Oil Jumps as Trump Steps Up Pressure on Russia With Sanctions – Financial Post

Published on: 2025-10-23

Intelligence Report: Oil Jumps as Trump Steps Up Pressure on Russia With Sanctions – Financial Post

1. BLUF (Bottom Line Up Front)

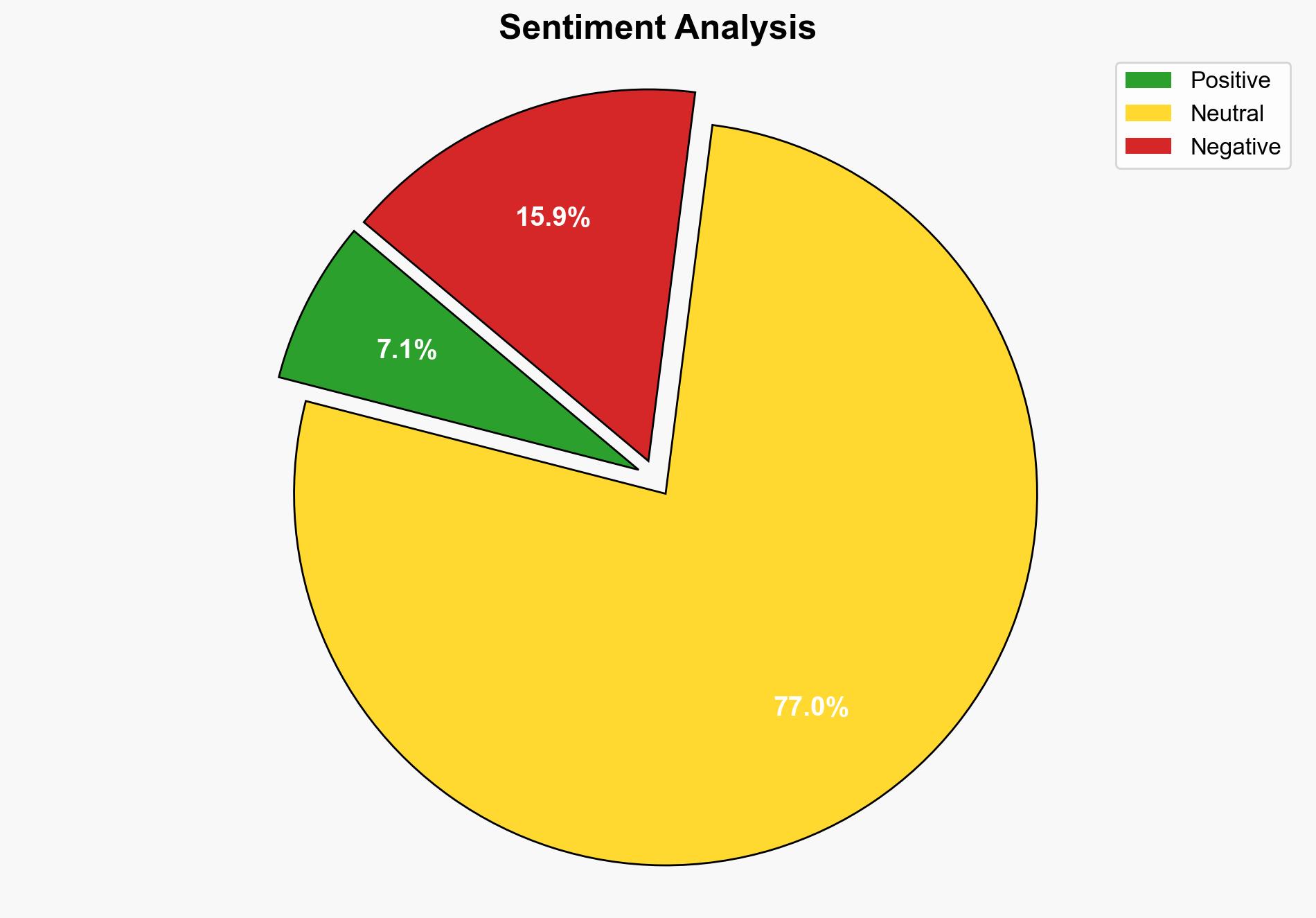

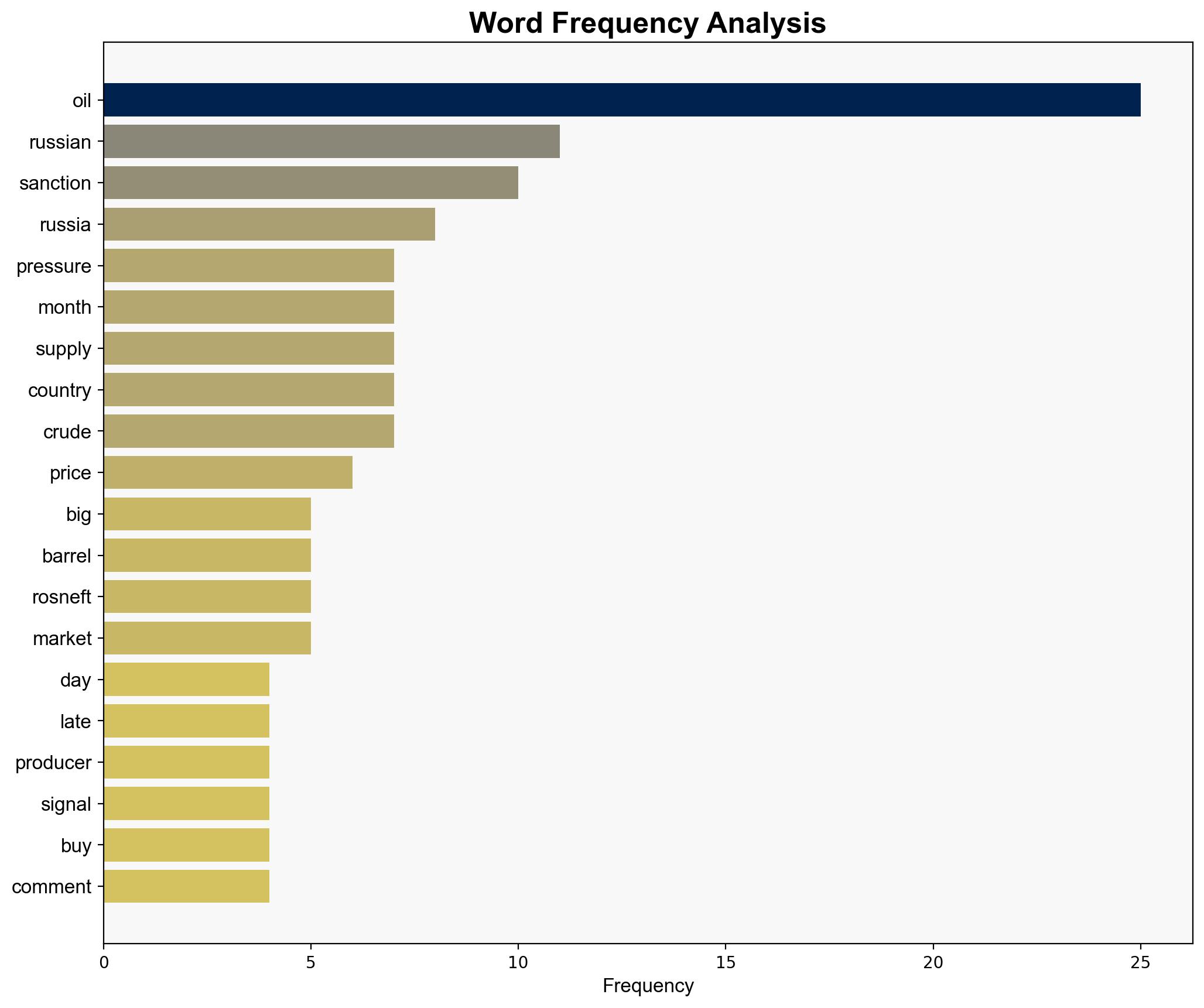

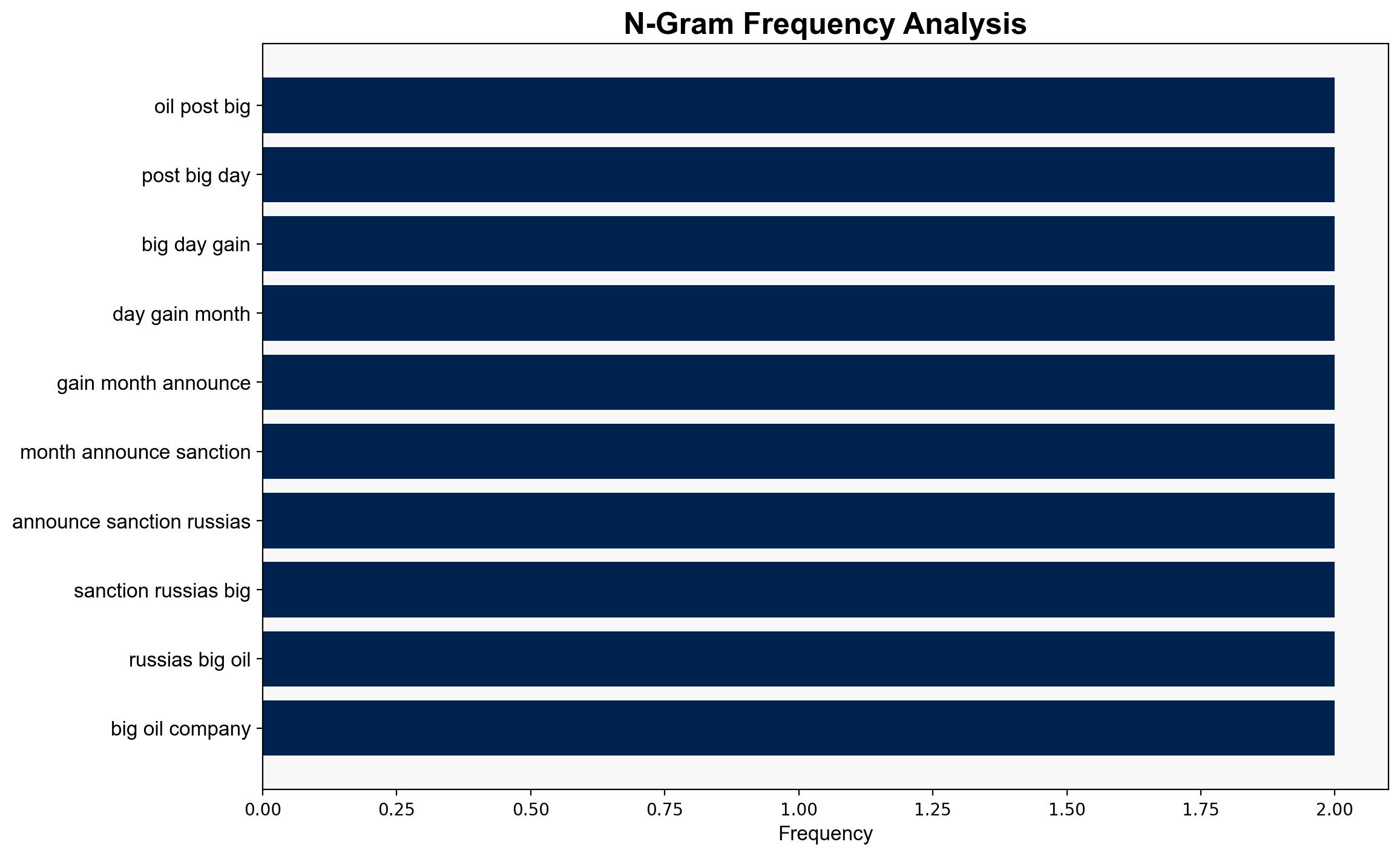

The imposition of new sanctions on Russian oil companies by the U.S. has led to a significant increase in oil prices, reflecting heightened geopolitical tensions and potential disruptions in global oil supply. The most supported hypothesis suggests that these sanctions will lead to a short-term spike in oil prices due to supply chain disruptions, but the long-term impact will depend on the ability of other countries to fill the supply gap. Confidence level: Moderate. Recommended action: Monitor the response of major oil-importing countries, particularly China and India, and prepare for potential shifts in global oil trade dynamics.

2. Competing Hypotheses

– **Hypothesis 1**: The sanctions will cause a significant and sustained increase in global oil prices due to disruptions in Russian oil exports and limited capacity of other producers to compensate.

– **Hypothesis 2**: The initial spike in oil prices will be temporary as other oil-producing nations, particularly those in OPEC, ramp up production to stabilize the market, and countries like China and India adjust their import strategies.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that Russian oil exports will be significantly curtailed by the sanctions and that other producers can increase output quickly. Another assumption is that China and India will alter their purchasing strategies in response to geopolitical pressures.

– **Red Flags**: Potential overestimation of OPEC’s ability to increase production rapidly. Uncertainty about China’s and India’s willingness to comply with U.S. pressure. Lack of clarity on the full scope and enforcement of the sanctions.

4. Implications and Strategic Risks

The sanctions could lead to increased volatility in global oil markets, impacting economic stability in oil-dependent regions. There is a risk of further geopolitical escalation if Russia retaliates. Cyber threats to oil infrastructure could increase as tensions rise. The disruption in oil supply chains may also lead to inflationary pressures globally.

5. Recommendations and Outlook

- Engage with OPEC and non-OPEC producers to assess their capacity to increase output.

- Monitor China’s and India’s oil import patterns for shifts that could indicate strategic realignments.

- Scenario Projections:

- Best Case: Other producers compensate for Russian shortfall, stabilizing prices.

- Worst Case: Prolonged high prices lead to economic downturns in oil-importing nations.

- Most Likely: Temporary price spike followed by gradual stabilization as market adjusts.

6. Key Individuals and Entities

– Donald Trump

– Narendra Modi

– Xi Jinping

– Igor Sechin

– Rosneft PJSC

– Lukoil PJSC

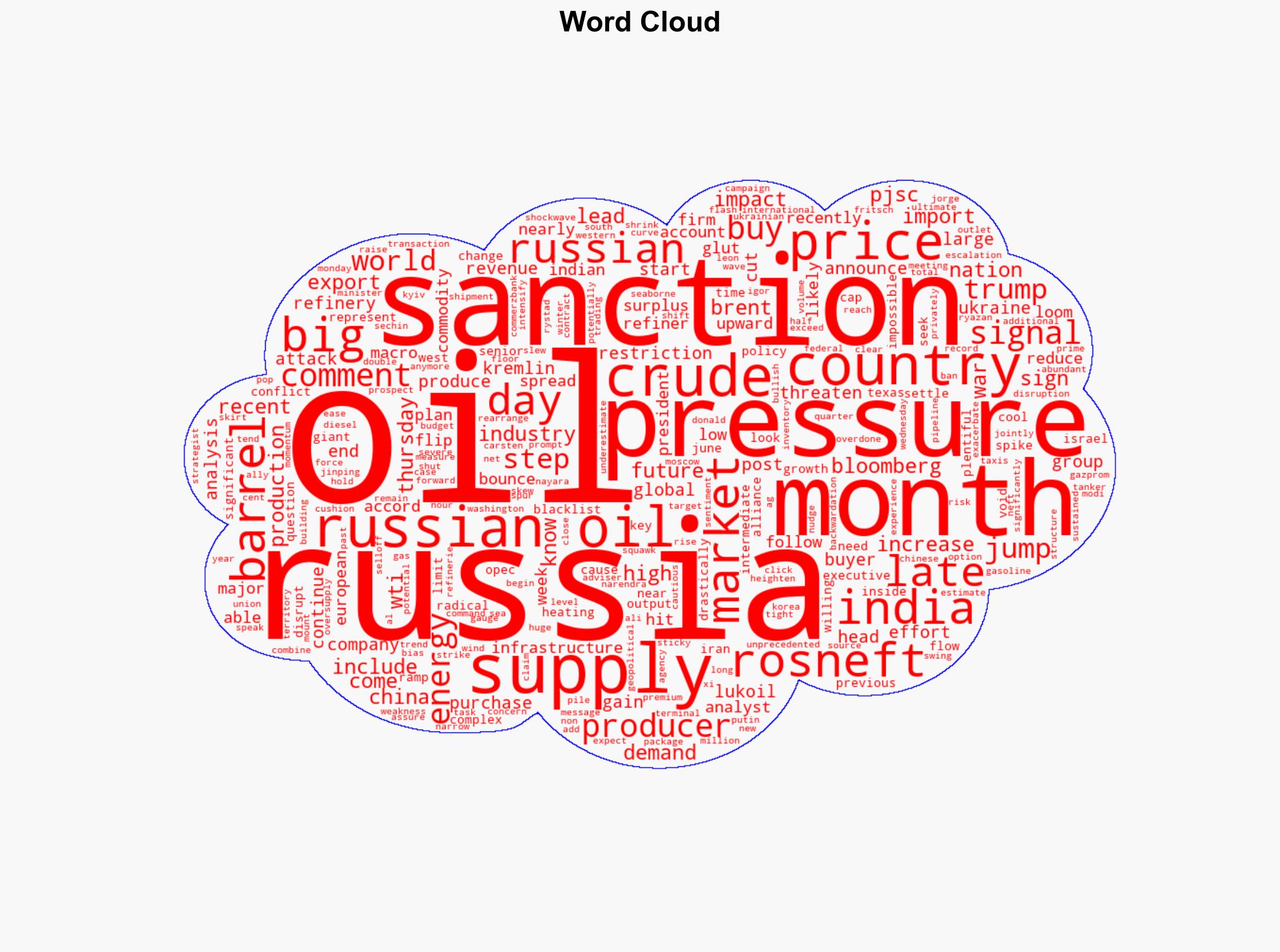

7. Thematic Tags

national security threats, economic stability, geopolitical tensions, energy security