Oil Markets Brush Off the OPEC Production Push – OilPrice.com

Published on: 2025-07-08

Intelligence Report: Oil Markets Brush Off the OPEC Production Push – OilPrice.com

1. BLUF (Bottom Line Up Front)

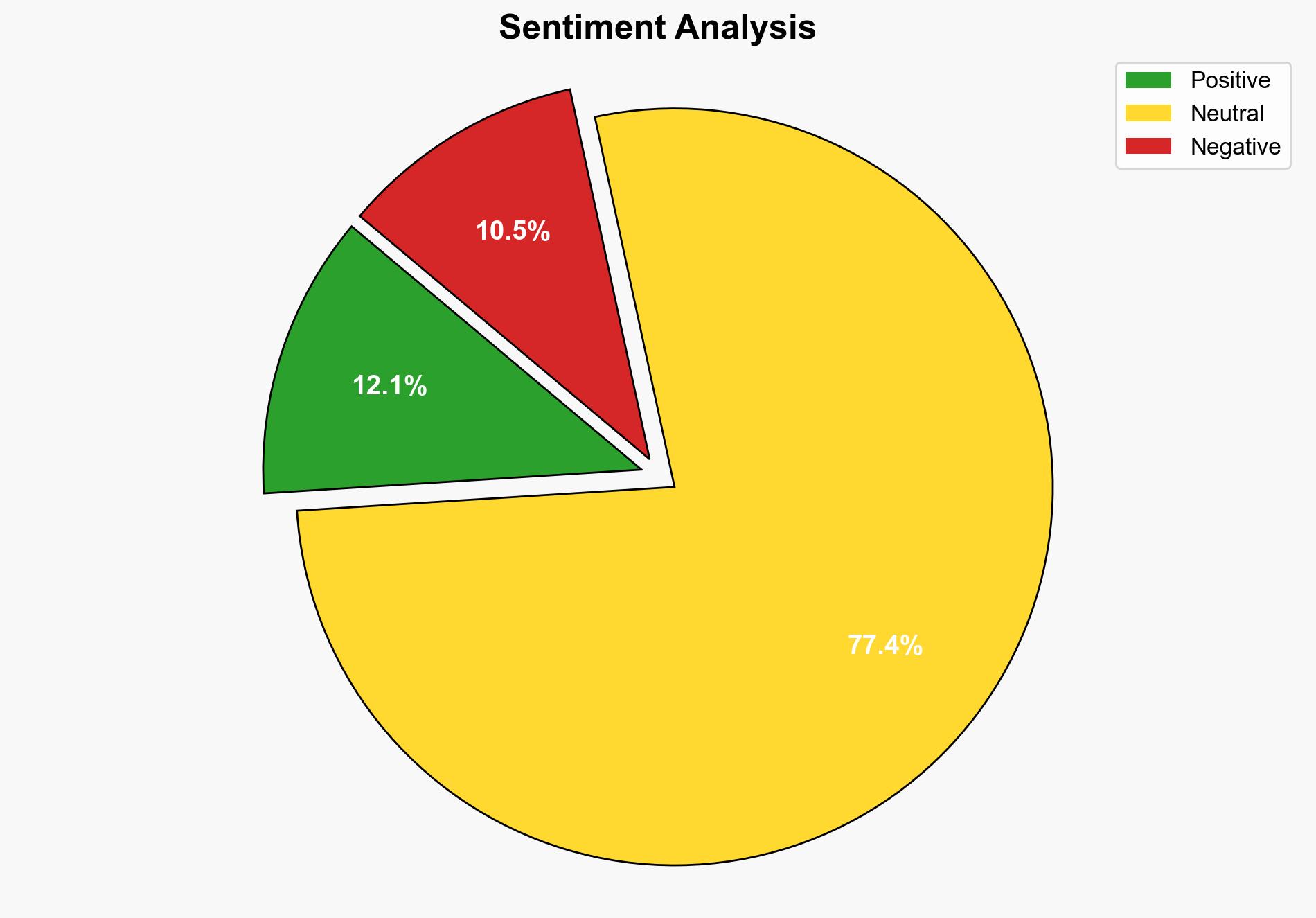

Despite OPEC’s anticipated production increase, oil prices remain elevated due to ongoing geopolitical tensions and regional refinery disruptions. The resilience of oil prices suggests underlying market vulnerabilities and potential supply chain disruptions. Strategic recommendations include monitoring geopolitical developments and enhancing supply chain resilience.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Causal Layered Analysis (CLA)

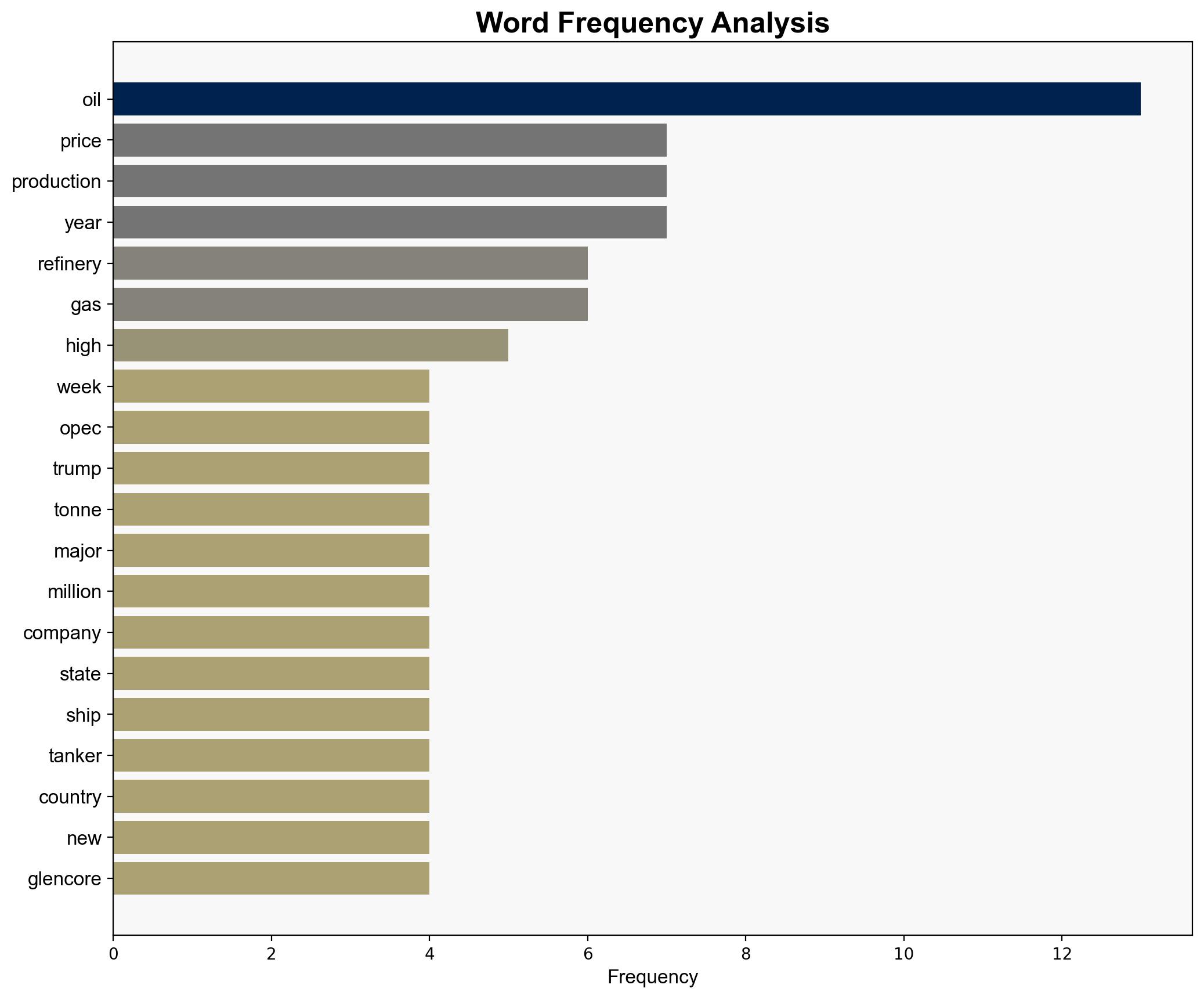

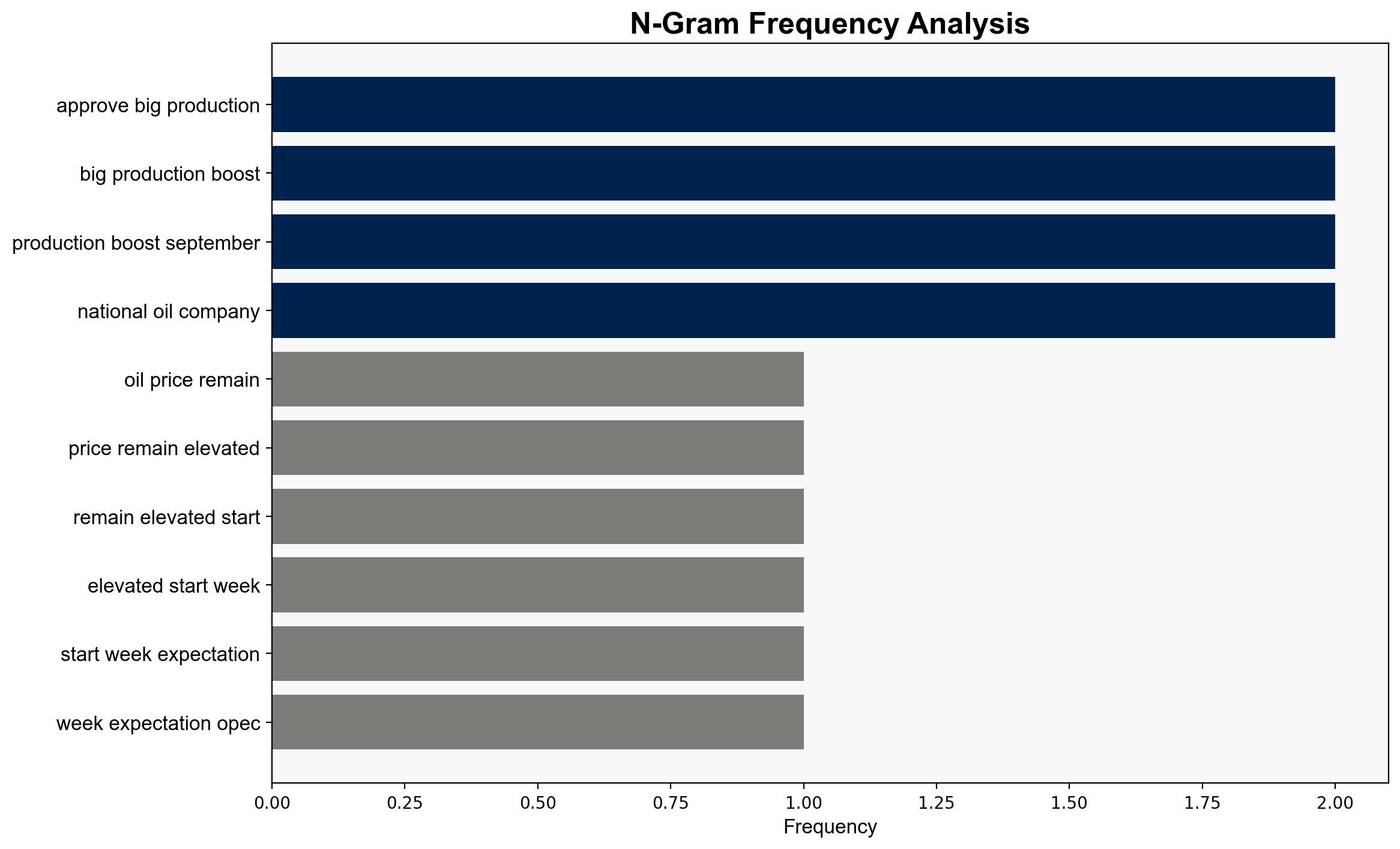

Surface events include OPEC’s production decisions and regional refinery outages. Systemic structures involve global supply chains and geopolitical tensions, particularly in the Middle East. Worldviews reflect the strategic importance of energy security, while myths pertain to the perceived stability of oil markets.

Cross-Impact Simulation

The interplay between Middle Eastern conflicts and European refinery operations highlights potential supply chain vulnerabilities. The stability of Asian markets amid these tensions suggests a buffer against immediate disruptions.

Scenario Generation

Scenarios include a stabilized market with successful OPEC production increases, a disrupted market due to heightened Middle Eastern tensions, and a balanced market with diversified energy sources.

Cognitive Bias Stress Test

Biases towards overestimating OPEC’s control over market prices have been identified and addressed, emphasizing the role of geopolitical factors in price stability.

3. Implications and Strategic Risks

The potential for escalating Middle Eastern conflicts poses a significant risk to global oil supply chains. European refinery outages further exacerbate supply vulnerabilities. The strategic risk includes potential fuel shortages and economic disruptions in affected regions.

4. Recommendations and Outlook

- Enhance monitoring of geopolitical developments in the Middle East and their impact on oil supply chains.

- Develop contingency plans to address potential supply disruptions, focusing on alternative energy sources and strategic reserves.

- Scenario-based projections: Best case involves successful OPEC production increases stabilizing prices; worst case includes heightened regional conflicts disrupting supplies; most likely scenario sees moderate disruptions with gradual stabilization.

5. Key Individuals and Entities

Notable mentions include BP, Shell, Sonatrach, Eni, CNPC, MSC, and Glencore. These entities are central to developments in the oil market and have significant influence over regional supply dynamics.

6. Thematic Tags

national security threats, energy security, geopolitical tensions, supply chain resilience