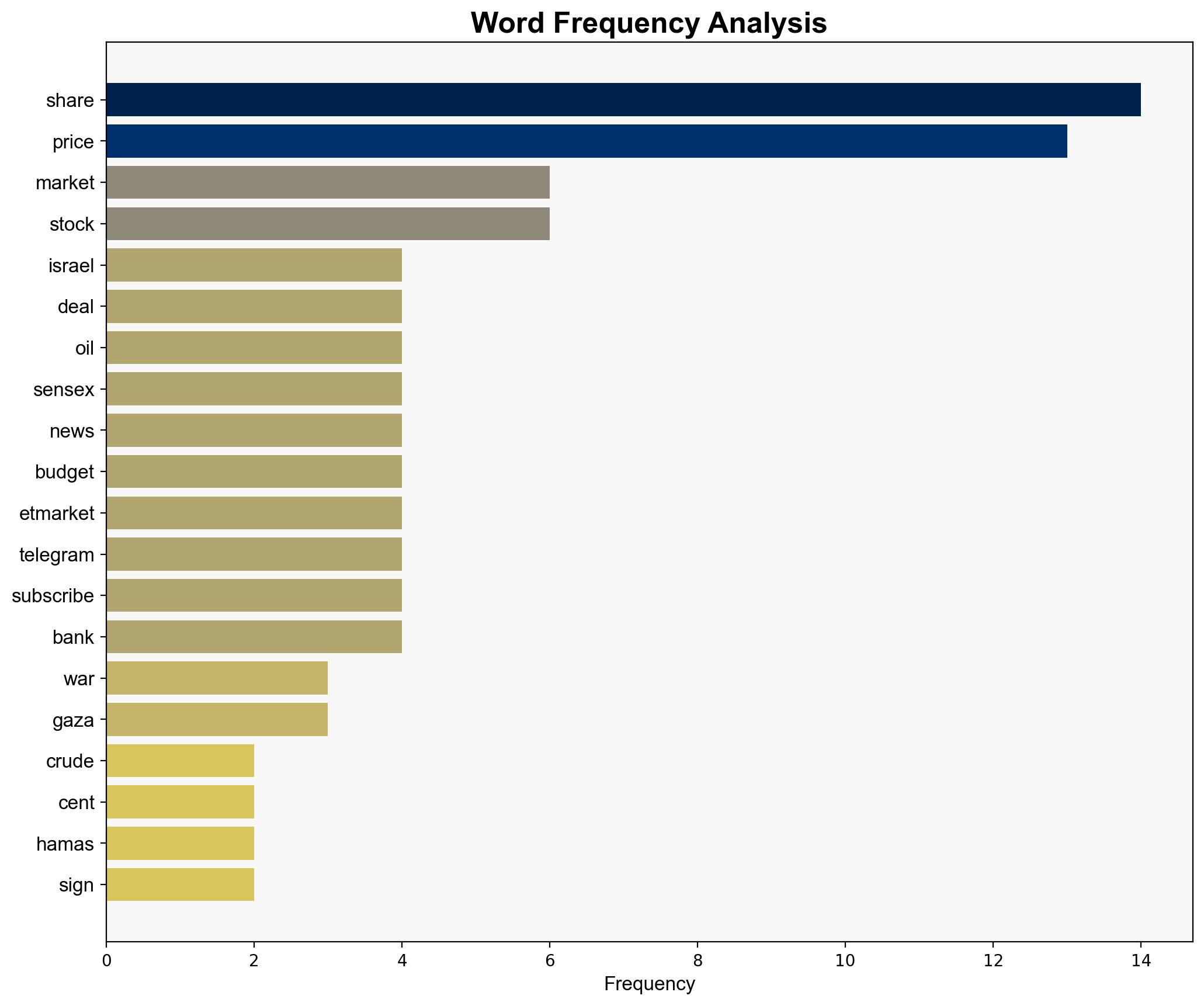

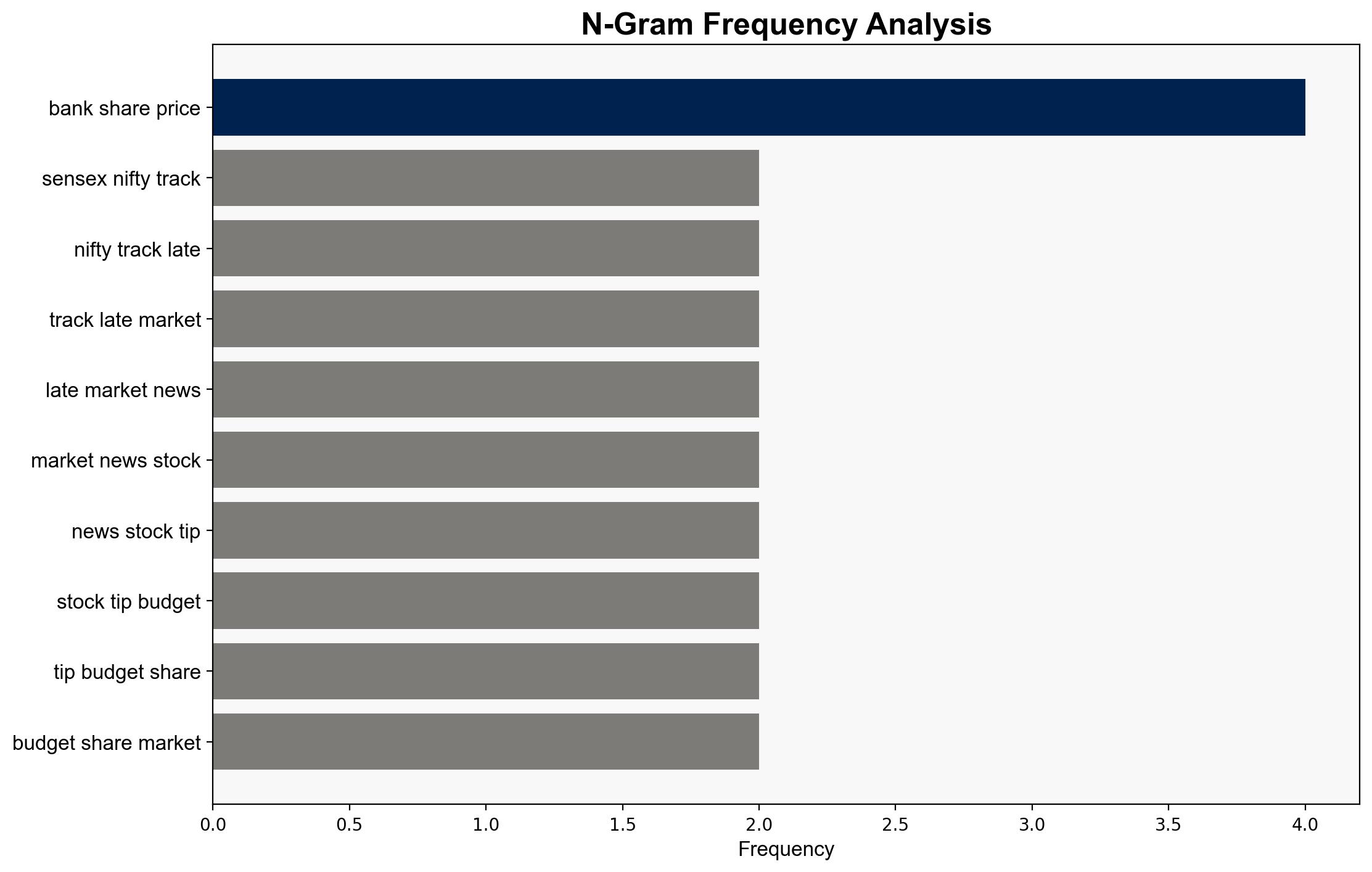

Oil little changed amid fading risk premium after Gaza deal – The Times of India

Published on: 2025-10-10

Intelligence Report: Oil little changed amid fading risk premium after Gaza deal – The Times of India

1. BLUF (Bottom Line Up Front)

The most supported hypothesis is that the recent ceasefire between Israel and Hamas has temporarily stabilized oil prices by reducing geopolitical risk premiums. However, underlying market dynamics and geopolitical tensions could lead to future volatility. Confidence in this assessment is moderate, given the complexity of the geopolitical landscape. It is recommended to closely monitor OPEC’s production decisions and geopolitical developments in the Middle East.

2. Competing Hypotheses

Hypothesis 1: The ceasefire agreement between Israel and Hamas has led to a reduction in geopolitical risk premiums, stabilizing oil prices temporarily. This hypothesis suggests that the agreement has alleviated immediate concerns about supply disruptions in the region.

Hypothesis 2: The stabilization of oil prices is primarily due to market anticipation of increased oil supply from OPEC and its allies, rather than the geopolitical developments in Gaza. This hypothesis posits that the market is more focused on the potential for an oil surplus due to OPEC’s production adjustments.

Using ACH 2.0, Hypothesis 1 is better supported by the immediate context of the ceasefire and its impact on market sentiment. However, Hypothesis 2 remains plausible given ongoing discussions within OPEC.

3. Key Assumptions and Red Flags

– **Assumptions:**

– The ceasefire will hold, reducing immediate risk premiums.

– OPEC will proceed with planned production increases without significant deviations.

– **Red Flags:**

– Potential for ceasefire breakdown, leading to renewed hostilities and increased risk premiums.

– Uncertainty regarding OPEC’s ability to manage production effectively amidst internal disagreements.

4. Implications and Strategic Risks

The ceasefire could lead to short-term stability in oil markets, but the risk of escalation remains if the agreement fails. Additionally, OPEC’s production decisions could either alleviate or exacerbate market volatility. A failure in the ceasefire could trigger broader regional instability, impacting global oil supply chains.

5. Recommendations and Outlook

- Monitor the ceasefire’s durability and any signs of renewed conflict in Gaza.

- Track OPEC’s production announcements and potential shifts in policy.

- Scenario Projections:

- Best Case: Ceasefire holds, OPEC manages production smoothly, leading to stable oil prices.

- Worst Case: Ceasefire collapses, leading to regional conflict and significant oil price spikes.

- Most Likely: Temporary stability with potential for volatility based on geopolitical developments.

6. Key Individuals and Entities

– Donald Trump (mentioned in context of past initiatives)

– Daniel Hynes (analyst referenced in the report)

– OPEC (Organization of the Petroleum Exporting Countries)

7. Thematic Tags

national security threats, geopolitical stability, energy markets, Middle East conflict