Obscure Chinese Stock Scams Dupe American Investors by the Thousands – Slashdot.org

Published on: 2025-06-16

Intelligence Report: Obscure Chinese Stock Scams Dupe American Investors by the Thousands – Slashdot.org

1. BLUF (Bottom Line Up Front)

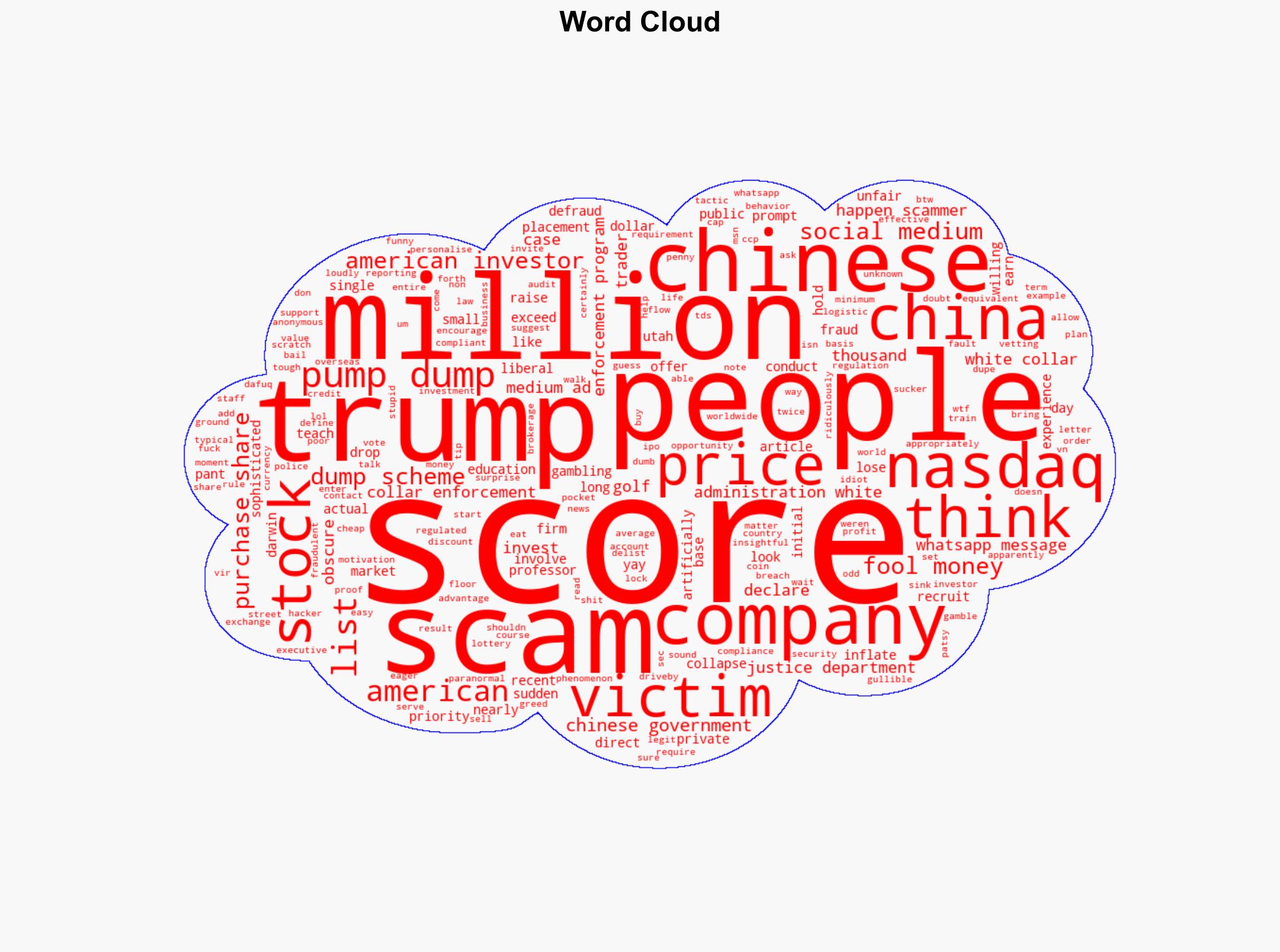

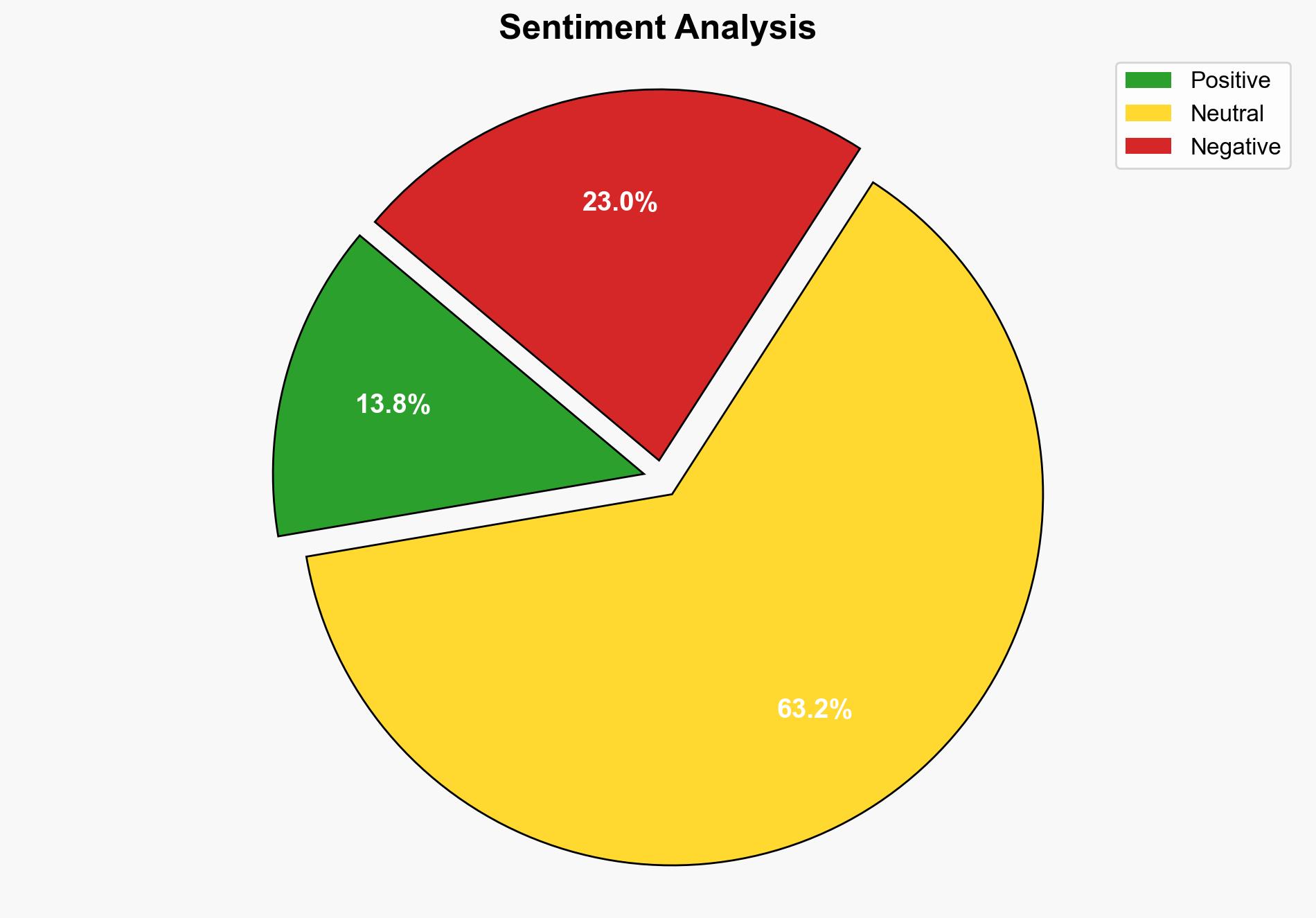

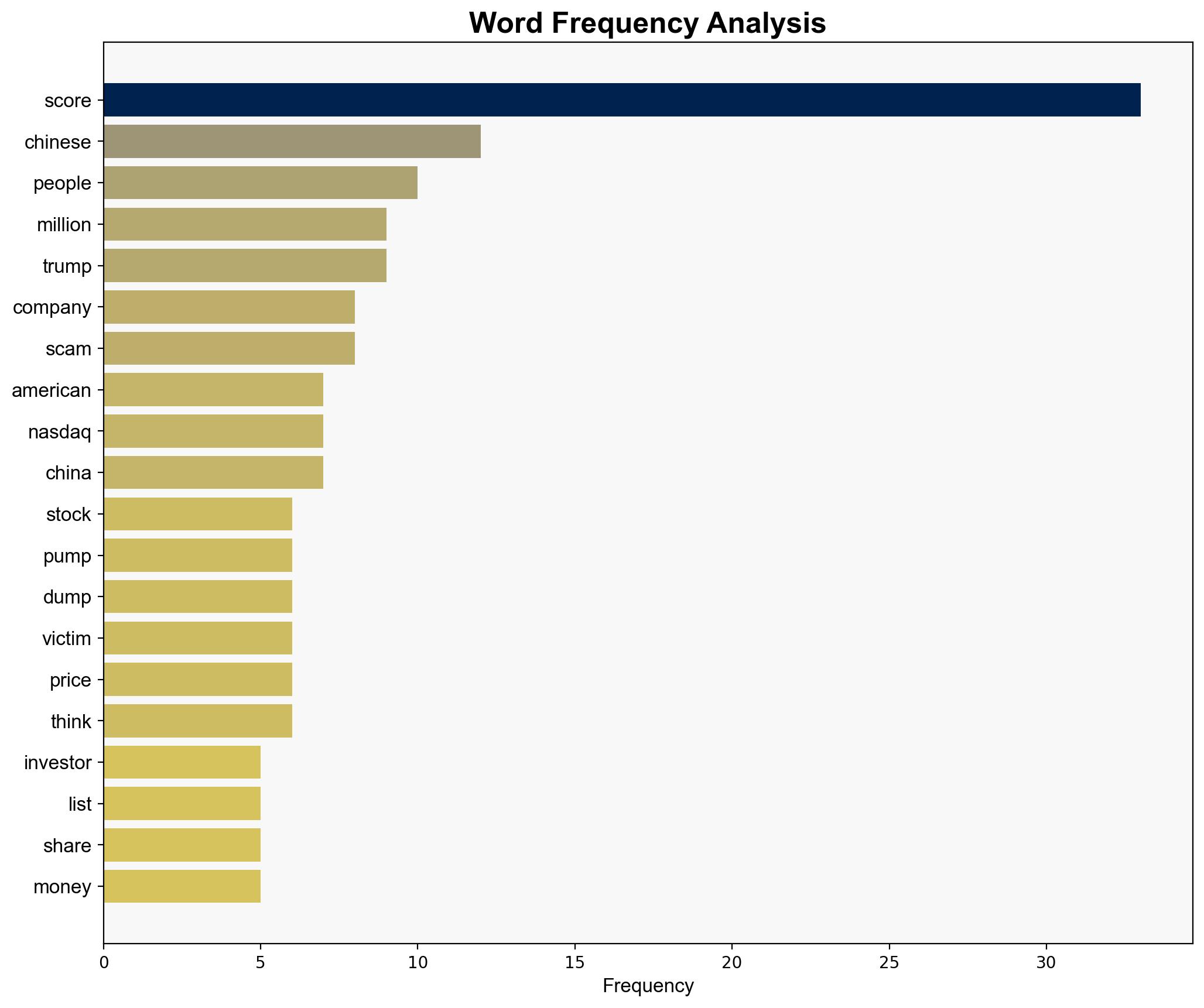

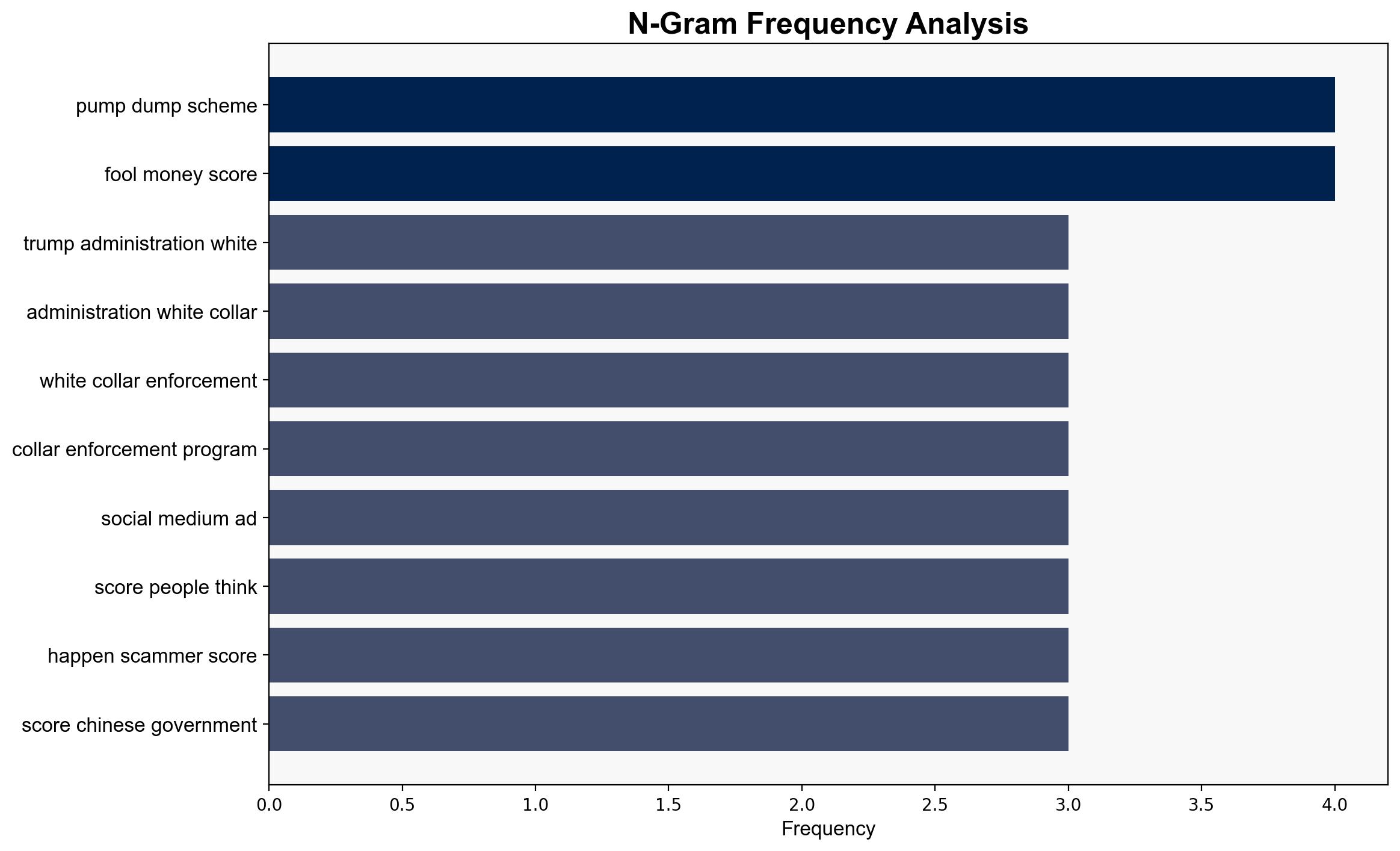

A sophisticated pump-and-dump scheme involving small Chinese companies listed on NASDAQ has resulted in significant financial losses for thousands of American investors. The Justice Department has prioritized this fraud under the Trump administration’s white-collar enforcement program. The scams exploit social media and messaging platforms to recruit victims, leading to artificially inflated stock prices followed by rapid collapses. Immediate action is recommended to enhance regulatory oversight and investor education to prevent future occurrences.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Causal Layered Analysis (CLA)

Surface events: The scams involve obscure Chinese companies conducting IPOs on NASDAQ, followed by sudden stock price drops.

Systemic structures: Lax regulatory frameworks and inadequate vetting processes for overseas companies listing on U.S. exchanges.

Worldviews: Perception of U.S. markets as vulnerable to foreign manipulation.

Myths: The belief in quick financial gains through unregulated investments.

Cross-Impact Simulation

The scams could lead to increased scrutiny of Chinese companies on U.S. exchanges, affecting bilateral economic relations and investor confidence.

Scenario Generation

Best case: Enhanced regulations and investor awareness reduce the prevalence of such scams.

Worst case: Continued exploitation leads to broader market instability and diplomatic tensions.

Most likely: Incremental regulatory improvements with ongoing challenges in enforcement.

3. Implications and Strategic Risks

The scams highlight vulnerabilities in the financial regulatory system, posing risks to market stability and investor trust. There is a potential for cascading effects on U.S.-China economic relations and increased cyber threats as scammers exploit digital platforms.

4. Recommendations and Outlook

- Strengthen regulatory frameworks for foreign companies listing on U.S. exchanges, including enhanced vetting and compliance checks.

- Increase public awareness campaigns to educate investors about the risks of pump-and-dump schemes.

- Foster international cooperation to address cross-border financial fraud and cyber threats.

- Scenario-based projections suggest a focus on regulatory reforms and investor education as the most effective mitigation strategies.

5. Key Individuals and Entities

No specific individuals are named in the source material. The focus remains on the involved Chinese companies and the broader regulatory and enforcement landscape.

6. Thematic Tags

financial fraud, regulatory oversight, investor protection, U.S.-China relations