Oil rises 2 after Ukrainian attack damages Russian oil depot – CNA

Published on: 2025-11-14

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Oil rises 2 after Ukrainian attack damages Russian oil depot – CNA

1. BLUF (Bottom Line Up Front)

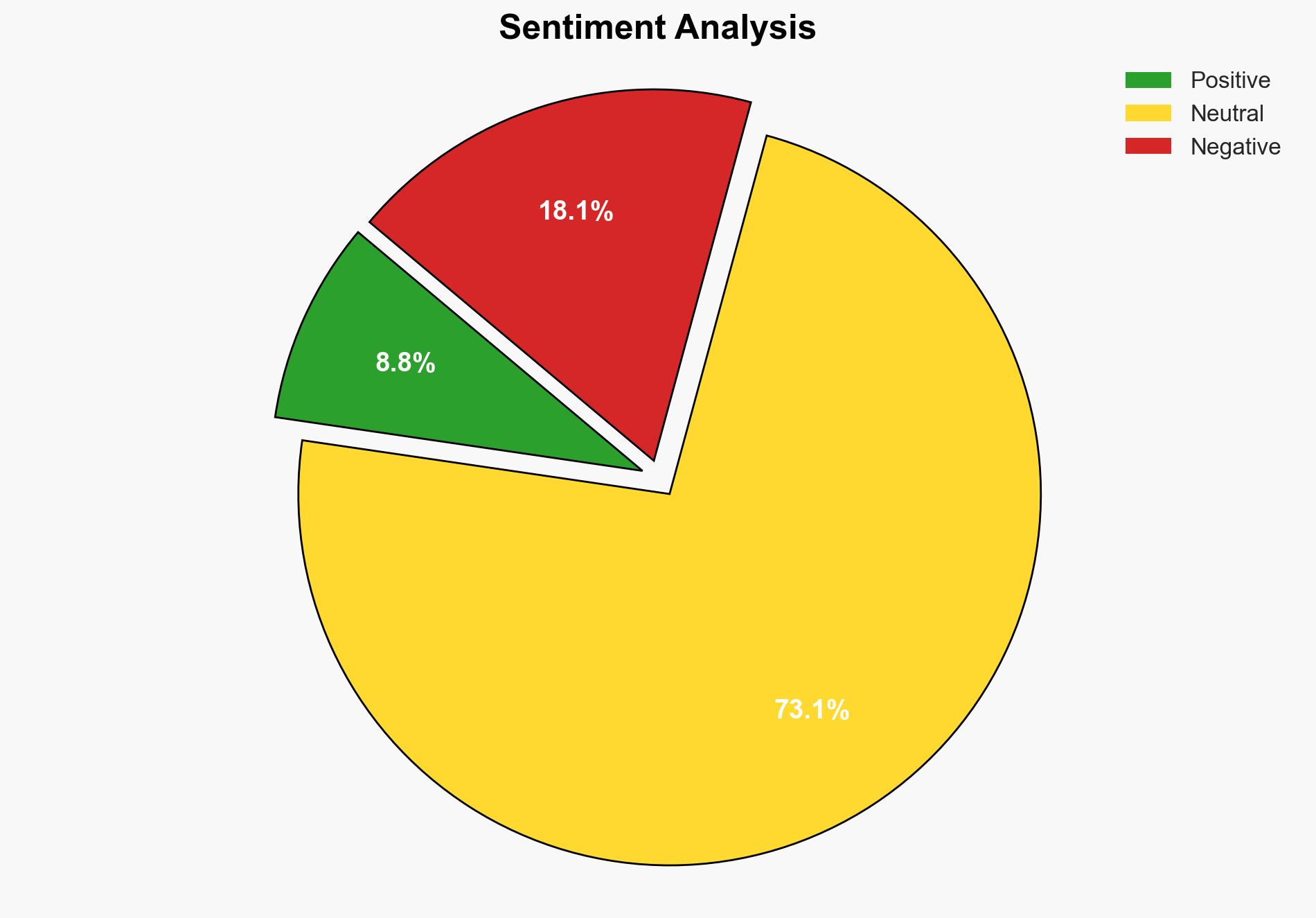

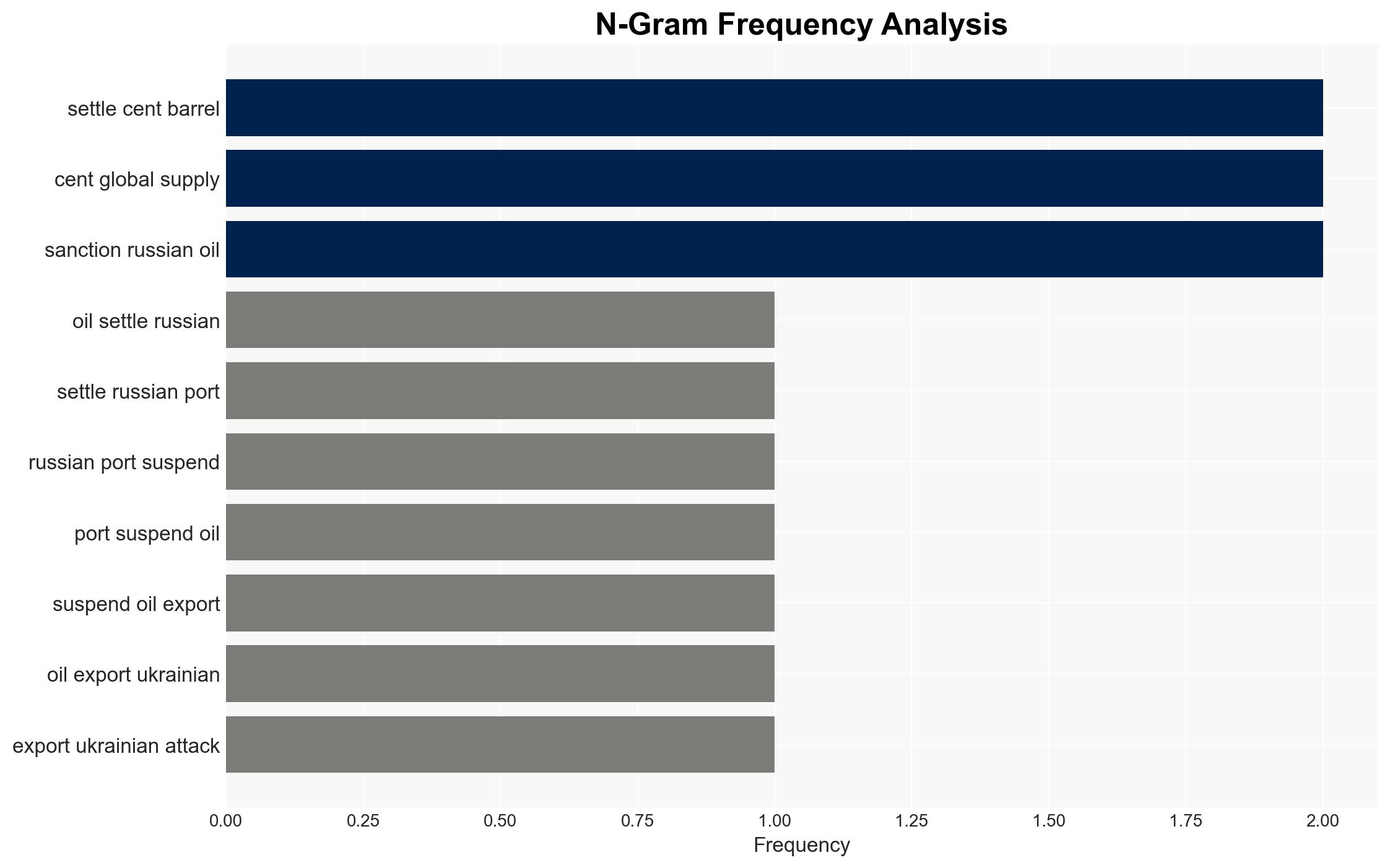

The most supported hypothesis is that the recent Ukrainian attack on the Russian oil depot will lead to temporary disruptions in oil supply, causing short-term price increases but not significantly altering long-term global supply dynamics. Confidence Level: Moderate. Recommended action includes monitoring further escalations and potential retaliatory measures that could affect broader geopolitical stability and energy markets.

2. Competing Hypotheses

Hypothesis 1: The Ukrainian attack represents a strategic move to disrupt Russian oil exports, leading to sustained supply chain disruptions and prolonged price increases.

Hypothesis 2: The attack is an isolated incident with limited long-term impact on global oil supply, as Russia will quickly restore operations and mitigate disruptions.

Hypothesis 2 is more likely, given historical resilience of oil supply chains and Russia’s capacity to adapt to such disruptions. However, ongoing geopolitical tensions could exacerbate the situation.

3. Key Assumptions and Red Flags

Assumptions include the belief that Russia can rapidly repair and resume operations at the affected depot. A red flag is the potential underestimation of Ukraine’s capacity for sustained attacks, which could indicate a broader strategy to weaken Russian energy infrastructure.

4. Implications and Strategic Risks

The primary risk is geopolitical escalation, potentially involving further military actions or cyberattacks targeting critical infrastructure. Economically, prolonged disruptions could lead to increased global oil prices, affecting inflation and economic stability. Politically, this could strain relations between Russia and Western nations, complicating diplomatic efforts in the region.

5. Recommendations and Outlook

- Enhance monitoring of Russian and Ukrainian military activities to anticipate further disruptions.

- Engage with international partners to stabilize oil markets and explore alternative energy sources.

- Best-case scenario: Quick resolution with minimal impact on global supply.

- Worst-case scenario: Escalation leading to broader conflict and significant economic disruption.

- Most-likely scenario: Temporary price increases with gradual stabilization as Russia restores operations.

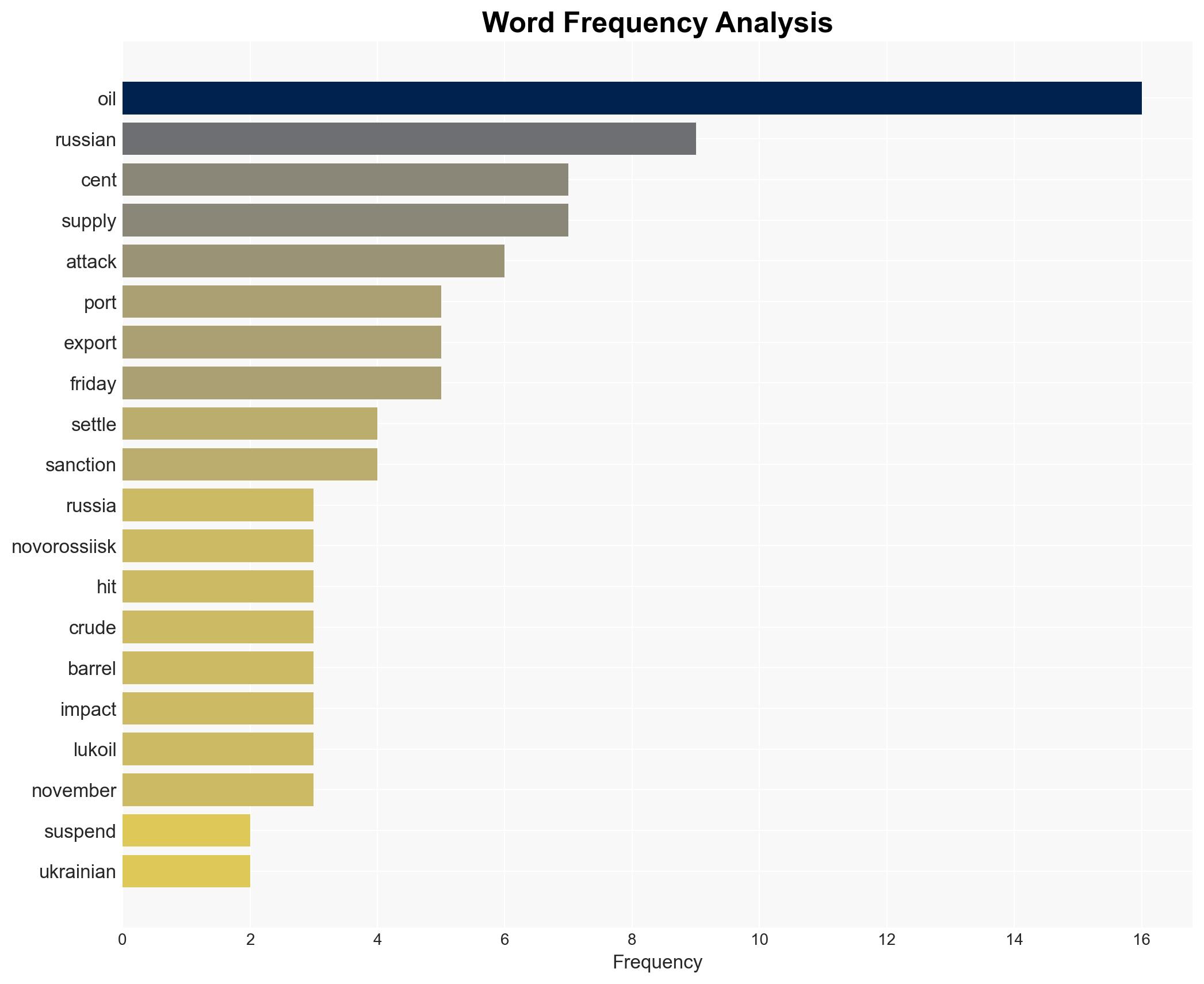

6. Key Individuals and Entities

Phil Flynn, Senior Analyst at Price Futures Group; Giovanni Staunovo, Commodity Analyst at UBS.

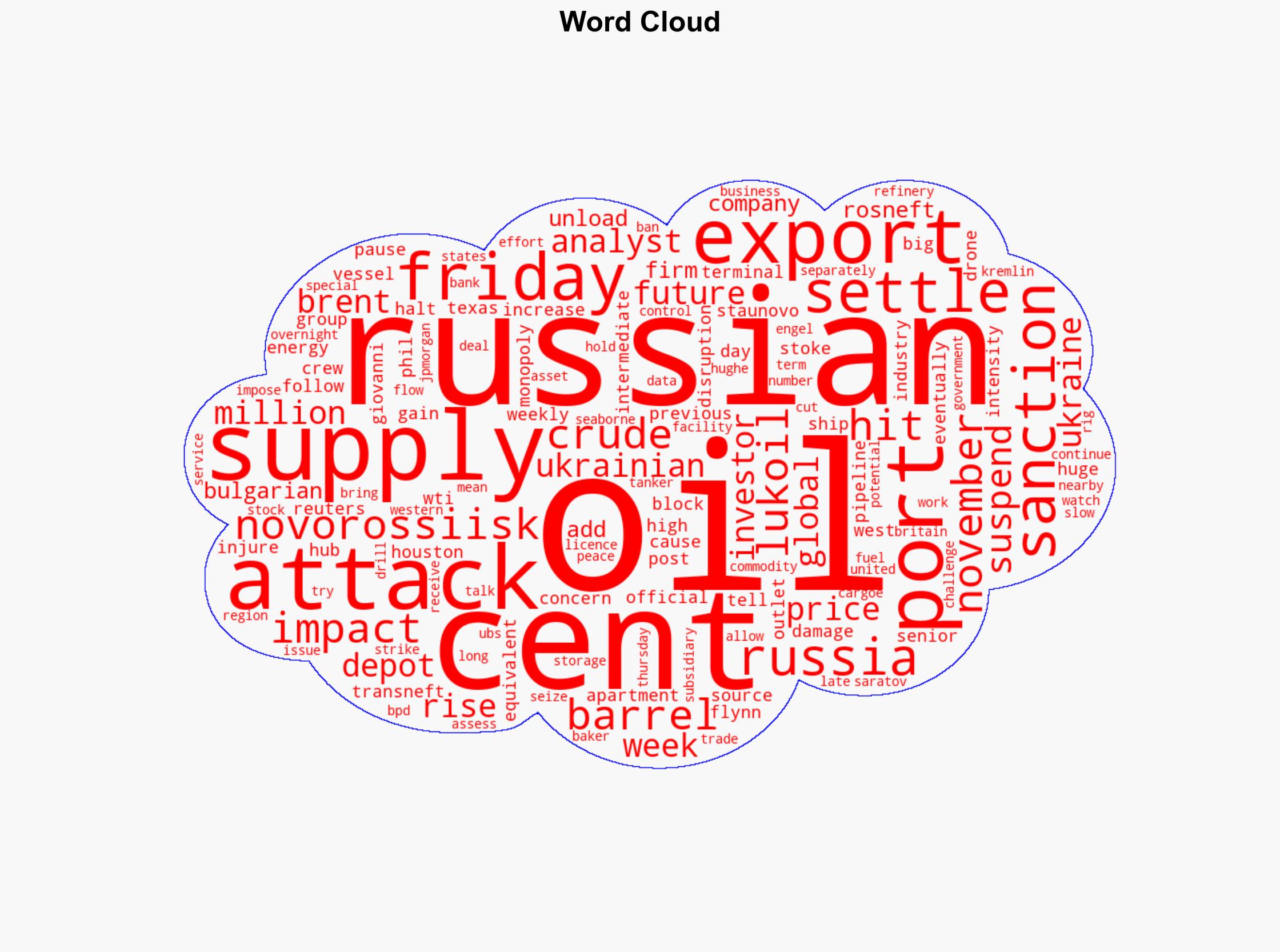

7. Thematic Tags

Regional Focus: Eastern Europe, Energy Markets, Geopolitical Tensions

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

Explore more:

Regional Focus Briefs ·

Daily Summary ·

Methodology