Oil Extends Decline on Glut Outlook and Push to End War in Gaza – Financial Post

Published on: 2025-09-30

Intelligence Report: Oil Extends Decline on Glut Outlook and Push to End War in Gaza – Financial Post

1. BLUF (Bottom Line Up Front)

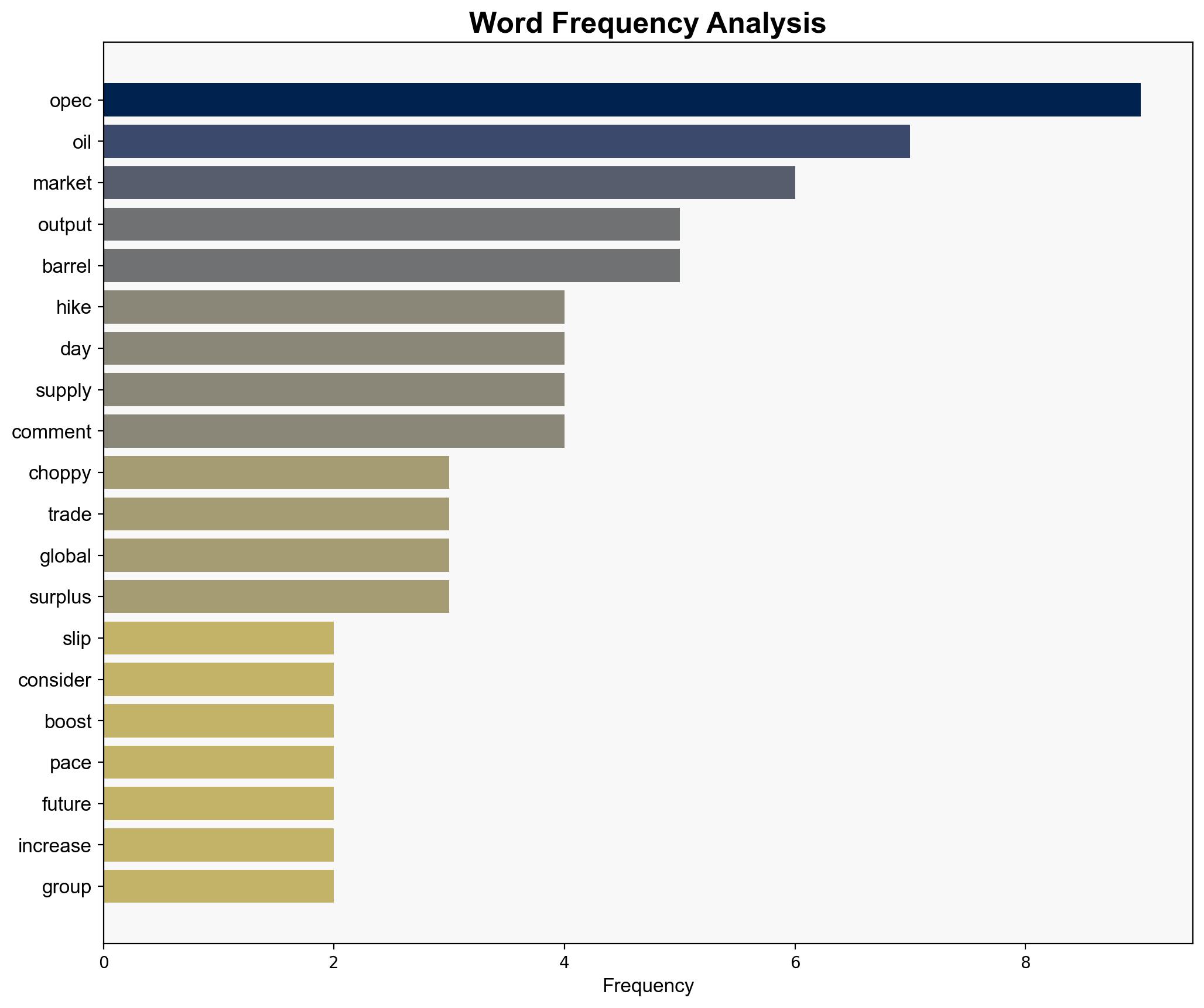

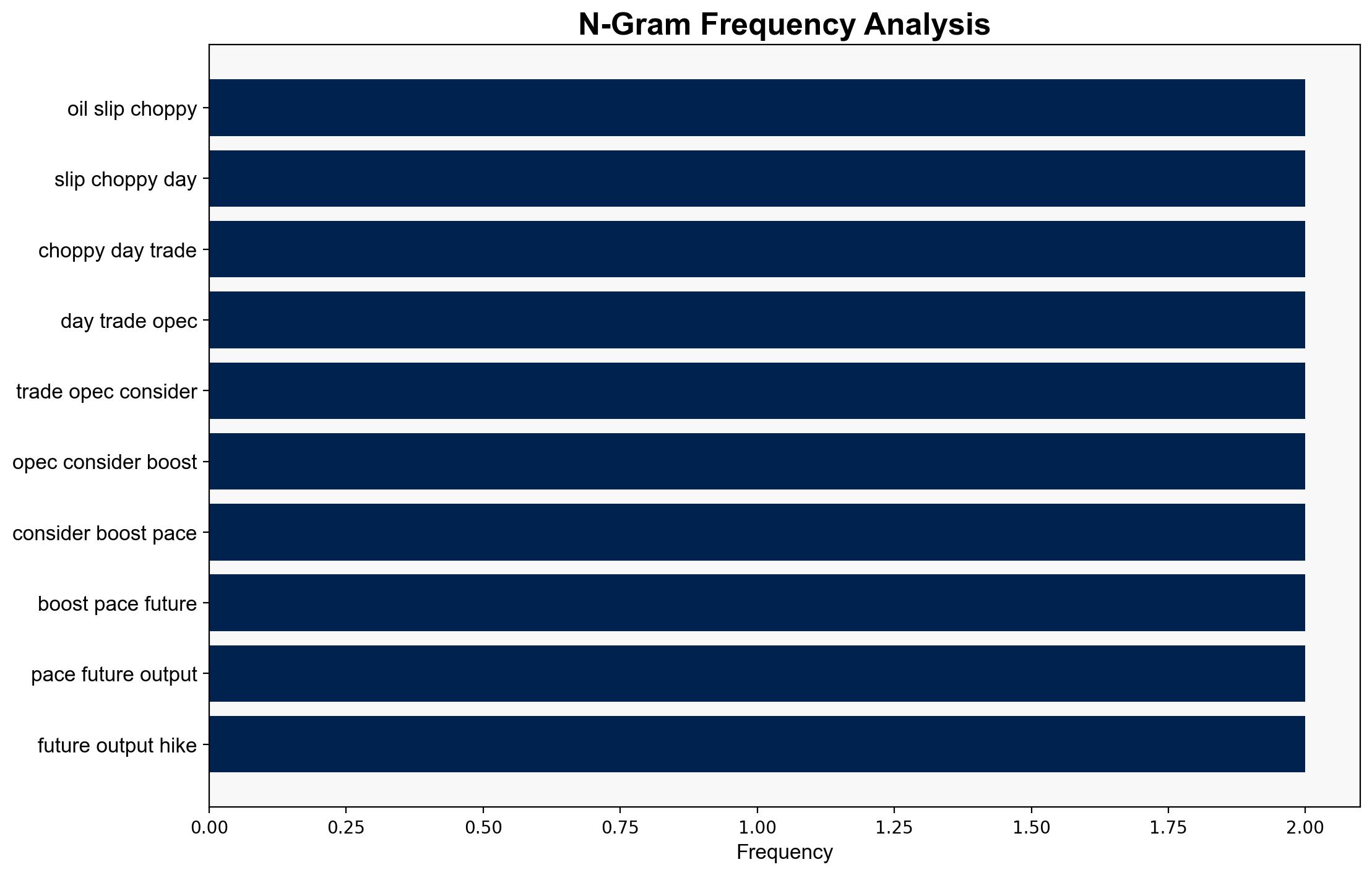

The most supported hypothesis is that the global oil market will experience a continued decline in prices due to a significant oversupply, despite geopolitical tensions and potential OPEC production adjustments. Confidence level: Moderate. Recommended action: Monitor OPEC’s production decisions closely and assess the impact of geopolitical developments on market dynamics.

2. Competing Hypotheses

1. **Hypothesis A**: The global oil market will continue to experience a decline in prices due to an oversupply, as OPEC and other producers increase output, and demand remains stable or decreases.

2. **Hypothesis B**: Geopolitical tensions, particularly in the Middle East, will lead to disruptions in oil supply, potentially stabilizing or increasing prices despite the current oversupply outlook.

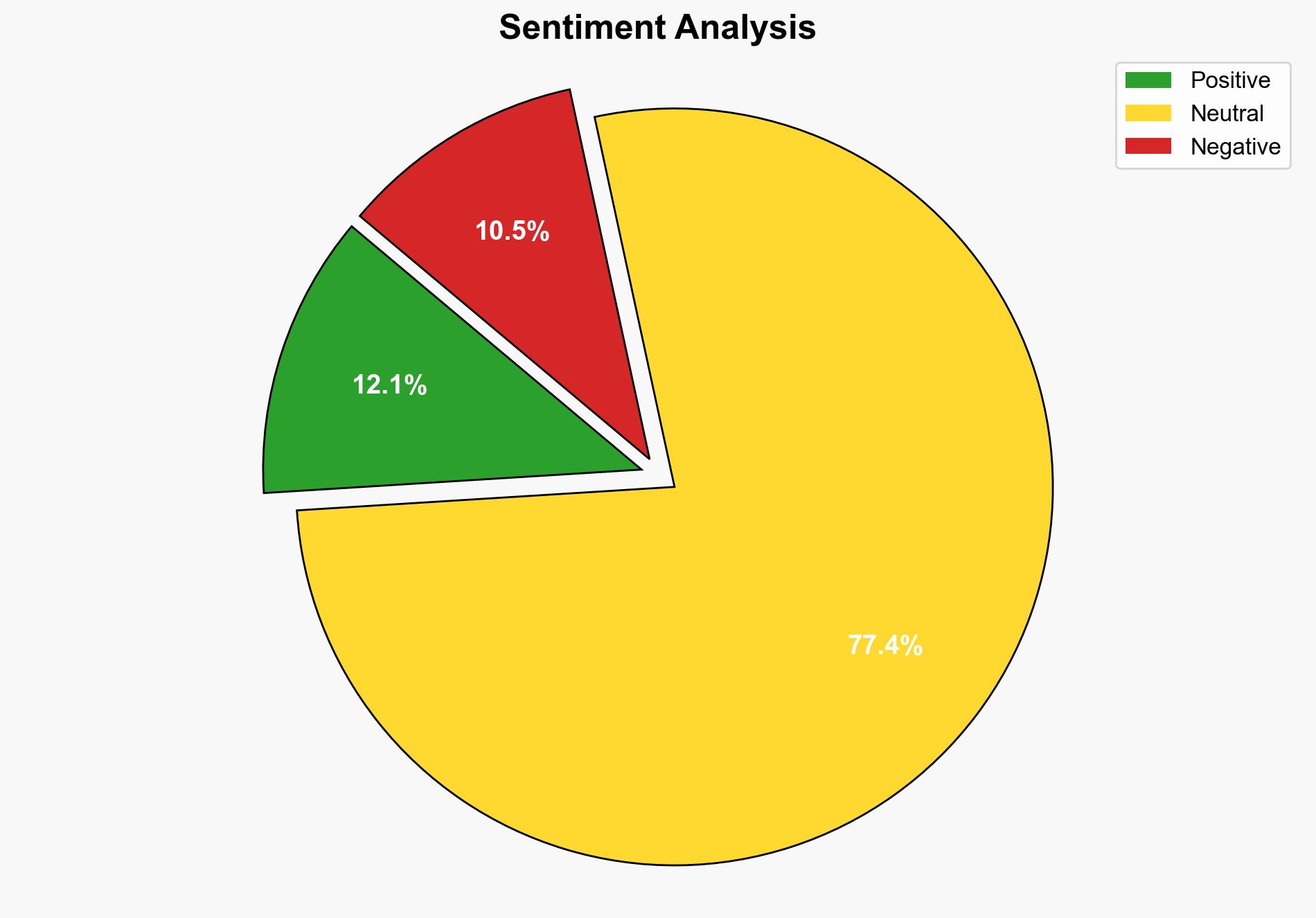

Using the ACH 2.0 method, Hypothesis A is better supported by the data, which indicates a significant surplus and skepticism about OPEC’s ability to effectively implement production hikes.

3. Key Assumptions and Red Flags

– **Assumptions**:

– OPEC will follow through with production increases.

– Global demand for oil will not significantly rise in the short term.

– **Red Flags**:

– Potential underestimation of geopolitical risks affecting supply.

– Overreliance on current forecasts without accounting for rapid changes in geopolitical landscapes.

4. Implications and Strategic Risks

– **Economic**: Prolonged low oil prices could impact oil-dependent economies, leading to economic instability.

– **Geopolitical**: Escalation in Middle East tensions could disrupt supply chains, affecting global markets.

– **Psychological**: Market sentiment may shift rapidly with any new developments in geopolitical tensions or unexpected changes in OPEC policy.

5. Recommendations and Outlook

- Maintain vigilance on OPEC meetings and announcements for any changes in production strategy.

- Develop contingency plans for potential supply disruptions due to geopolitical tensions.

- Scenario Projections:

- Best: OPEC manages a balanced output increase, stabilizing prices.

- Worst: Geopolitical tensions escalate, causing significant supply disruptions and price spikes.

- Most Likely: Continued oversupply leads to sustained low prices, with minor fluctuations due to geopolitical developments.

6. Key Individuals and Entities

– Warren Patterson (ING Groep NV)

– Rebecca Babin (CIBC Private Wealth Group)

– Vikas Dwivedi (Macquarie Global Oil & Gas Strategist)

7. Thematic Tags

national security threats, economic stability, geopolitical tensions, energy markets