Oil Declines With Gaza Peace Plan and US Inventories in Focus – Financial Post

Published on: 2025-10-09

Intelligence Report: Oil Declines With Gaza Peace Plan and US Inventories in Focus – Financial Post

1. BLUF (Bottom Line Up Front)

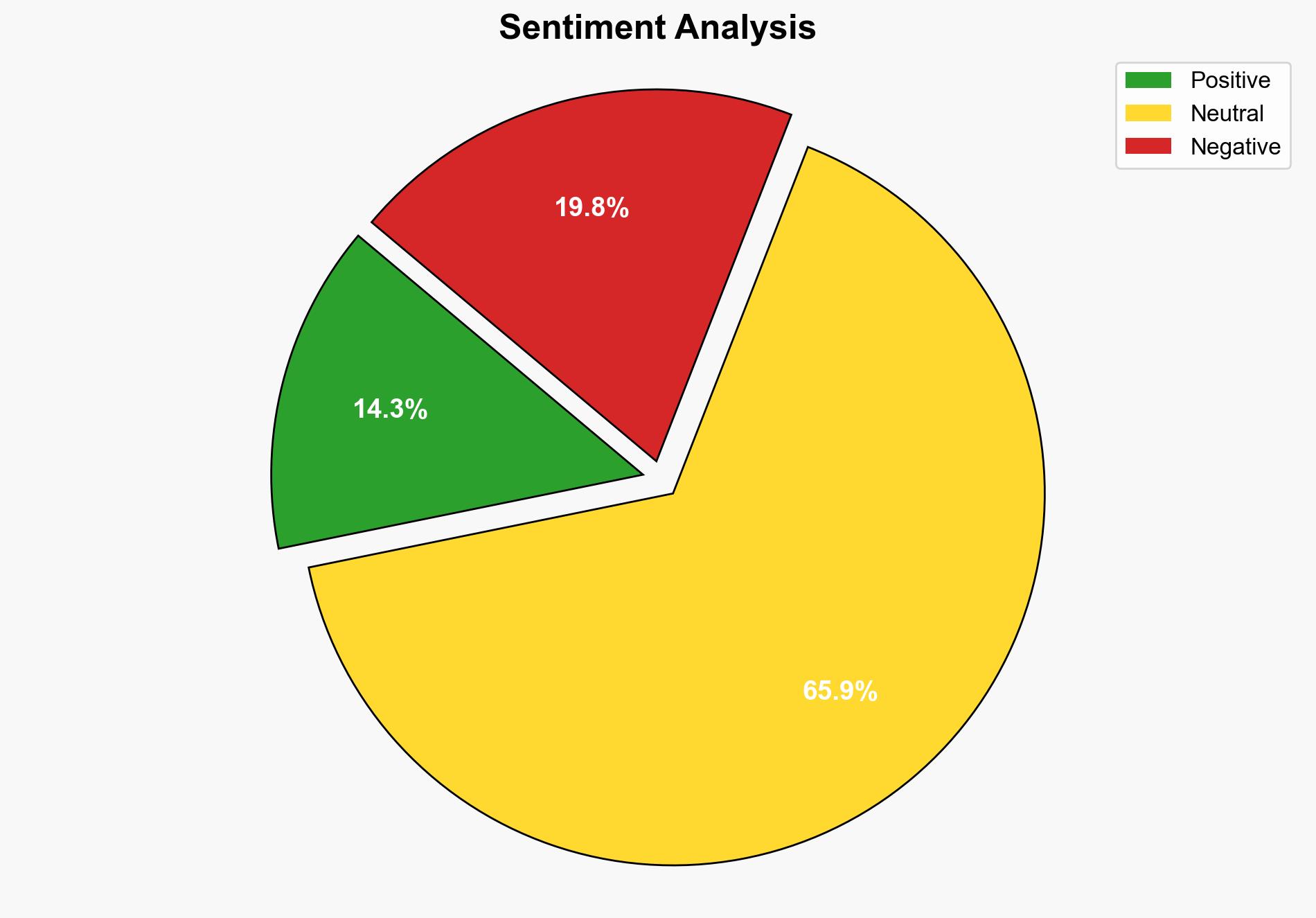

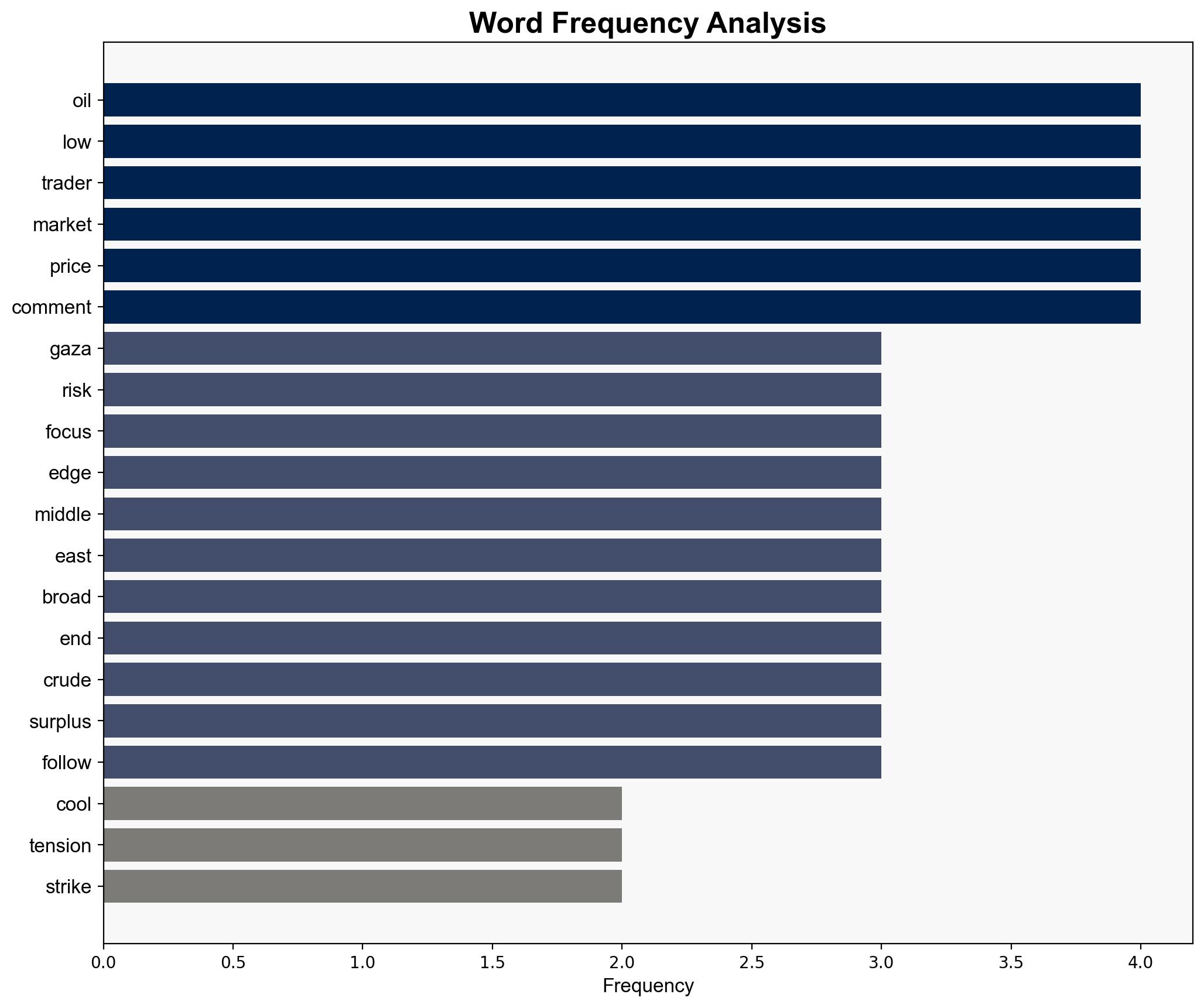

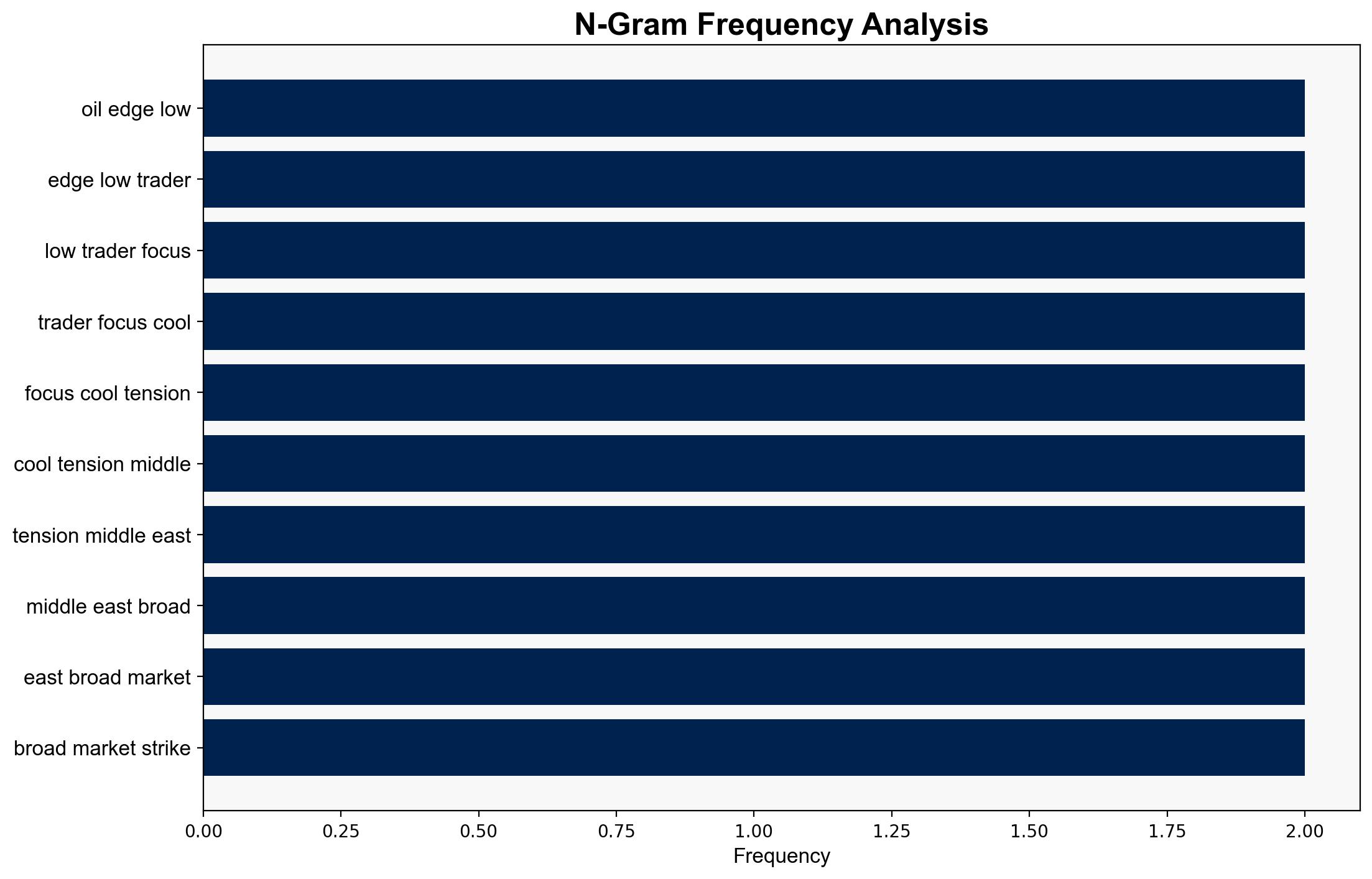

The most supported hypothesis is that the decline in oil prices is primarily driven by geopolitical developments, specifically the Gaza peace plan, which has eased tensions in the Middle East. This is reinforced by the anticipated surplus in global oil production. Confidence level: Moderate. Recommended action: Monitor geopolitical developments and adjust oil market strategies accordingly.

2. Competing Hypotheses

Hypothesis 1: The decline in oil prices is primarily due to the implementation of the Gaza peace plan, which has reduced geopolitical risk premiums associated with Middle Eastern oil supply disruptions.

Hypothesis 2: The decline in oil prices is primarily driven by economic factors, including increased US oil inventories and anticipated global oil surplus, rather than geopolitical developments.

Using ACH 2.0, Hypothesis 1 is better supported as the peace plan directly addresses a significant geopolitical tension point, which historically impacts oil prices. Hypothesis 2 is plausible but less supported due to the immediate impact of geopolitical events on market sentiment.

3. Key Assumptions and Red Flags

– Assumption: The Gaza peace plan will hold and continue to reduce regional tensions.

– Red Flag: Potential for renewed conflict or failure of the peace plan, which could quickly reverse current market trends.

– Blind Spot: Underestimation of other geopolitical risks, such as Iran’s actions or OPEC’s production decisions, which could influence oil prices.

4. Implications and Strategic Risks

The easing of tensions in the Middle East could stabilize oil markets in the short term, but the potential for renewed conflict remains a significant risk. Economic factors, such as the strengthening US dollar and increased inventories, could exert downward pressure on oil prices. Geopolitical risks from other regions, such as Iran’s involvement in regional conflicts, could also impact market stability.

5. Recommendations and Outlook

- Monitor developments related to the Gaza peace plan and adjust market strategies to account for potential volatility.

- Prepare for scenario-based projections:

- Best Case: Continued peace and stable oil prices.

- Worst Case: Breakdown of the peace plan leading to increased oil prices due to renewed conflict.

- Most Likely: Short-term stability with potential for minor fluctuations based on geopolitical developments.

6. Key Individuals and Entities

– Rebecca Babin

– Francesco Martoccia

– Omar El Chmouri

– Yongchang Chin

7. Thematic Tags

national security threats, geopolitical stability, oil market dynamics, Middle East peace process