Oil rises after OPEC hikes output less than expected – CNA

Published on: 2025-10-06

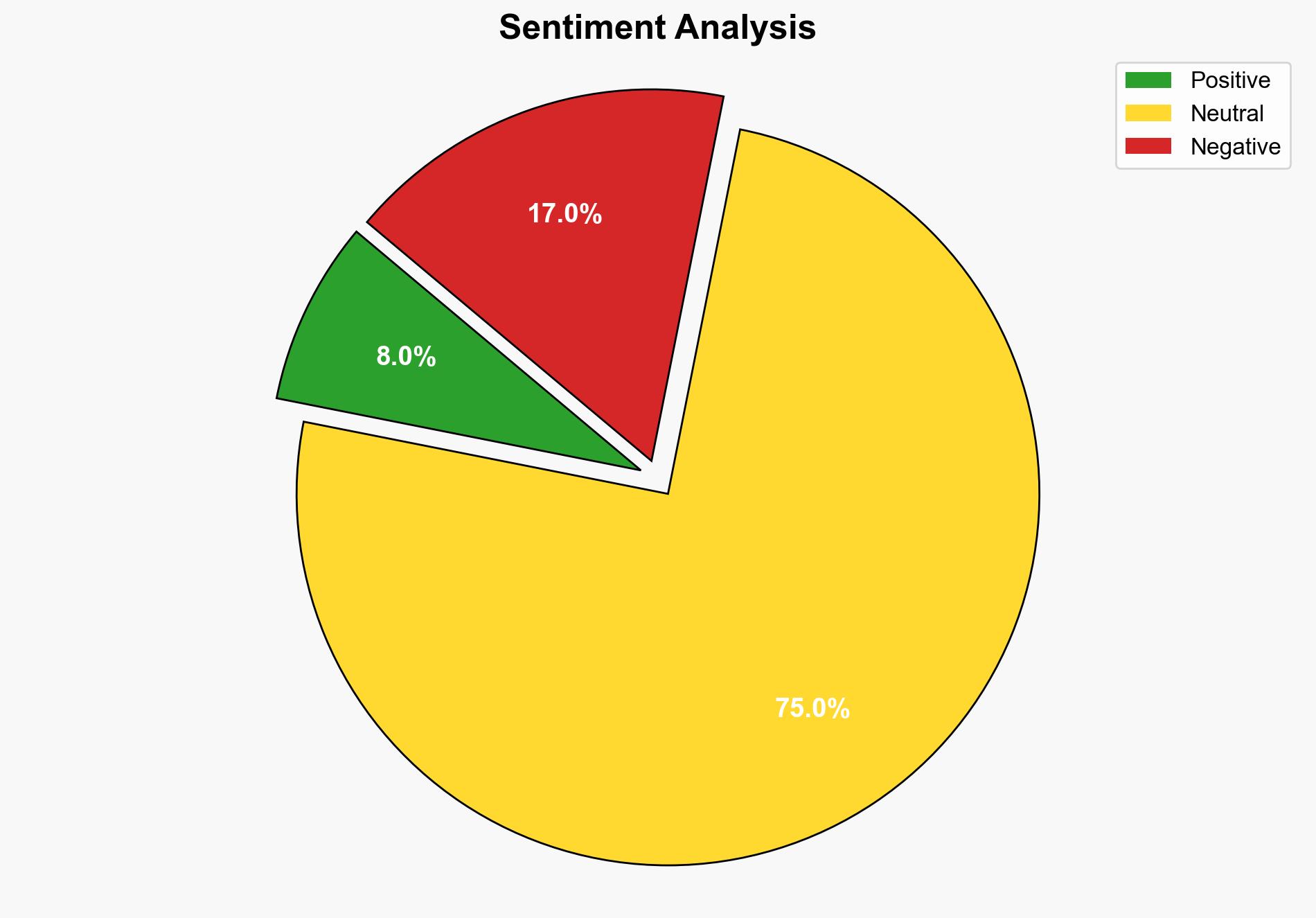

Intelligence Report: Oil rises after OPEC hikes output less than expected – CNA

1. BLUF (Bottom Line Up Front)

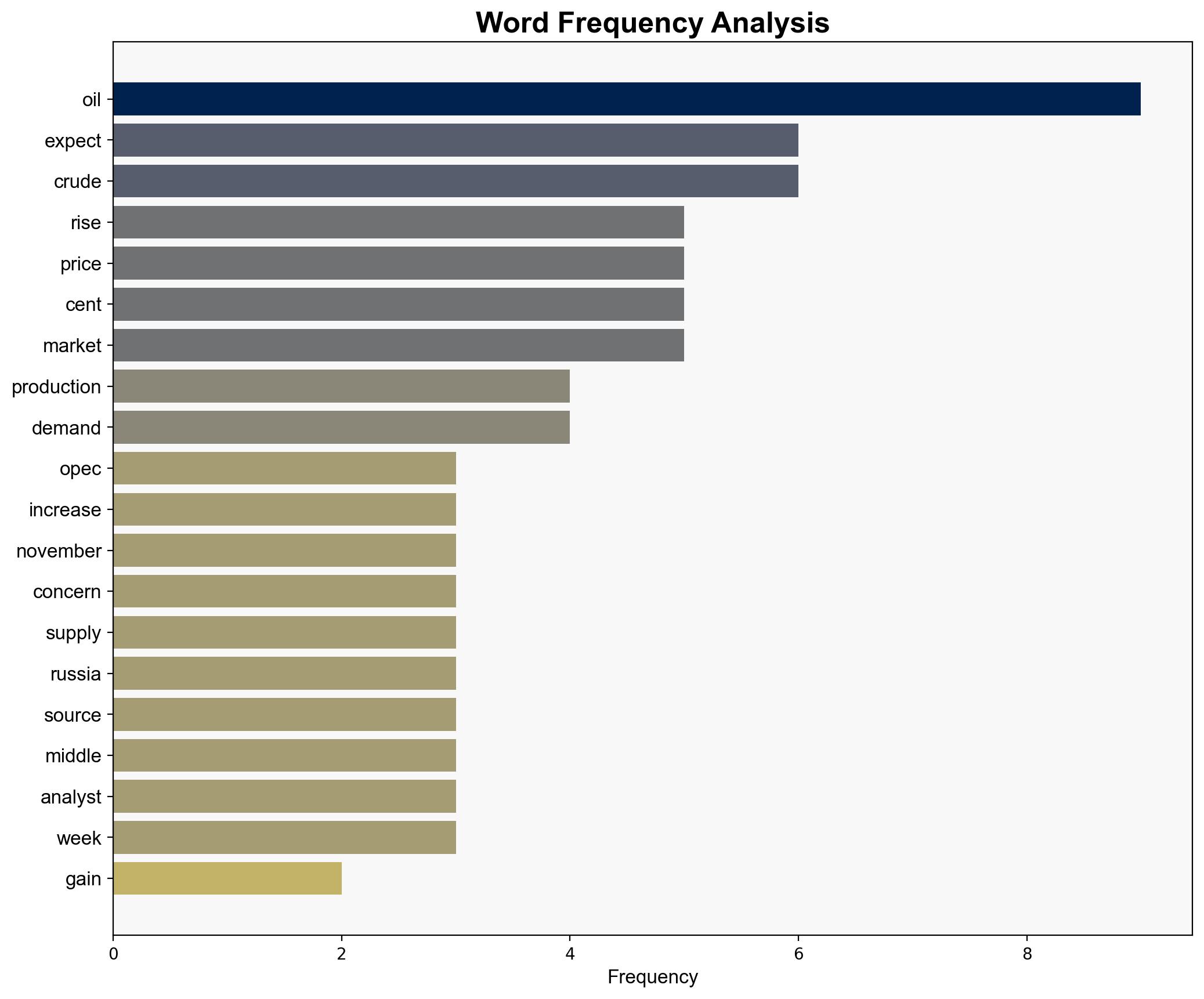

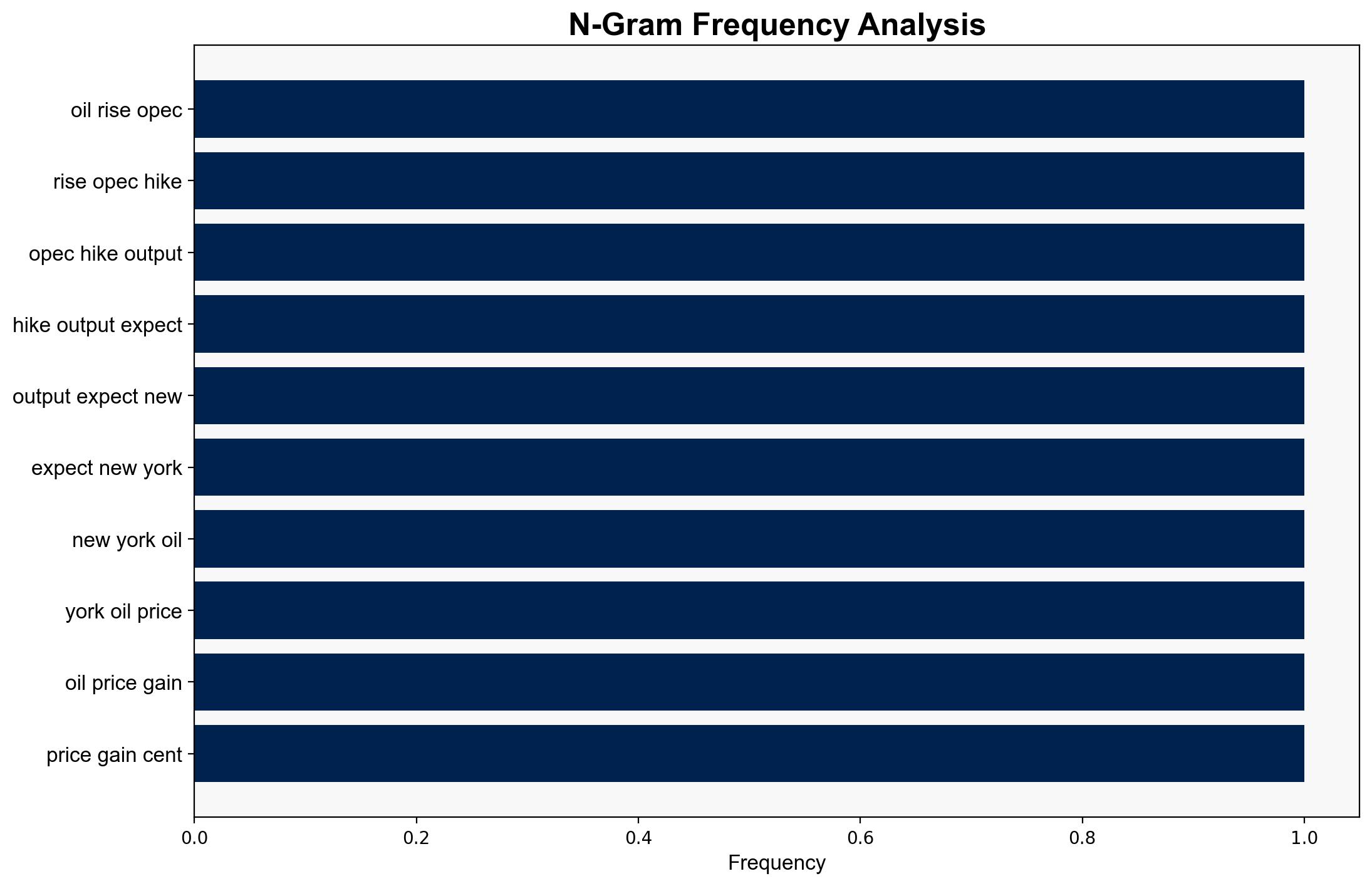

The most supported hypothesis is that OPEC’s decision to increase oil production less than expected is a strategic move to stabilize oil prices amidst uncertain demand and potential oversupply. Confidence level: Moderate. Recommended action: Monitor OPEC’s future production announcements and geopolitical developments affecting oil supply, particularly in the Middle East and Russia.

2. Competing Hypotheses

1. **Hypothesis 1**: OPEC’s limited production increase is a deliberate strategy to maintain higher oil prices by controlling supply, anticipating a demand rebound post-refinery maintenance season.

2. **Hypothesis 2**: The limited increase is a result of internal disagreements within OPEC+, particularly between Russia and Saudi Arabia, leading to a compromise that reflects neither party’s full preference.

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis 1 is better supported. The decision aligns with OPEC’s historical behavior of managing supply to influence prices, and the current market conditions suggest a strategic need to prevent price drops due to oversupply.

3. Key Assumptions and Red Flags

– **Assumptions**: OPEC has the capacity to increase production significantly if desired; demand will rebound post-maintenance season.

– **Red Flags**: Potential underreporting of production capabilities; geopolitical tensions affecting supply chains.

– **Blind Spots**: Uncertainty in global economic recovery affecting demand forecasts.

4. Implications and Strategic Risks

– **Economic**: Prolonged high oil prices could strain economies dependent on oil imports, potentially slowing global economic recovery.

– **Geopolitical**: Tensions within OPEC+ could lead to future disagreements affecting global oil supply stability.

– **Psychological**: Market uncertainty may lead to speculative trading, further influencing price volatility.

5. Recommendations and Outlook

- Monitor OPEC+ meetings and statements for shifts in production strategy.

- Engage with energy analysts to refine demand forecasts post-maintenance season.

- Scenario Projections:

- Best Case: OPEC+ stabilizes production, demand rebounds, prices stabilize.

- Worst Case: Internal OPEC+ conflict leads to production increases, causing price collapse.

- Most Likely: Controlled production increases maintain moderate price levels.

6. Key Individuals and Entities

– Andrew Lipow

– Tamas Varga

– Chris Beauchamp

– OPEC+

– Saudi Arabia

– Russia

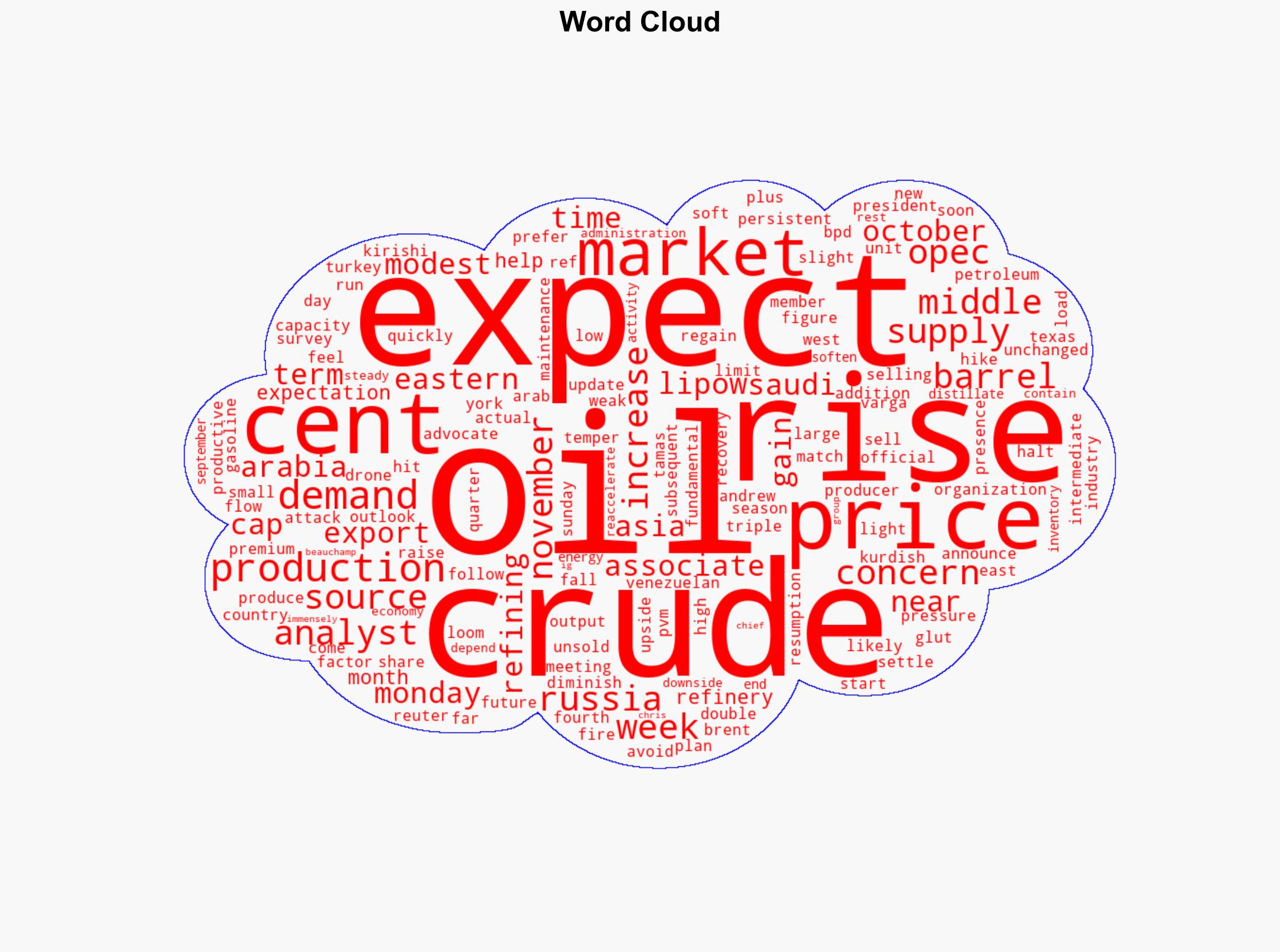

7. Thematic Tags

national security threats, energy security, geopolitical stability, economic forecasting