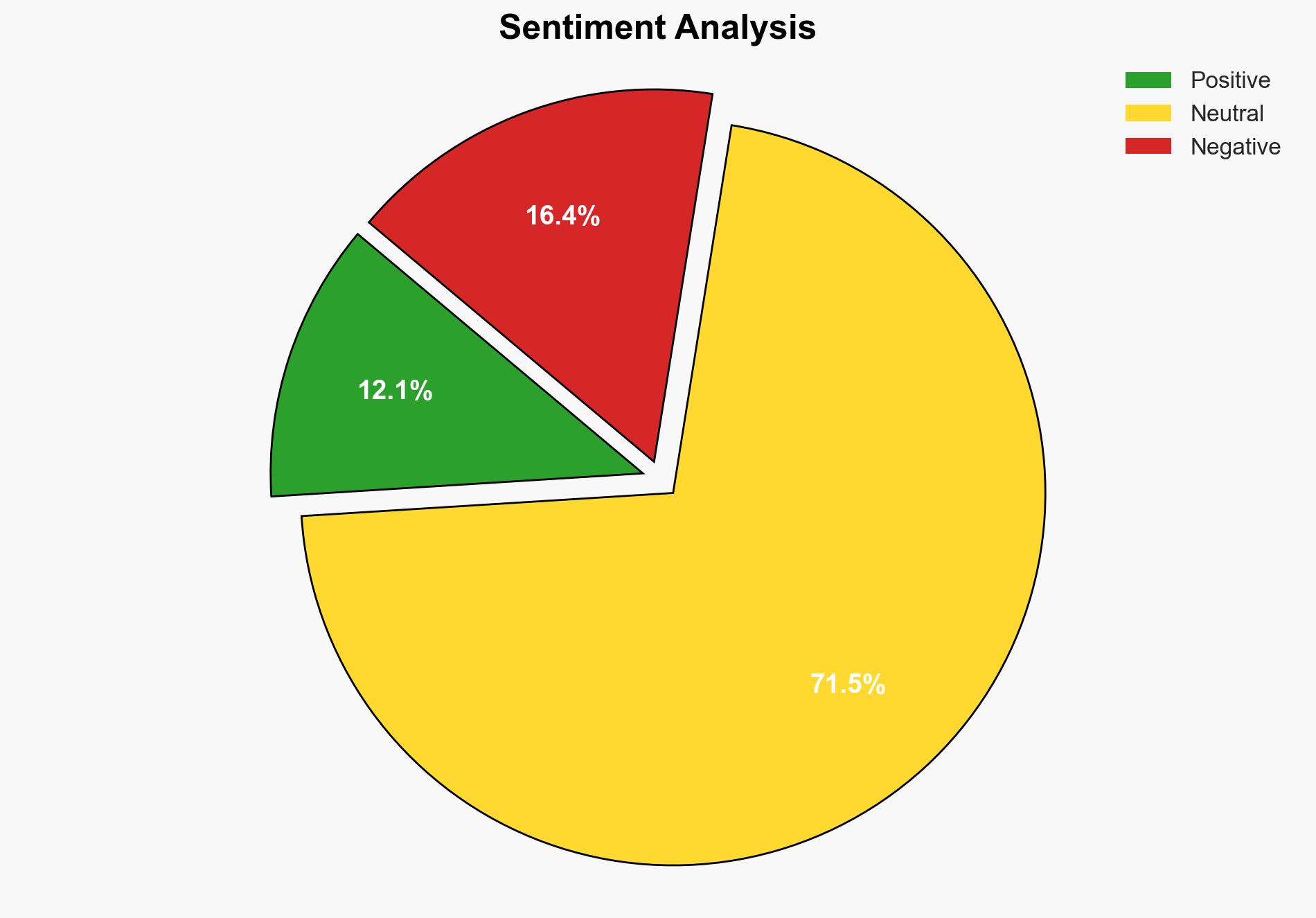

General Analysis

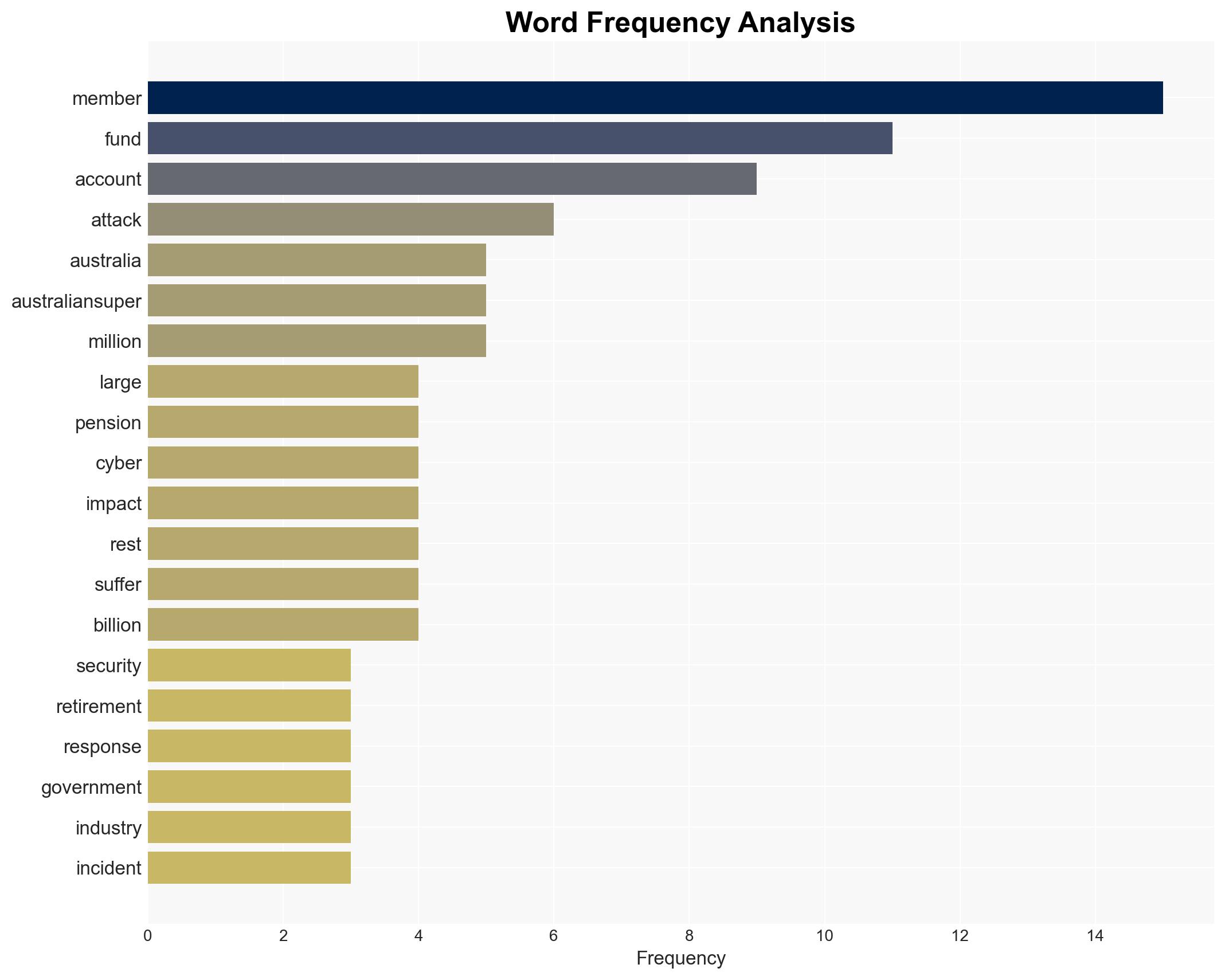

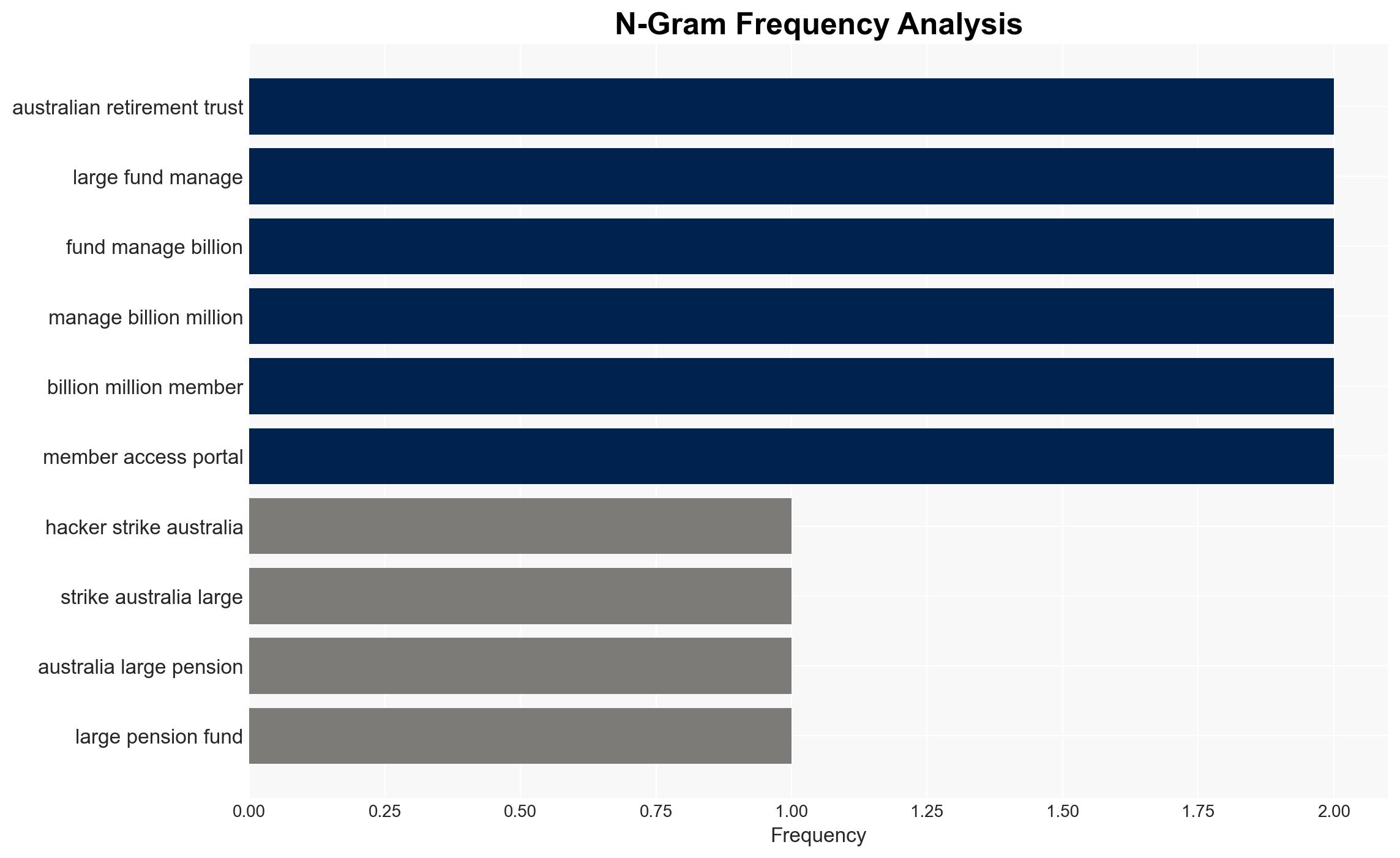

The attack targeted several large Australian pension funds, including AustralianSuper, Australian Retirement Trust, Rest, Insignia, and Hostplus. These funds collectively manage billions in assets and serve millions of members. The breach involved unauthorized access to member accounts, with attempts to drain balances and transfer funds. Cybersecurity protocols were activated, resulting in account lockdowns and investigations into the extent of the breaches. The incident underscores vulnerabilities in the financial sector’s cybersecurity infrastructure.

3. Implications and Strategic Risks

The attack poses significant risks to national economic stability, given the scale of assets managed by the affected funds. It highlights the potential for increased frequency and sophistication of cyber threats targeting critical financial infrastructure. The breach also raises concerns about the adequacy of current cybersecurity measures and the potential for reputational damage to the affected entities. Additionally, there is a risk of decreased public trust in the financial sector’s ability to safeguard personal and financial data.

4. Recommendations and Outlook

Recommendations:

- Enhance cybersecurity frameworks across the financial sector, focusing on threat detection and response capabilities.

- Implement mandatory cybersecurity audits and stress tests for financial institutions.

- Increase collaboration between government agencies and private sector entities to share intelligence on emerging threats.

- Develop comprehensive incident response plans and ensure regular training for staff on cybersecurity best practices.

Outlook:

In the best-case scenario, immediate actions taken by the affected funds and government agencies will mitigate financial losses and restore public confidence. In the worst-case scenario, further breaches could occur, leading to significant financial and reputational damage. The most likely outcome involves increased regulatory scrutiny and investment in cybersecurity measures to prevent future incidents.

5. Key Individuals and Entities

The report mentions significant individuals and organizations involved in the incident:

- Anthony Albanese

- Jim Chalmers

- James Paterson

- Michelle McGuinness

- Rise Kerlin

- Vicki Doyle

- Liz McCarthy

These individuals are noted for their involvement in the response to the cyber attack and their roles in the affected organizations.