Oil Steadies With Global Surplus and Russian Sanctions in Focus – Financial Post

Published on: 2025-11-18

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Oil Steadies With Global Surplus and Russian Sanctions in Focus

1. BLUF (Bottom Line Up Front)

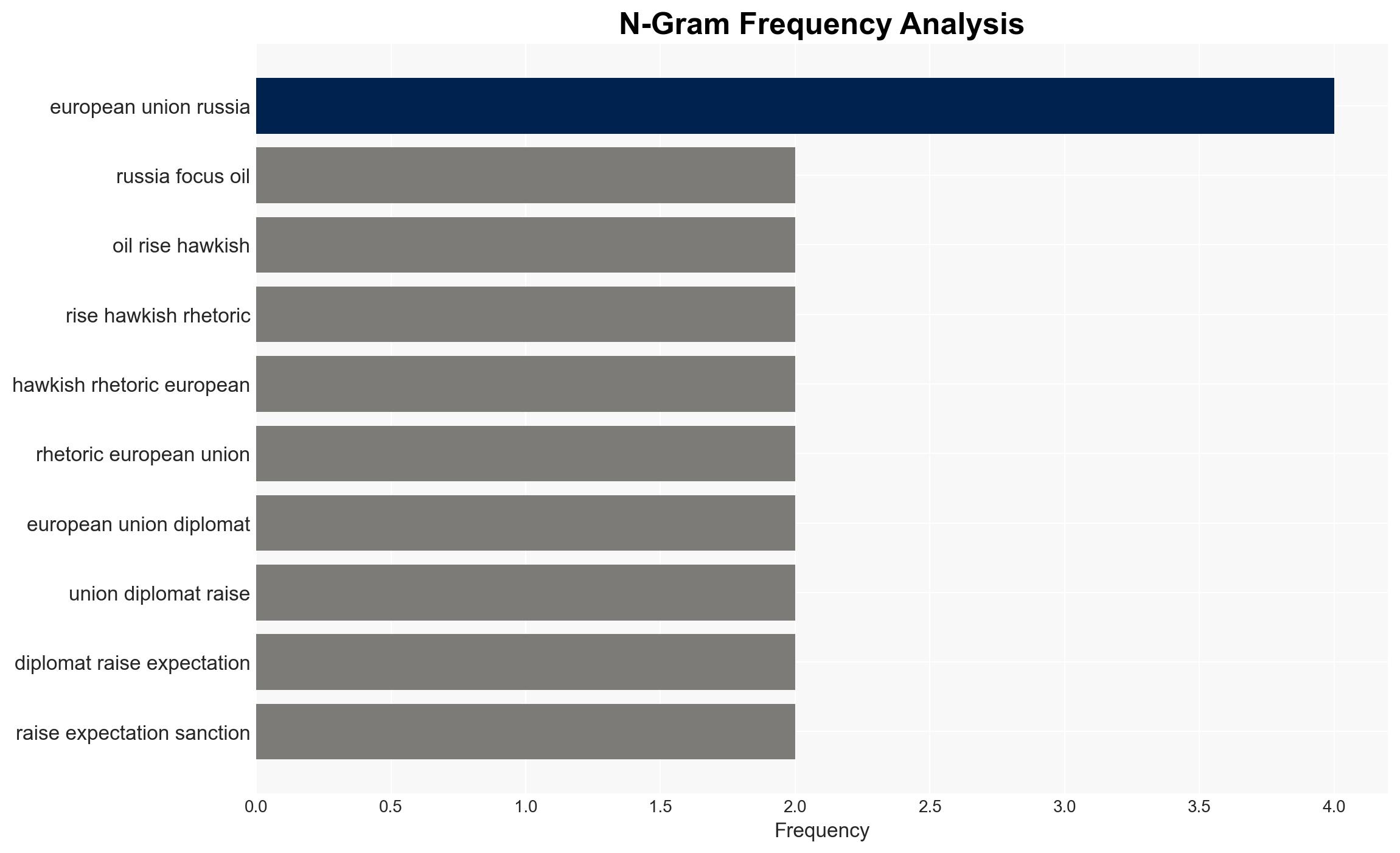

With a moderate confidence level, the most supported hypothesis is that the global oil market will experience short-term volatility due to the interplay of European Union sanctions on Russia and a forecasted global surplus. Strategic recommendation: Monitor EU policy developments closely and prepare for potential supply chain adjustments.

2. Competing Hypotheses

Hypothesis 1: The EU’s tightening sanctions on Russia will lead to a significant reduction in Russian oil exports, causing short-term price spikes and market volatility.

Hypothesis 2: Despite EU sanctions, the global oil market will stabilize due to a forecasted surplus and increased production from OPEC and allies, mitigating the impact of reduced Russian exports.

Hypothesis 2 is more likely due to the International Energy Agency’s forecast of a record surplus and the potential for increased production from other oil-producing nations to fill the gap left by Russian exports.

3. Key Assumptions and Red Flags

Assumptions: The EU will implement sanctions effectively, and OPEC will increase production as forecasted. The global demand for oil will remain stable.

Red Flags: Potential underestimation of Russia’s ability to circumvent sanctions, unexpected geopolitical developments, or disruptions in other major oil-producing regions.

4. Implications and Strategic Risks

The primary risk is market volatility leading to economic instability in regions heavily dependent on oil imports. Political tensions may escalate if sanctions lead to significant economic impacts in Russia, potentially affecting global security dynamics. Cyber threats targeting oil infrastructure could increase as a retaliatory measure.

5. Recommendations and Outlook

- Monitor EU policy changes and prepare for rapid response to supply chain disruptions.

- Engage with OPEC and other oil-producing nations to ensure stable supply lines.

- Best-case scenario: Market stabilizes with minimal price fluctuations due to surplus.

- Worst-case scenario: Significant price spikes and geopolitical tensions due to ineffective sanctions and production shortfalls.

- Most-likely scenario: Short-term volatility followed by stabilization as surplus and alternative supplies mitigate impacts.

6. Key Individuals and Entities

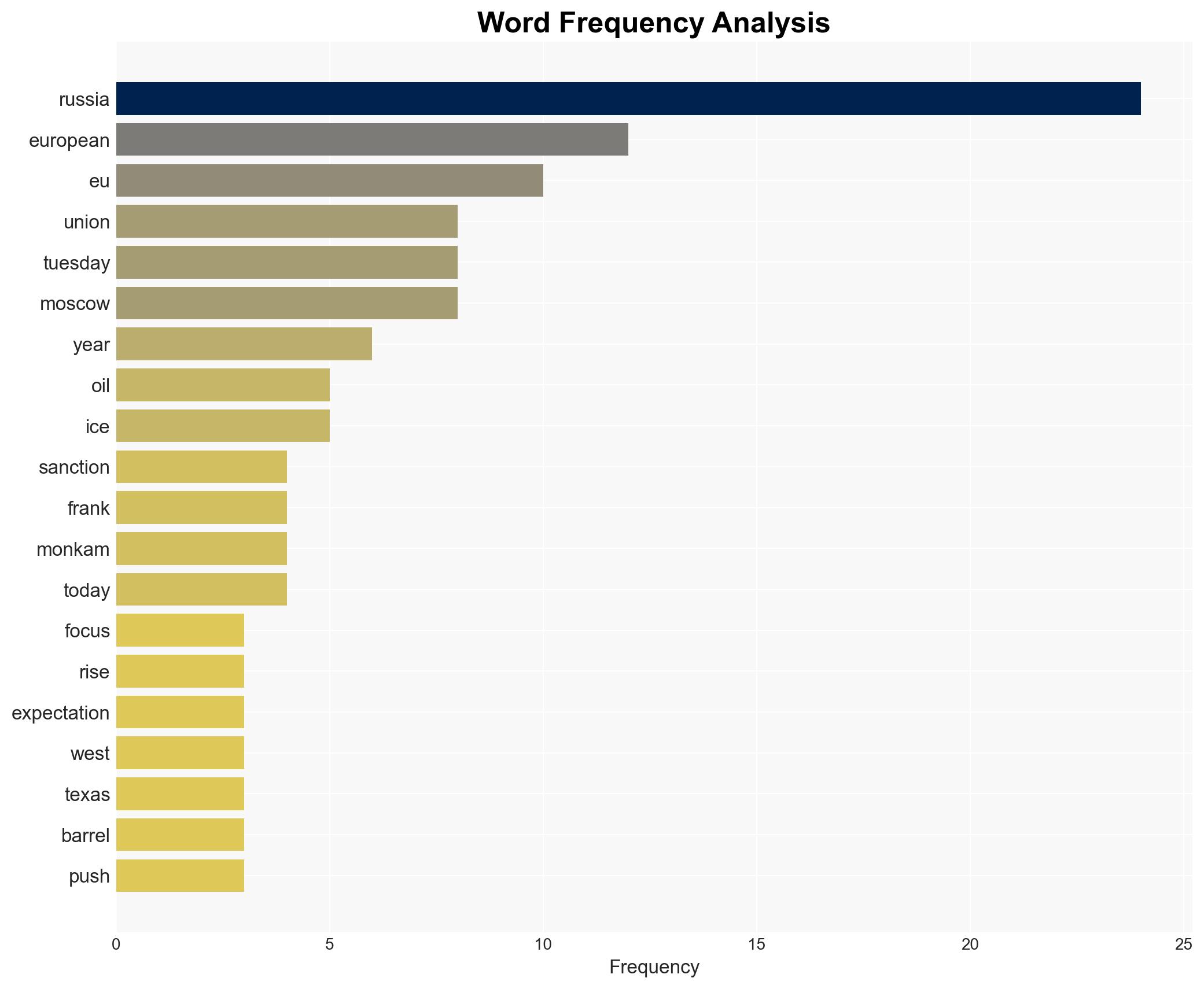

Kaja Kallas, Rosneft PJSC, Lukoil PJSC, Frank Monkam, Srinidhi Ragavendran

7. Thematic Tags

Regional Focus, Regional Focus: Europe, Russia, Global Oil Market

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

Explore more:

Regional Focus Briefs ·

Daily Summary ·

Support us

·