Oil steadies as investors weigh OPEC output hike against US crude inventories – The Times of India

Published on: 2025-10-01

Intelligence Report: Oil steadies as investors weigh OPEC output hike against US crude inventories – The Times of India

1. BLUF (Bottom Line Up Front)

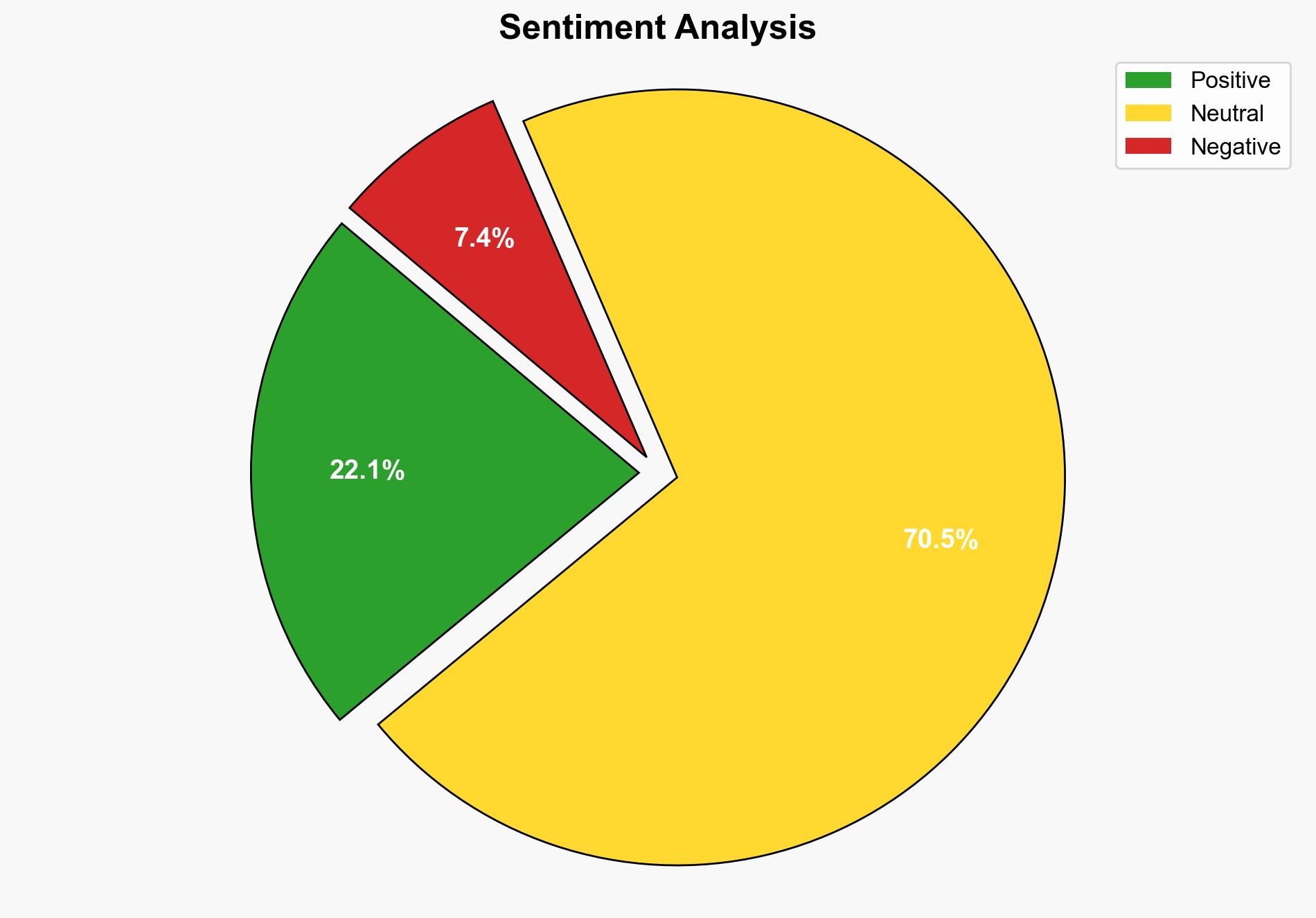

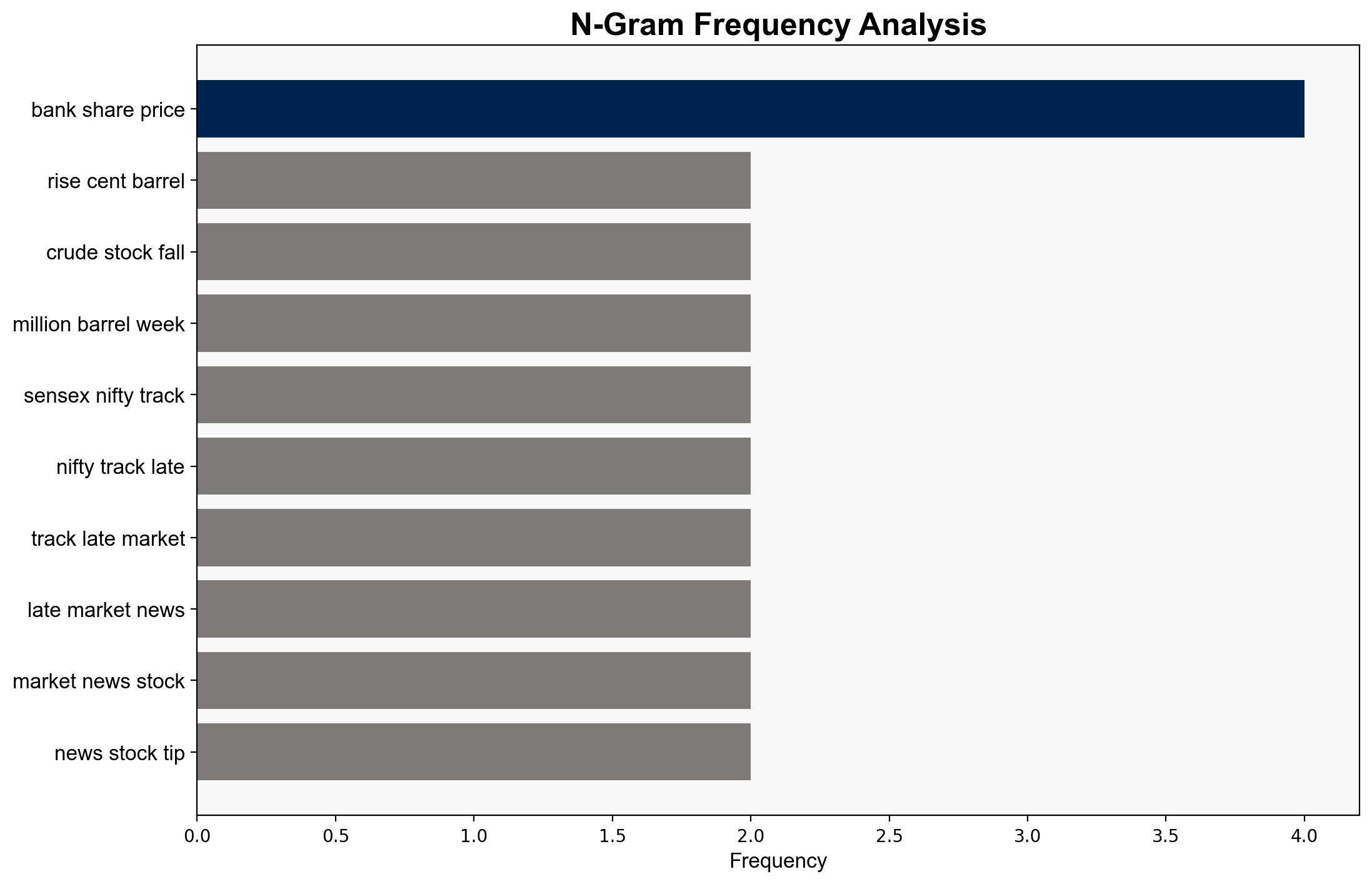

The strategic judgment is that the oil market is currently experiencing a stabilization phase as investors assess the impact of OPEC’s planned output increase against the backdrop of declining US crude inventories. The hypothesis that OPEC’s production hike will exert downward pressure on oil prices is better supported. Confidence level: Moderate. Recommended action: Monitor OPEC’s adherence to production targets and US inventory trends to anticipate market shifts.

2. Competing Hypotheses

1. **Hypothesis A**: OPEC’s decision to increase oil production will lead to a decrease in global oil prices as supply outpaces demand.

2. **Hypothesis B**: Despite OPEC’s production increase, declining US crude inventories will sustain or increase oil prices due to perceived supply constraints.

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis A is more supported. The planned significant increase in OPEC’s output suggests a strategic move to reclaim market share, potentially leading to a supply surplus.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that OPEC will follow through with the announced production increases and that US inventory data is accurate and reflective of broader trends.

– **Red Flags**: Potential discrepancies in OPEC’s actual production versus announced targets. The reliability of anonymous sources could be questioned, and the geopolitical motivations behind OPEC’s decisions are not fully transparent.

4. Implications and Strategic Risks

– **Economic**: A significant increase in oil supply could depress prices, impacting oil-dependent economies and industries.

– **Geopolitical**: OPEC’s actions could strain relations with non-member oil-producing countries and influence global energy politics.

– **Market Volatility**: Fluctuations in oil prices could lead to broader market instability, affecting global financial markets.

5. Recommendations and Outlook

- Monitor OPEC’s production levels and US inventory reports closely to anticipate market changes.

- Engage with energy market analysts to refine predictive models for oil price movements.

- Scenario Projections:

- Best Case: OPEC’s output increase stabilizes prices, benefiting global economic growth.

- Worst Case: Overproduction leads to a price collapse, destabilizing oil-dependent economies.

- Most Likely: Prices remain volatile as market adjusts to new supply-demand dynamics.

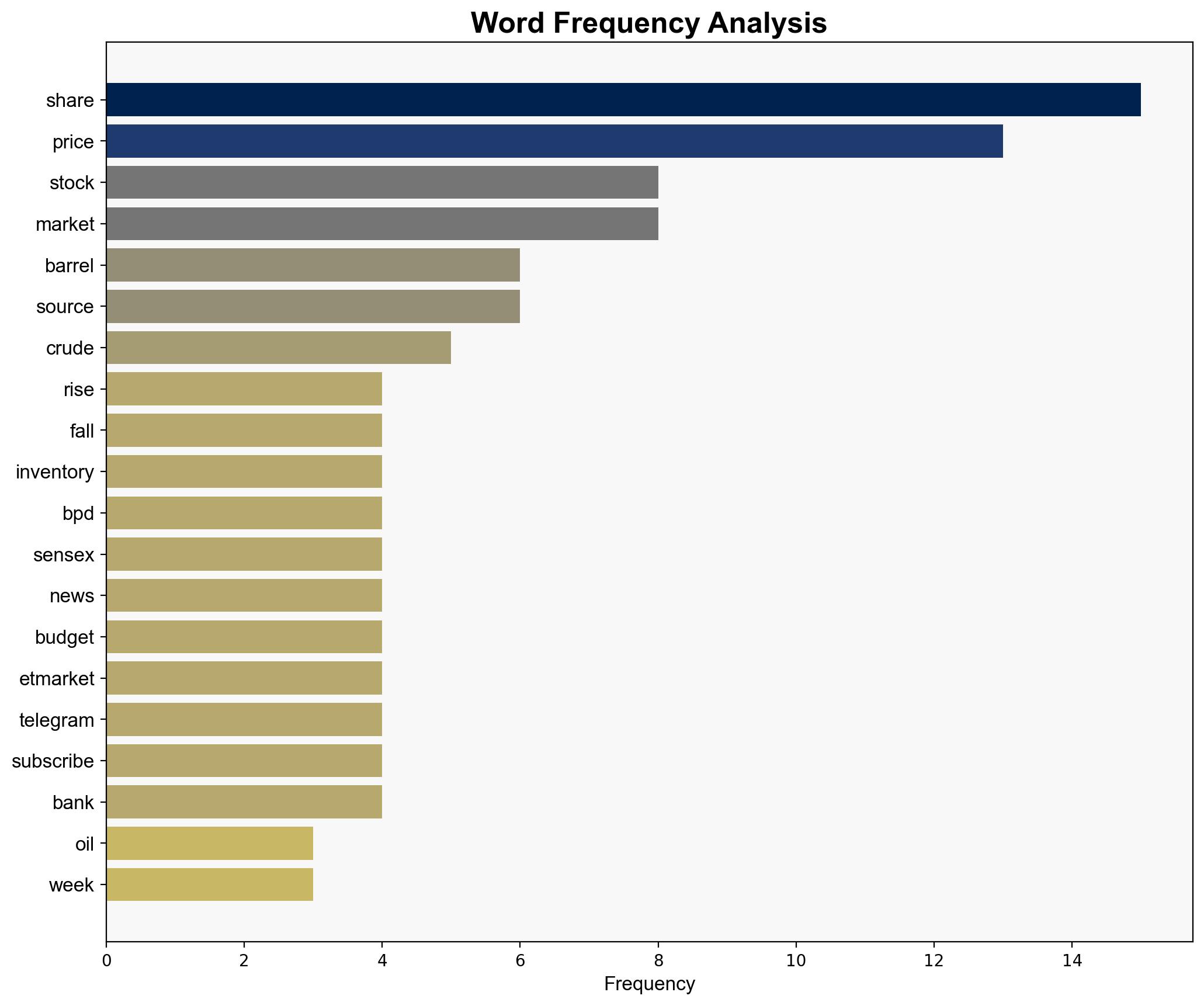

6. Key Individuals and Entities

– OPEC members, particularly Saudi Arabia.

– American Petroleum Institute (API) as a source of inventory estimates.

– Donald Trump and Benjamin Netanyahu mentioned in context but not directly relevant to oil market analysis.

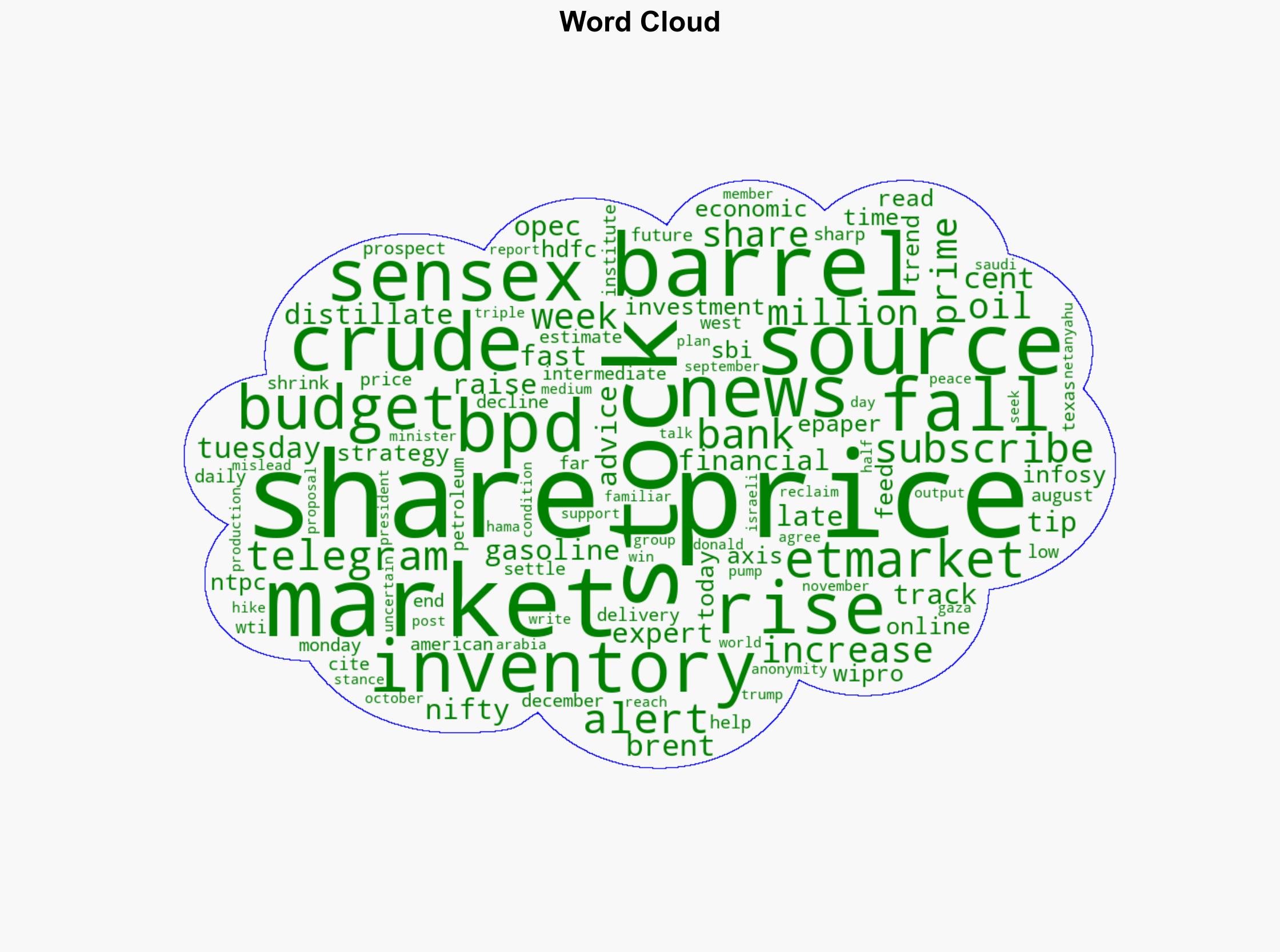

7. Thematic Tags

energy markets, economic stability, geopolitical strategy, oil production, market analysis