Oil rebounds as deadline on US sanctions waiver looms – CNA

Published on: 2025-11-20

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

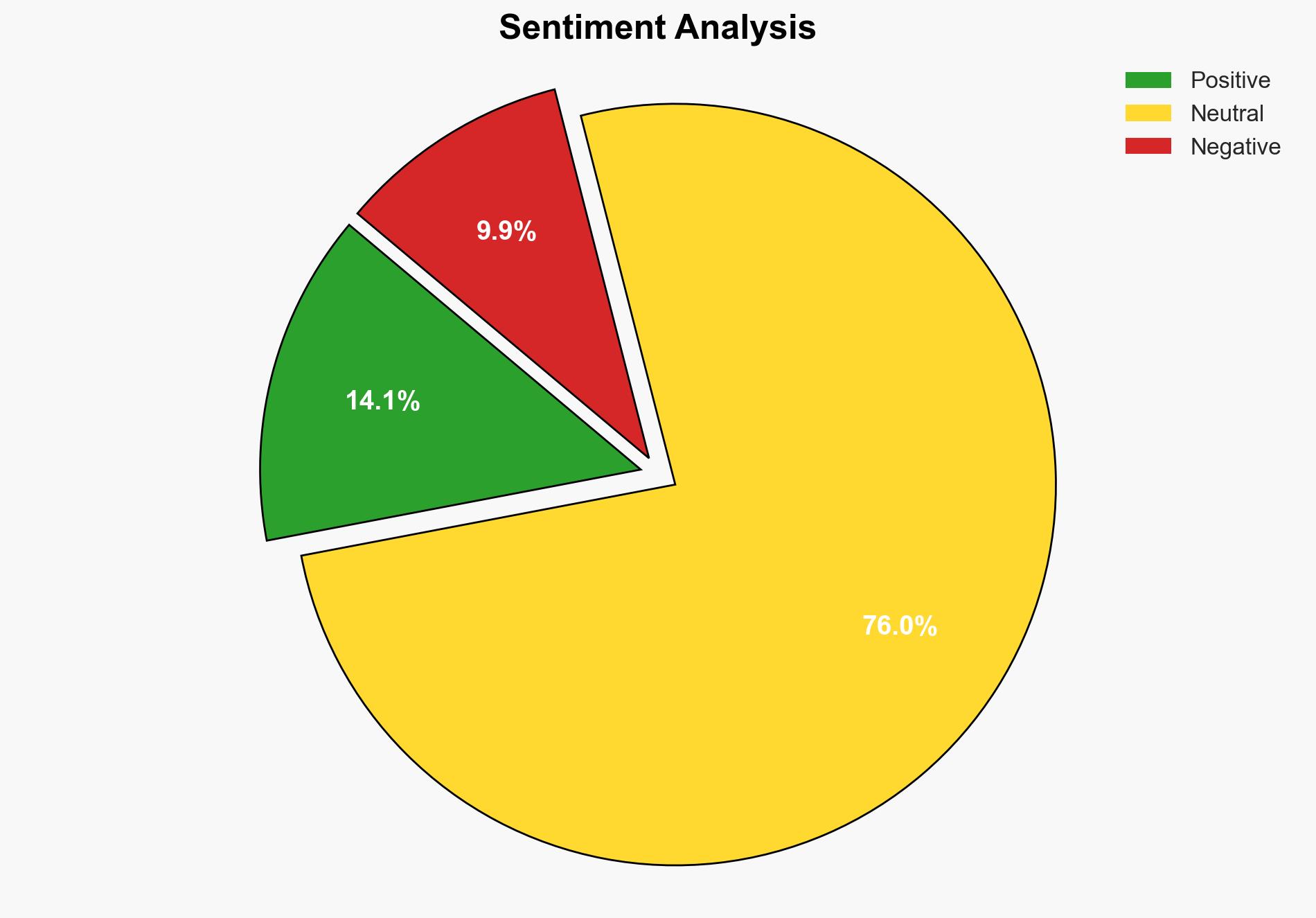

Intelligence Report: Oil Market Dynamics Amid U.S. Sanctions and Geopolitical Tensions

1. BLUF (Bottom Line Up Front)

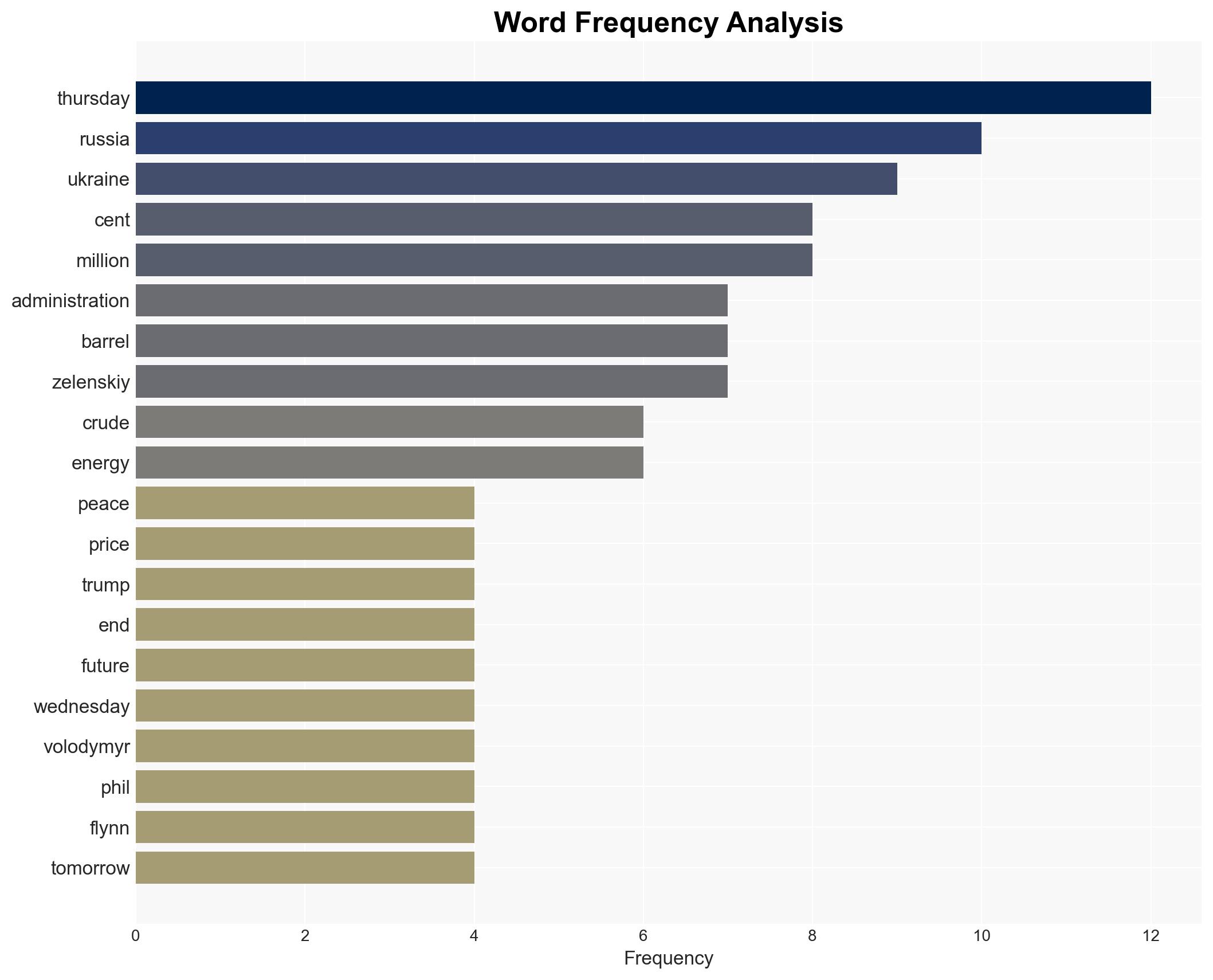

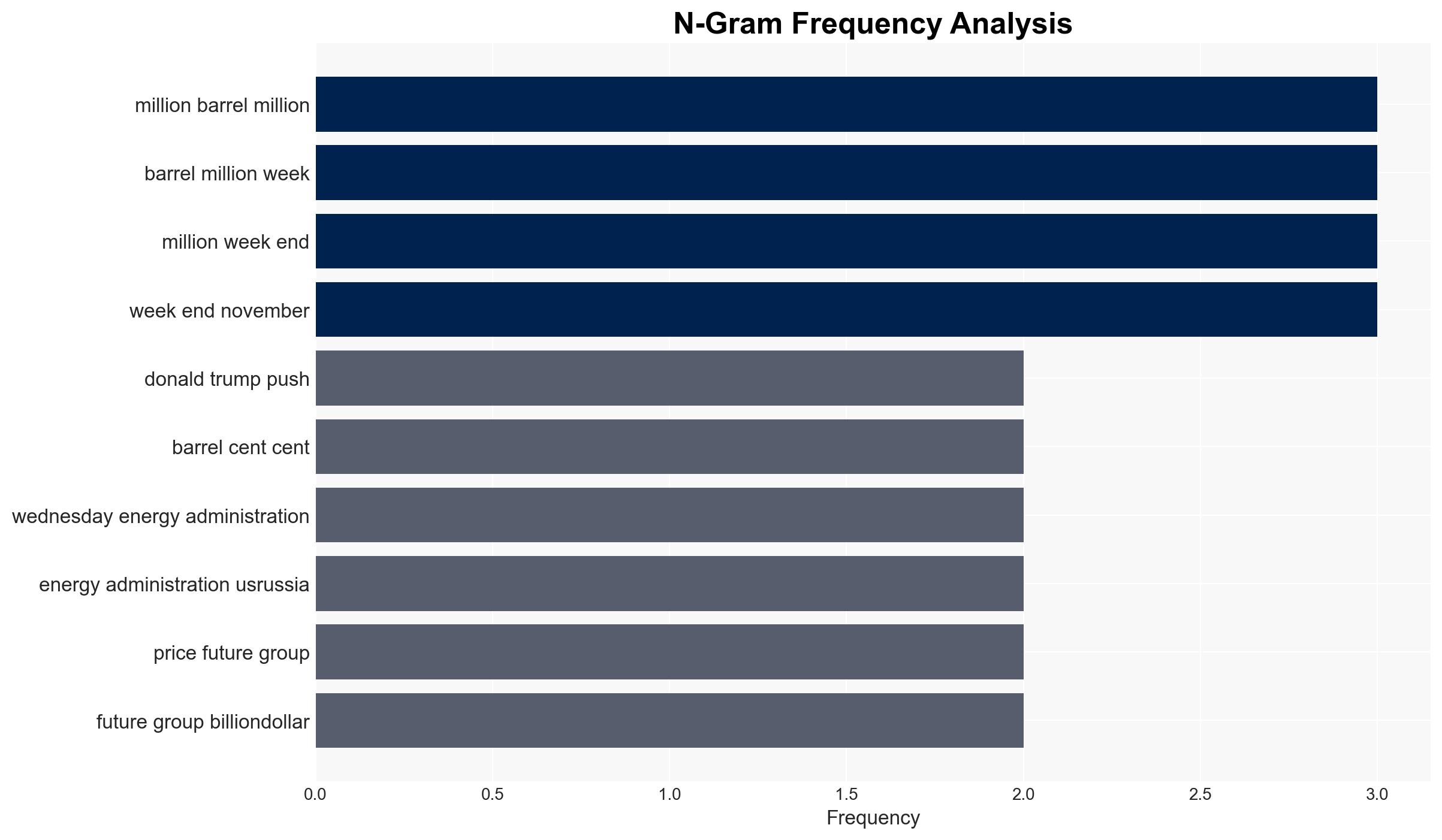

With a moderate confidence level, it is assessed that the looming U.S. sanctions on Russian oil companies will likely lead to short-term volatility in oil prices, with potential geopolitical ramifications. The most supported hypothesis is that the sanctions will be enforced, causing a temporary spike in oil prices due to anticipated supply disruptions. Strategic recommendation includes monitoring geopolitical developments closely and preparing for potential market interventions to stabilize prices.

2. Competing Hypotheses

Hypothesis 1: The U.S. will enforce sanctions on Russian oil companies, leading to a temporary increase in oil prices due to supply concerns.

Hypothesis 2: The U.S. will delay or lift sanctions, maintaining current oil price levels and avoiding immediate geopolitical tensions.

Hypothesis 1 is more likely due to the U.S. administration’s historical stance on Russia and recent geopolitical developments, including the proposed U.S.-Russia peace plan for Ukraine, which may not be immediately accepted by Ukraine.

3. Key Assumptions and Red Flags

Assumptions: The U.S. administration will prioritize geopolitical leverage over immediate economic impacts. Ukraine’s rejection of the peace proposal will not alter U.S. sanctions policy.

Red Flags: Sudden shifts in U.S. foreign policy, unexpected acceptance of the peace proposal by Ukraine, or significant changes in global oil demand could alter the current assessment.

Deception Indicators: Public statements by involved parties that contradict private negotiations or intelligence reports.

4. Implications and Strategic Risks

Enforcing sanctions could lead to increased oil prices, affecting global markets and potentially straining U.S. relations with European allies dependent on Russian energy. Conversely, delaying sanctions might embolden Russian geopolitical strategies, impacting regional stability. Cyber threats and misinformation campaigns could escalate as Russia seeks to counteract economic pressures.

5. Recommendations and Outlook

- Monitor geopolitical developments and market reactions closely to anticipate further price fluctuations.

- Engage with European allies to coordinate responses and mitigate potential energy supply disruptions.

- Prepare contingency plans for potential cyber threats targeting energy infrastructure.

- Best-case scenario: Sanctions lead to successful diplomatic negotiations, stabilizing oil prices and regional tensions.

- Worst-case scenario: Sanctions result in prolonged market instability and heightened geopolitical conflicts.

- Most-likely scenario: Short-term price volatility with gradual stabilization as markets adjust to new supply dynamics.

6. Key Individuals and Entities

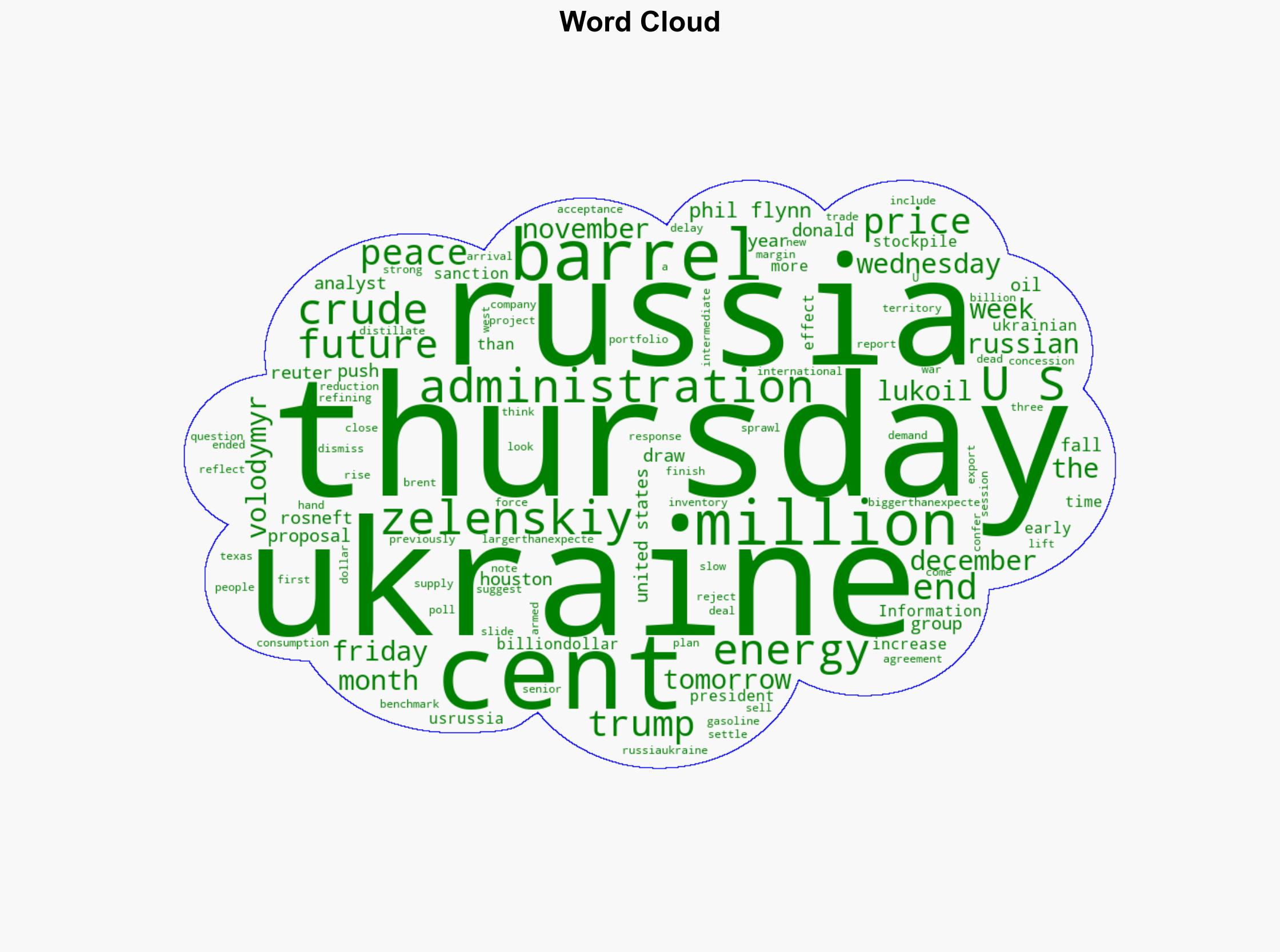

Donald Trump, Volodymyr Zelenskiy, Rosneft, Lukoil

7. Thematic Tags

Regional Focus, Regional Focus: U.S, Russia, Ukraine, Global Oil Markets

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

Explore more:

Regional Focus Briefs ·

Daily Summary ·

Support us