Oil prices gain 1 after lower-than-expected OPEC output hike – The Times of India

Published on: 2025-10-06

Intelligence Report: Oil prices gain 1 after lower-than-expected OPEC output hike – The Times of India

1. BLUF (Bottom Line Up Front)

The strategic judgment is that the modest increase in oil prices is primarily influenced by OPEC’s decision to implement a lower-than-expected production hike. The most supported hypothesis is that OPEC is strategically managing production to stabilize prices amidst geopolitical tensions and economic uncertainties. Confidence level: Moderate. Recommended action: Monitor OPEC’s future production decisions and geopolitical developments, particularly in Russia and Ukraine, to anticipate further market shifts.

2. Competing Hypotheses

1. **Hypothesis A**: OPEC’s decision for a modest production increase is a calculated move to stabilize oil prices amidst geopolitical tensions, particularly the ongoing conflict involving Russia and Ukraine, and to counteract potential supply disruptions.

2. **Hypothesis B**: The decision reflects internal disagreements within OPEC, with some members like Russia advocating for higher output increases to regain market share, while others, such as Saudi Arabia, prefer a conservative approach to maintain price stability.

3. Key Assumptions and Red Flags

– **Assumptions**:

– OPEC’s production decisions are primarily driven by economic factors and geopolitical stability.

– Russia’s advocacy for higher output is genuine and not a strategic deception.

– **Red Flags**:

– Potential underestimation of internal OPEC dynamics and disagreements.

– Lack of clarity on the impact of European sanctions on Russian oil exports.

4. Implications and Strategic Risks

The current situation presents several risks, including:

– **Economic Risks**: Continued volatility in oil prices could impact global economic stability, particularly in energy-dependent economies.

– **Geopolitical Risks**: Escalation in the Russia-Ukraine conflict could lead to further disruptions in energy supply chains.

– **Market Risks**: Potential for a supply glut if demand does not meet increased production levels, leading to price drops.

5. Recommendations and Outlook

- Monitor OPEC’s production announcements and align investment strategies accordingly.

- Engage in diplomatic efforts to mitigate geopolitical tensions, particularly in Eastern Europe.

- Scenario-based projections:

– **Best Case**: Stabilization of oil prices with a balanced supply-demand dynamic.

– **Worst Case**: Significant price drops due to oversupply and geopolitical escalations.

– **Most Likely**: Continued moderate price fluctuations with periodic geopolitical disruptions.

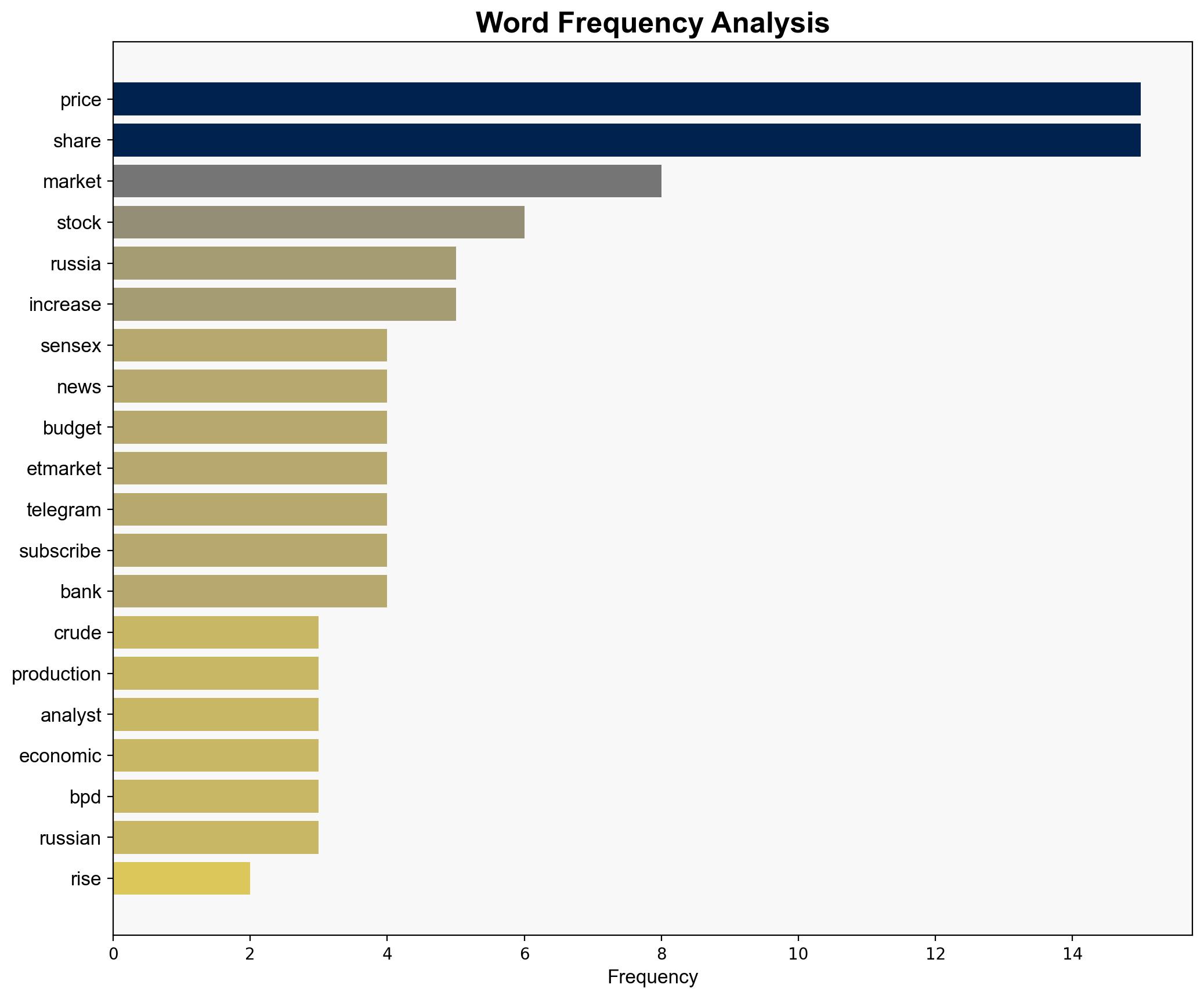

6. Key Individuals and Entities

– Tina Teng (Independent Analyst)

– OPEC (Organization of the Petroleum Exporting Countries)

– Russia and Saudi Arabia (Key OPEC members)

7. Thematic Tags

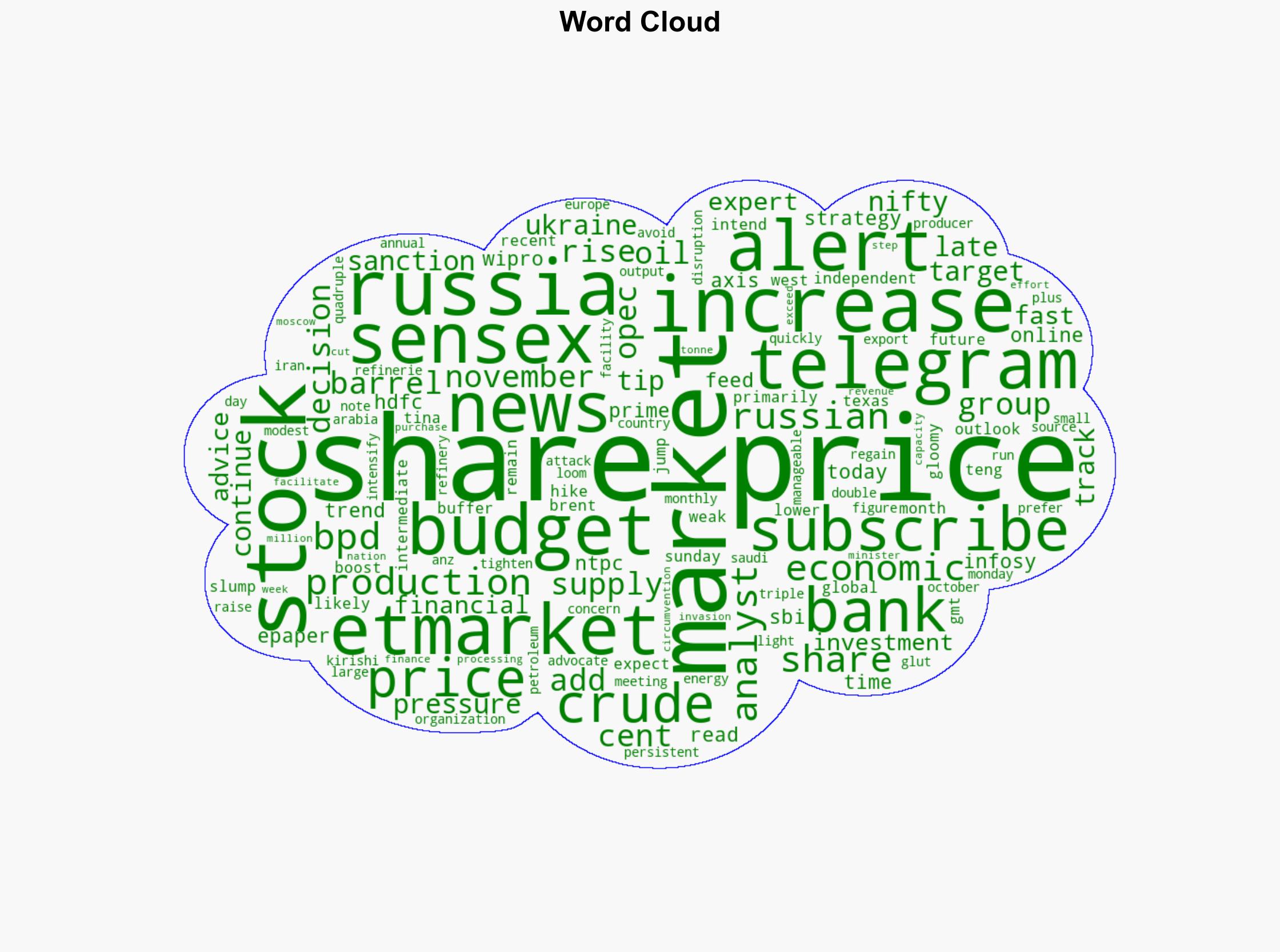

national security threats, geopolitical stability, energy market dynamics, economic volatility