Navigating Risks and Liabilities for Life Coaches Protection from client disputes – Blogtrepreneur.com

Published on: 2025-04-05

Intelligence Report: Navigating Risks and Liabilities for Life Coaches Protection from Client Disputes – Blogtrepreneur.com

1. BLUF (Bottom Line Up Front)

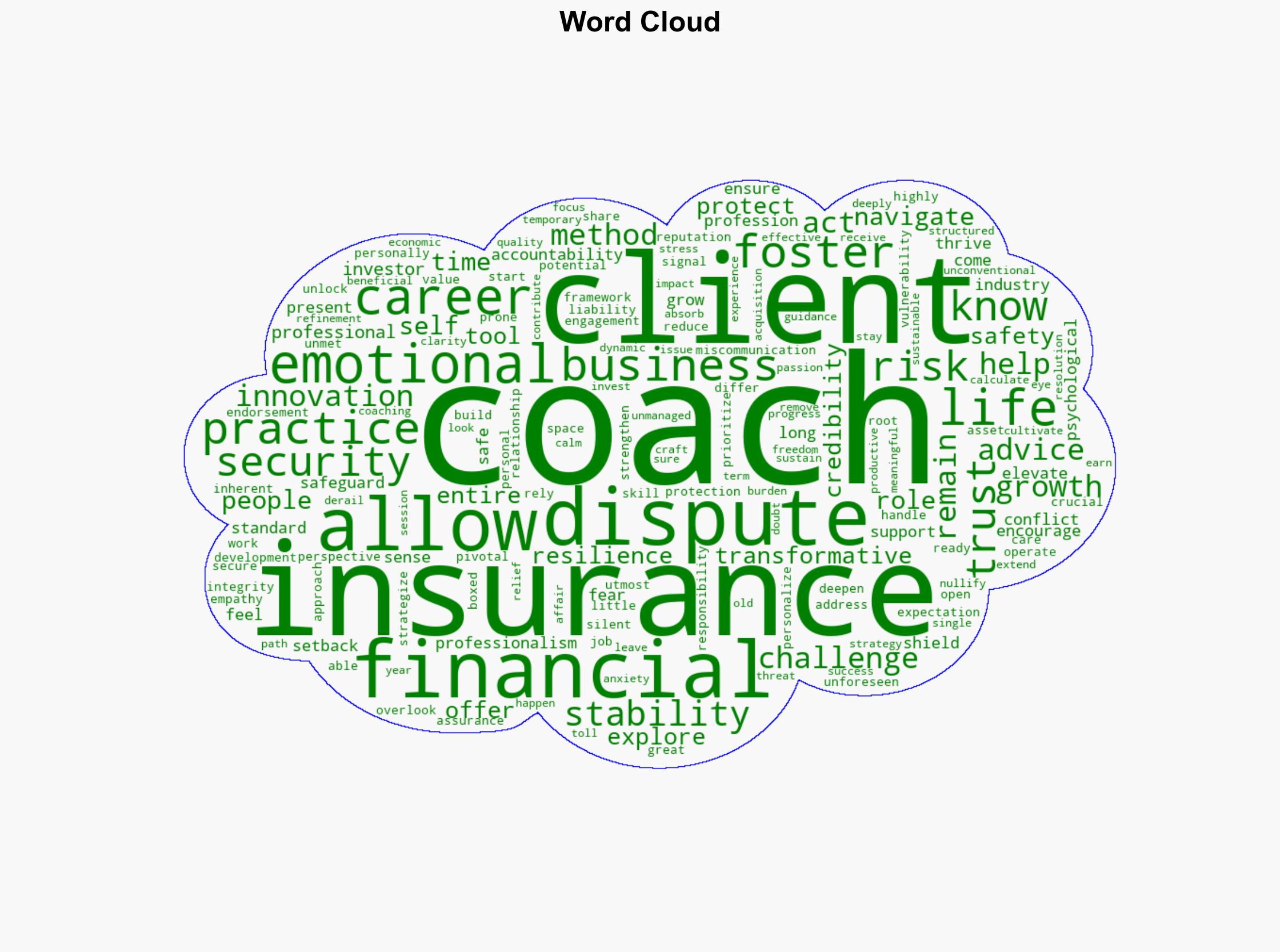

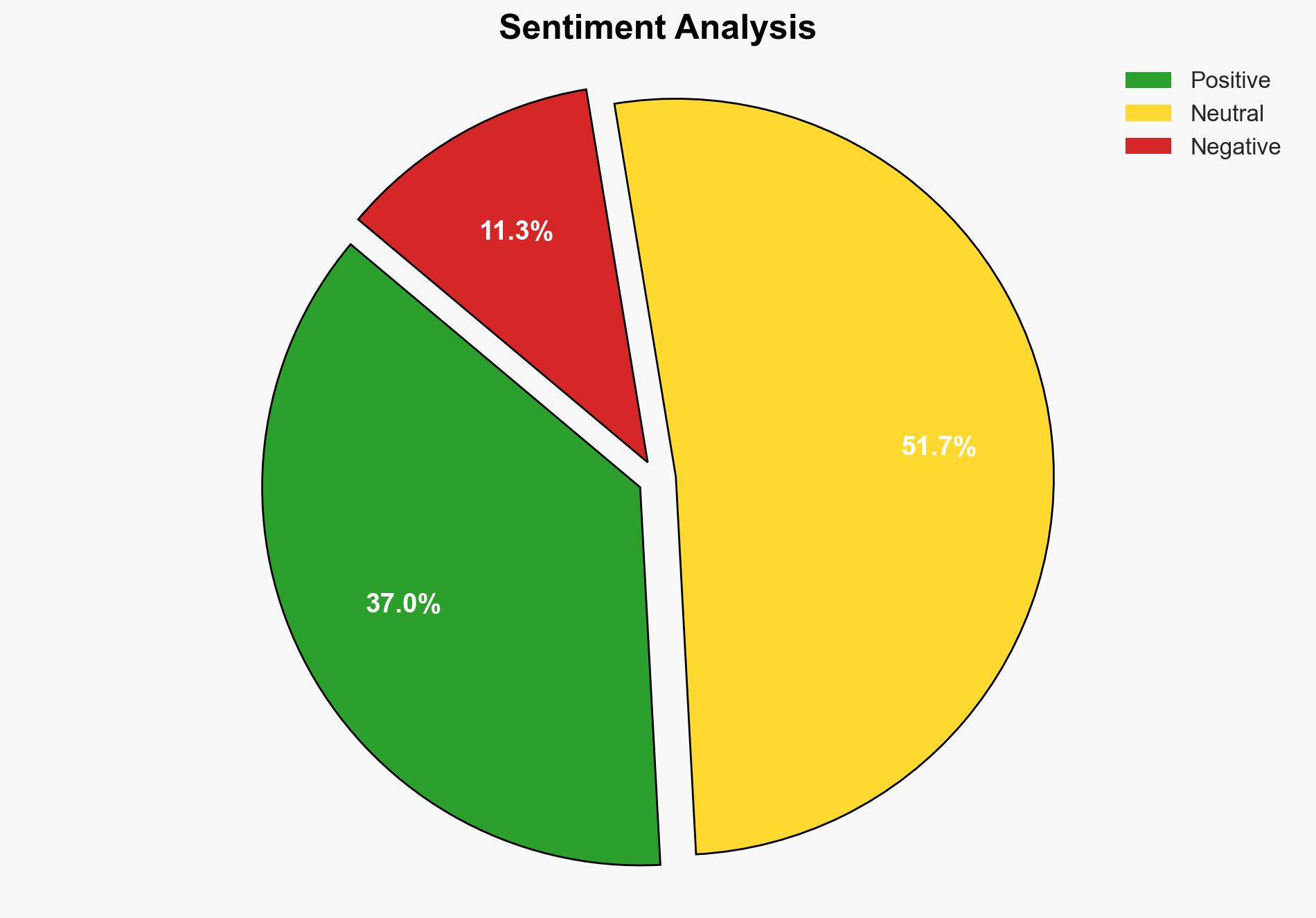

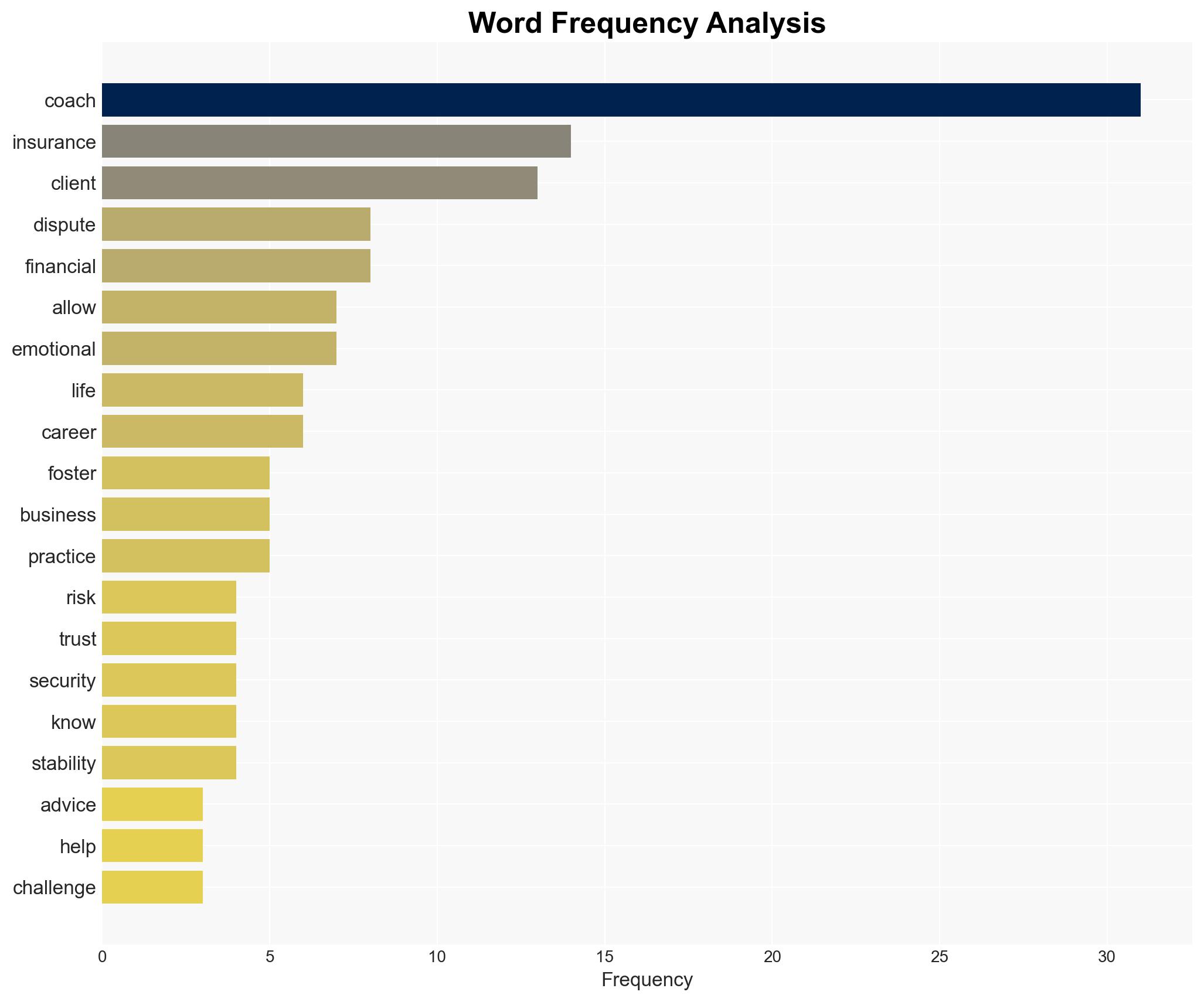

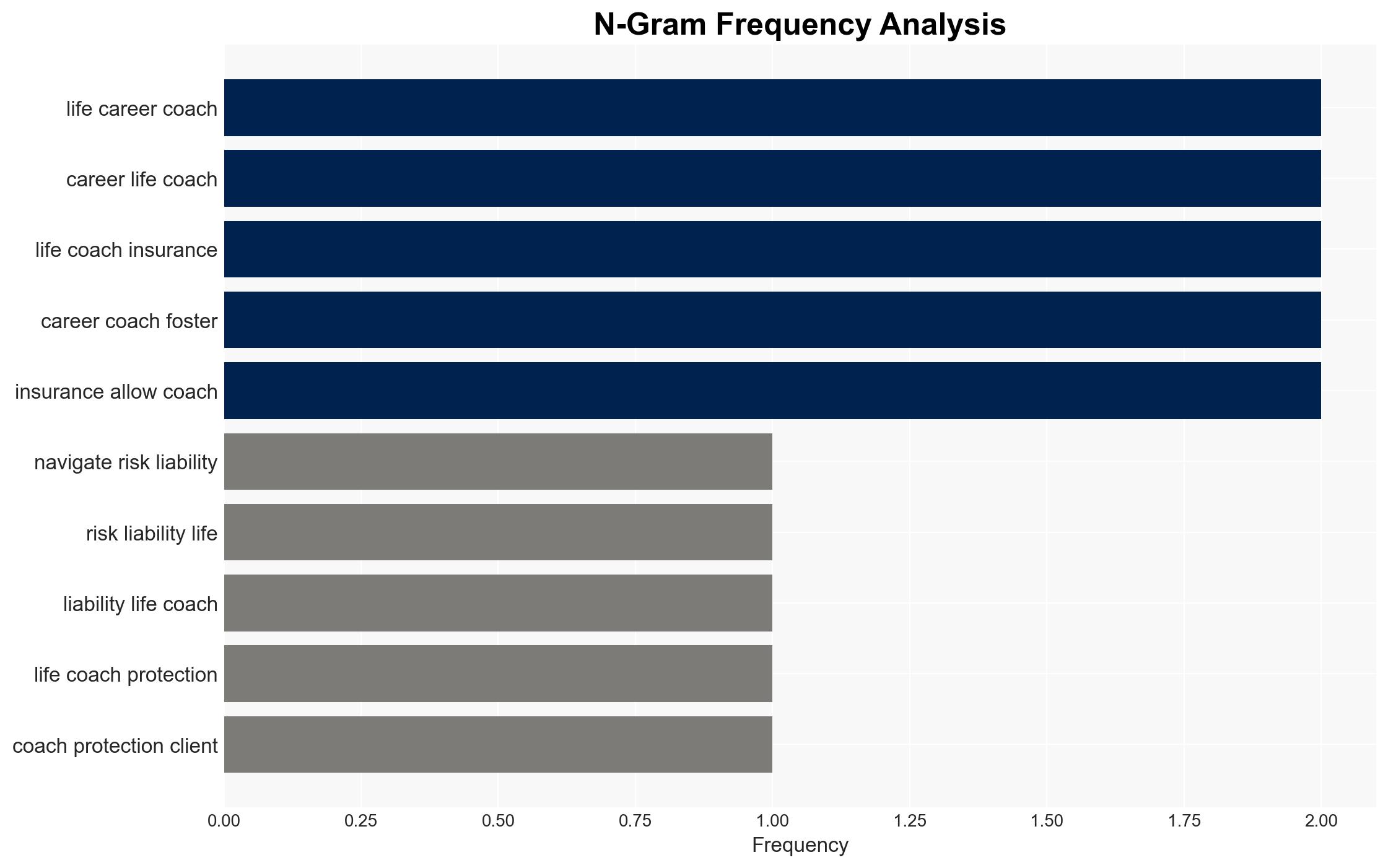

Life coaches face inherent risks related to client disputes, often stemming from unmet expectations and miscommunication. Insurance is a crucial tool for mitigating these risks, offering financial protection and enhancing professional credibility. Adoption of insurance practices can elevate industry standards and ensure sustainable business operations.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

General Analysis

Life coaches provide transformative advice that can lead to client disputes due to differing perspectives. Insurance acts as a financial safeguard, allowing coaches to focus on client growth without fear of financial setbacks. This protection fosters innovation and enhances the quality of coaching services by removing the fear of economic repercussions from disputes.

3. Implications and Strategic Risks

The lack of insurance in the life coaching industry poses risks to both coaches and clients. Unresolved disputes can lead to financial instability for coaches and undermine client trust. The absence of regulatory standards increases the vulnerability of the profession to reputational damage. Implementing insurance practices can mitigate these risks, promoting accountability and ethical practices.

4. Recommendations and Outlook

Recommendations:

- Encourage the adoption of insurance practices among life coaches to protect against financial and reputational risks.

- Advocate for the establishment of industry standards and regulatory frameworks to enhance professionalism and client trust.

- Promote awareness and education on the benefits of insurance for life coaches to foster a culture of accountability and security.

Outlook:

In a best-case scenario, widespread adoption of insurance practices will lead to increased client trust and industry credibility. In a worst-case scenario, failure to adopt these practices could result in significant financial losses and reputational damage. The most likely outcome is a gradual increase in insurance adoption, driven by growing awareness of its benefits.

5. Key Individuals and Entities

The report does not specifically mention any individuals or organizations. However, the emphasis is placed on life coaches as a collective group within the industry.