Oil Climbs as Traders Weigh Trumps Tariff Threats Doha Strike – Financial Post

Published on: 2025-09-10

Intelligence Report: Oil Climbs as Traders Weigh Trump’s Tariff Threats and Doha Strike – Financial Post

1. BLUF (Bottom Line Up Front)

The most supported hypothesis is that geopolitical tensions, particularly Trump’s tariff threats and regional conflicts, are driving short-term volatility in oil prices. Confidence level: Moderate. Recommended action: Monitor geopolitical developments and potential policy shifts closely to anticipate further market impacts.

2. Competing Hypotheses

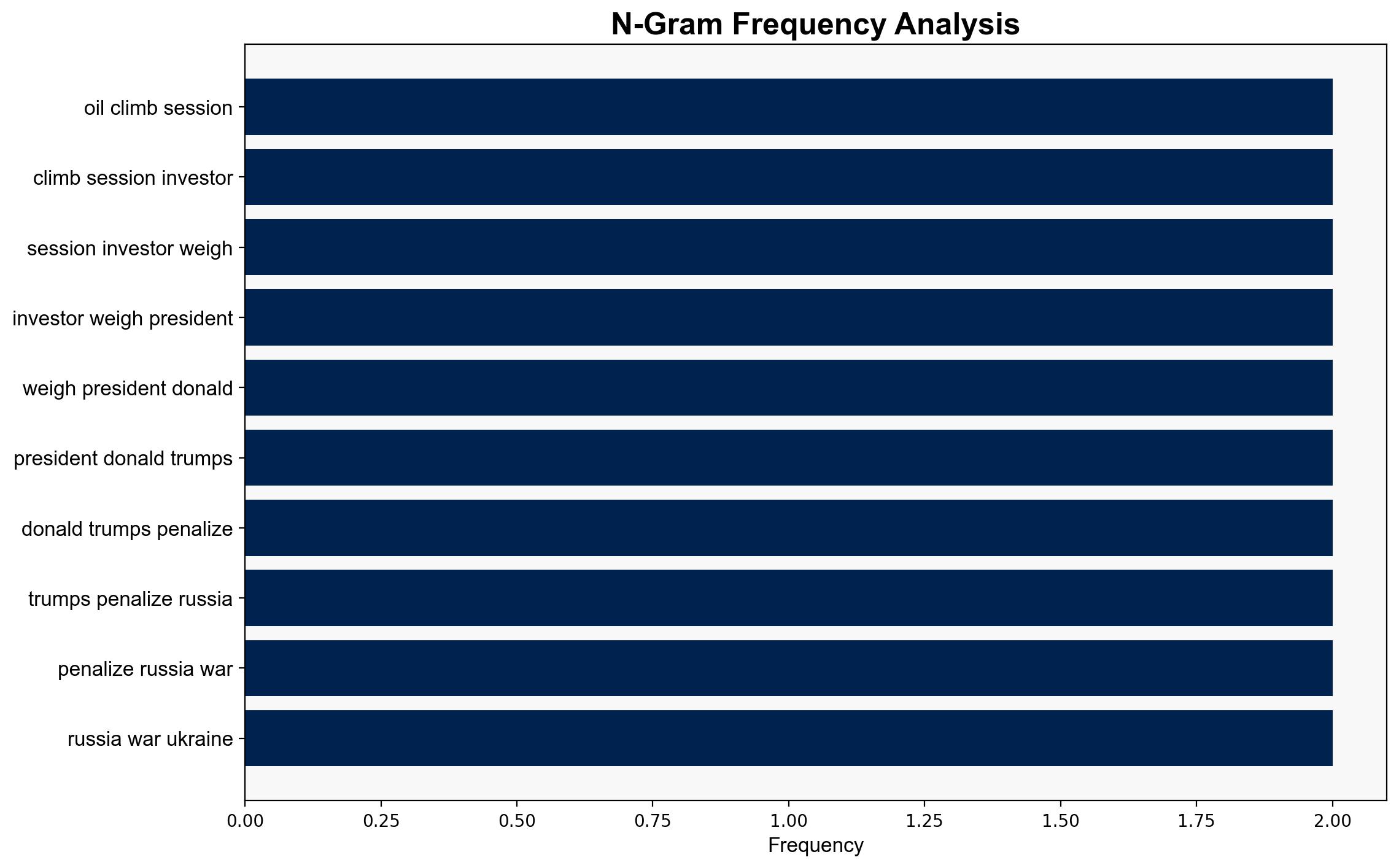

Hypothesis 1: The rise in oil prices is primarily driven by Trump’s tariff threats against Russia and potential penalties related to the Ukraine conflict, which heighten concerns about crude supply disruptions.

Hypothesis 2: The increase in oil prices is mainly due to regional conflicts, such as the Israeli strike in Doha and tensions in Poland, which exacerbate geopolitical risks and add a premium to crude prices.

Using ACH 2.0, both hypotheses are plausible, but Hypothesis 1 is better supported by the specific mention of Trump’s actions and their direct impact on market perceptions of supply risk.

3. Key Assumptions and Red Flags

Assumptions:

– Trump’s tariff threats will lead to significant supply disruptions.

– Regional conflicts will continue to escalate without resolution.

Red Flags:

– Lack of concrete evidence linking Trump’s actions to immediate supply disruptions.

– Potential overestimation of the impact of regional conflicts on global oil supply.

4. Implications and Strategic Risks

The potential for escalating tariffs and regional conflicts could lead to increased volatility in global oil markets, impacting economic stability. A miscalculation in geopolitical strategies could exacerbate tensions, leading to broader economic and security risks.

5. Recommendations and Outlook

- Monitor geopolitical developments, particularly US-Russia relations and Middle East conflicts, for early indicators of market shifts.

- Develop contingency plans for potential supply disruptions and price spikes.

- Scenario Projections:

- Best Case: De-escalation of tensions leads to stabilization of oil prices.

- Worst Case: Escalation of tariffs and regional conflicts causes significant supply disruptions and economic instability.

- Most Likely: Continued volatility with periodic price spikes due to geopolitical uncertainties.

6. Key Individuals and Entities

– Donald Trump

– Rebecca Babin

– European Union officials

7. Thematic Tags

national security threats, geopolitical risk, energy markets, regional conflicts