Nippon Steel acquires US Steel for 149bn after months of struggle – Al Jazeera English

Published on: 2025-06-18

Intelligence Report: Nippon Steel acquires US Steel for 149bn after months of struggle – Al Jazeera English

1. BLUF (Bottom Line Up Front)

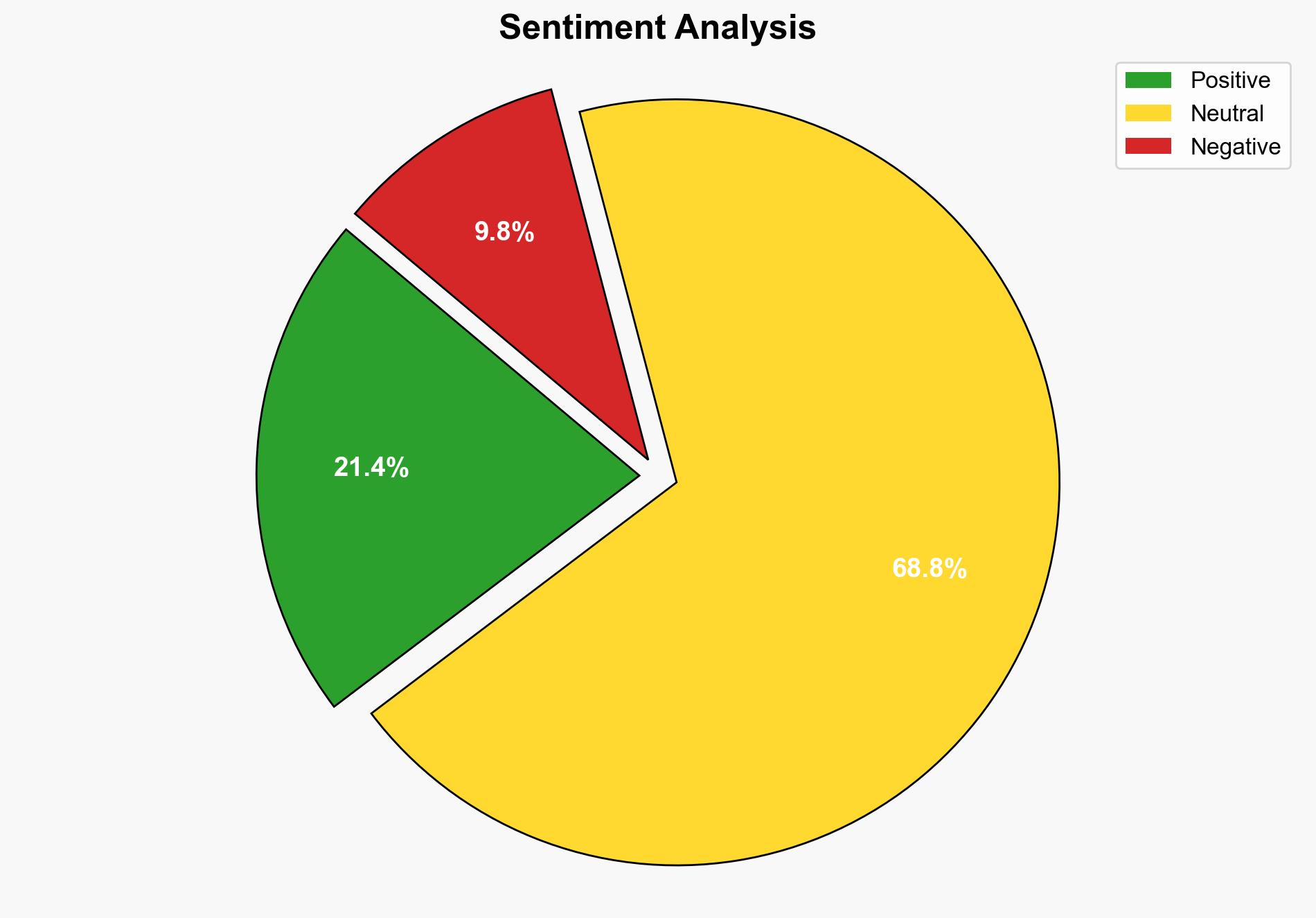

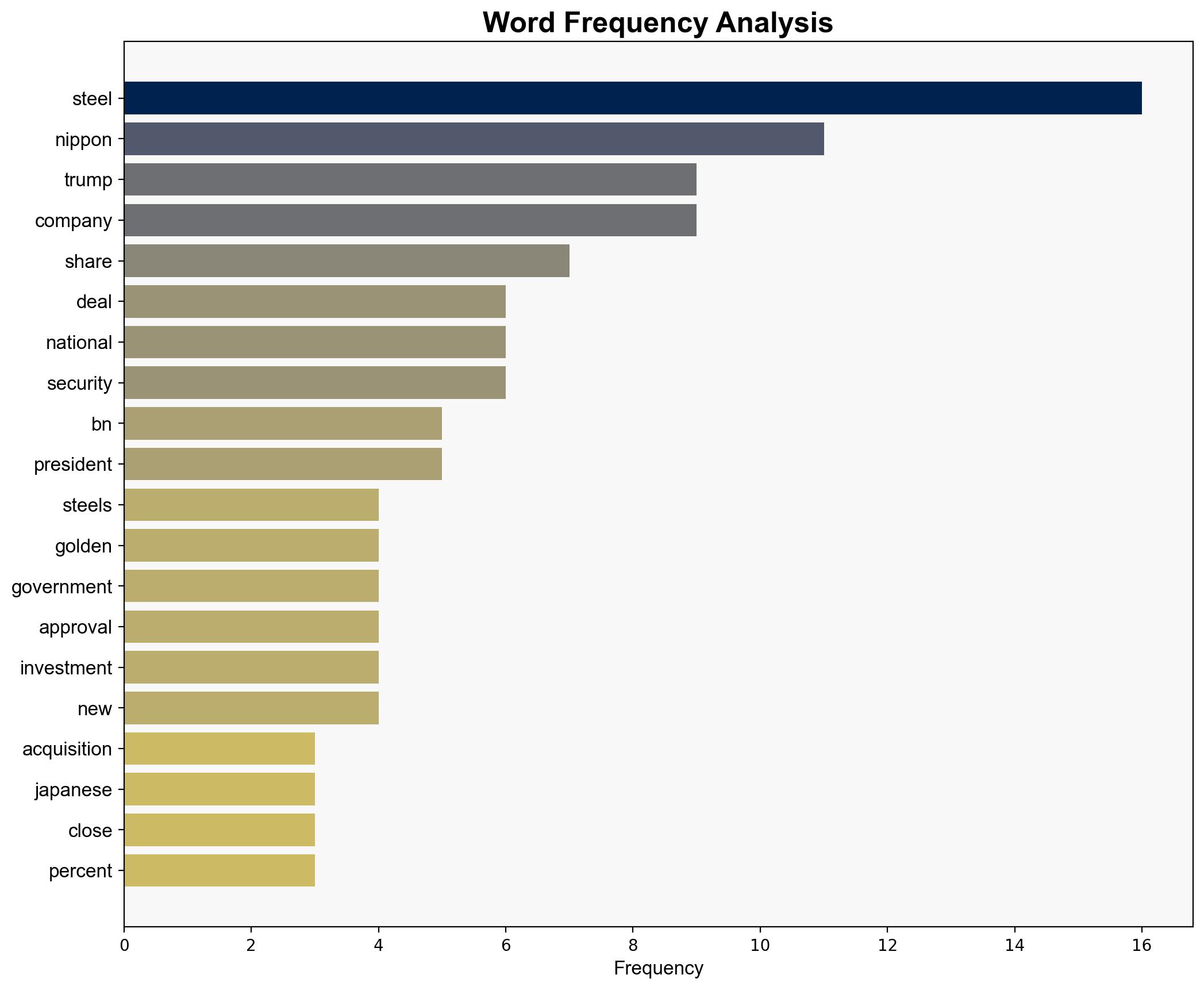

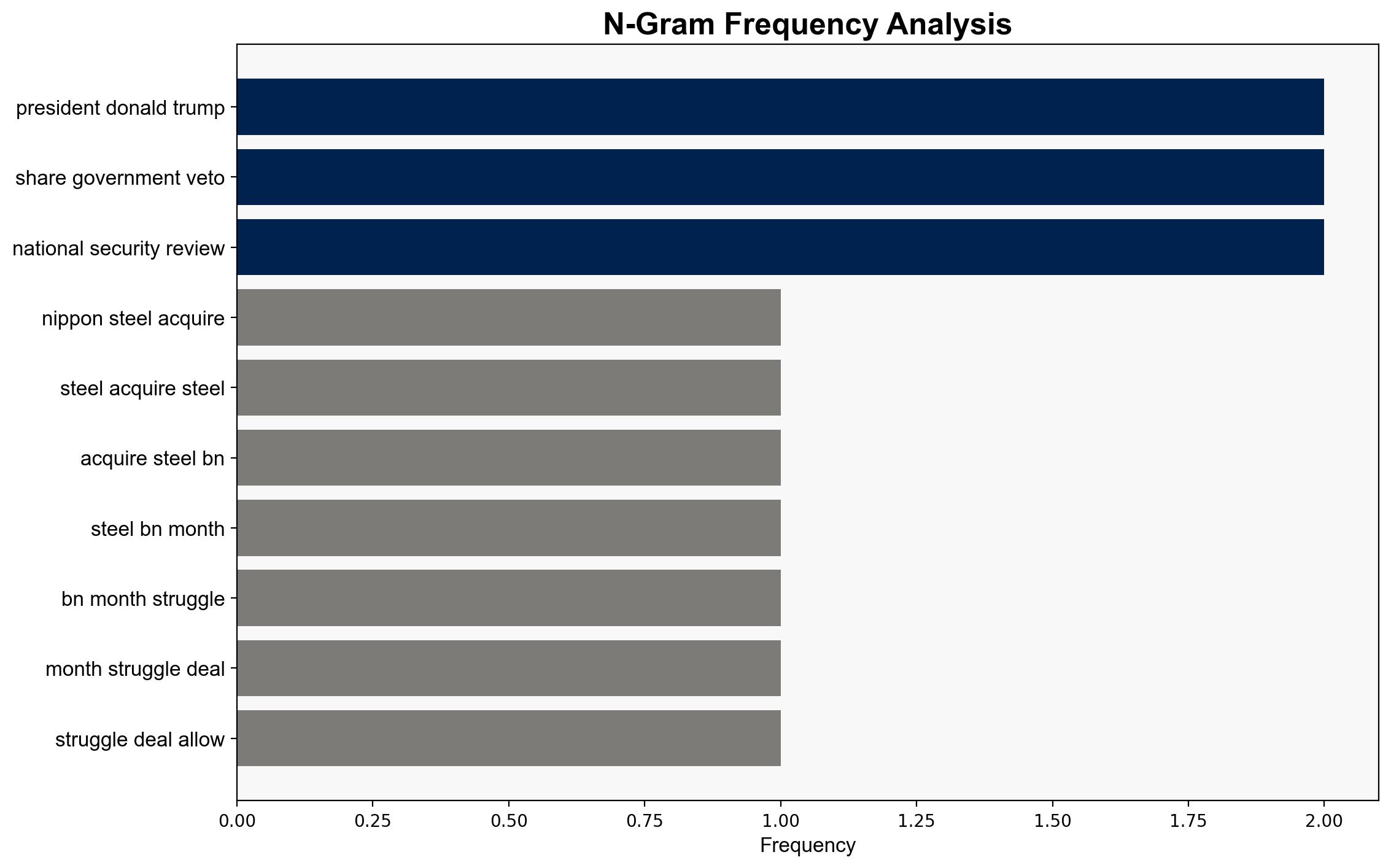

Nippon Steel has successfully acquired US Steel for $149 billion after a protracted negotiation period. This acquisition grants significant influence to the United States government, specifically through a “golden share” arrangement that allows veto power over key corporate decisions. The deal is expected to enhance Nippon Steel’s global strategic goals and increase its production capacity, positioning it as a major player in the global steel industry. The acquisition has geopolitical implications, particularly in the context of US-Japan relations and national security considerations.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Cognitive Bias Stress Test

The analysis identifies potential biases in the perception of the acquisition’s impact on national security and economic stability. The structured challenge suggests that while the deal enhances US-Japan economic ties, it also raises concerns about foreign control over critical infrastructure.

Bayesian Scenario Modeling

Probabilistic forecasting indicates a moderate likelihood of increased geopolitical tension if the acquisition is perceived as compromising US national security. However, the strategic partnership could also lead to strengthened bilateral relations and economic cooperation.

Network Influence Mapping

The acquisition maps out influence dynamics between Nippon Steel, the US government, and other stakeholders, highlighting the potential for increased leverage by the US over corporate decisions due to the golden share arrangement.

3. Implications and Strategic Risks

The acquisition may set a precedent for future foreign investments in critical US industries, potentially leading to increased scrutiny and regulatory hurdles. The golden share arrangement introduces a new layer of government oversight, which could deter future foreign investors. Additionally, the geopolitical landscape may shift, with potential impacts on US relations with other steel-producing nations.

4. Recommendations and Outlook

- Monitor the implementation of the golden share arrangement to assess its impact on corporate governance and national security.

- Engage in diplomatic efforts to reassure allies and mitigate potential geopolitical tensions arising from the acquisition.

- Scenario-based projections suggest that in the best case, the acquisition strengthens US-Japan economic ties; in the worst case, it leads to increased regulatory scrutiny and geopolitical tension; the most likely scenario involves a balanced outcome with both opportunities and challenges.

5. Key Individuals and Entities

Eiji Hashimoto, Donald Trump, Joe Biden, Howard Lutnick

6. Thematic Tags

national security threats, foreign investment, US-Japan relations, economic cooperation