OGDCL begins Pasakhi-14 oil production in Pakistans Hyderabad district – Offshore Technology

Published on: 2025-11-17

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: OGDCL’s Pasakhi-14 Oil Production in Pakistan’s Hyderabad District

1. BLUF (Bottom Line Up Front)

With a moderate confidence level, the most supported hypothesis is that OGDCL’s initiation of oil production at Pasakhi-14 is a strategic move to bolster national energy security and optimize its exploration and production capabilities. Recommended action includes monitoring geopolitical developments and energy market trends to anticipate potential disruptions or opportunities.

2. Competing Hypotheses

Hypothesis 1: OGDCL’s Pasakhi-14 production is primarily aimed at enhancing Pakistan’s energy security by increasing domestic oil output, aligning with national strategic objectives.

Hypothesis 2: The production at Pasakhi-14 is driven by OGDCL’s commercial interests to capitalize on favorable market conditions and technological advancements, with national energy security being a secondary benefit.

Hypothesis 1 is more likely due to OGDCL’s historical role in supporting national energy needs and the strategic emphasis on energy security in its public statements. Hypothesis 2 remains plausible but less supported by the available evidence.

3. Key Assumptions and Red Flags

Assumptions include the stability of Pakistan’s political environment and continued government support for energy sector initiatives. Red flags involve potential over-reliance on technological advancements without contingency plans and the risk of geopolitical tensions affecting operations. Deception indicators could arise if OGDCL overstates production capabilities or downplays operational challenges.

4. Implications and Strategic Risks

Potential implications include increased energy independence for Pakistan, reducing reliance on imports. Strategic risks involve geopolitical tensions, particularly with neighboring countries, which could disrupt operations. Economic risks include fluctuating oil prices affecting profitability. Cyber threats targeting critical infrastructure could also pose significant risks.

5. Recommendations and Outlook

- Actionable steps include enhancing cybersecurity measures, diversifying energy sources, and engaging in diplomatic efforts to mitigate geopolitical risks.

- Best-case scenario: Successful production leads to increased energy security and economic growth.

- Worst-case scenario: Geopolitical tensions or economic downturns severely impact operations and profitability.

- Most-likely scenario: Gradual increase in production supports national energy goals with manageable risks.

6. Key Individuals and Entities

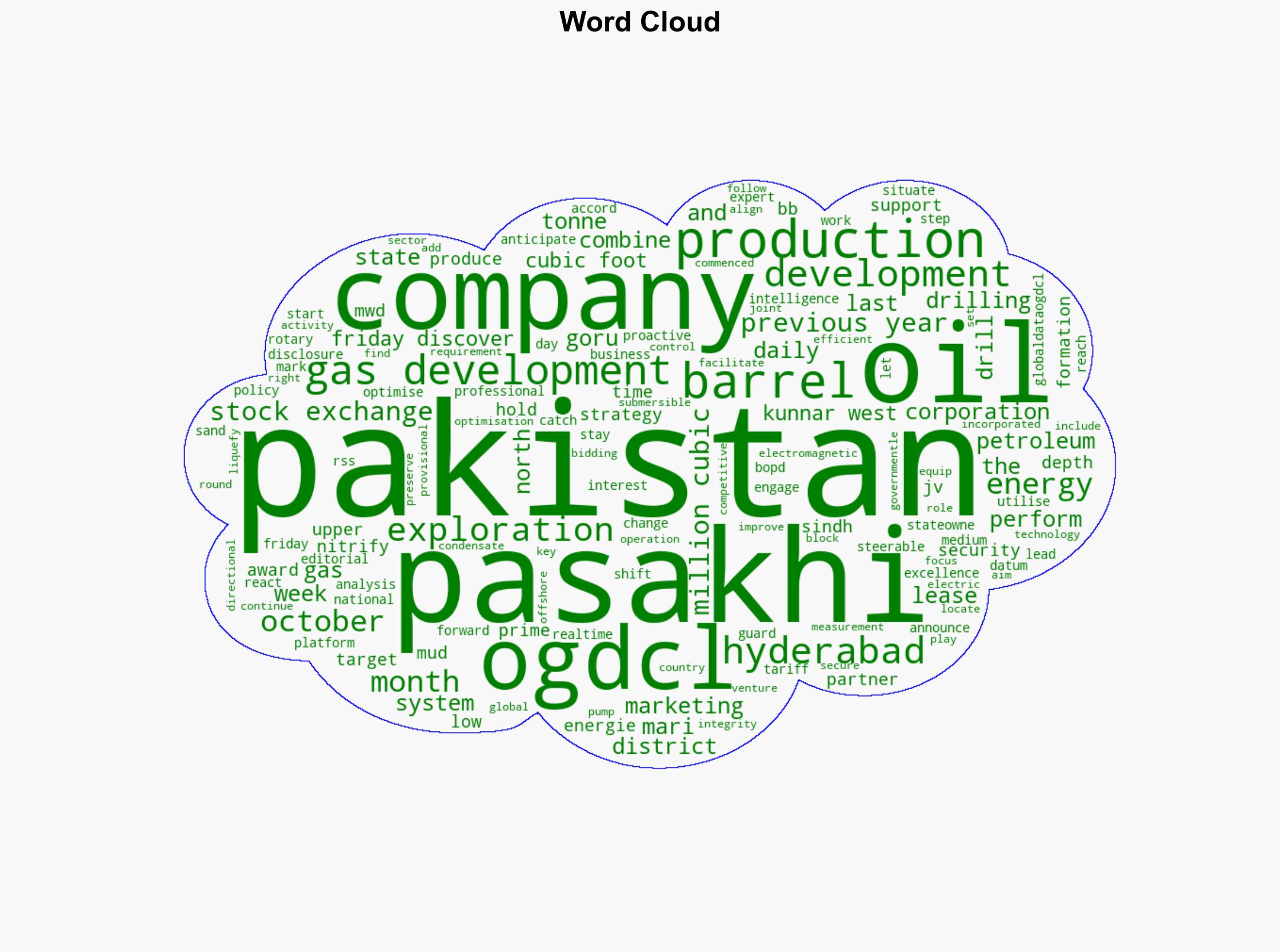

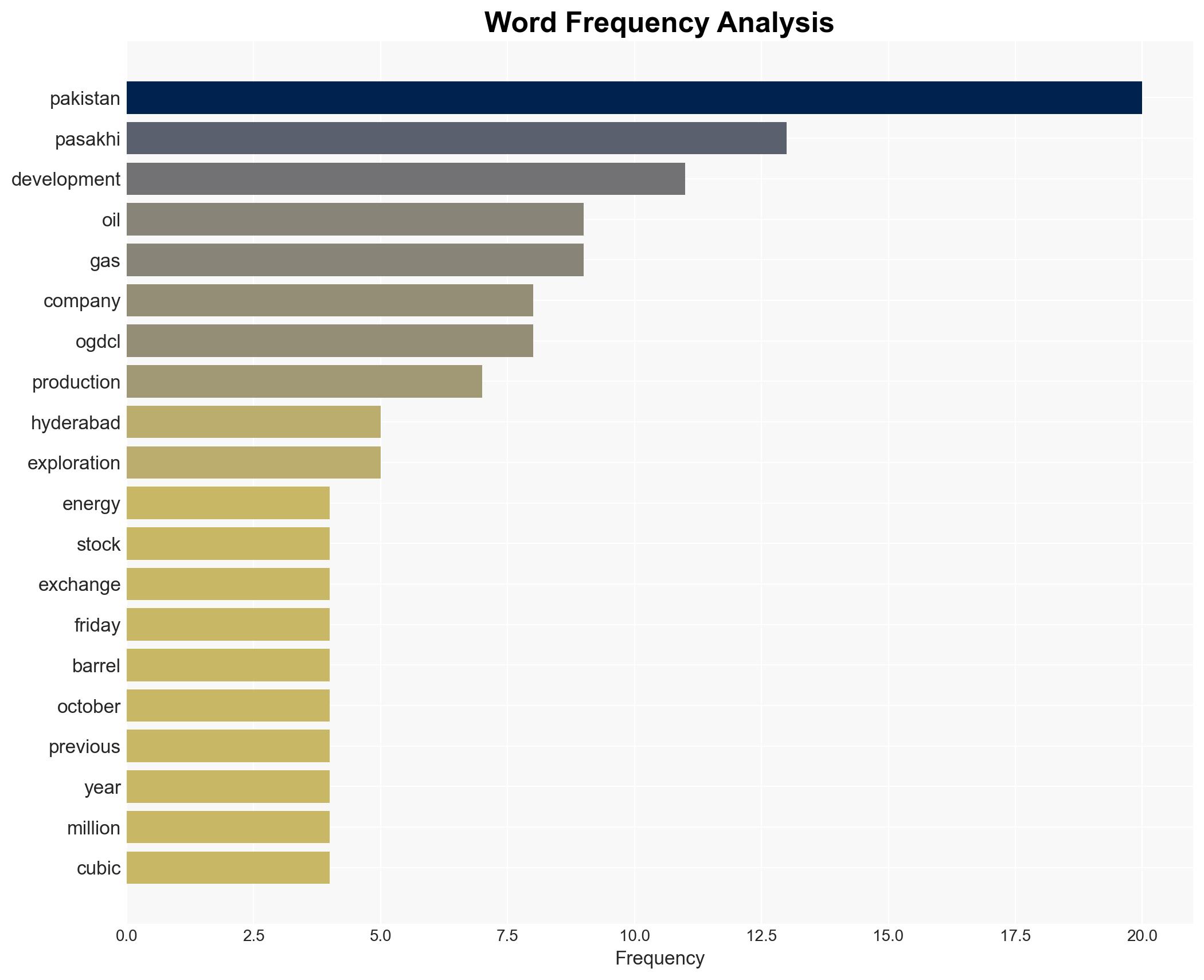

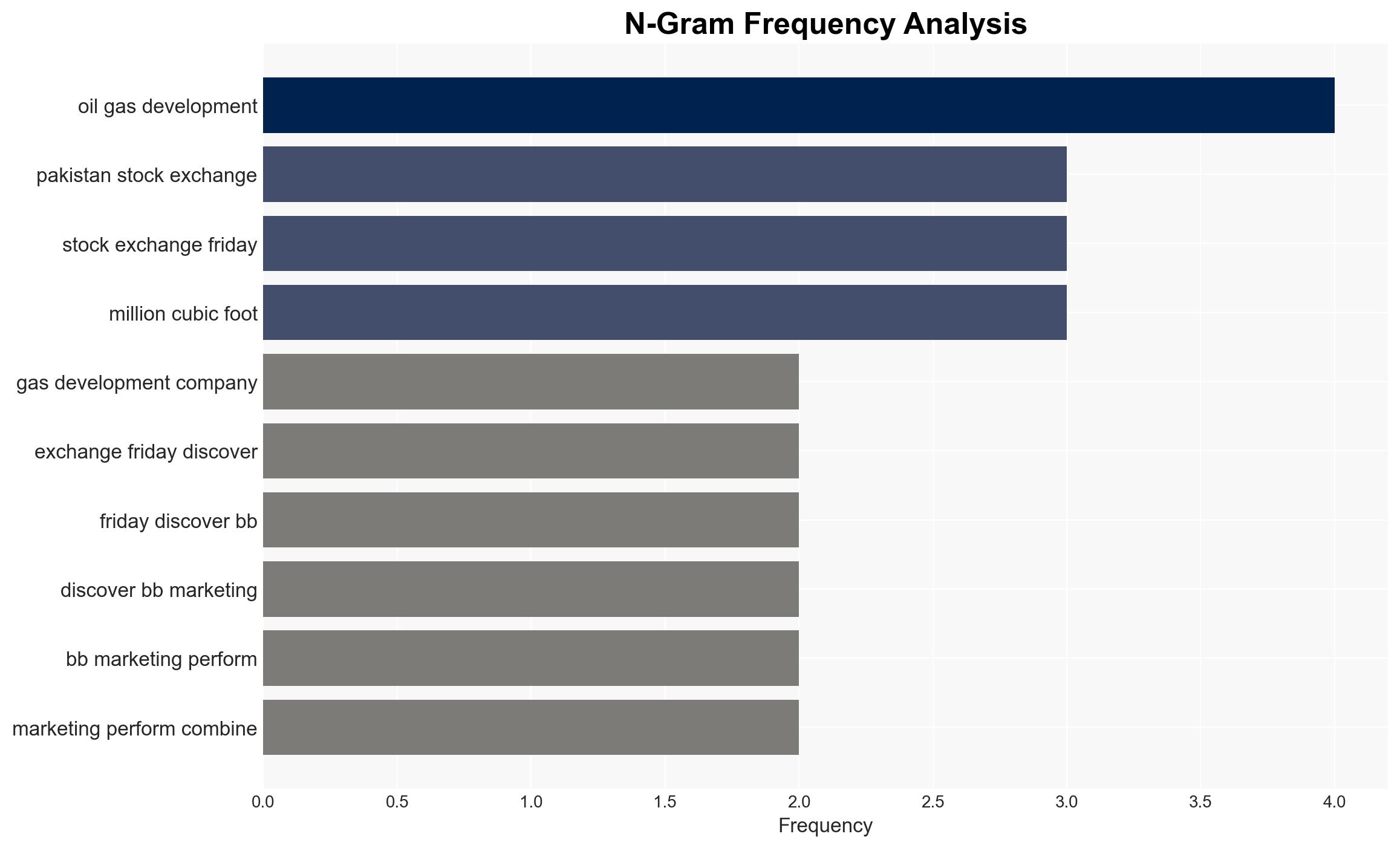

Oil and Gas Development Company Limited (OGDCL), Pakistan Stock Exchange, Pakistan Petroleum, Mari Energy, Prime Global Energy.

7. Thematic Tags

Regional Focus, Regional Focus: South Asia, Energy Security, Oil Production, Geopolitical Risks

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

Explore more:

Regional Focus Briefs ·

Daily Summary ·

Support us

·