Oils Plunge Pauses as Traders Take Stock of Growth Outlook – Yahoo Entertainment

Published on: 2025-04-08

Intelligence Report: Oils Plunge Pauses as Traders Take Stock of Growth Outlook – Yahoo Entertainment

1. BLUF (Bottom Line Up Front)

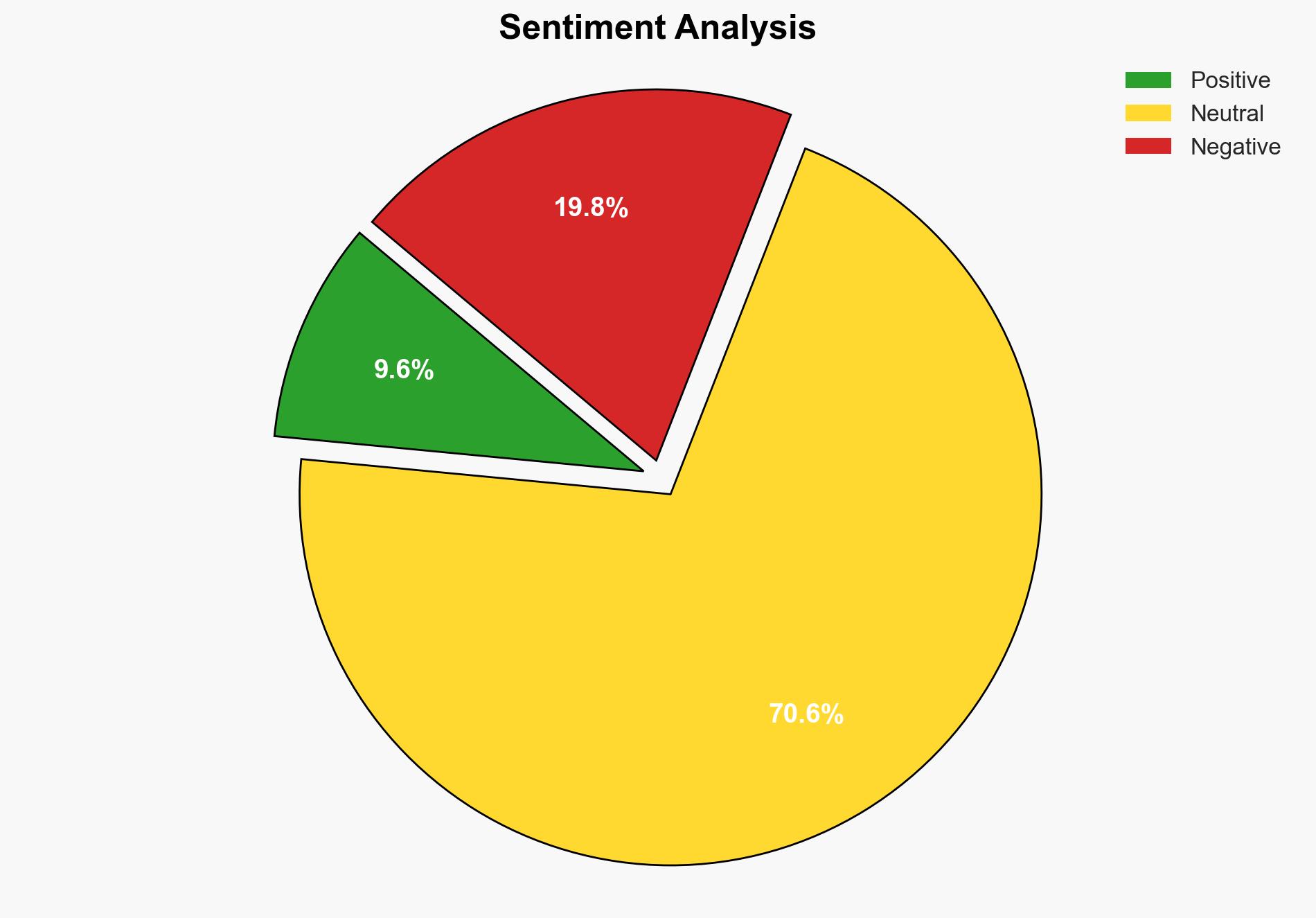

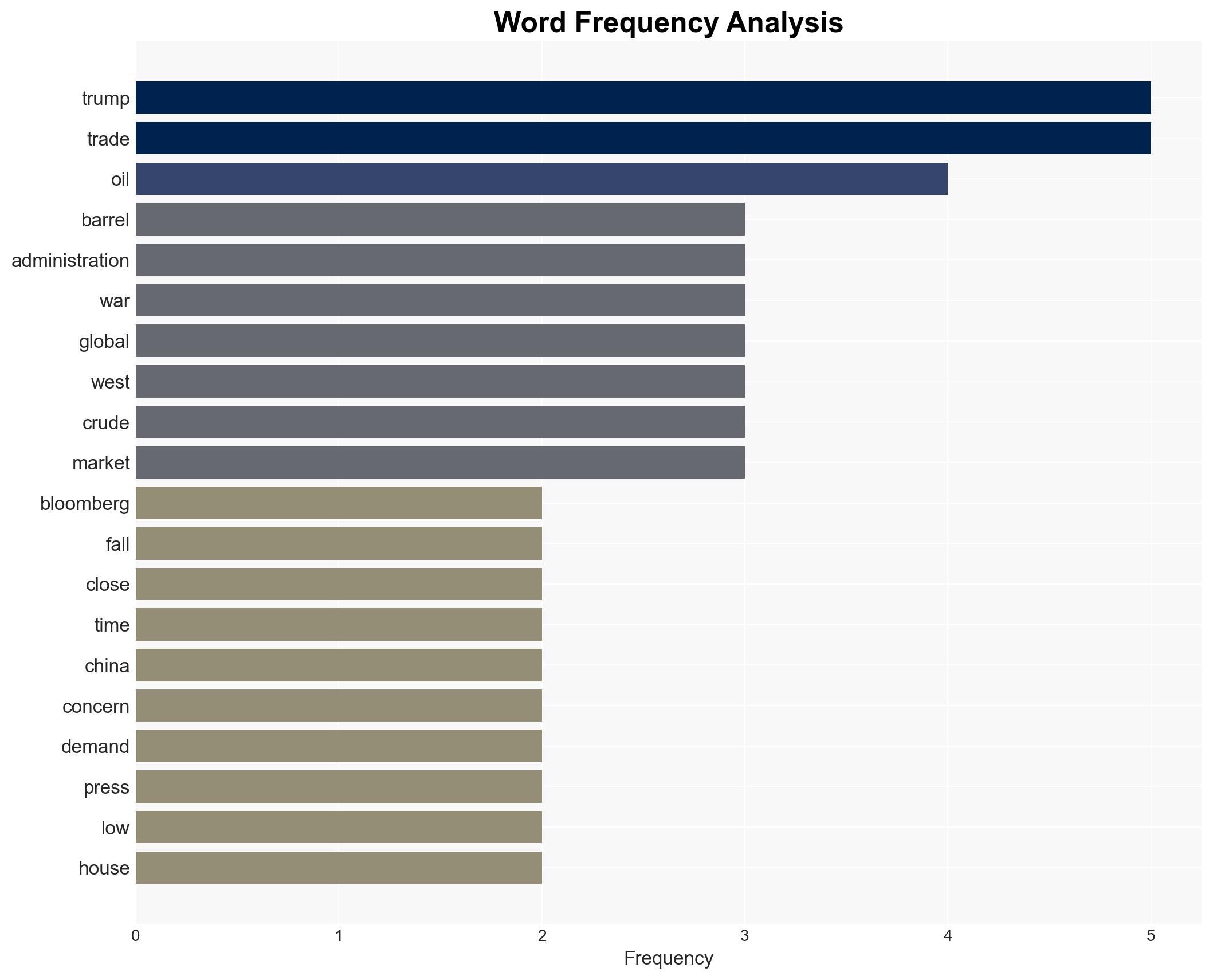

The recent decline in oil prices has temporarily halted as traders reassess the global economic growth outlook amidst escalating trade tensions between the United States and China. The implementation of new tariffs by the United States is expected to further strain international trade relations, potentially impacting global oil demand. Strategic recommendations focus on monitoring trade developments and adjusting energy market strategies accordingly.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

General Analysis

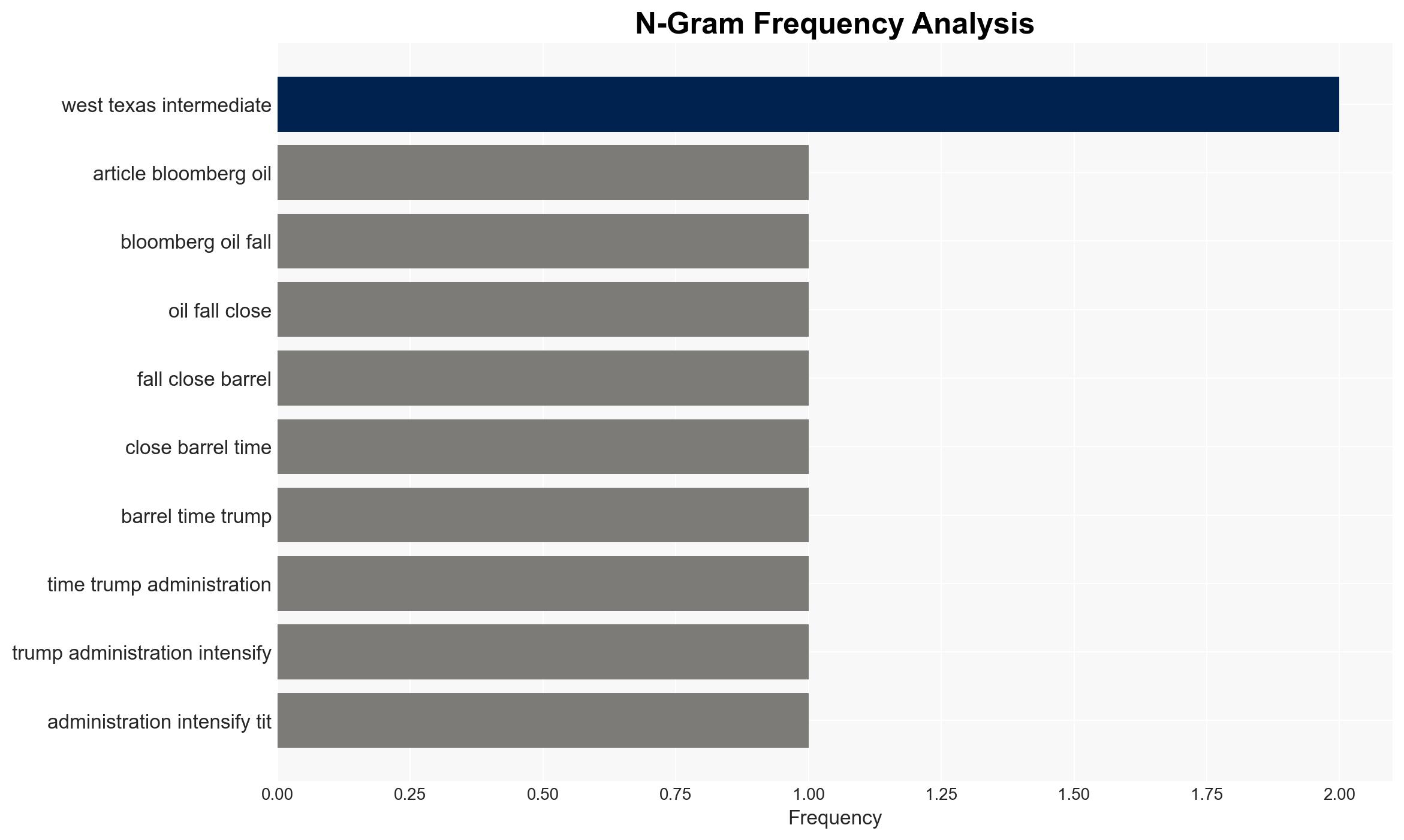

The oil market has experienced a four-session decline, reaching a new yearly low. This trend is primarily driven by the intensification of the trade conflict between the United States and China. The imposition of tariffs by the United States and the anticipated retaliatory measures by China have heightened concerns about a global economic slowdown. This scenario poses a risk to energy demand, with potential repercussions for oil market stability. The Organization of the Petroleum Exporting Countries (OPEC) has not delivered the expected output hike, further complicating the market dynamics.

3. Implications and Strategic Risks

The ongoing trade tensions present significant risks to global economic stability, with potential impacts on national security and regional stability. The energy sector is particularly vulnerable, as reduced demand could lead to financial instability for oil-producing nations. The uncertainty surrounding trade policies may also deter investment in the energy sector, affecting long-term economic interests.

4. Recommendations and Outlook

Recommendations:

- Enhance monitoring of trade negotiations and adjust energy market strategies to mitigate potential disruptions.

- Encourage diversification of energy sources to reduce dependency on volatile markets.

- Promote international dialogue to de-escalate trade tensions and stabilize global markets.

Outlook:

Best-case scenario: Resolution of trade tensions leads to a stabilization of oil prices and a rebound in global economic growth.

Worst-case scenario: Prolonged trade conflict results in a significant global economic downturn, severely impacting oil demand and market stability.

Most likely scenario: Continued volatility in oil markets as trade tensions persist, with gradual adjustments in global economic policies.

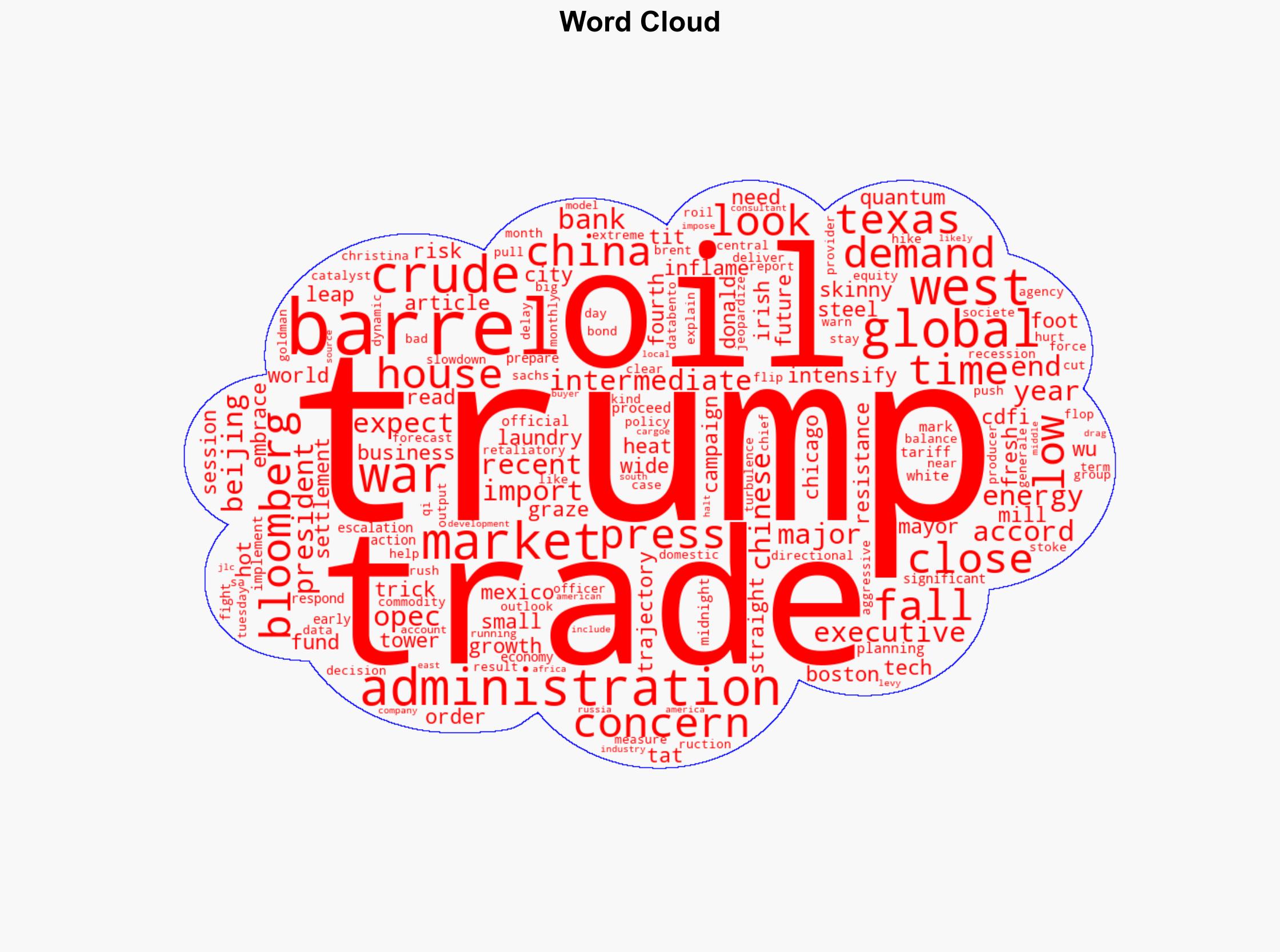

5. Key Individuals and Entities

The report mentions significant individuals and organizations, including Donald Trump and Christina Qi, without providing any roles or affiliations. Additionally, entities such as Databento, Societe Generale SA, and Goldman Sachs Group are referenced in the context of market analysis and forecasts.