Nigerias Lessons for Emerging Economies – Project Syndicate

Published on: 2025-11-14

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Nigerias Lessons for Emerging Economies – Project Syndicate

1. BLUF (Bottom Line Up Front)

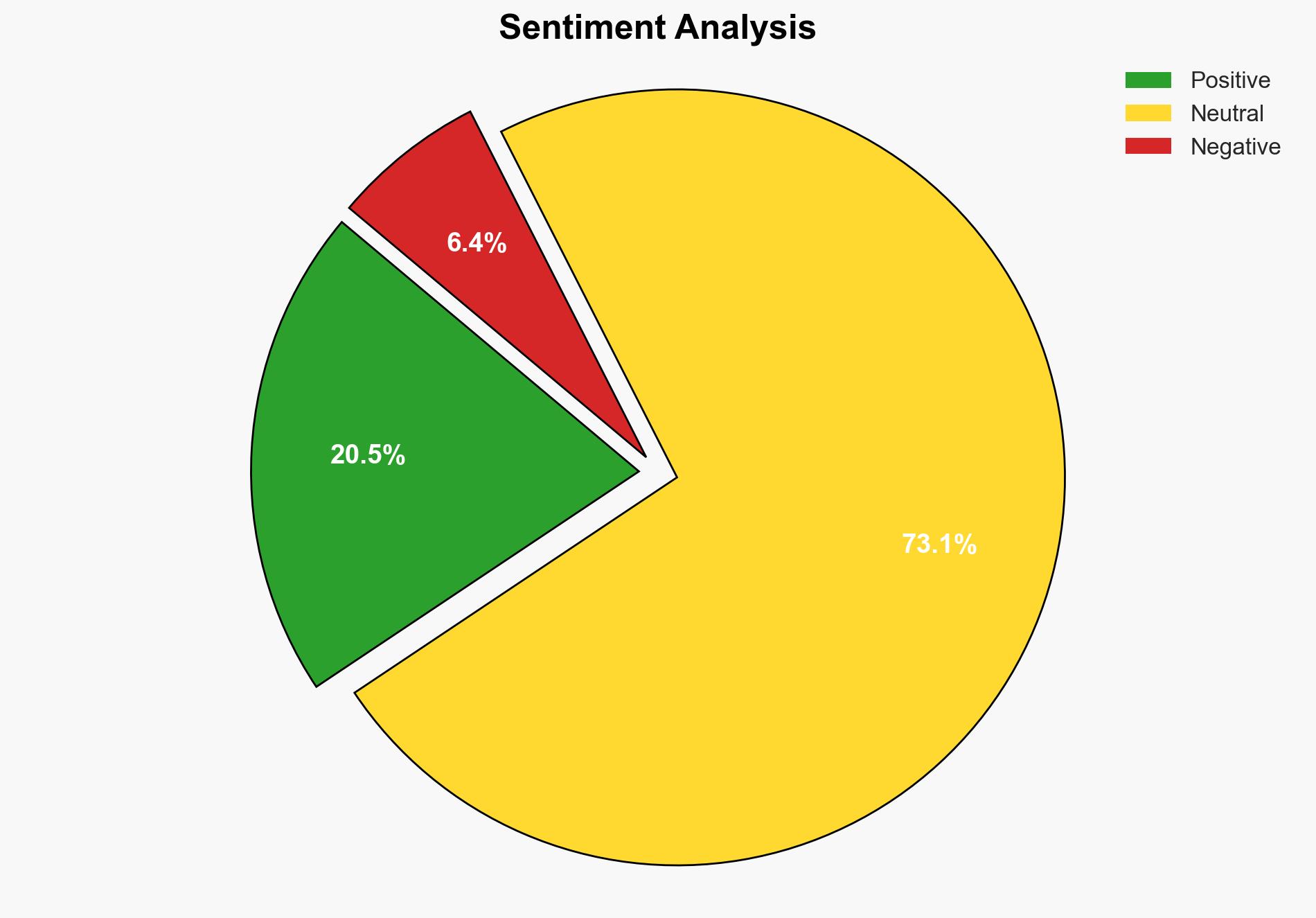

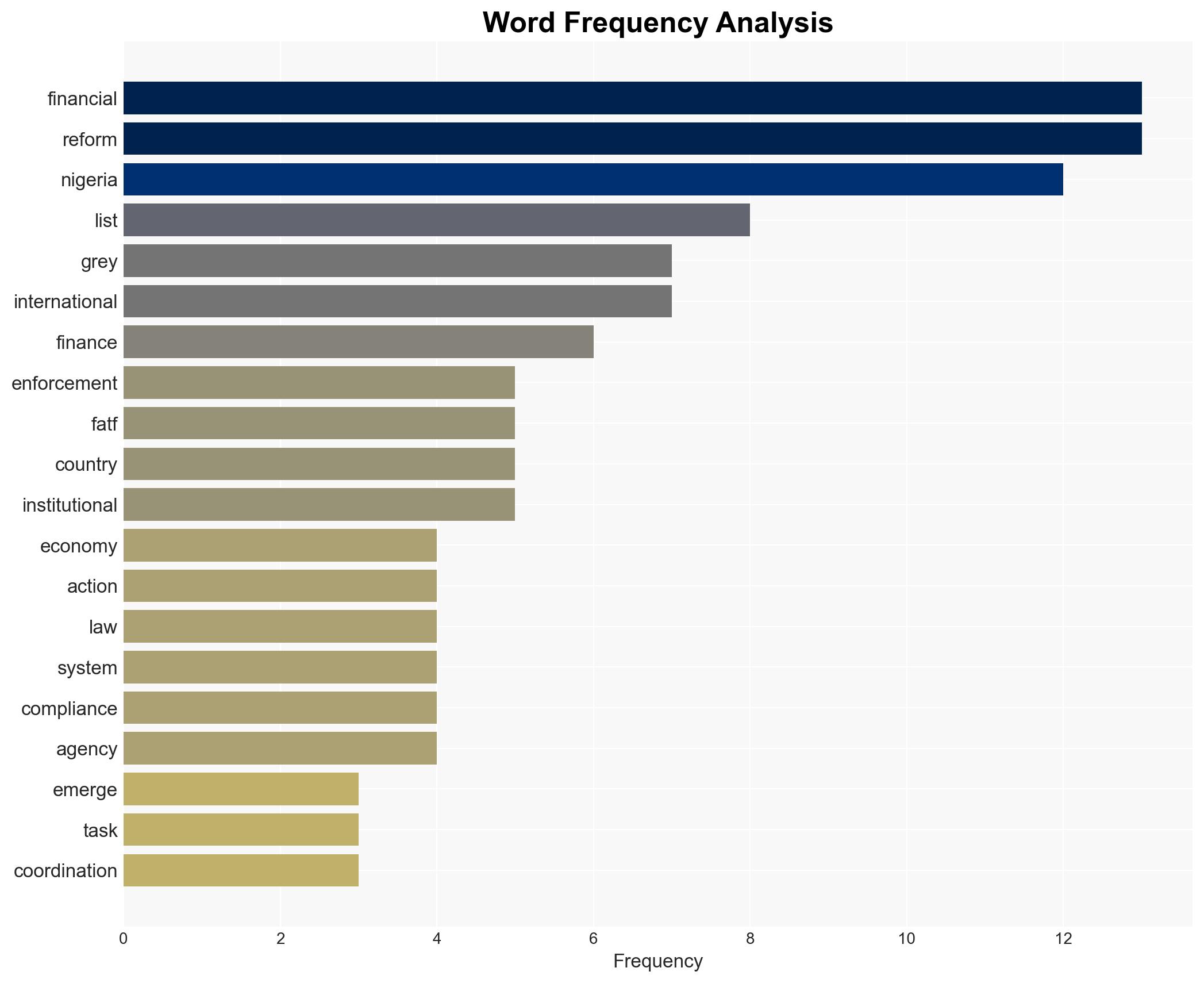

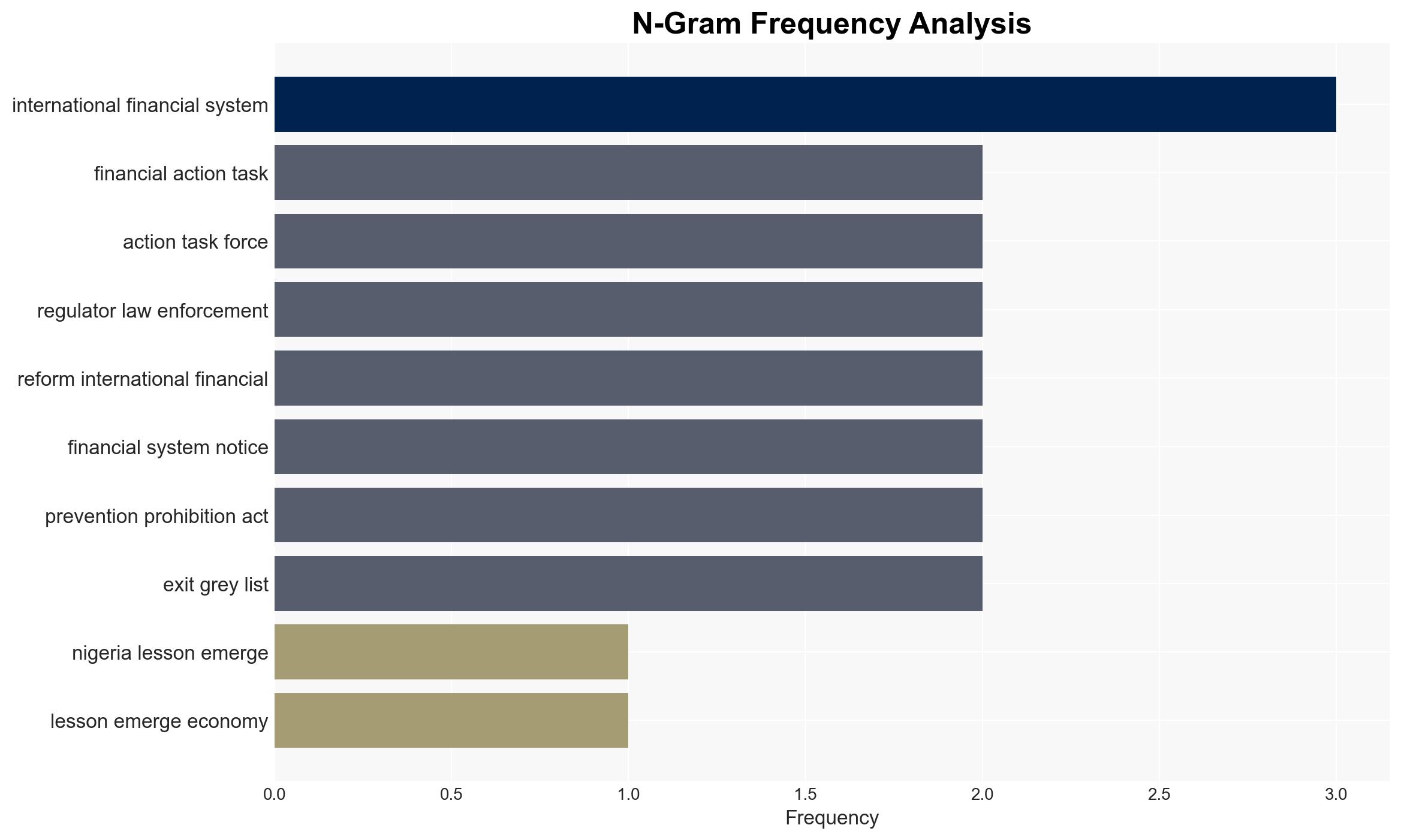

With a moderate confidence level, the most supported hypothesis is that Nigeria’s removal from the FATF grey list is a result of genuine institutional reform rather than mere technical compliance. This suggests a positive trajectory for Nigeria’s economic governance, offering a model for other emerging economies. Recommended actions include monitoring Nigeria’s continued adherence to international standards and encouraging similar reforms in other emerging markets.

2. Competing Hypotheses

Hypothesis 1: Nigeria’s removal from the FATF grey list is due to genuine institutional reforms that have strengthened its financial governance and transparency.

Hypothesis 2: Nigeria’s removal is primarily a result of technical compliance with FATF standards, lacking deep-rooted institutional changes.

Hypothesis 1 is more likely due to the comprehensive nature of the reforms, including legislative changes and enhanced coordination among various government agencies, as indicated by the source text. However, the possibility of superficial compliance cannot be entirely ruled out without further evidence of sustained reform implementation.

3. Key Assumptions and Red Flags

Key assumptions include the belief that Nigeria’s government is committed to long-term reform and that international oversight will continue to incentivize compliance. Red flags include potential political instability that could derail reforms and the risk of reforms being reversed if international attention wanes. There is also a risk of bias in assuming that all reforms are effectively implemented across all levels of government.

4. Implications and Strategic Risks

Successful reforms in Nigeria could lead to increased foreign investment and economic stability, serving as a model for other emerging economies. However, failure to maintain reforms could result in renewed economic challenges and loss of international credibility. Politically, there is a risk of backlash if reforms are perceived as externally imposed rather than domestically driven.

5. Recommendations and Outlook

- Encourage Nigeria to maintain transparency and continue strengthening its financial institutions to ensure sustained compliance with international standards.

- Monitor potential political changes that could impact reform sustainability.

- Best-case scenario: Nigeria’s reforms lead to increased foreign investment and economic growth, setting a precedent for other emerging economies.

- Worst-case scenario: Reforms are reversed due to political instability, leading to renewed economic challenges.

- Most-likely scenario: Nigeria maintains a moderate level of reform, with gradual improvements in economic governance.

6. Key Individuals and Entities

President Bola Ahmed Tinubu, Hafsat Abubakar Bakari, Nuhu Ribadu, Finance Minister Wale Edun.

7. Thematic Tags

National Security Threats, Economic Reform, Financial Governance, Emerging Markets

Structured Analytic Techniques Applied

- Cognitive Bias Stress Test: Expose and correct potential biases in assessments through red-teaming and structured challenge.

- Bayesian Scenario Modeling: Use probabilistic forecasting for conflict trajectories or escalation likelihood.

- Network Influence Mapping: Map relationships between state and non-state actors for impact estimation.

Explore more:

National Security Threats Briefs ·

Daily Summary ·

Support us

·