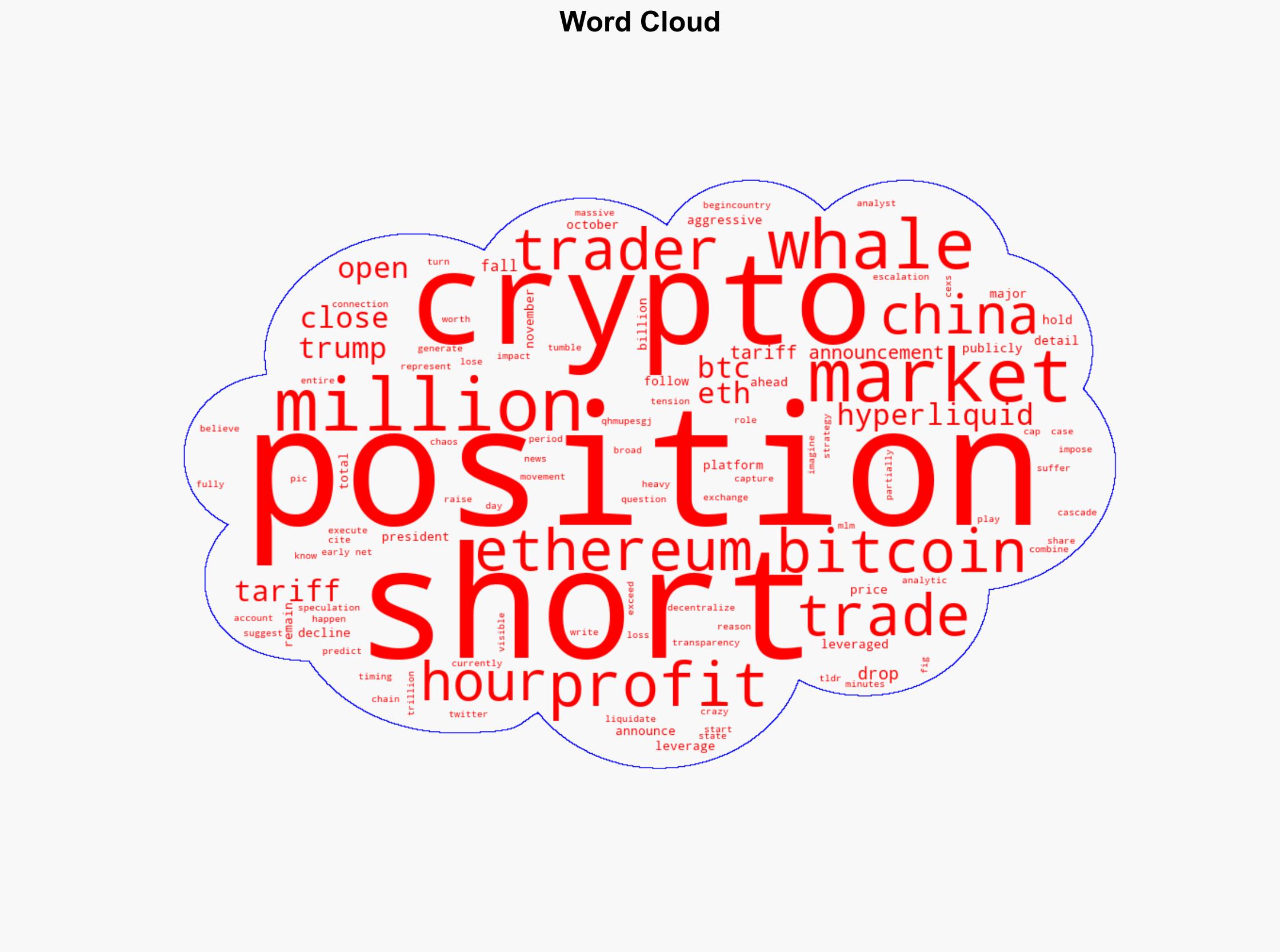

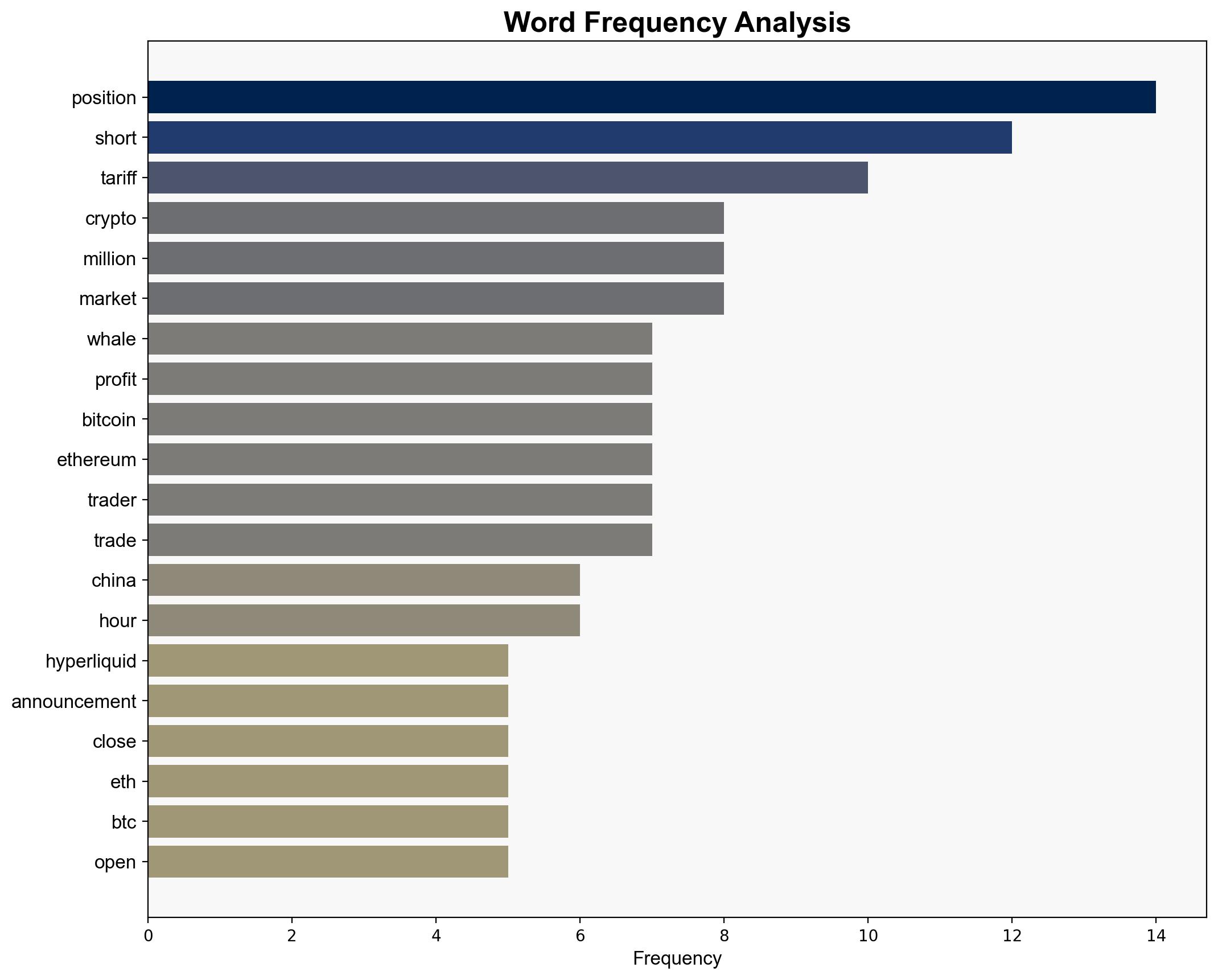

Mystery Trader Made 160M Shorting Before Tariff Bombshell – Coincentral.com

Published on: 2025-10-12

Intelligence Report: Mystery Trader Made 160M Shorting Before Tariff Bombshell – Coincentral.com

1. BLUF (Bottom Line Up Front)

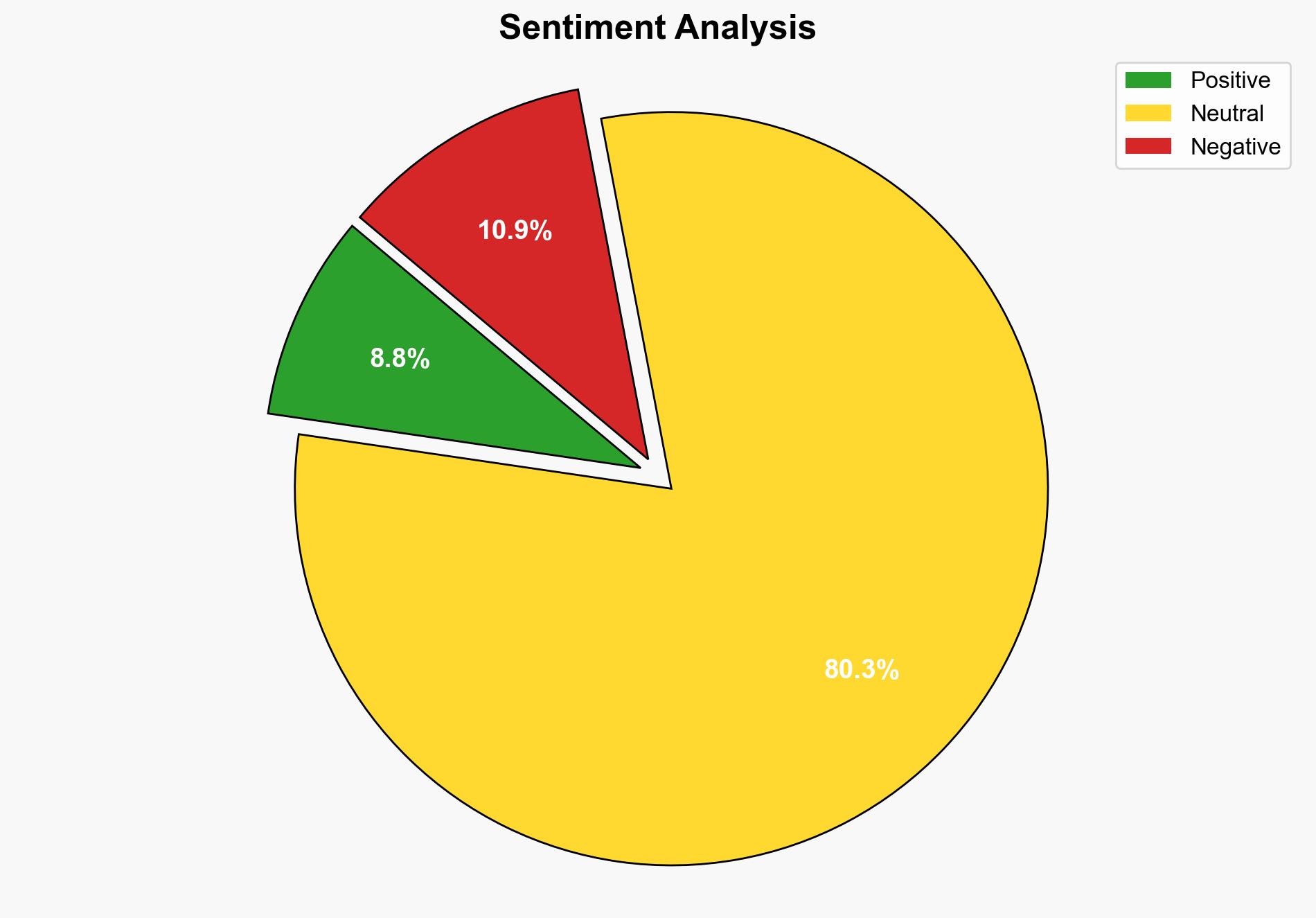

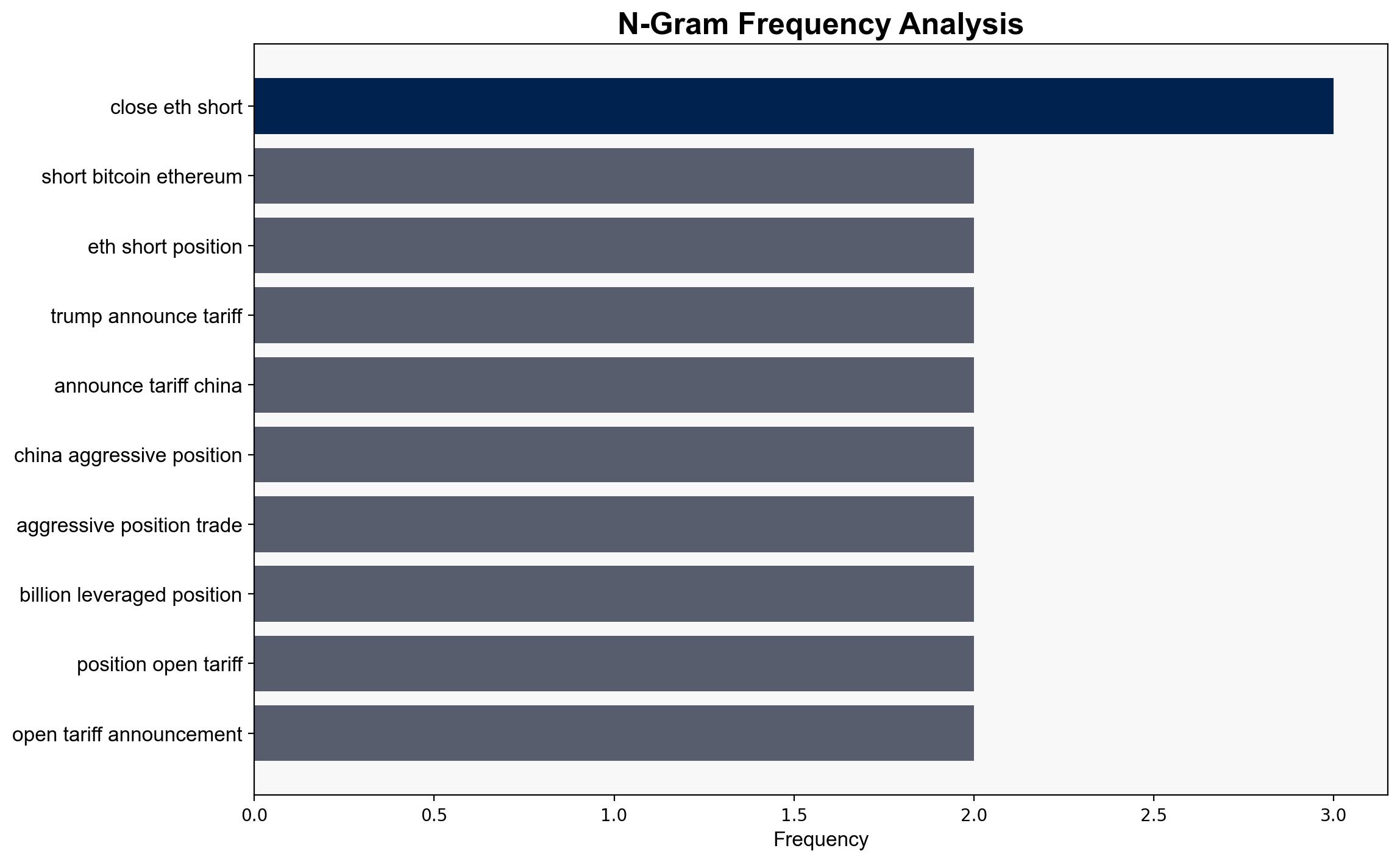

The most supported hypothesis is that the mystery trader had prior knowledge of the tariff announcement, allowing them to strategically position themselves for profit. This conclusion is drawn with moderate confidence due to the timing and magnitude of the trades. It is recommended to investigate potential information leaks and enhance monitoring of trading activities on decentralized platforms.

2. Competing Hypotheses

1. **Insider Knowledge Hypothesis**: The trader had access to non-public information regarding the tariff announcement, enabling them to execute highly profitable trades just before the news broke.

2. **Market Savvy Hypothesis**: The trader is exceptionally skilled at market analysis and anticipated the tariff announcement based on available public information and geopolitical trends.

3. Key Assumptions and Red Flags

– **Assumptions**:

– Insider Knowledge Hypothesis assumes a breach in information security.

– Market Savvy Hypothesis assumes the trader’s decisions were based solely on public data.

– **Red Flags**:

– The timing of the trades closely preceding the announcement.

– Lack of transparency regarding the trader’s identity and trading strategy.

– **Blind Spots**:

– Potential undisclosed connections between the trader and government or corporate entities.

– Insufficient data on the trader’s historical trading patterns.

4. Implications and Strategic Risks

– **Economic**: The incident underscores vulnerabilities in financial markets to insider trading, potentially undermining market integrity.

– **Cybersecurity**: Highlights the need for robust monitoring of decentralized exchanges to prevent illicit activities.

– **Geopolitical**: The event could exacerbate tensions between the U.S. and China if perceived as a manipulation linked to state actors.

– **Psychological**: Erodes trust in market fairness, potentially deterring investors.

5. Recommendations and Outlook

- Enhance surveillance on decentralized trading platforms to detect anomalous trading patterns.

- Investigate potential leaks within government and corporate sectors regarding sensitive economic policies.

- Scenario Projections:

- **Best Case**: Strengthened regulatory frameworks deter future insider trading, restoring market confidence.

- **Worst Case**: Continued exploitation of market vulnerabilities leads to significant financial instability.

- **Most Likely**: Incremental improvements in monitoring and regulation mitigate but do not eliminate risks.

6. Key Individuals and Entities

No specific individuals are identified in the source text. The trader’s identity remains unknown, referred to as a “crypto whale.”

7. Thematic Tags

national security threats, cybersecurity, financial market integrity, insider trading, geopolitical tensions