Oil Traders Brace for Turmoil as Iran Crisis Imperils Supply – Financial Post

Published on: 2025-06-15

Intelligence Report: Oil Traders Brace for Turmoil as Iran Crisis Imperils Supply – Financial Post

1. BLUF (Bottom Line Up Front)

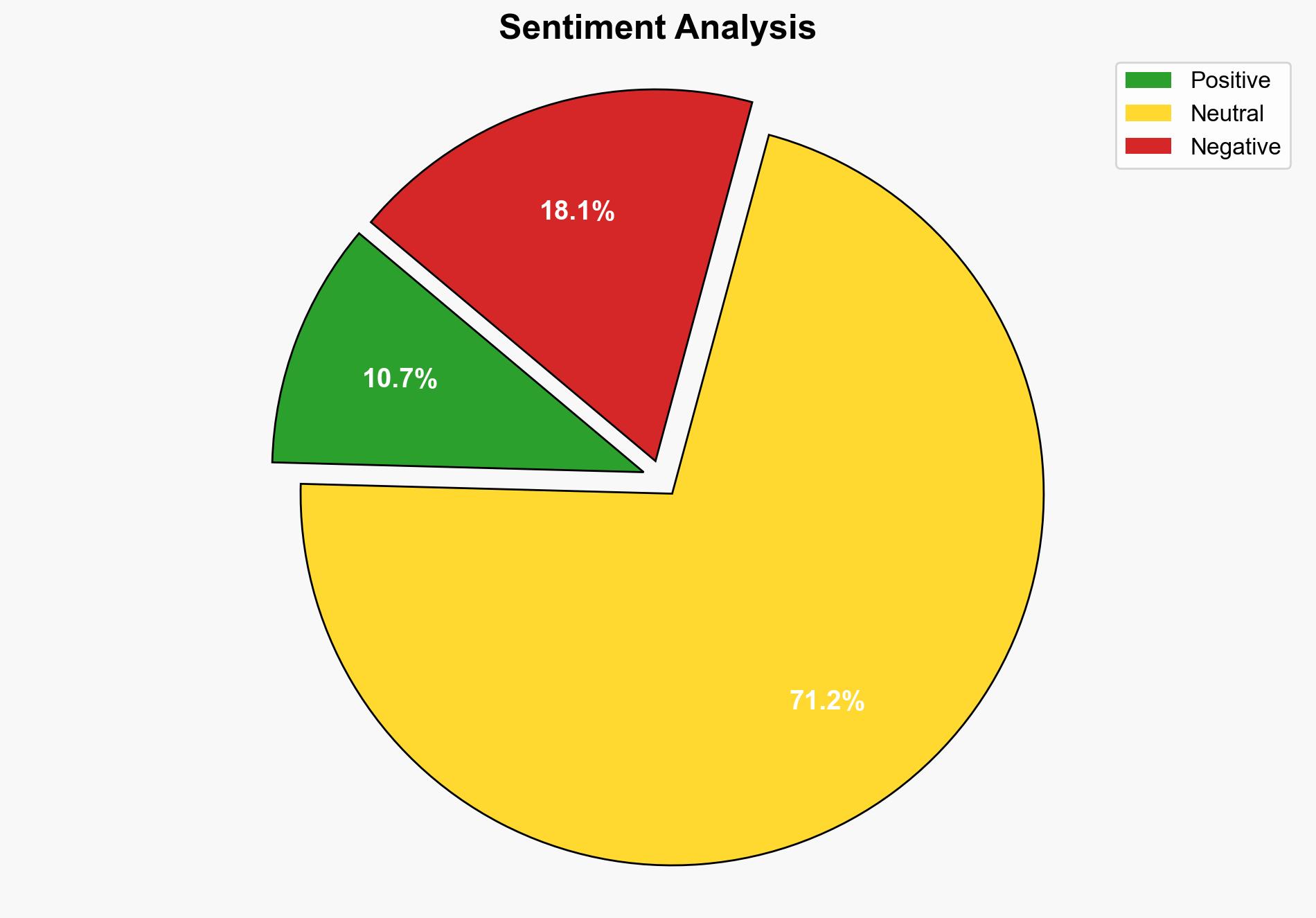

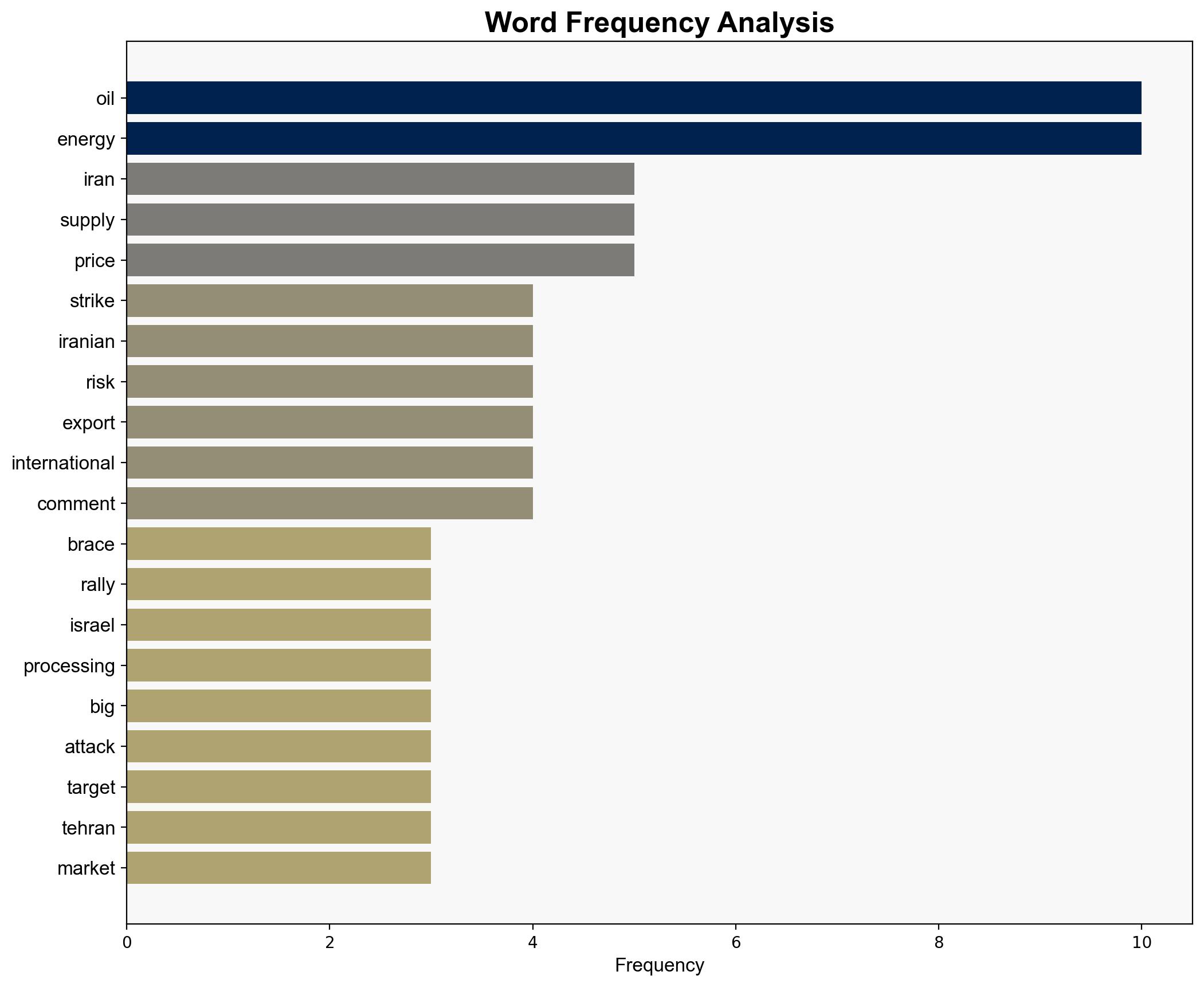

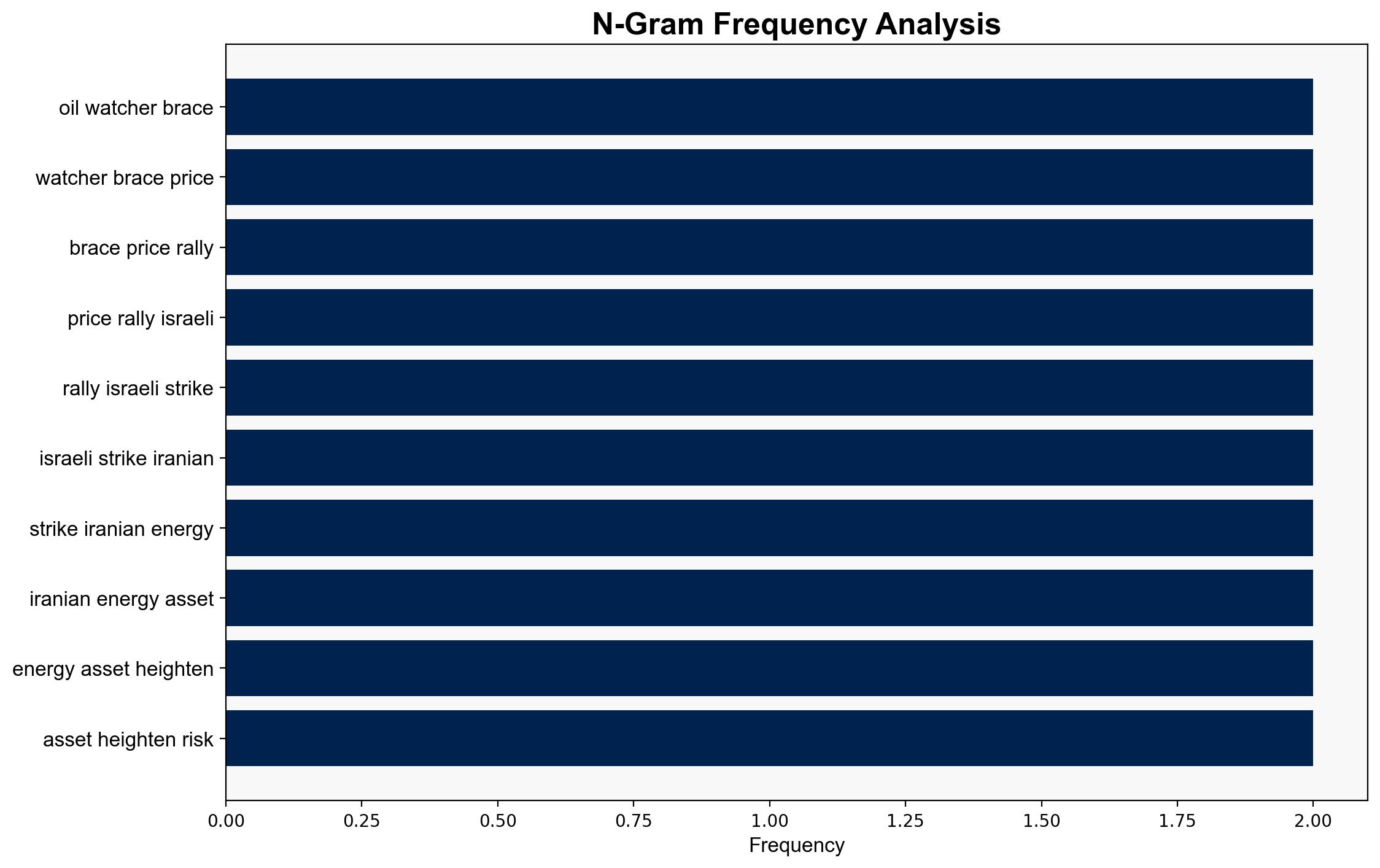

The recent Israeli strike on Iranian energy assets has heightened risks in the Middle East, potentially disrupting global oil supply chains. This report identifies the likelihood of increased oil prices and geopolitical tensions, with strategic recommendations to mitigate economic and security impacts.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Causal Layered Analysis (CLA)

– **Surface Events**: Israeli military action against Iranian energy infrastructure.

– **Systemic Structures**: Strained relations between Iran and neighboring countries, with potential impacts on global oil markets.

– **Worldviews**: Perceptions of Iran as a regional destabilizer and the strategic importance of the Strait of Hormuz.

– **Myths**: Historical narratives of Middle Eastern conflicts influencing current geopolitical strategies.

Cross-Impact Simulation

– Potential escalation of military conflicts affecting neighboring states.

– Economic dependencies on oil supply from the region could lead to global market volatility.

Scenario Generation

– **Best Case**: Diplomatic interventions stabilize the region, maintaining steady oil supply.

– **Worst Case**: Prolonged conflict leads to significant disruptions in oil exports, causing global economic instability.

– **Most Likely**: Short-term price surges with intermittent disruptions, prompting strategic reserves usage.

3. Implications and Strategic Risks

The attack on Iranian energy assets could trigger a series of retaliatory actions, increasing regional instability. The potential blockade of the Strait of Hormuz poses a critical risk to global oil supply, with cascading economic effects. Additionally, heightened tensions may lead to increased cyber threats targeting critical infrastructure.

4. Recommendations and Outlook

- Enhance diplomatic efforts to de-escalate tensions and ensure open communication channels between involved parties.

- Prepare to activate strategic oil reserves to stabilize markets in the event of supply disruptions.

- Strengthen cybersecurity measures to protect critical infrastructure from potential retaliatory cyberattacks.

- Monitor regional developments closely to anticipate further escalations or opportunities for conflict resolution.

5. Key Individuals and Entities

– Bob McNally

– Richard Bronze

– Helima Croft

– Clay Seigle

– Vandana Hari

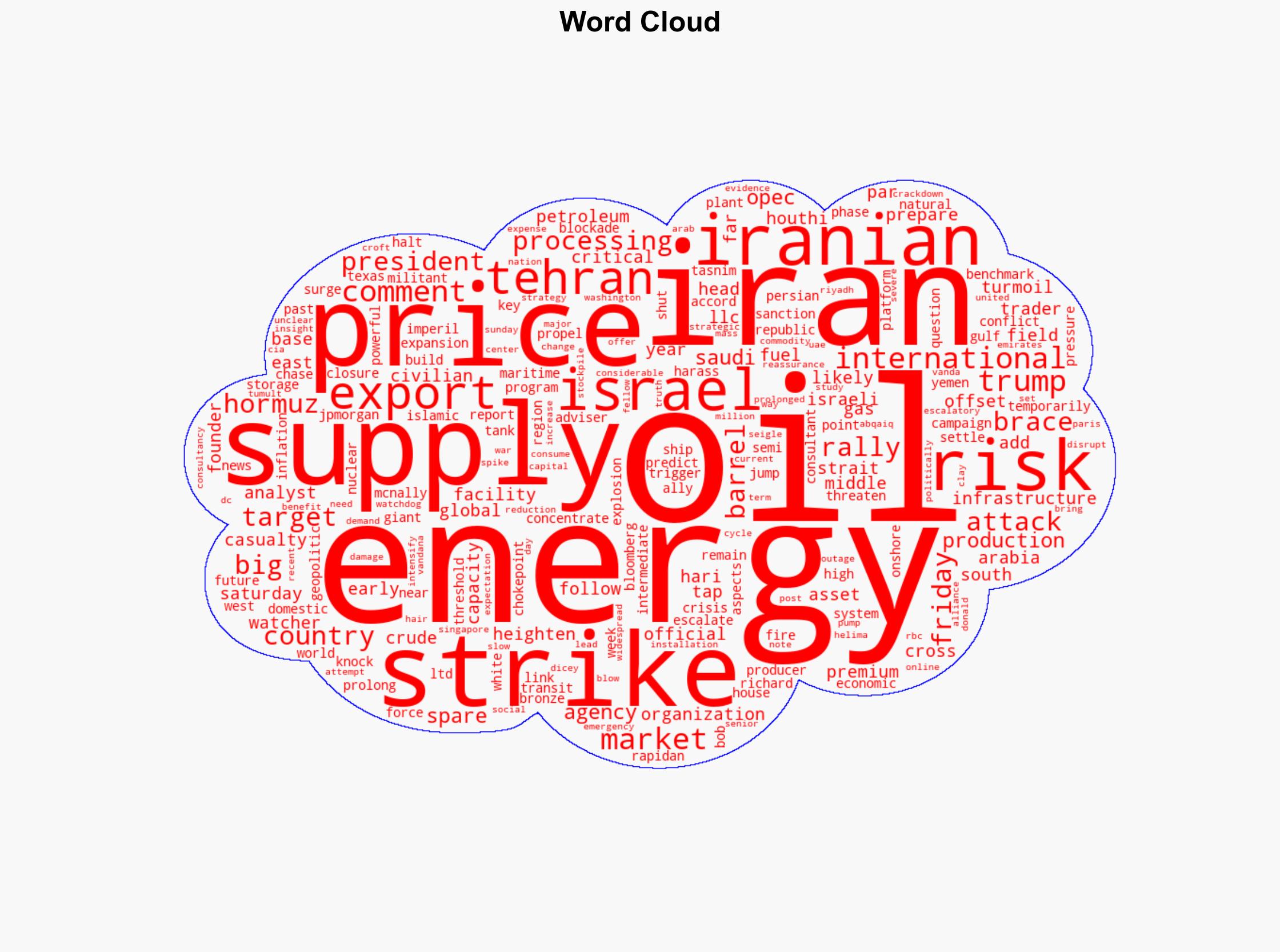

6. Thematic Tags

national security threats, geopolitical tensions, energy security, Middle East conflict, oil market volatility