Oil Chiefs See 60 Oil as Breaking Point for Shale Growth – OilPrice.com

Published on: 2025-10-16

Intelligence Report: Oil Chiefs See 60 Oil as Breaking Point for Shale Growth – OilPrice.com

1. BLUF (Bottom Line Up Front)

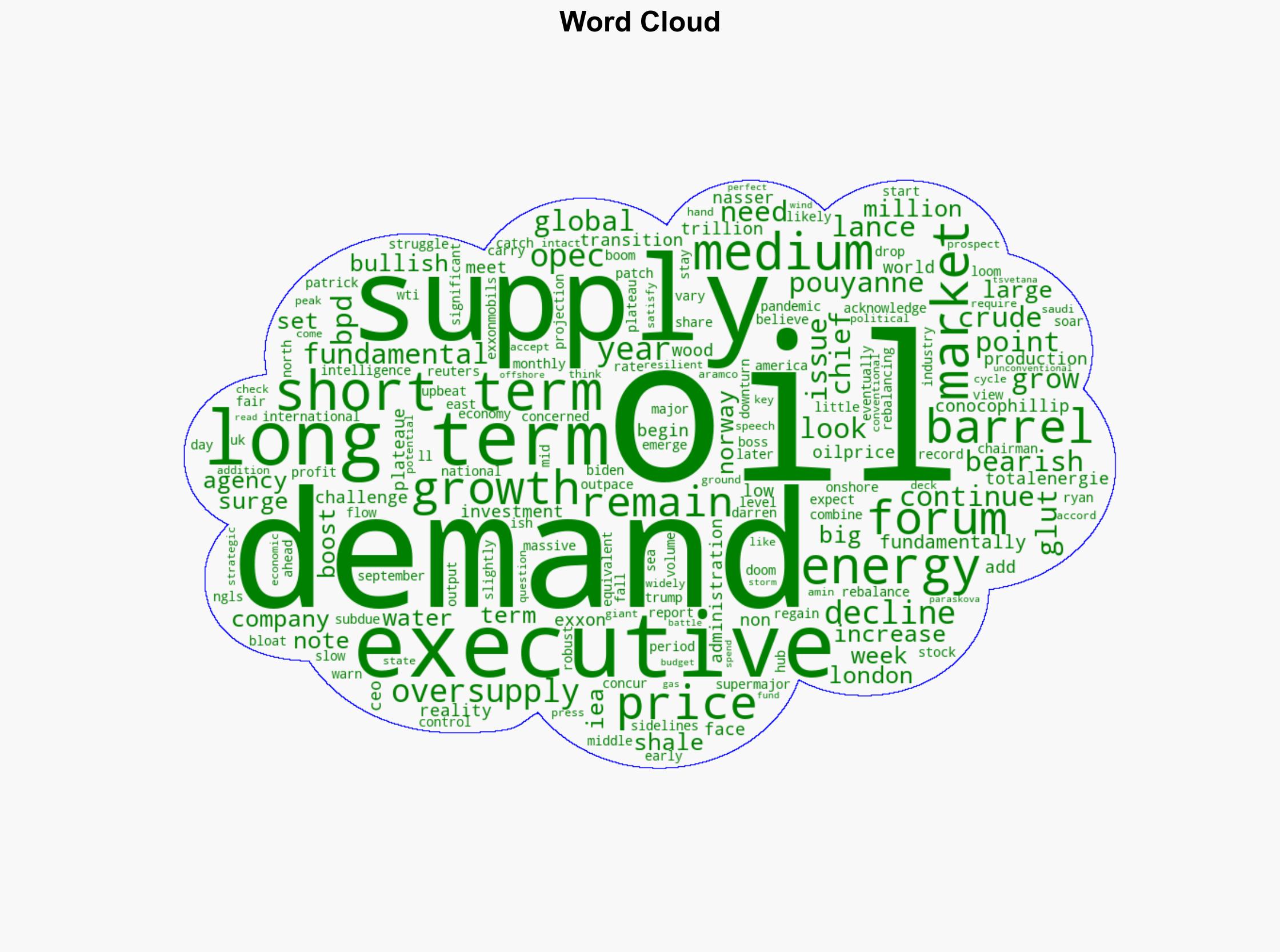

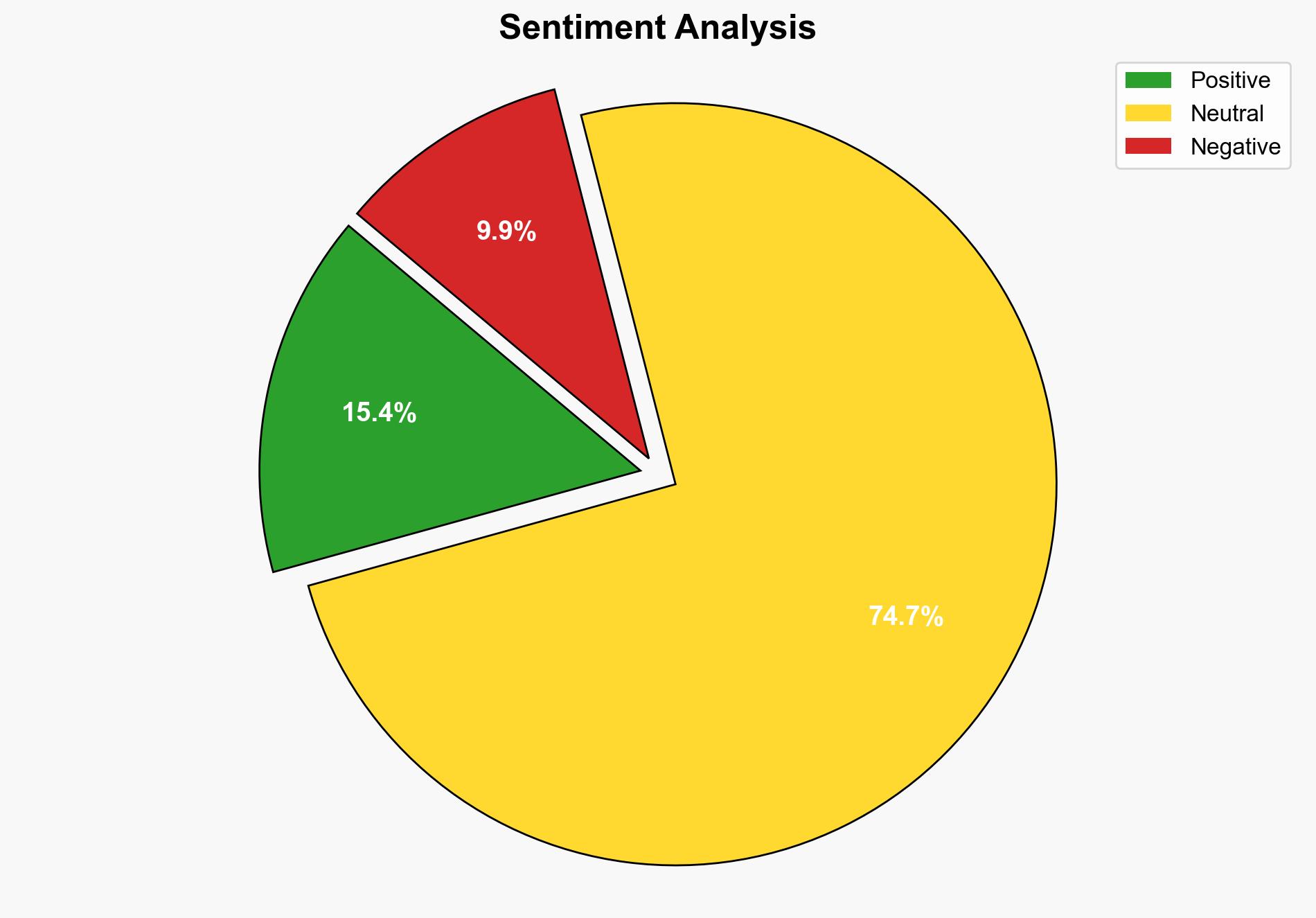

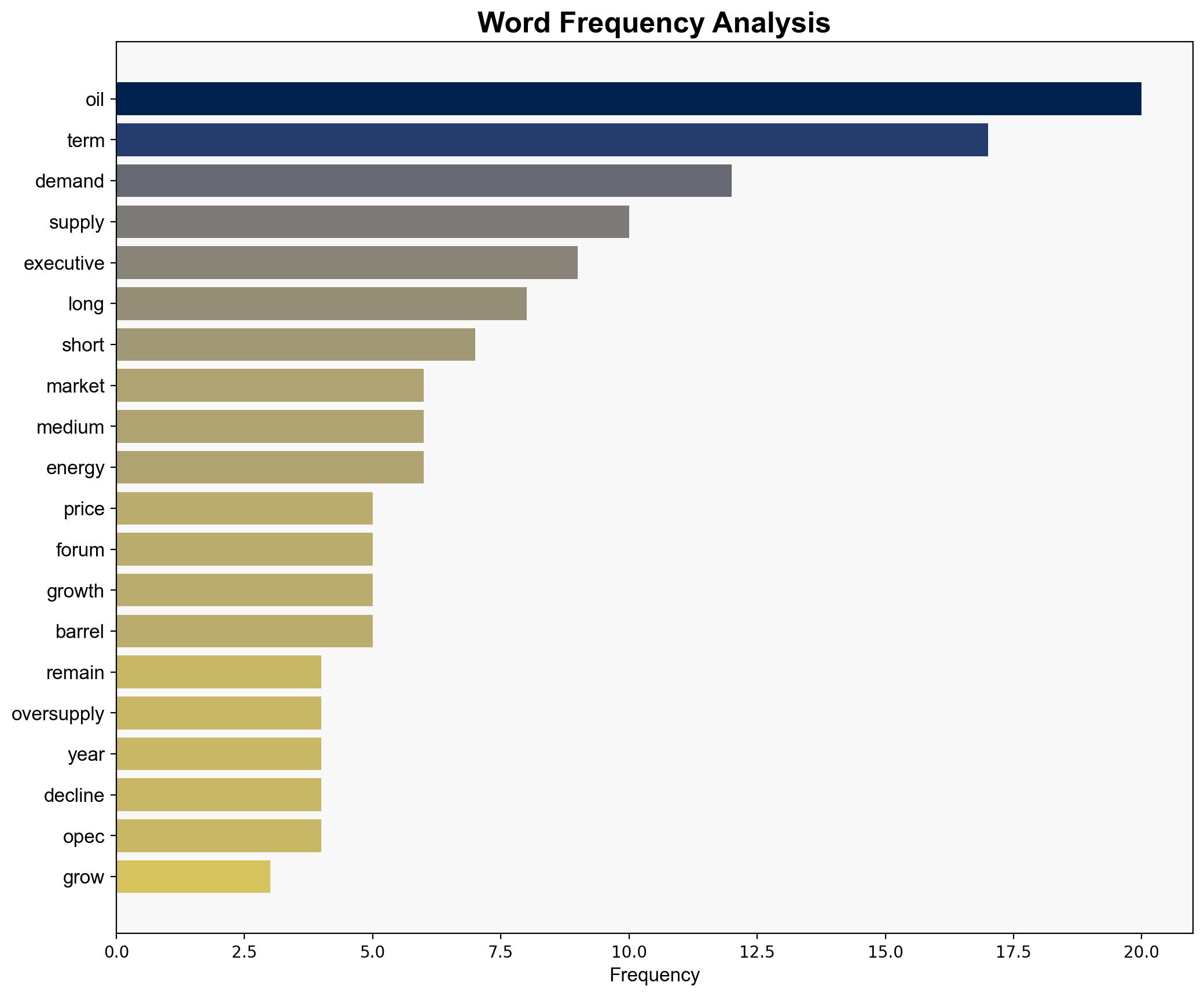

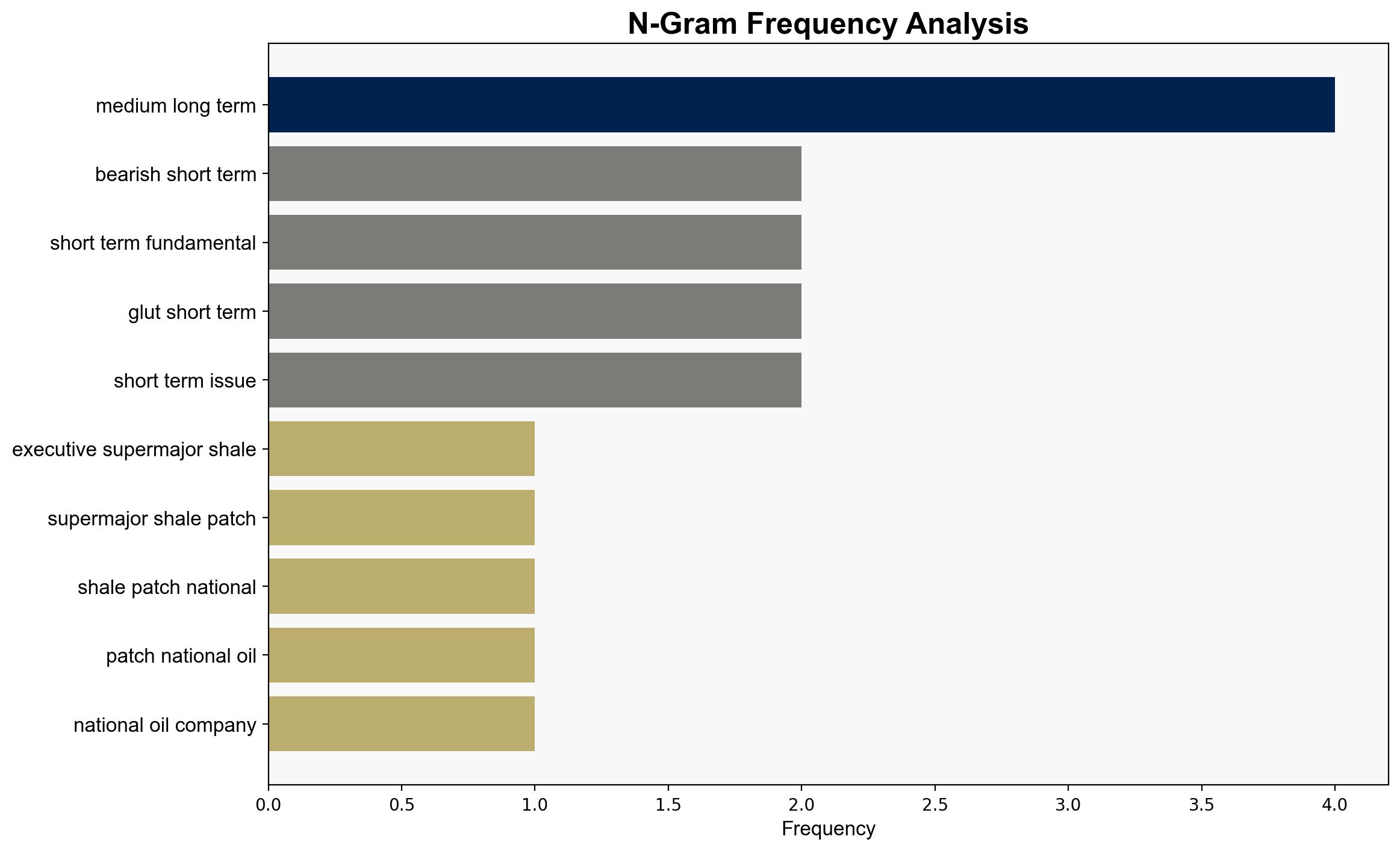

The analysis suggests that while there is a short-term oversupply in the oil market, the medium to long-term outlook remains positive due to expected demand growth and potential supply constraints. The most supported hypothesis is that the current bearish market conditions are temporary, with a rebalancing expected as demand catches up. Confidence Level: Moderate. Recommended action includes monitoring market signals for shifts in supply-demand dynamics and preparing for potential investment opportunities in the medium term.

2. Competing Hypotheses

Hypothesis 1: The current oversupply and bearish market conditions are temporary, with a medium to long-term rebalancing expected as demand increases and supply constraints emerge.

Hypothesis 2: The oversupply will persist longer than anticipated, leading to prolonged low prices and a potential slowdown in shale growth, impacting the broader oil market dynamics.

3. Key Assumptions and Red Flags

Assumptions: Both hypotheses assume a certain level of economic recovery and demand growth. Hypothesis 1 assumes that OPEC and non-OPEC producers will manage supply effectively.

Red Flags: Potential overestimation of demand recovery and underestimation of new supply sources. The impact of geopolitical tensions and policy changes on oil production and consumption is uncertain.

4. Implications and Strategic Risks

The short-term oversupply could lead to reduced investment in new oil projects, potentially causing supply shortages in the future. Prolonged low prices may strain economies dependent on oil revenues, leading to geopolitical instability. Additionally, the energy transition and policy shifts could accelerate changes in the market, impacting long-term oil demand.

5. Recommendations and Outlook

- Monitor global economic indicators and policy changes that could impact oil demand.

- Invest in technologies and strategies that enhance production efficiency and reduce costs.

- Scenario Projections:

- Best Case: Rapid economic recovery leads to increased demand, stabilizing prices and encouraging investment.

- Worst Case: Prolonged oversupply and low prices result in significant industry contraction and geopolitical tensions.

- Most Likely: Gradual rebalancing with moderate price recovery as demand slowly increases.

6. Key Individuals and Entities

Patrick Pouyanne, Ryan Lance, Darren Woods, Amin Nasser

7. Thematic Tags

energy market dynamics, economic recovery, geopolitical stability, oil industry investment