Oil heads for second weekly loss as supply concerns weigh – The Times of India

Published on: 2025-11-07

Intelligence Report: Oil heads for second weekly loss as supply concerns weigh – The Times of India

1. BLUF (Bottom Line Up Front)

The most supported hypothesis is that the current oil price decline is primarily driven by increased supply and economic uncertainty due to geopolitical tensions and domestic economic disruptions. Confidence level is moderate, given the complexity and interdependence of global oil markets. It is recommended to monitor OPEC’s decisions and geopolitical developments closely, as these will significantly impact future oil prices.

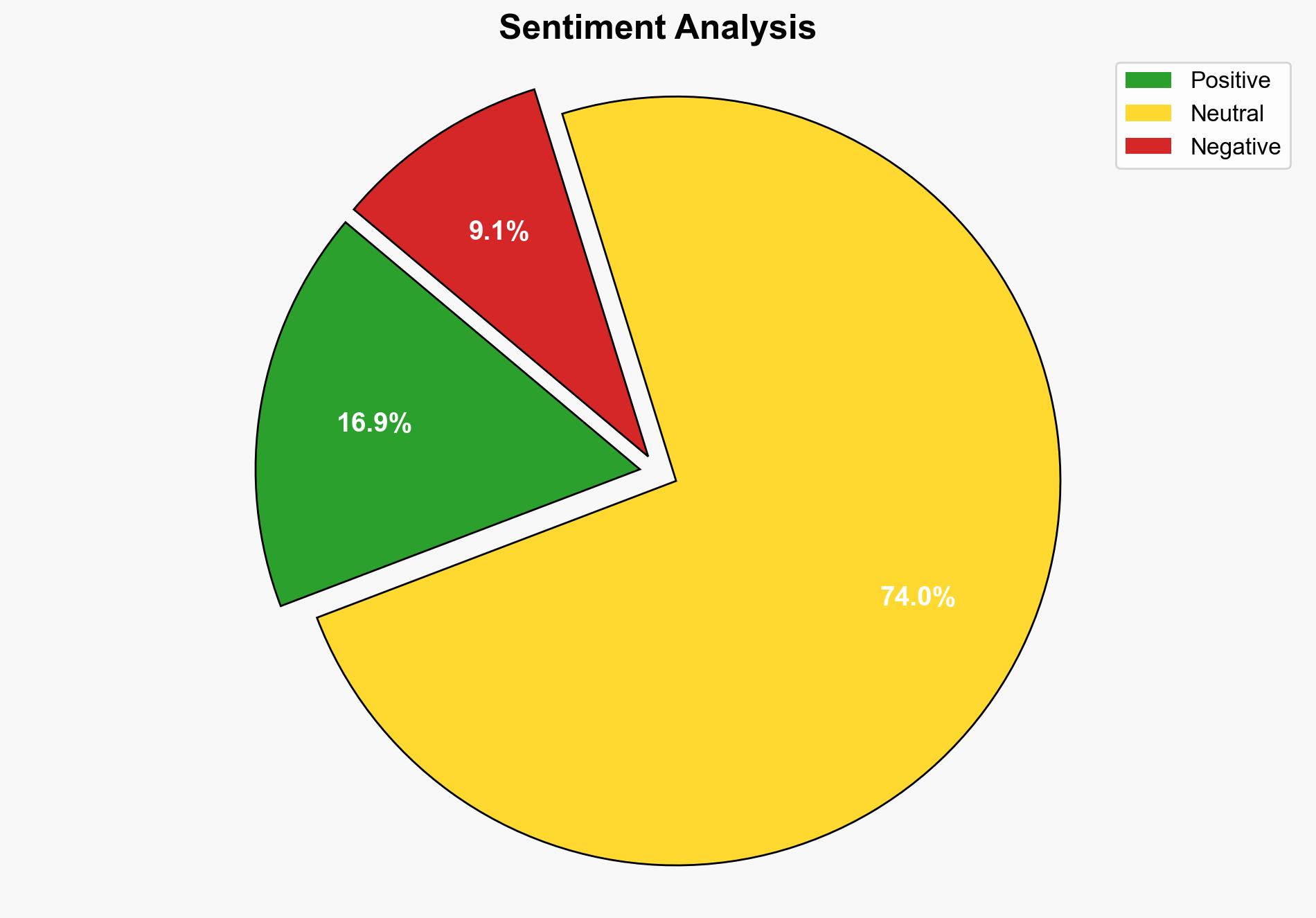

2. Competing Hypotheses

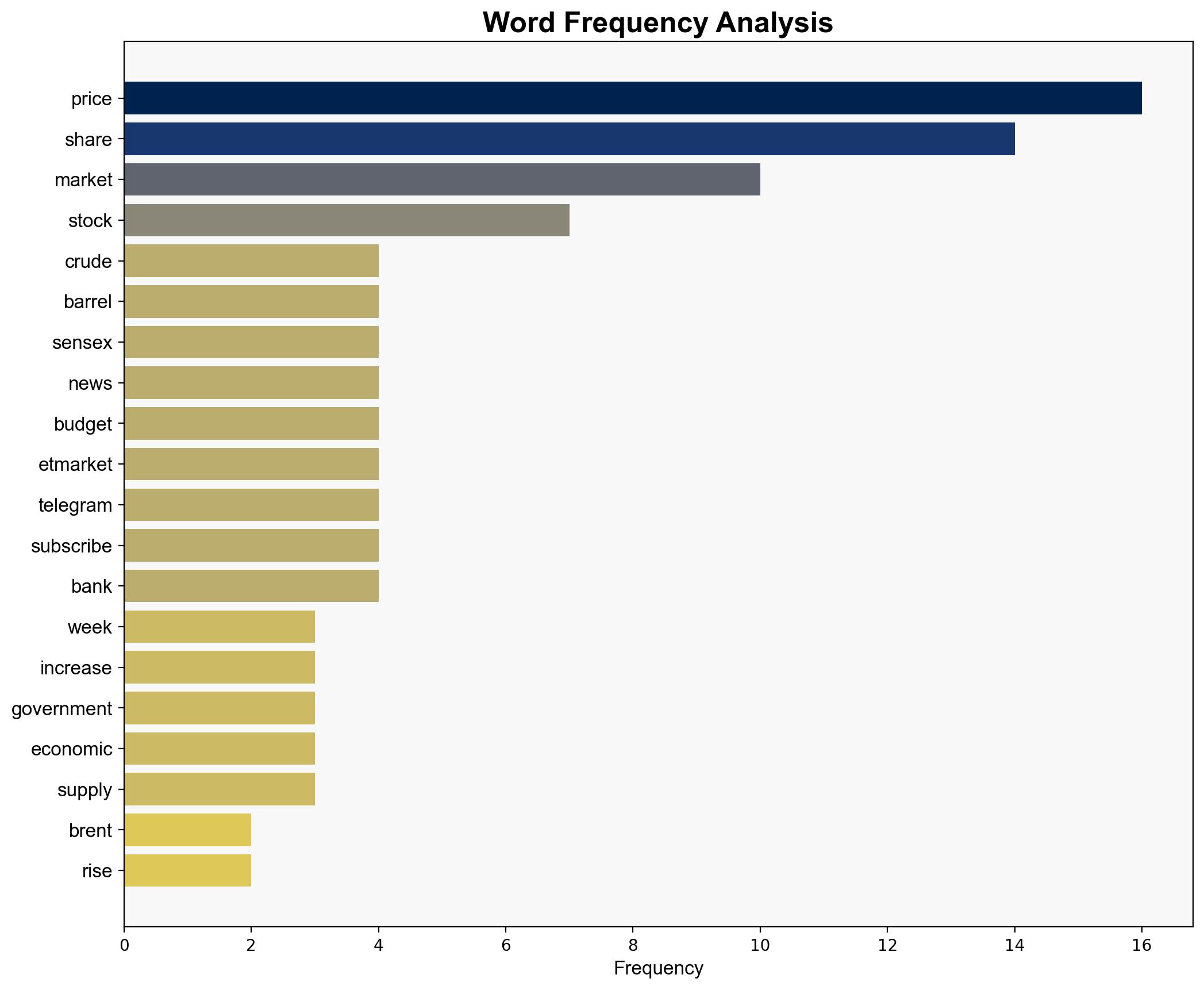

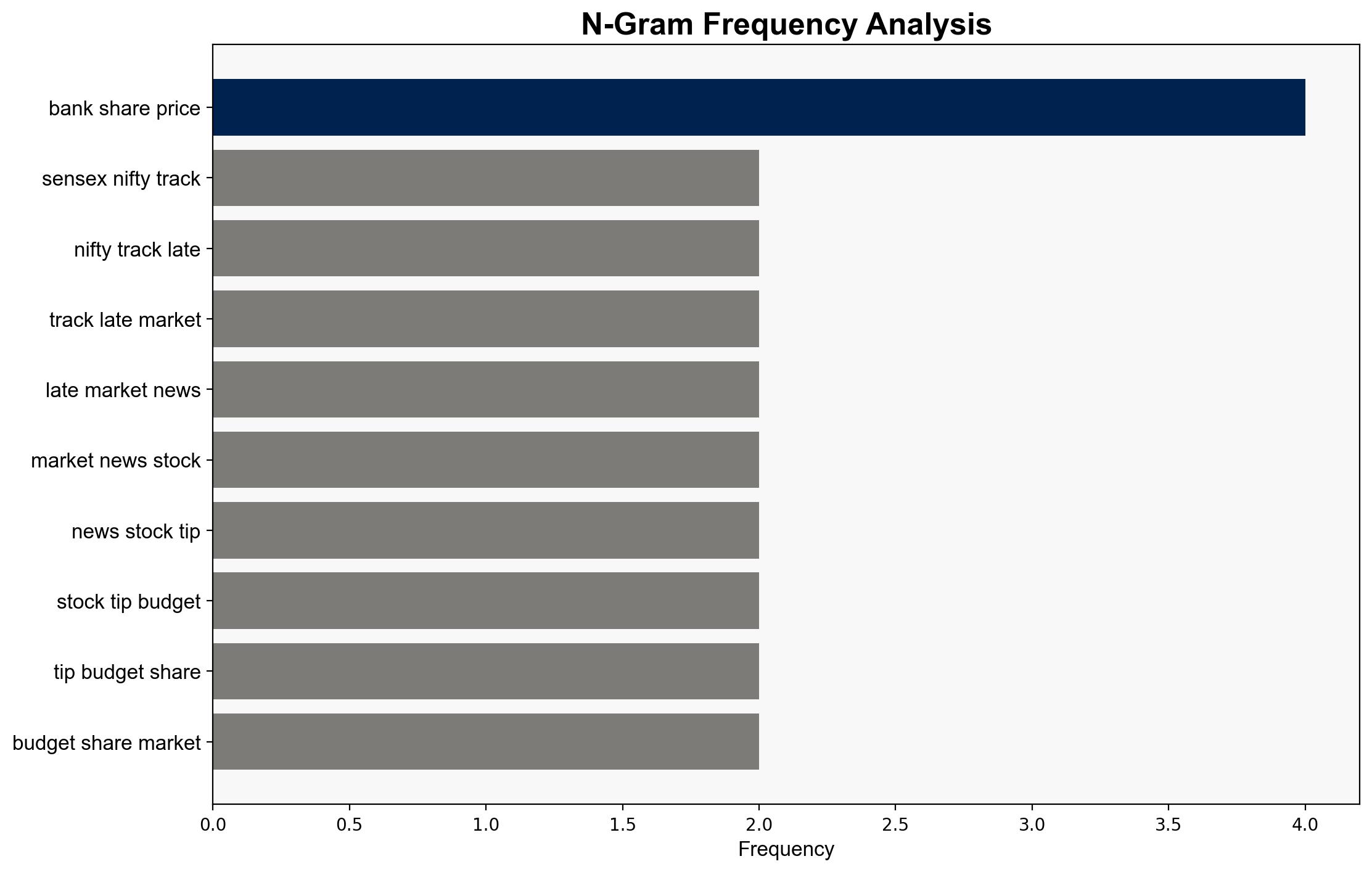

Hypothesis 1: The decline in oil prices is primarily due to increased global oil supply and inventory builds, exacerbated by OPEC’s output decisions and strategic price reductions by major exporters like Saudi Arabia.

Hypothesis 2: The decline in oil prices is mainly driven by economic uncertainty and demand-side issues, including the impact of the U.S. government shutdown, weak labor market signals, and geopolitical tensions affecting market confidence.

Using ACH 2.0, Hypothesis 1 is better supported by the evidence of increased supply and inventory builds, along with OPEC’s strategic decisions. Hypothesis 2, while plausible, lacks direct evidence linking economic uncertainty to the current price trends.

3. Key Assumptions and Red Flags

Assumptions for Hypothesis 1 include the belief that supply increases directly correlate with price declines. For Hypothesis 2, it assumes economic indicators directly impact oil demand. A red flag is the lack of detailed data on actual demand changes. Potential bias includes over-reliance on supply-side data without considering demand elasticity.

4. Implications and Strategic Risks

The ongoing supply increase could lead to prolonged price suppression, affecting oil-dependent economies. Geopolitical tensions, particularly involving Russia and Iran, may disrupt supply chains, leading to volatility. Economic disruptions in major markets like the U.S. could further dampen demand, exacerbating price declines.

5. Recommendations and Outlook

- Monitor OPEC’s upcoming decisions and any changes in production quotas.

- Engage in scenario planning for potential geopolitical escalations affecting oil supply.

- Consider hedging strategies for oil price volatility.

- Scenario Projections:

- Best Case: Stabilization of supply and demand balance leads to gradual price recovery.

- Worst Case: Escalating geopolitical tensions cause severe supply disruptions, leading to price spikes.

- Most Likely: Continued price volatility with moderate recovery as economic conditions stabilize.

6. Key Individuals and Entities

Tony Sycamore, OPEC, Saudi Arabia, Russia, Iran, Gunvor, Lukoil.

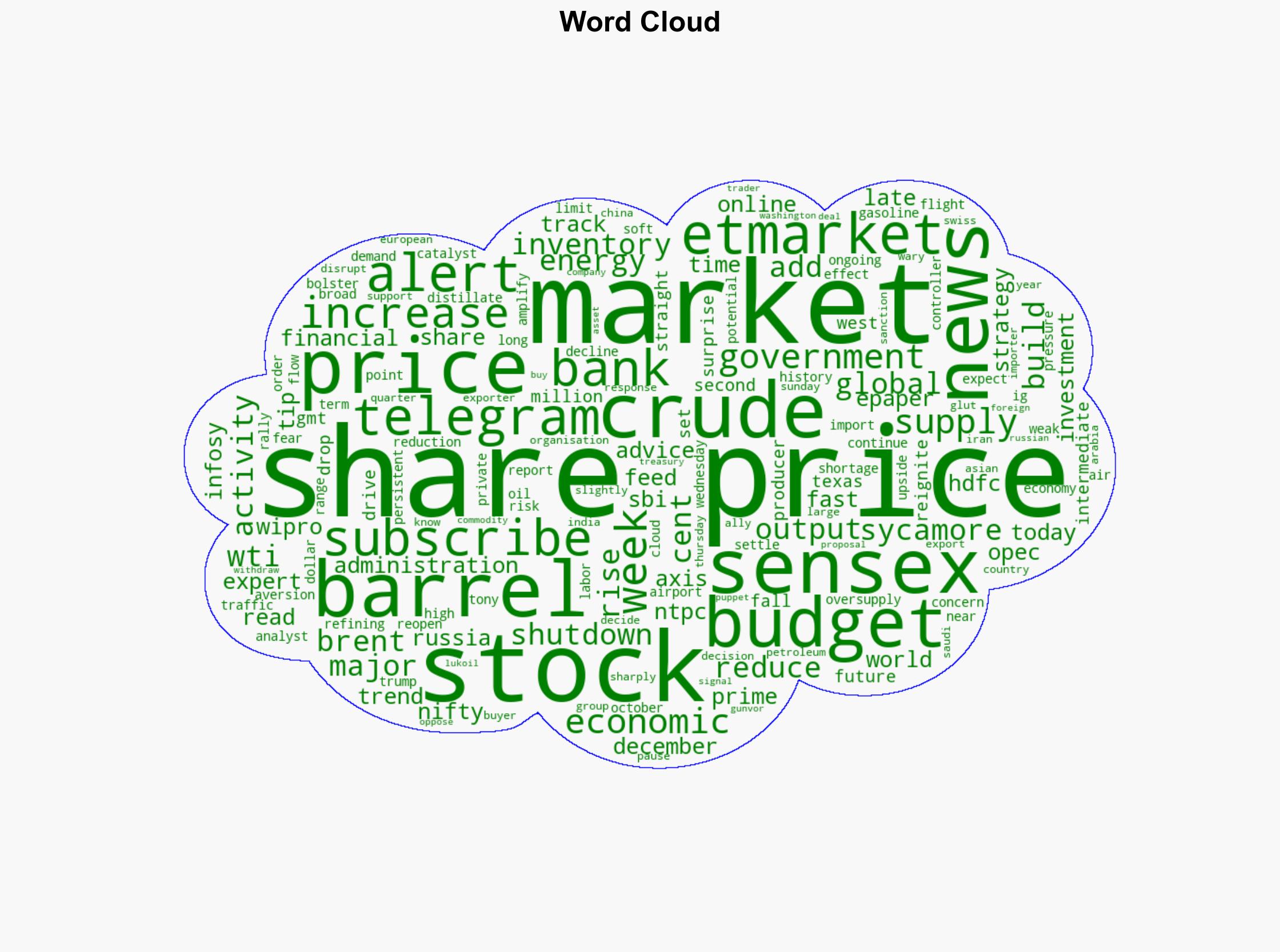

7. Thematic Tags

national security threats, economic stability, geopolitical tensions, energy markets