Nearly 13M stolen from Abracadabra Finance in crypto heist – Therecord.media

Published on: 2025-04-08

Intelligence Report: Nearly 13M stolen from Abracadabra Finance in crypto heist – Therecord.media

1. BLUF (Bottom Line Up Front)

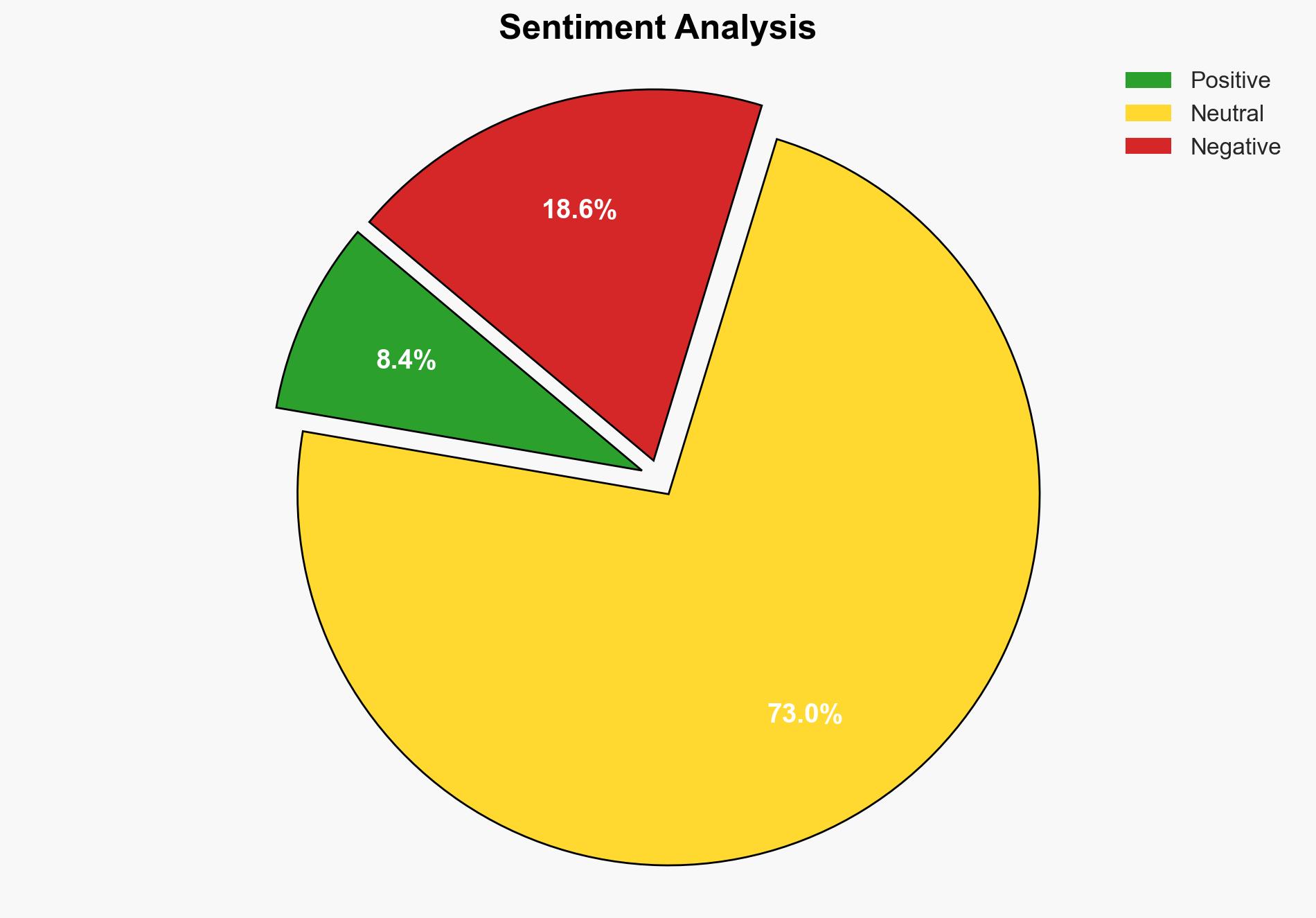

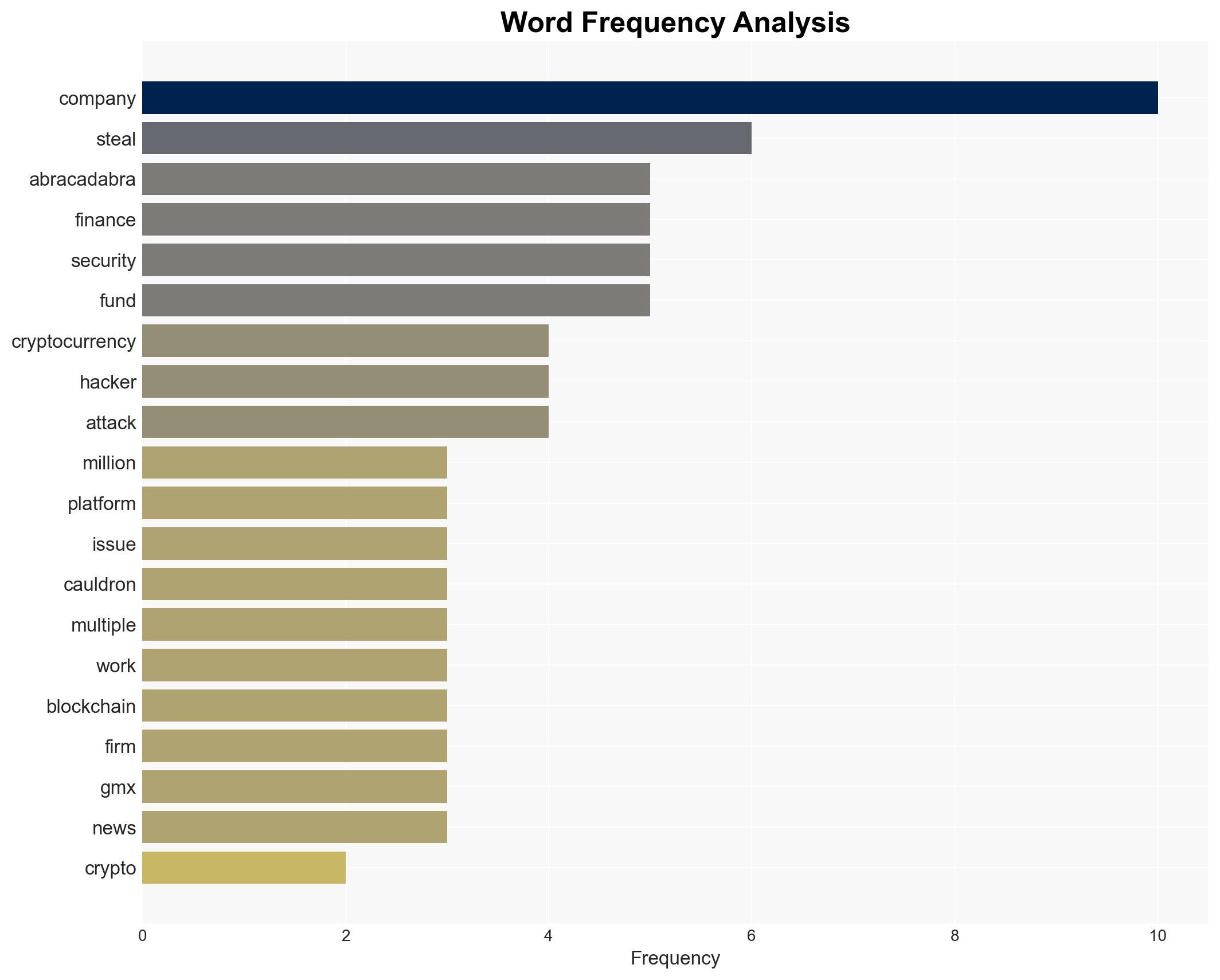

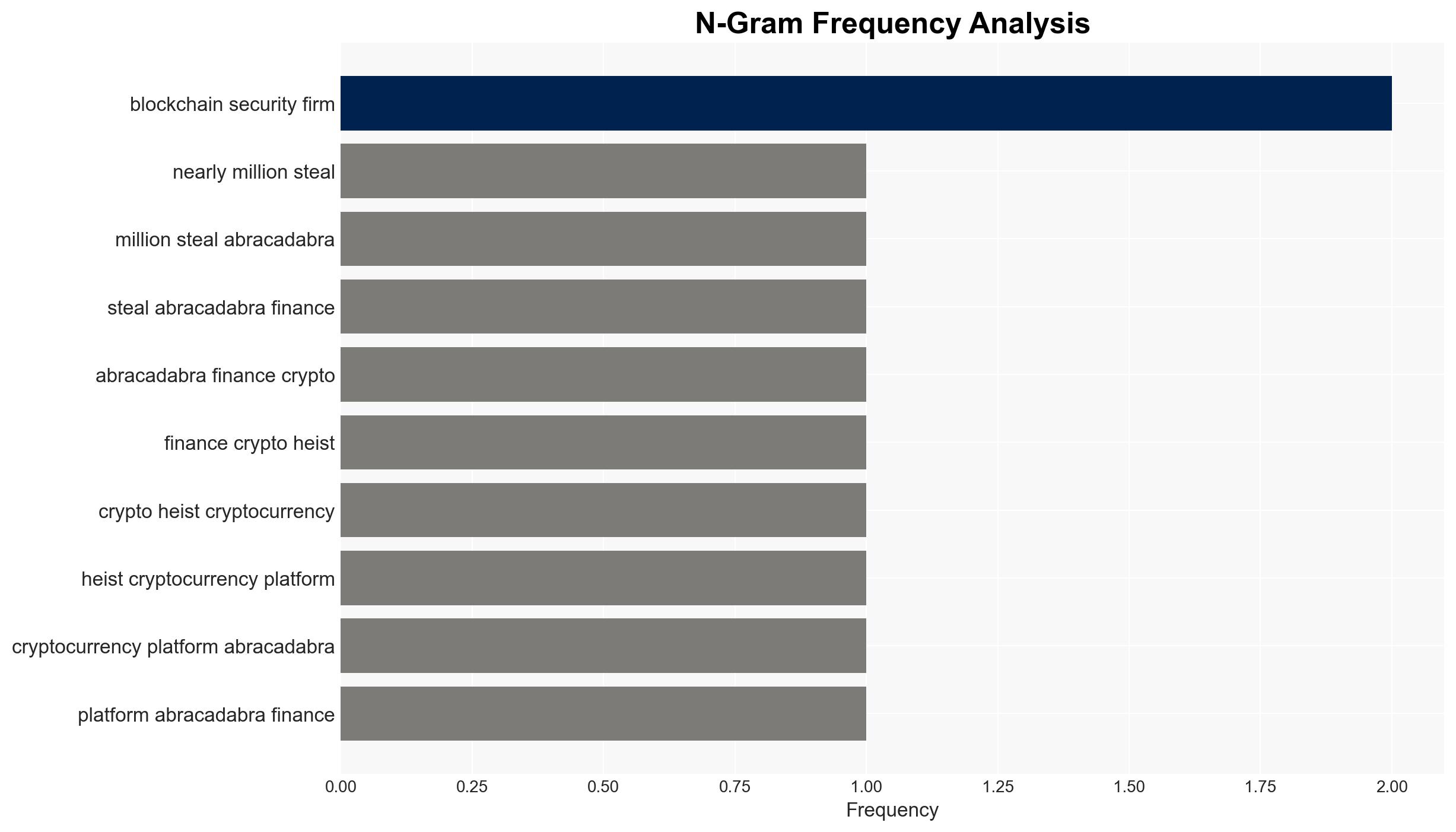

A significant security breach resulted in the theft of nearly $13 million from Abracadabra Finance, a cryptocurrency platform. The incident occurred on a Tuesday morning, with the attacker exploiting vulnerabilities in the platform’s Cauldron product. Abracadabra Finance, along with blockchain security firms, is actively investigating the breach. Immediate measures include a comprehensive audit and collaboration with security companies to track the stolen funds. The attack highlights vulnerabilities in decentralized finance platforms and underscores the need for enhanced security protocols.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

General Analysis

The attack on Abracadabra Finance involved the exploitation of its Cauldron lending market, which allows users to borrow various cryptocurrencies. The attacker successfully executed transactions that led to the theft of digital assets, including Ethereum and GMX coins. The platform’s response included isolating the affected markets and conducting an audit with the assistance of Guardian, a security company. Blockchain security firm Chainalysis is tracking the stolen funds, while Abracadabra Finance has offered a bug bounty to incentivize the return of the assets. The incident is linked to the decentralized exchange GMX, although GMX representatives have clarified that their contracts were not directly affected.

3. Implications and Strategic Risks

The breach poses several strategic risks, including:

- Increased scrutiny on decentralized finance platforms, potentially leading to regulatory changes.

- Potential loss of investor confidence in cryptocurrency platforms, affecting market stability.

- Risks of further attacks if vulnerabilities are not addressed, impacting economic interests and regional stability.

4. Recommendations and Outlook

Recommendations:

- Enhance security protocols and conduct regular audits to identify and mitigate vulnerabilities.

- Collaborate with regulatory bodies to establish clear guidelines for decentralized finance operations.

- Implement advanced monitoring systems to detect and respond to suspicious activities promptly.

Outlook:

Best-case scenario: Successful recovery of stolen funds and implementation of robust security measures restore confidence in Abracadabra Finance and similar platforms.

Worst-case scenario: Continued vulnerabilities lead to further breaches, resulting in significant financial losses and regulatory crackdowns.

Most likely outcome: Partial recovery of funds and gradual implementation of improved security measures, with increased regulatory oversight.

5. Key Individuals and Entities

The report mentions the following individuals and entities:

- Abracadabra Finance

- Guardian

- Chainalysis

- GMX

- Jonathan Greig