Oil maintains gains on supply risks and US plan to refill strategic reserves – The Times of India

Published on: 2025-10-22

Intelligence Report: Oil maintains gains on supply risks and US plan to refill strategic reserves – The Times of India

1. BLUF (Bottom Line Up Front)

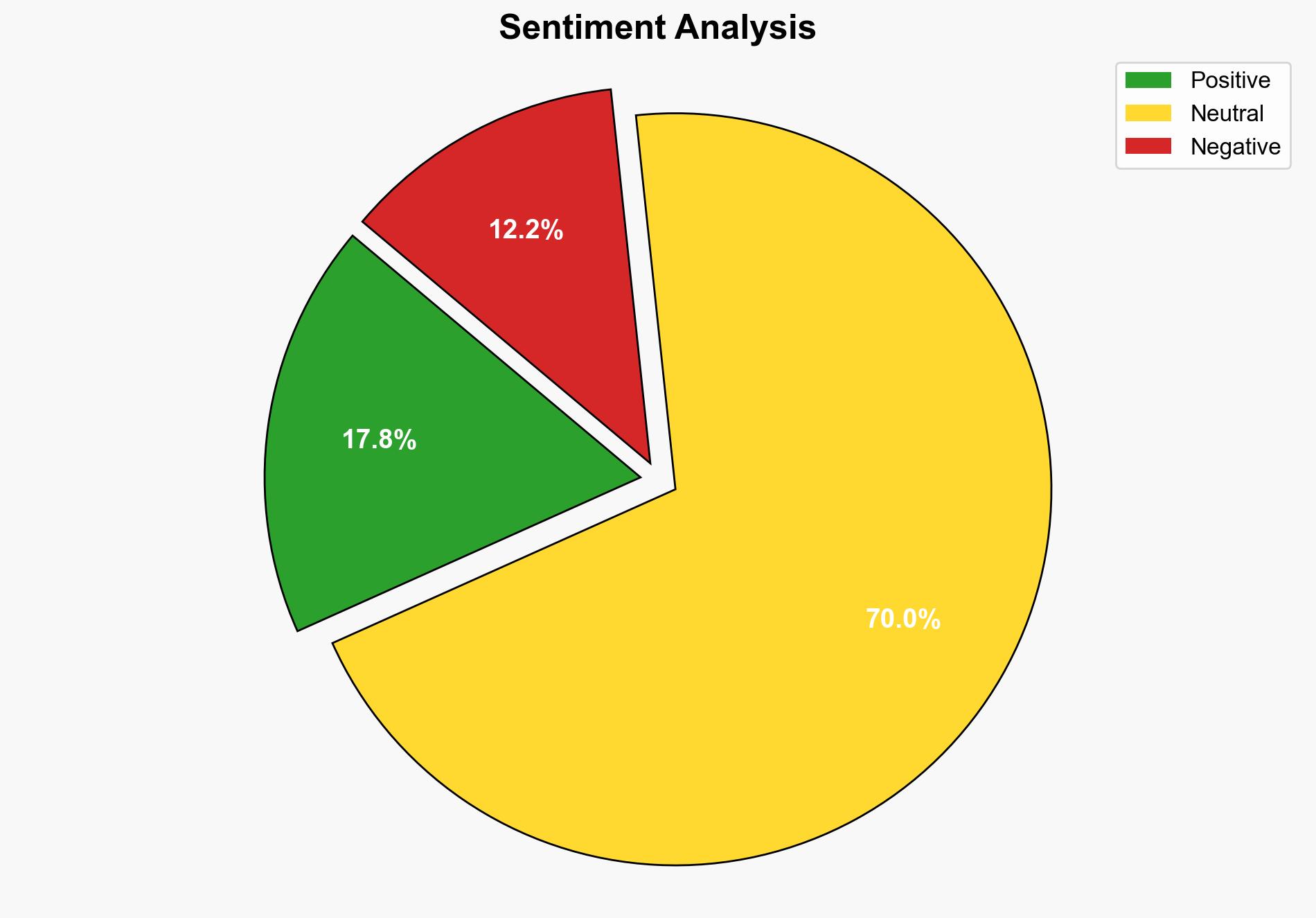

The most supported hypothesis is that oil prices are likely to remain stable or increase slightly due to supply risks and strategic reserve refilling plans. Confidence level is moderate, as geopolitical tensions and market dynamics introduce significant uncertainty. Recommended action is to monitor geopolitical developments closely and consider strategic oil reserve management to buffer against potential supply disruptions.

2. Competing Hypotheses

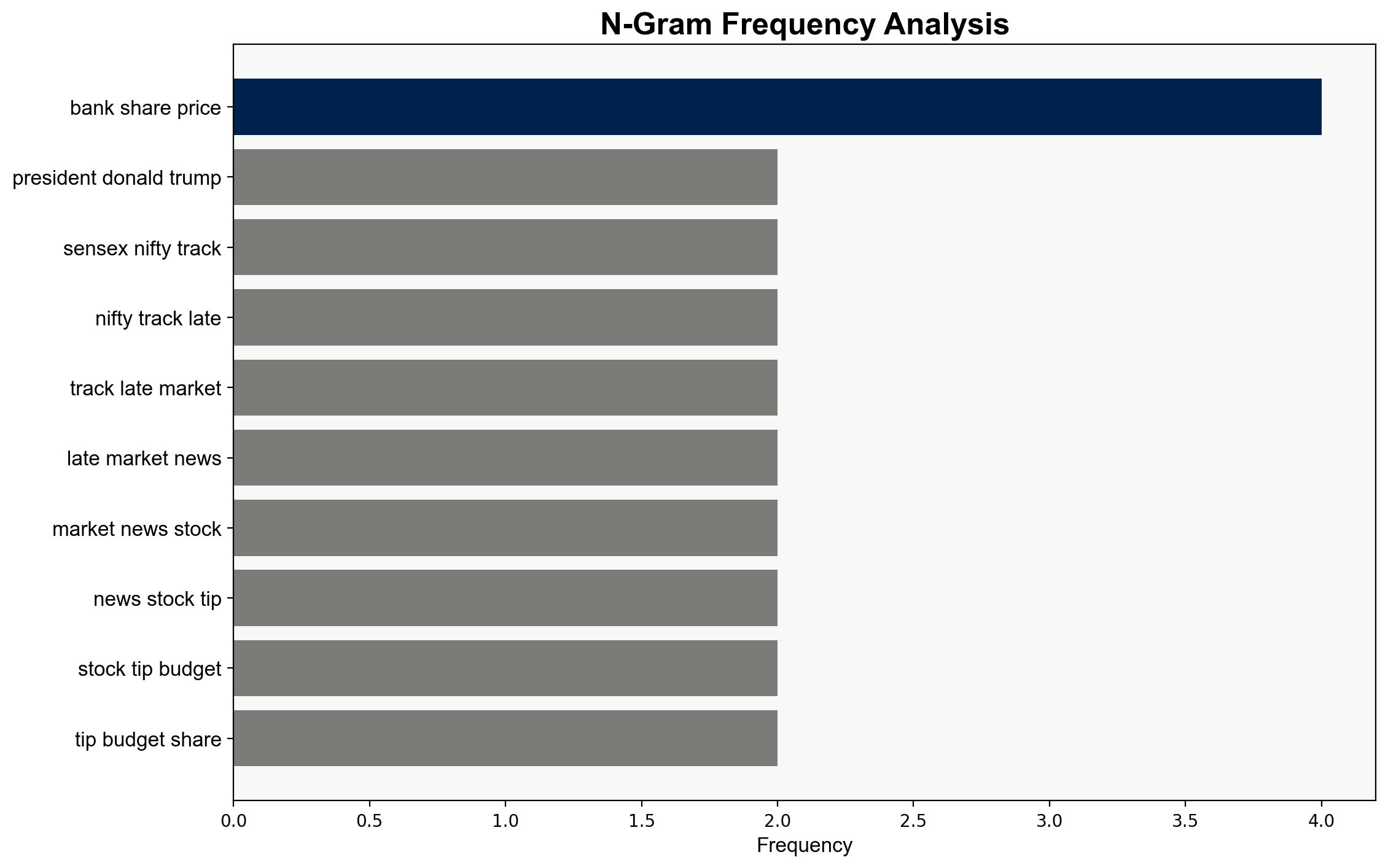

Hypothesis 1: Oil prices will stabilize or increase due to ongoing supply risks and the U.S. plan to refill strategic reserves. This scenario is supported by geopolitical tensions involving Russia, Venezuela, and the Middle East, as well as the U.S. Department of Energy’s actions to purchase crude oil for strategic reserves.

Hypothesis 2: Oil prices will decrease due to weak global demand and bearish market sentiment. Despite supply risks, the impact of trade tensions and economic slowdowns, particularly in Asia, may outweigh the upward pressure on prices.

3. Key Assumptions and Red Flags

Assumptions:

– Hypothesis 1 assumes that geopolitical tensions will persist and significantly impact oil supply.

– Hypothesis 2 assumes that global economic conditions will not improve significantly in the short term.

Red Flags:

– Potential overestimation of the impact of strategic reserve refilling on market prices.

– Underestimation of the impact of a potential resolution in trade tensions between the U.S. and China.

Blind Spots:

– Lack of detailed analysis on the potential impact of new energy policies or technological advancements in renewable energy.

4. Implications and Strategic Risks

– Continued geopolitical tensions could lead to further supply disruptions, escalating oil prices and impacting global markets.

– A significant drop in oil prices could adversely affect oil-dependent economies, leading to economic instability.

– Trade negotiations between major economies could shift market dynamics rapidly, affecting oil demand and prices.

5. Recommendations and Outlook

- Monitor geopolitical developments closely, particularly in Russia, Venezuela, and the Middle East, to anticipate potential supply disruptions.

- Consider strategic diversification of energy sources to mitigate reliance on oil imports.

- Scenario-based projections:

- Best Case: Resolution of trade tensions and stable geopolitical conditions lead to moderate oil price increases.

- Worst Case: Escalation of geopolitical conflicts causes significant supply disruptions, leading to sharp oil price spikes.

- Most Likely: Oil prices remain stable with slight increases due to balanced supply risks and demand factors.

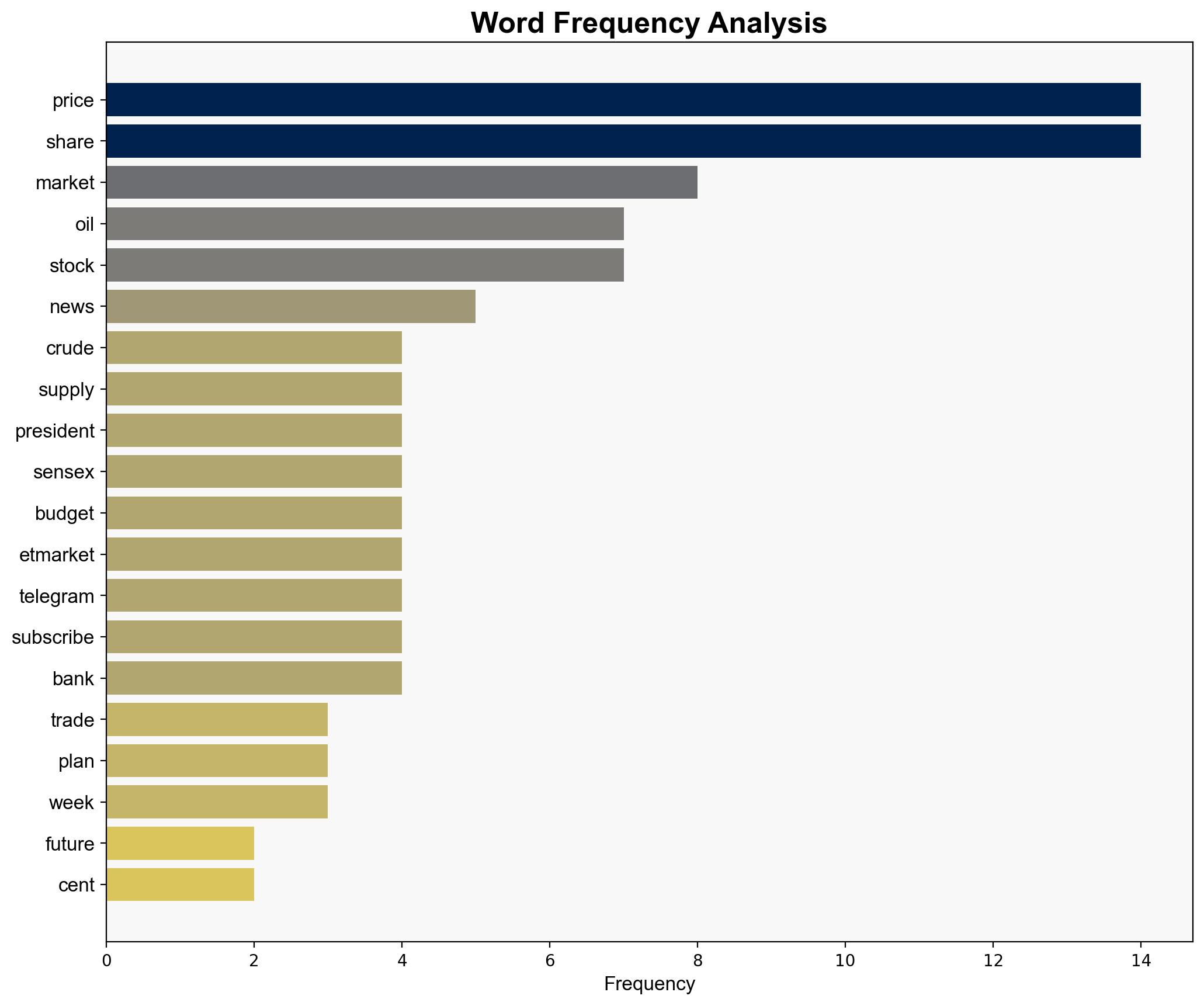

6. Key Individuals and Entities

– Donald Trump

– Vladimir Putin

– Xi Jinping

– Mukesh Sahdev

– ANZ Research

7. Thematic Tags

national security threats, economic stability, geopolitical tensions, energy market dynamics