Nepals Payment Giants Under Scrutiny New Rules Tighten Grip on Transactions Assets – Nep123.com

Published on: 2025-08-11

Intelligence Report: Nepals Payment Giants Under Scrutiny New Rules Tighten Grip on Transactions Assets – Nep123.com

1. BLUF (Bottom Line Up Front)

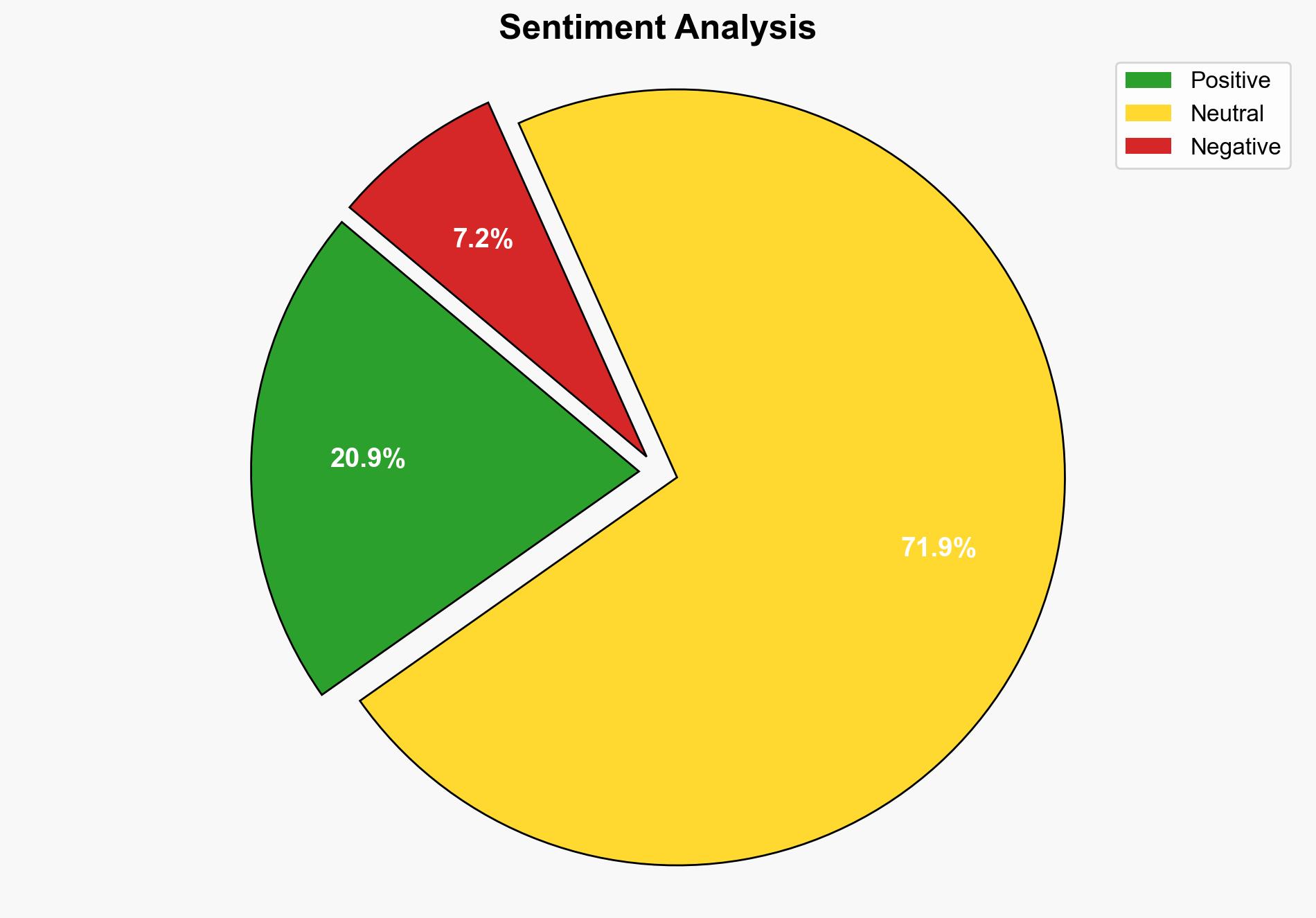

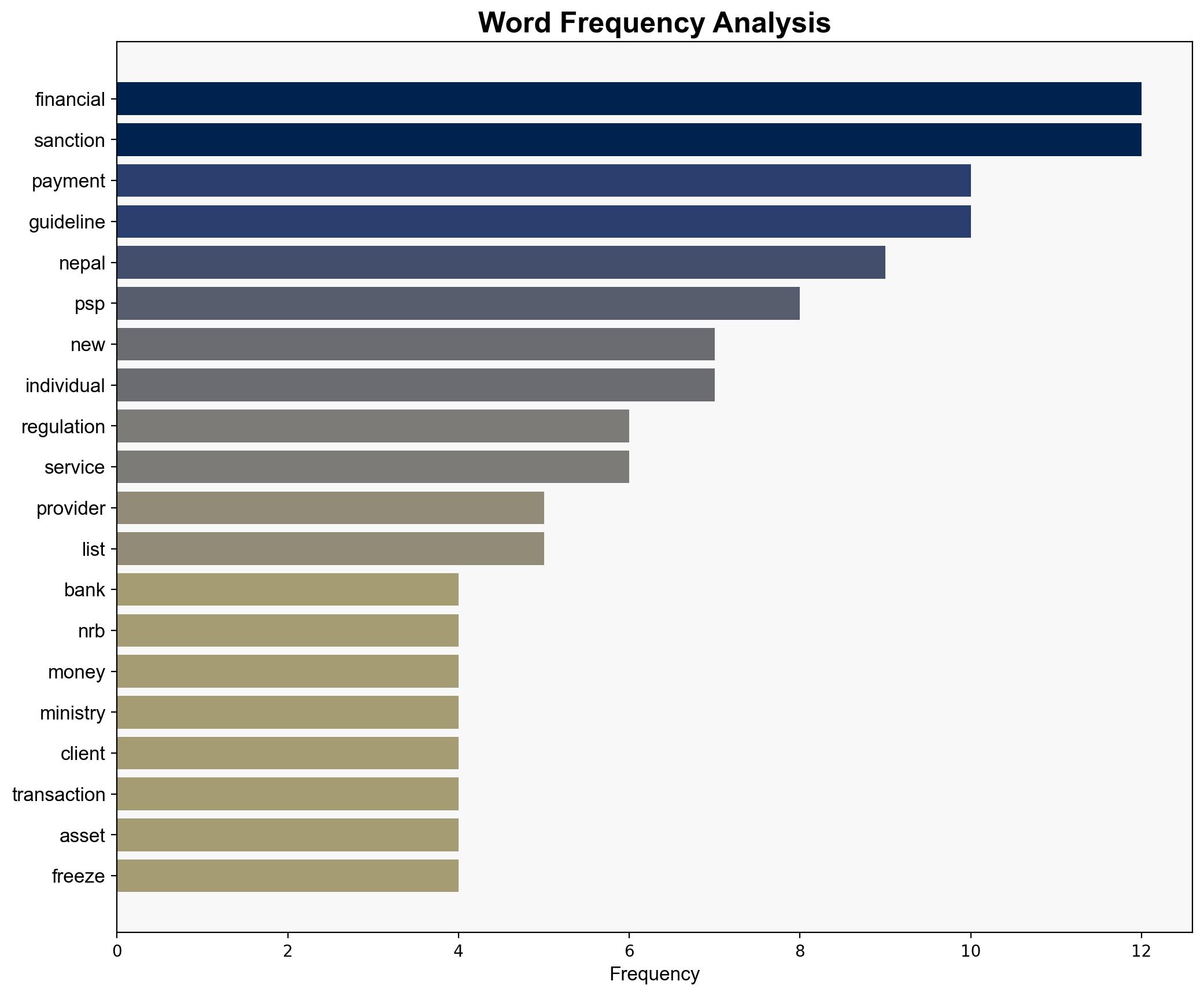

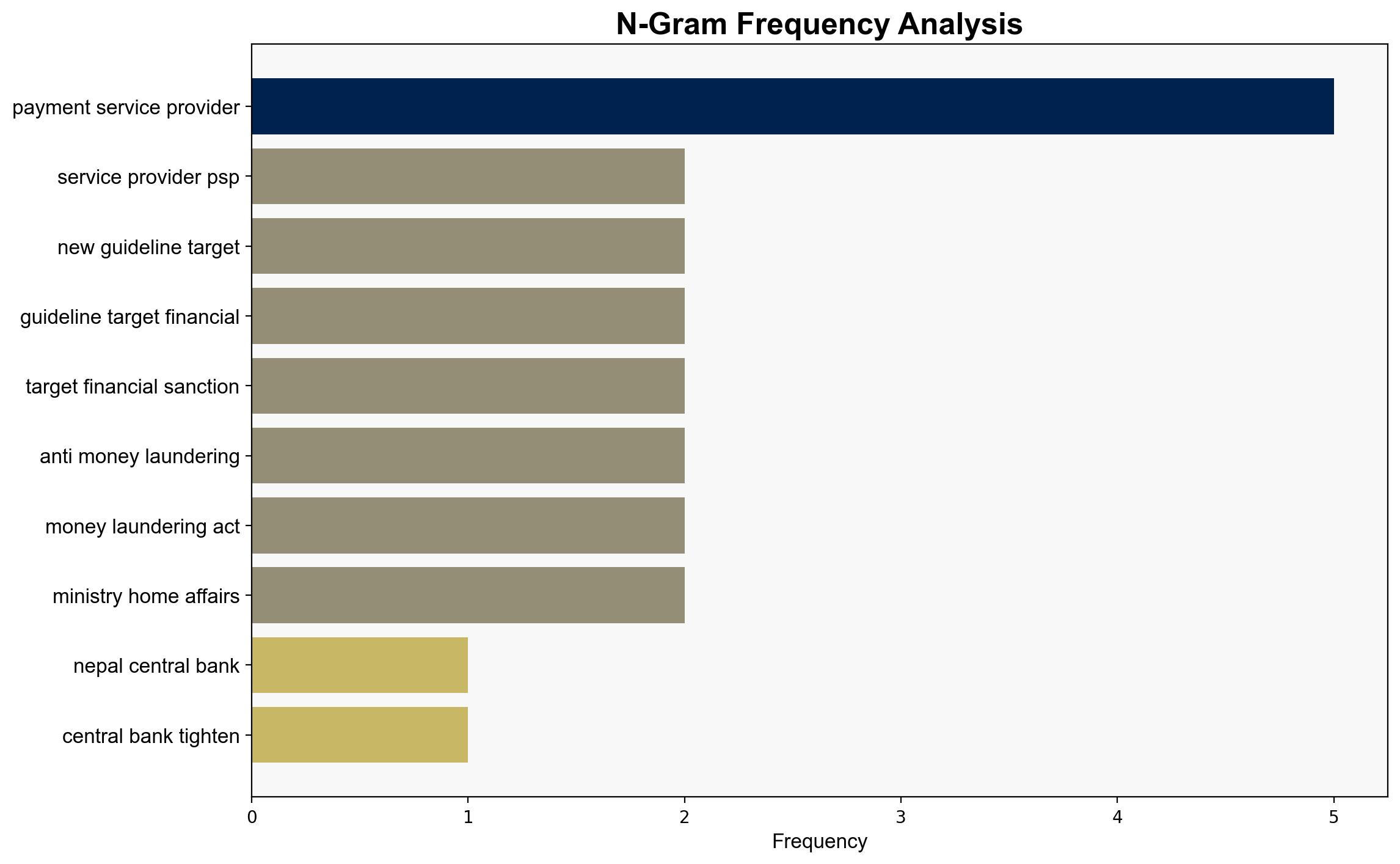

The new guidelines by Nepal Rastra Bank (NRB) aim to enhance the security and integrity of Nepal’s payment systems by aligning them with international standards for anti-money laundering (AML) and combating the financing of terrorism (CFT). The most supported hypothesis suggests that these regulations will strengthen Nepal’s financial ecosystem, though there may be challenges in implementation and compliance. Confidence Level: Moderate. Recommended Action: Monitor compliance and provide support to PSPs for smooth implementation.

2. Competing Hypotheses

1. **Hypothesis A**: The NRB’s new guidelines will successfully enhance the security and integrity of Nepal’s payment systems, aligning them with international standards and reducing financial crime risks.

2. **Hypothesis B**: The new guidelines will face significant implementation challenges, potentially leading to non-compliance and limited effectiveness in reducing financial crime risks.

3. Key Assumptions and Red Flags

– **Assumptions**:

– Hypothesis A assumes that PSPs have the capacity and resources to comply with the new guidelines.

– Hypothesis B assumes that the guidelines are overly complex or resource-intensive for PSPs to implement effectively.

– **Red Flags**:

– Lack of clarity on enforcement mechanisms and support for PSPs.

– Potential resistance from PSPs due to increased operational costs.

4. Implications and Strategic Risks

– **Economic Risks**: Non-compliance could lead to penalties and loss of licenses, affecting the financial stability of PSPs.

– **Cybersecurity Risks**: Increased regulatory scrutiny may expose vulnerabilities in PSPs’ systems if not adequately addressed.

– **Geopolitical Risks**: Failure to meet international standards could affect Nepal’s financial reputation and international relations.

5. Recommendations and Outlook

- Provide training and resources to PSPs to ensure compliance with new guidelines.

- Establish a clear communication channel between NRB and PSPs to address implementation challenges.

- Scenario Projections:

- Best Case: Full compliance leads to enhanced security and international recognition.

- Worst Case: Widespread non-compliance results in financial instability and reputational damage.

- Most Likely: Partial compliance with ongoing adjustments and support from NRB.

6. Key Individuals and Entities

– Nepal Rastra Bank

– Nepal Clearing House

– Smart Choice Technology

– Fonepay

– Nepal Payment Solution

– IME Pay

– Khalti

– eSewa

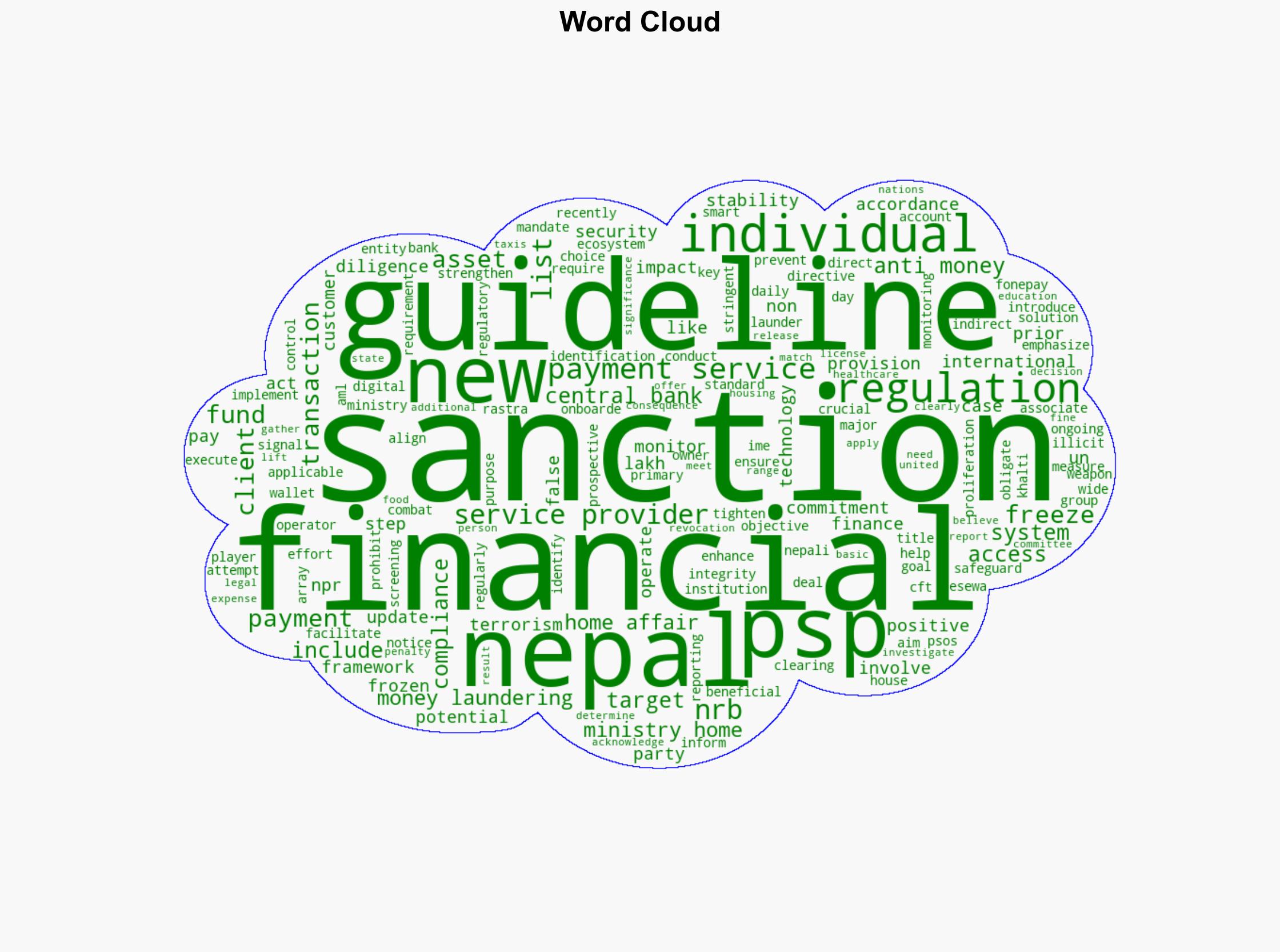

7. Thematic Tags

national security threats, cybersecurity, counter-terrorism, regional focus