Nvidia has lost 250 billion worth of market cap in almost an instant – Quartz India

Published on: 2025-04-17

Intelligence Report: Nvidia has lost 250 billion worth of market cap in almost an instant – Quartz India

1. BLUF (Bottom Line Up Front)

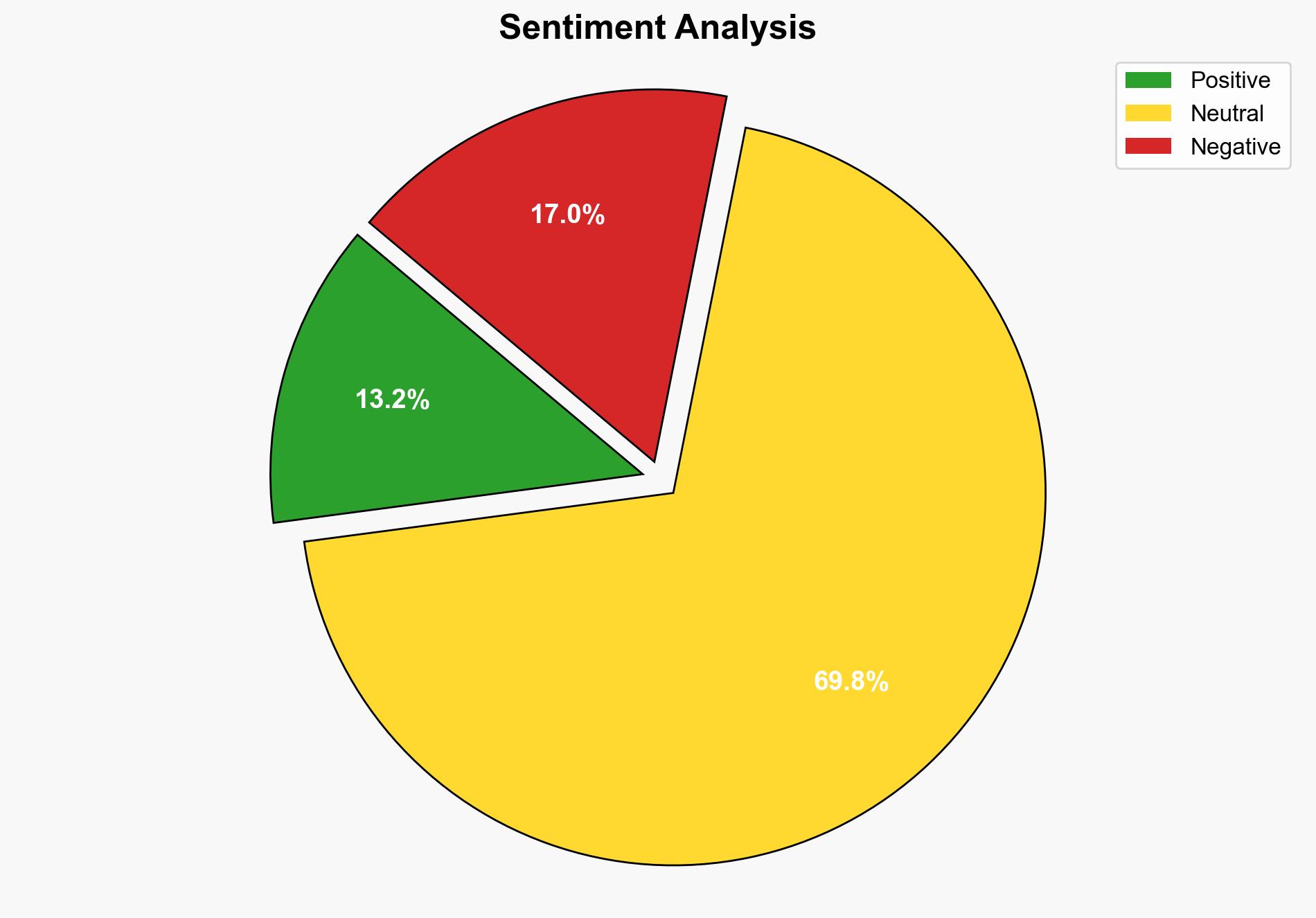

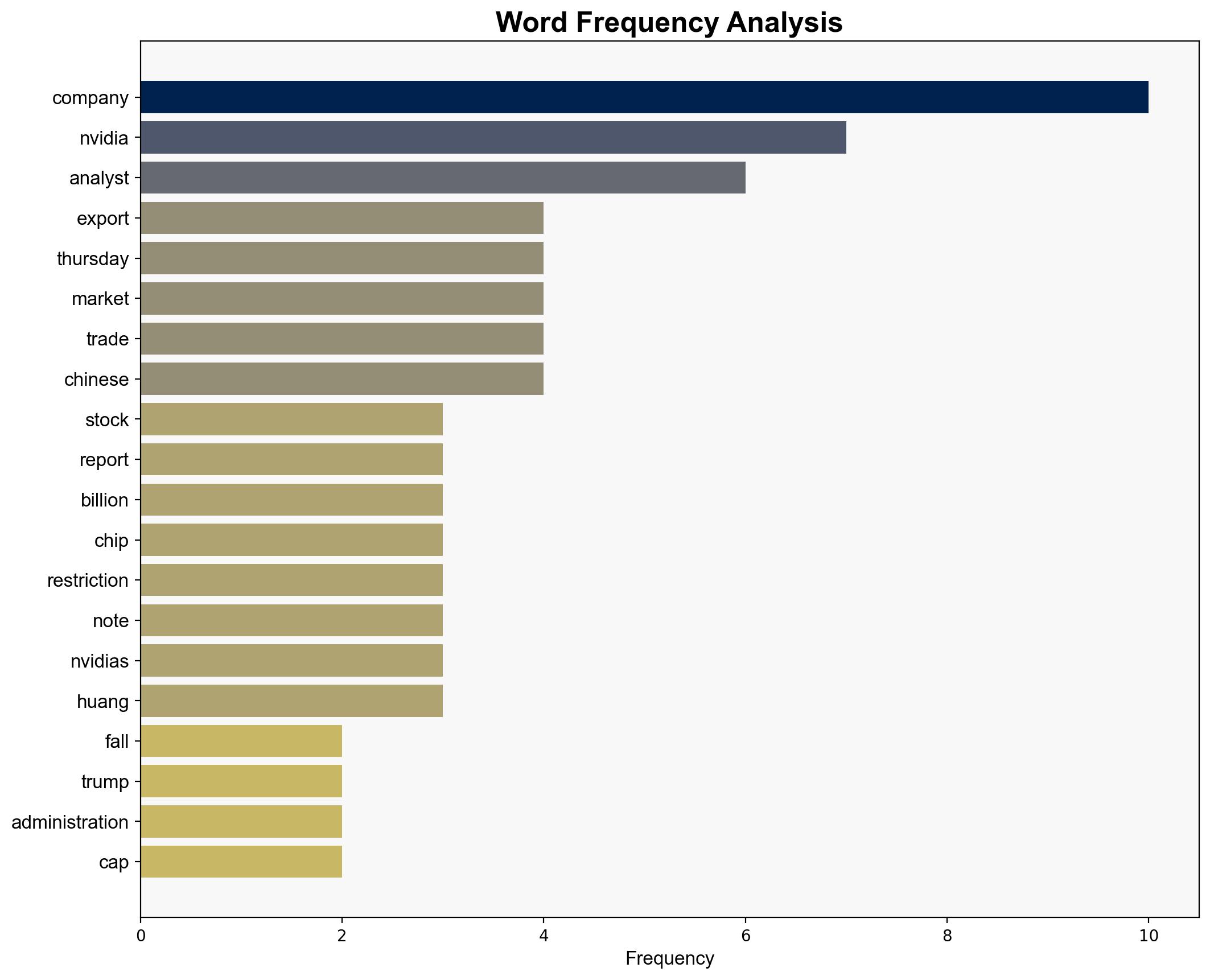

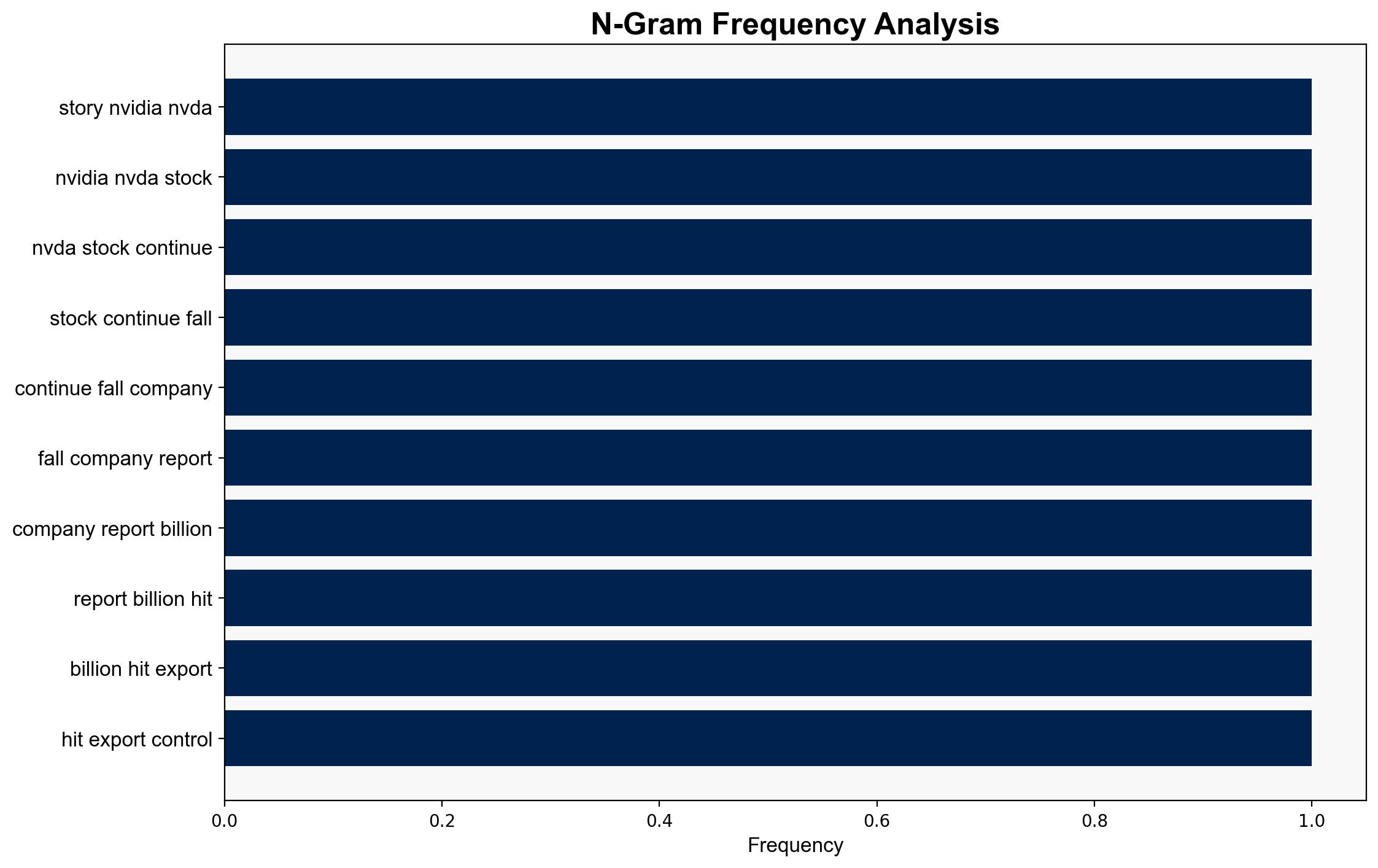

Nvidia experienced a significant market cap loss of over $250 billion due to U.S. export controls impacting its H20 AI chips to China. This development highlights the broader implications of ongoing trade tensions between the U.S. and China. While short-term volatility is expected, Nvidia’s long-term growth remains promising. Strategic recommendations include monitoring trade policy shifts and preparing for potential regulatory changes.

2. Detailed Analysis

The following structured analytic techniques have been applied:

Scenario Analysis

The U.S. export controls on Nvidia’s H20 chips could lead to several scenarios: increased trade tensions resulting in further restrictions, a potential easing of regulations if diplomatic relations improve, or Nvidia’s adaptation through product innovation compliant with existing laws.

Key Assumptions Check

The assumption that Nvidia can maintain its market position despite regulatory challenges is critical. This relies on the company’s ability to innovate and navigate geopolitical pressures effectively.

Indicators Development

Key indicators to monitor include changes in U.S.-China trade policies, Nvidia’s financial performance metrics, and any shifts in international semiconductor market dynamics.

3. Implications and Strategic Risks

The current situation underscores vulnerabilities in the tech sector due to geopolitical tensions. The restrictions on Nvidia’s exports may signal a broader trend of protectionism affecting global supply chains. Economically, this could lead to increased costs and market volatility. Politically, it may exacerbate U.S.-China relations, impacting international cooperation on technology standards and innovation.

4. Recommendations and Outlook

- Monitor U.S. and Chinese policy changes closely to anticipate further regulatory impacts on Nvidia and similar companies.

- Encourage Nvidia to diversify its market base and invest in compliant product development to mitigate risks associated with export controls.

- Consider scenario-based planning to prepare for potential escalations in trade tensions, including the development of alternative supply chains.

5. Key Individuals and Entities

Jensen Huang, Jefferies analysts, Stifel analysts, Wedbush Securities, DeepSeek.