Oil prices slip on concerns over US-China trade tensions – The Times of India

Published on: 2025-10-20

Intelligence Report: Oil prices slip on concerns over US-China trade tensions – The Times of India

1. BLUF (Bottom Line Up Front)

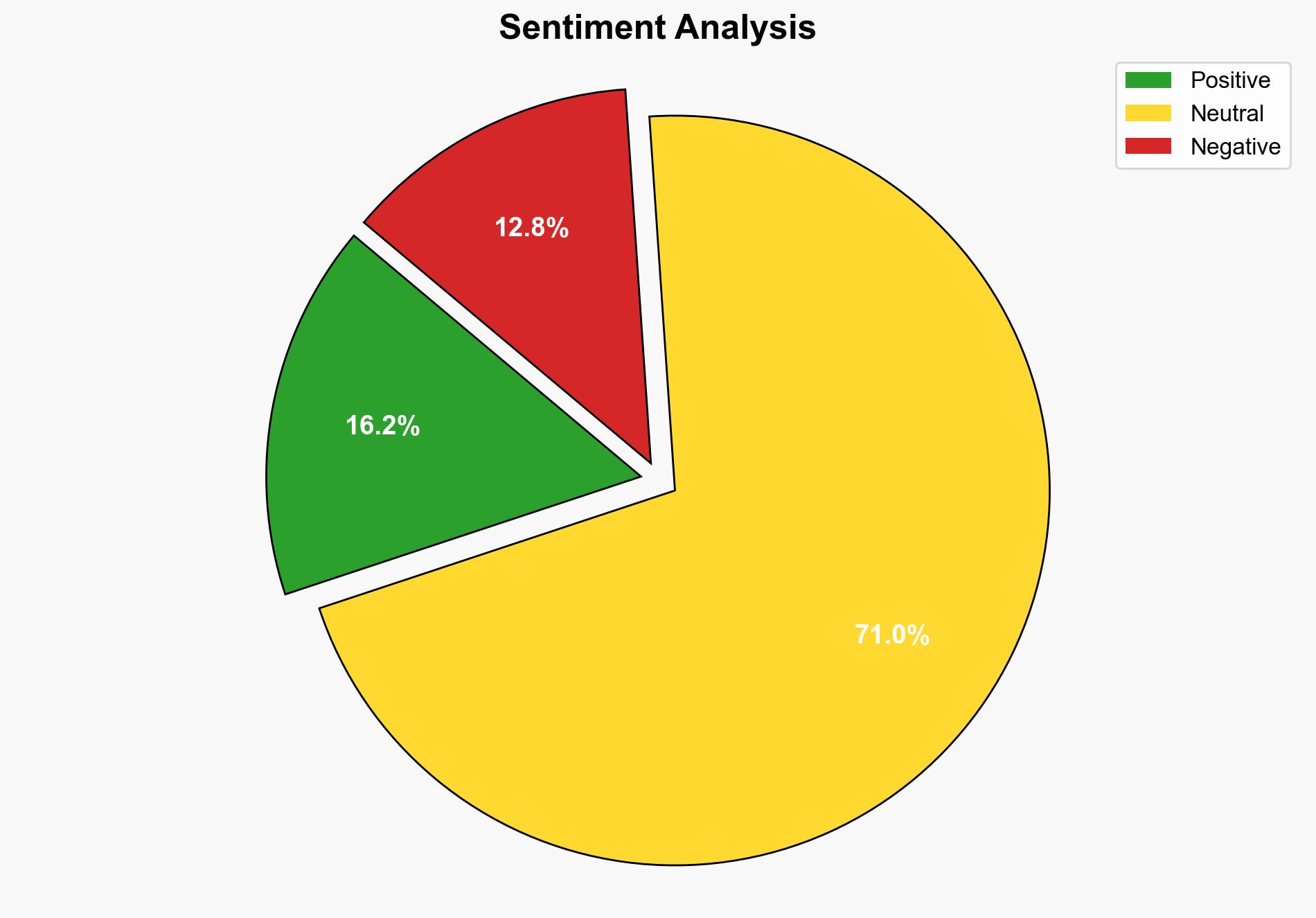

Oil prices are experiencing a decline due to concerns over US-China trade tensions and potential oversupply in the market. The most supported hypothesis is that geopolitical tensions and economic uncertainties are driving market behavior. Confidence Level: Moderate. Recommended action is to monitor geopolitical developments closely and prepare for potential market volatility.

2. Competing Hypotheses

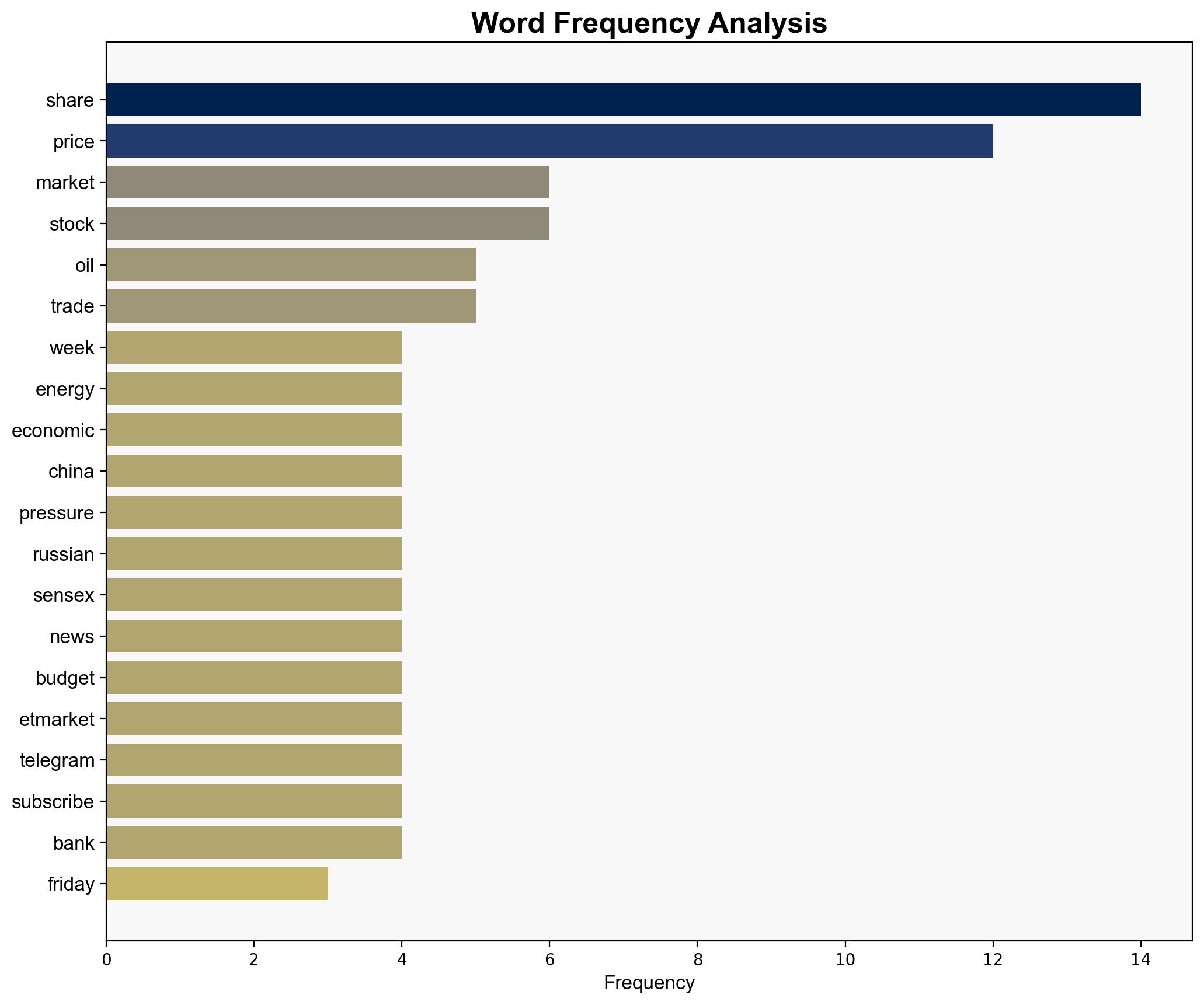

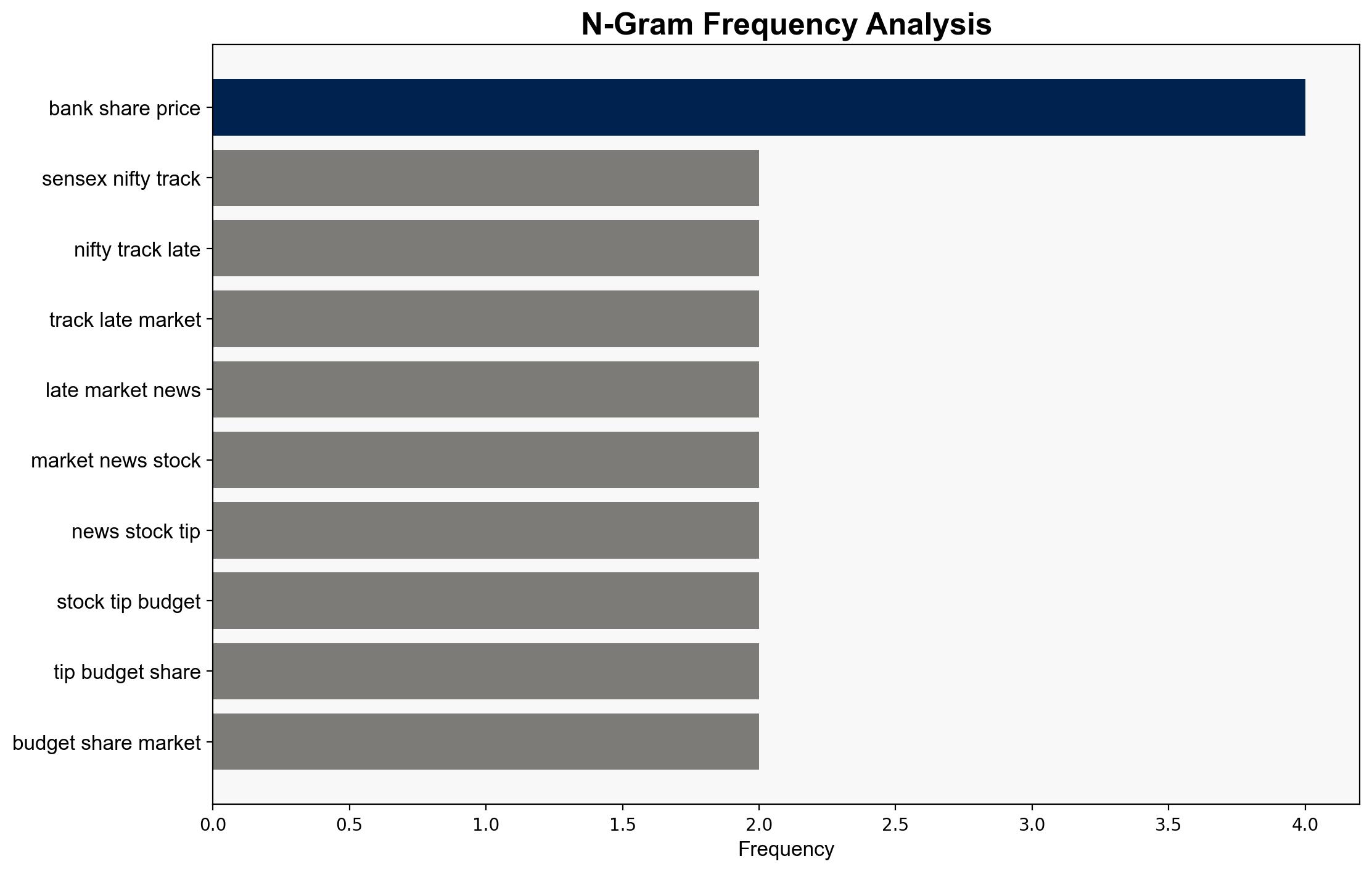

1. **Hypothesis A**: The decline in oil prices is primarily driven by fears of an economic slowdown due to escalating US-China trade tensions. This scenario suggests that the trade war could lead to reduced global demand for oil, thereby exerting downward pressure on prices.

2. **Hypothesis B**: The decline in oil prices is largely due to an anticipated oversupply, as major oil-producing nations continue to increase production. This hypothesis implies that supply-side dynamics, rather than demand concerns, are the primary driver of price movements.

3. Key Assumptions and Red Flags

– **Assumptions**:

– Hypothesis A assumes that trade tensions will significantly impact global economic growth.

– Hypothesis B assumes that oil production will continue to rise despite potential market saturation.

– **Red Flags**:

– Lack of concrete data on actual changes in oil demand.

– Potential bias in attributing price movements solely to geopolitical factors without considering other economic indicators.

4. Implications and Strategic Risks

– **Economic Implications**: A prolonged trade war could lead to a sustained economic downturn, reducing demand for oil and other commodities.

– **Geopolitical Risks**: Increased tensions between major economies could lead to broader geopolitical instability, affecting global markets.

– **Supply Chain Risks**: Disruptions in global freight flow due to trade tensions could impact oil distribution and pricing.

5. Recommendations and Outlook

- Monitor developments in US-China trade negotiations to anticipate potential impacts on oil markets.

- Engage in scenario planning to prepare for various outcomes, including a potential resolution or escalation of trade tensions.

- Consider diversifying energy sources to mitigate risks associated with oil market volatility.

- Best Case: Trade tensions ease, leading to market stabilization and recovery in oil prices.

- Worst Case: Escalation of trade tensions results in a global economic slowdown, further depressing oil prices.

- Most Likely: Continued volatility in oil prices due to mixed signals from geopolitical and supply-side factors.

6. Key Individuals and Entities

– Donald Trump

– Vladimir Putin

– Volodymyr Zelenskiy

– International Energy Agency

– Baker Hughes

7. Thematic Tags

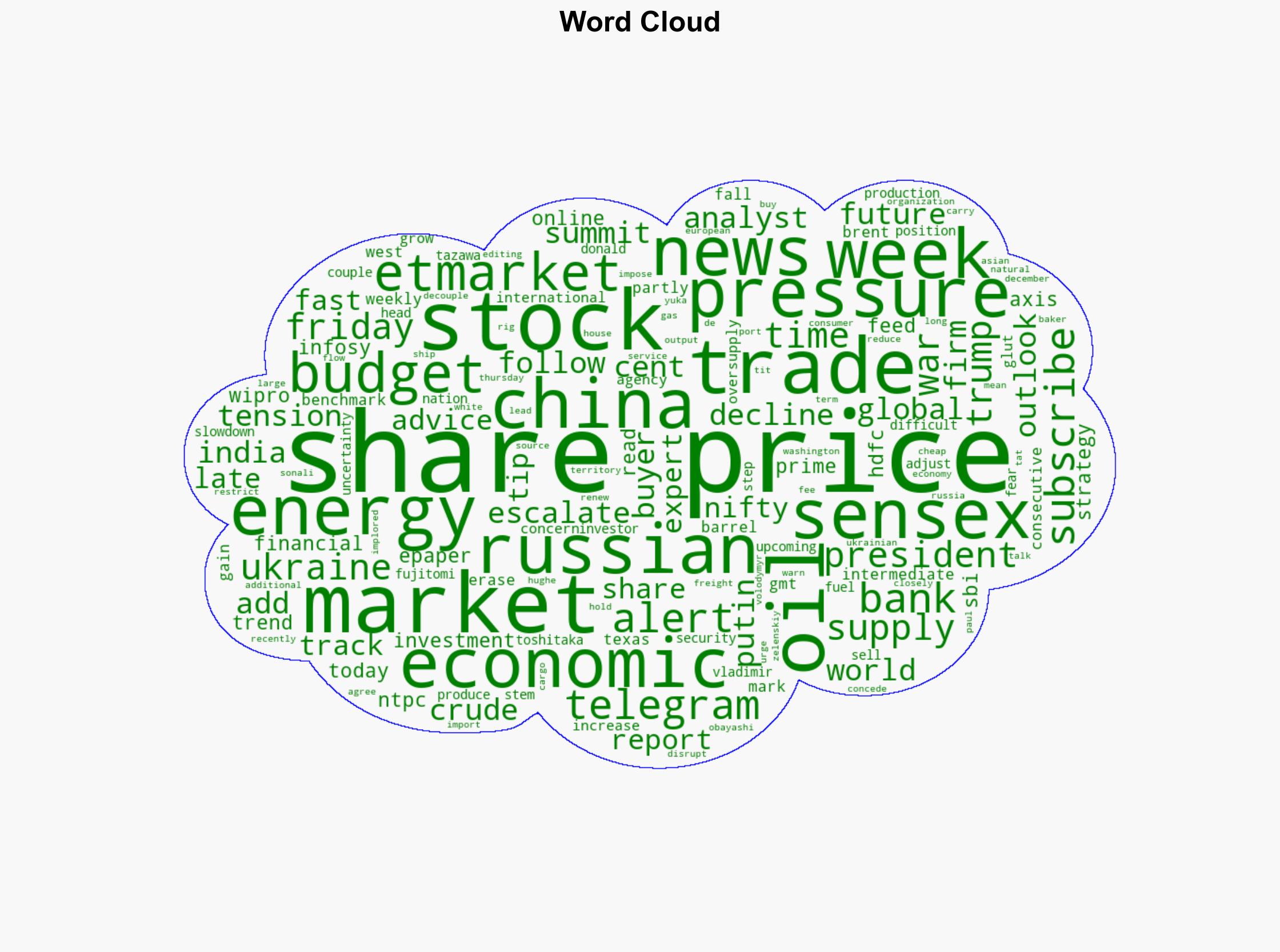

national security threats, economic stability, geopolitical tensions, energy markets