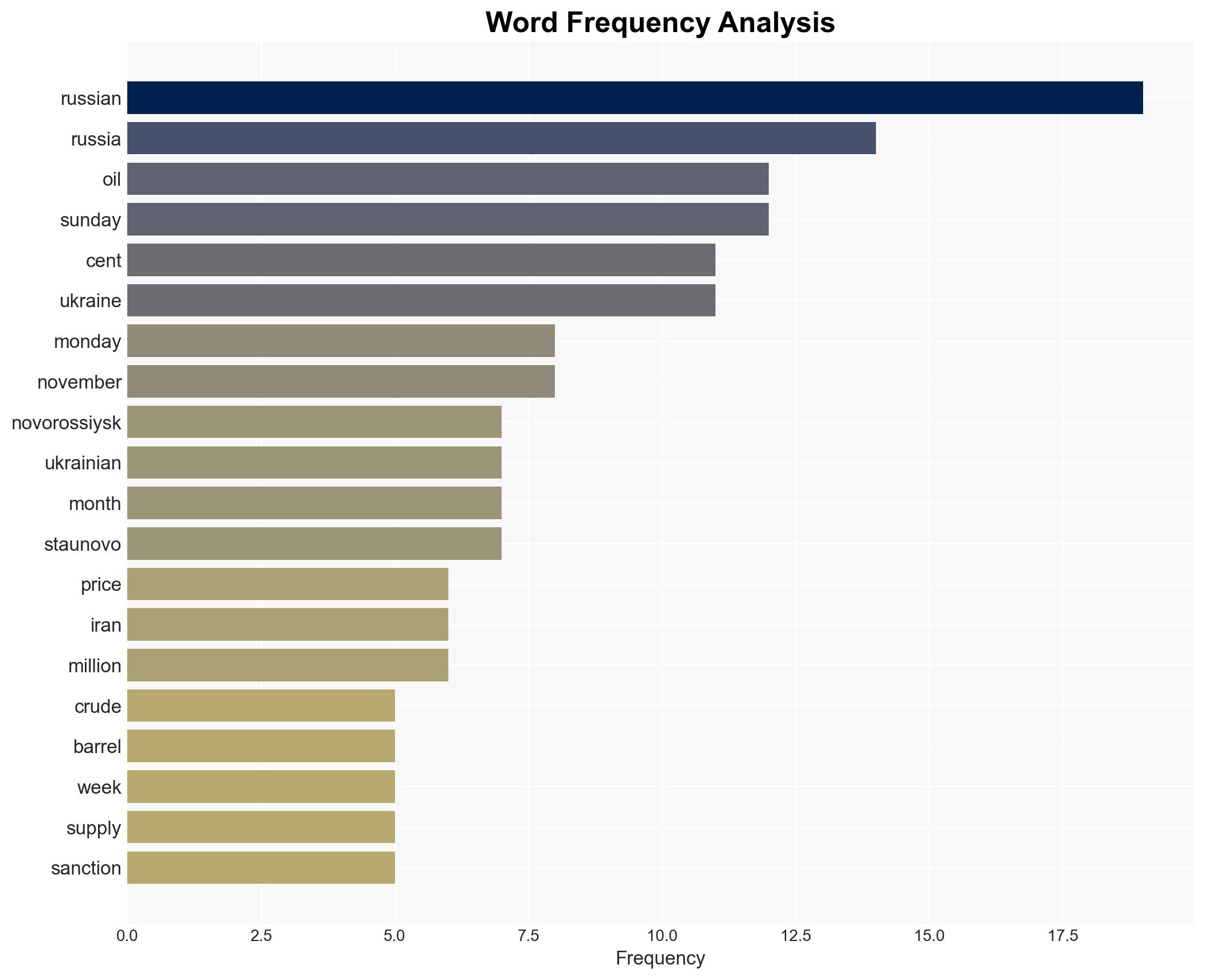

Oil falls after loadings resume at key Russian export hub – CNA

Published on: 2025-11-17

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report:

1. BLUF (Bottom Line Up Front)

The resumption of oil loadings at Russia’s Novorossiysk export hub, following a temporary suspension due to Ukrainian attacks, has led to a slight easing in oil prices. The most supported hypothesis is that the short-term resumption of operations will stabilize prices temporarily, but ongoing geopolitical tensions and potential future disruptions will maintain elevated price volatility. Confidence Level: Moderate. Recommended action includes monitoring geopolitical developments closely and preparing for potential supply chain disruptions.

2. Competing Hypotheses

Hypothesis 1: The resumption of oil loadings at Novorossiysk will stabilize oil prices in the short term, but ongoing geopolitical tensions will lead to continued volatility.

Hypothesis 2: The resumption of oil loadings will have a minimal impact on stabilizing prices due to the broader geopolitical context, including sanctions and potential future attacks, which will keep prices volatile.

Hypothesis 1 is more likely due to the immediate impact of resumed operations on easing prices, but the persistent geopolitical risks support the potential for ongoing volatility, aligning with Hypothesis 2.

3. Key Assumptions and Red Flags

Assumptions: It is assumed that the resumption of operations will continue without further immediate disruptions. The impact of sanctions and geopolitical tensions is assumed to remain constant.

Red Flags: Any new attacks on Russian oil infrastructure or changes in Western sanctions could significantly alter the current situation. Increased military activity in the Black Sea region is a potential red flag for future disruptions.

4. Implications and Strategic Risks

The primary strategic risk is the potential for further Ukrainian attacks on Russian oil infrastructure, which could lead to significant supply disruptions and price spikes. Additionally, increased sanctions or geopolitical tensions could exacerbate market instability. The economic impact could extend to global markets, affecting supply chains and energy security.

5. Recommendations and Outlook

- Actionable Steps: Enhance monitoring of geopolitical developments in the Black Sea region. Develop contingency plans for potential supply chain disruptions. Engage in diplomatic efforts to de-escalate tensions.

- Best Scenario: Continued stability in oil loadings leads to a gradual stabilization of prices.

- Worst Scenario: Renewed attacks or increased sanctions lead to significant supply disruptions and price spikes.

- Most-likely Scenario: Short-term stabilization of prices with ongoing volatility due to geopolitical tensions.

6. Key Individuals and Entities

Scott Shelton: Energy Specialist, TP ICAP Group.

Toshitaka Tazawa: Analyst, Fujitomi Securities.

Giovanni Staunovo: Analyst, UBS.

Dennis Kissler: Senior Vice President, BOK Financial.

7. Thematic Tags

Regional Focus, Regional Focus: Black Sea, Russia, Ukraine, Global Oil Markets

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

Explore more:

Regional Focus Briefs ·

Daily Summary ·

Support us

·