OPEC Meets With Future Oil Production Hanging In The Balance – International Business Times

Published on: 2025-10-05

Intelligence Report: OPEC Meets With Future Oil Production Hanging In The Balance – International Business Times

1. BLUF (Bottom Line Up Front)

The most supported hypothesis is that OPEC will opt for a moderate increase in oil production, balancing internal pressures and external market conditions. This hypothesis is supported by historical behavior and current geopolitical constraints. Confidence level: Moderate. Recommended action: Monitor OPEC’s decision closely and prepare for potential market volatility by diversifying energy sources and strengthening strategic reserves.

2. Competing Hypotheses

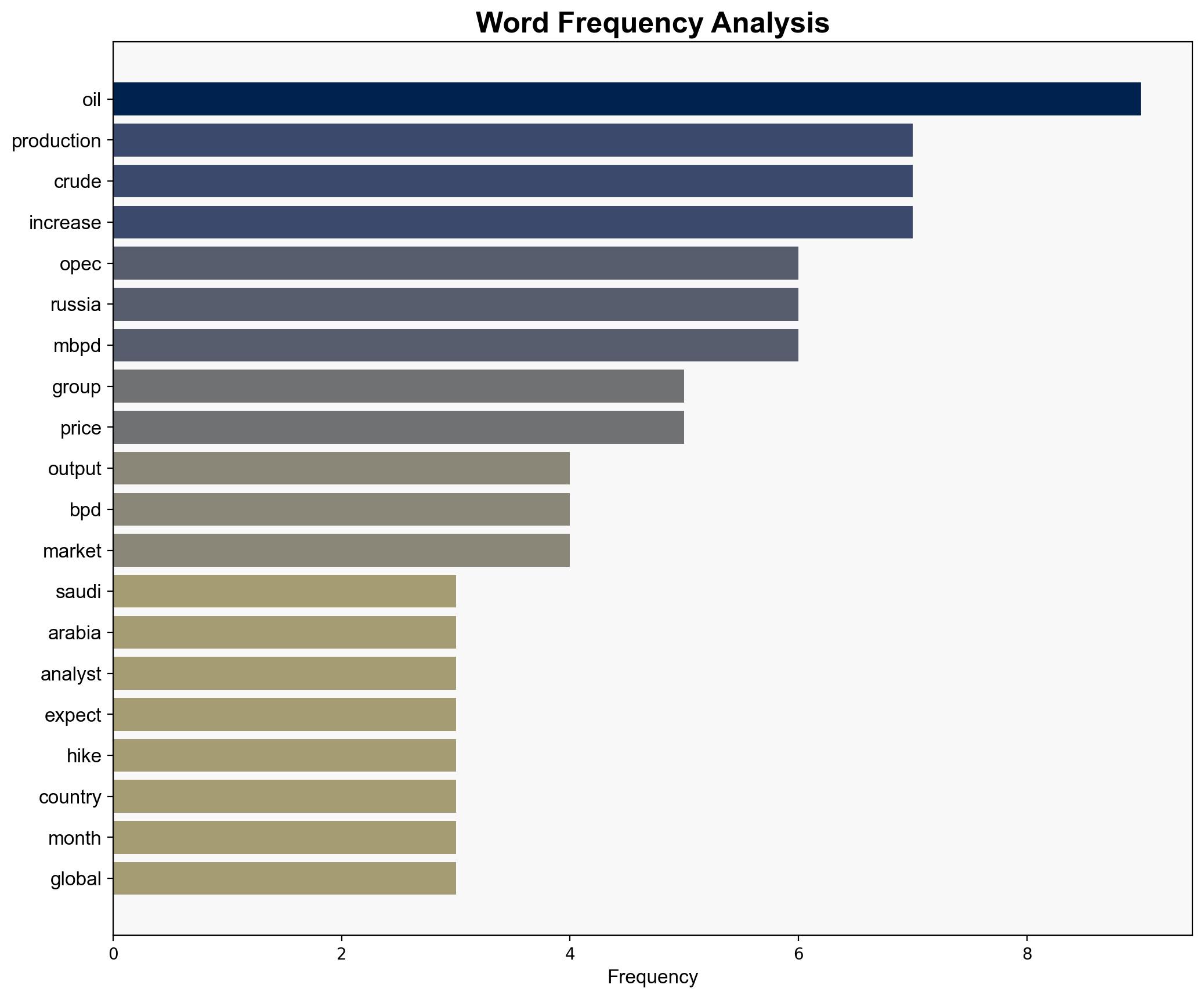

Hypothesis 1: OPEC will agree to a significant increase in oil production to regain market share and counteract the influence of non-OPEC producers like the United States, Brazil, and Canada. This is supported by past instances where OPEC has increased output to maintain market dominance.

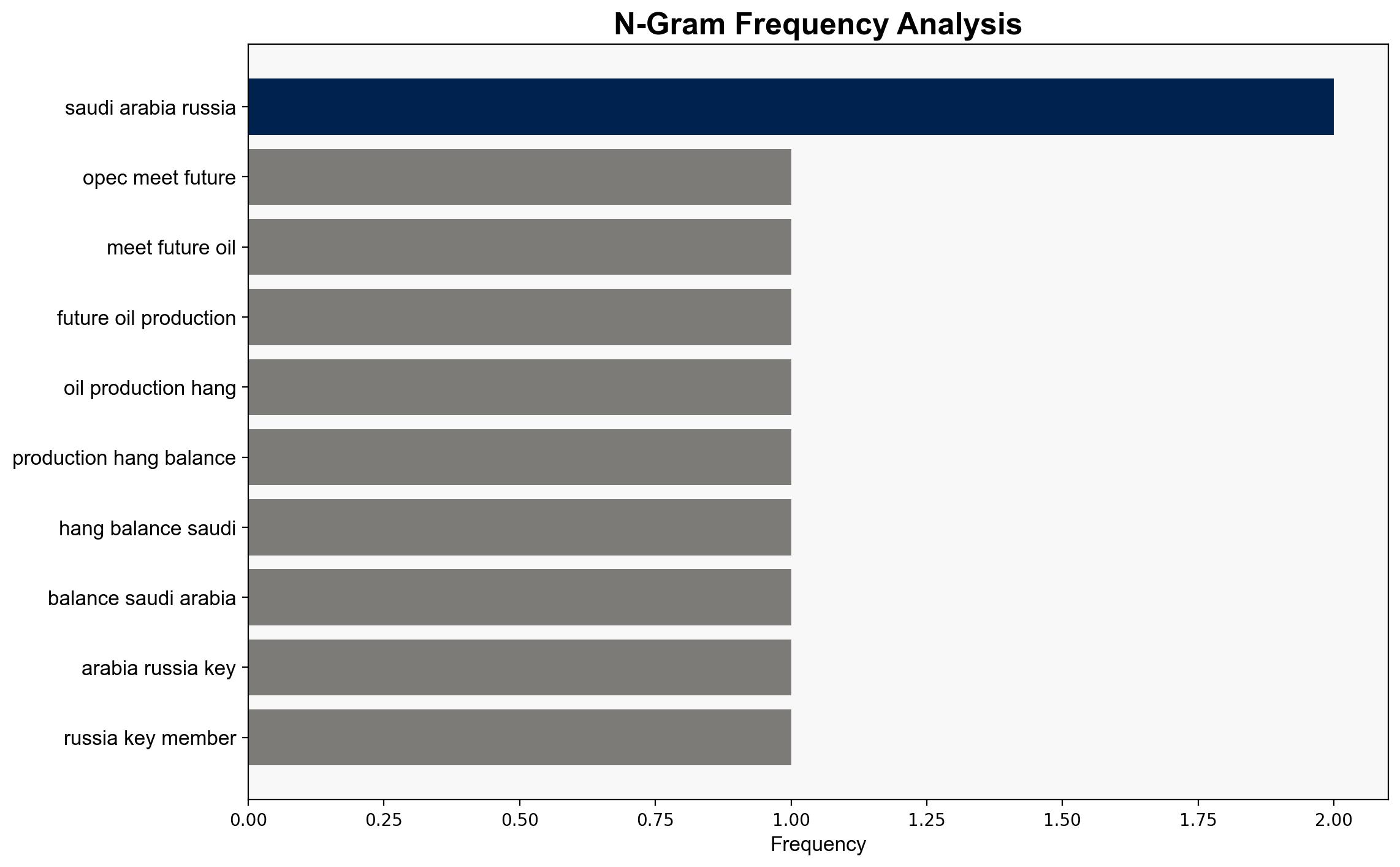

Hypothesis 2: OPEC will opt for a moderate or minimal increase in production due to internal disagreements and geopolitical constraints, particularly the interests of Saudi Arabia and Russia in maintaining higher oil prices. This is supported by recent statements and actions indicating caution and the need to balance market stability with revenue needs.

Using the Analysis of Competing Hypotheses (ACH) technique, Hypothesis 2 is more supported due to the alignment of key member interests and the current geopolitical landscape, including sanctions on Russia and Saudi Arabia’s economic strategies.

3. Key Assumptions and Red Flags

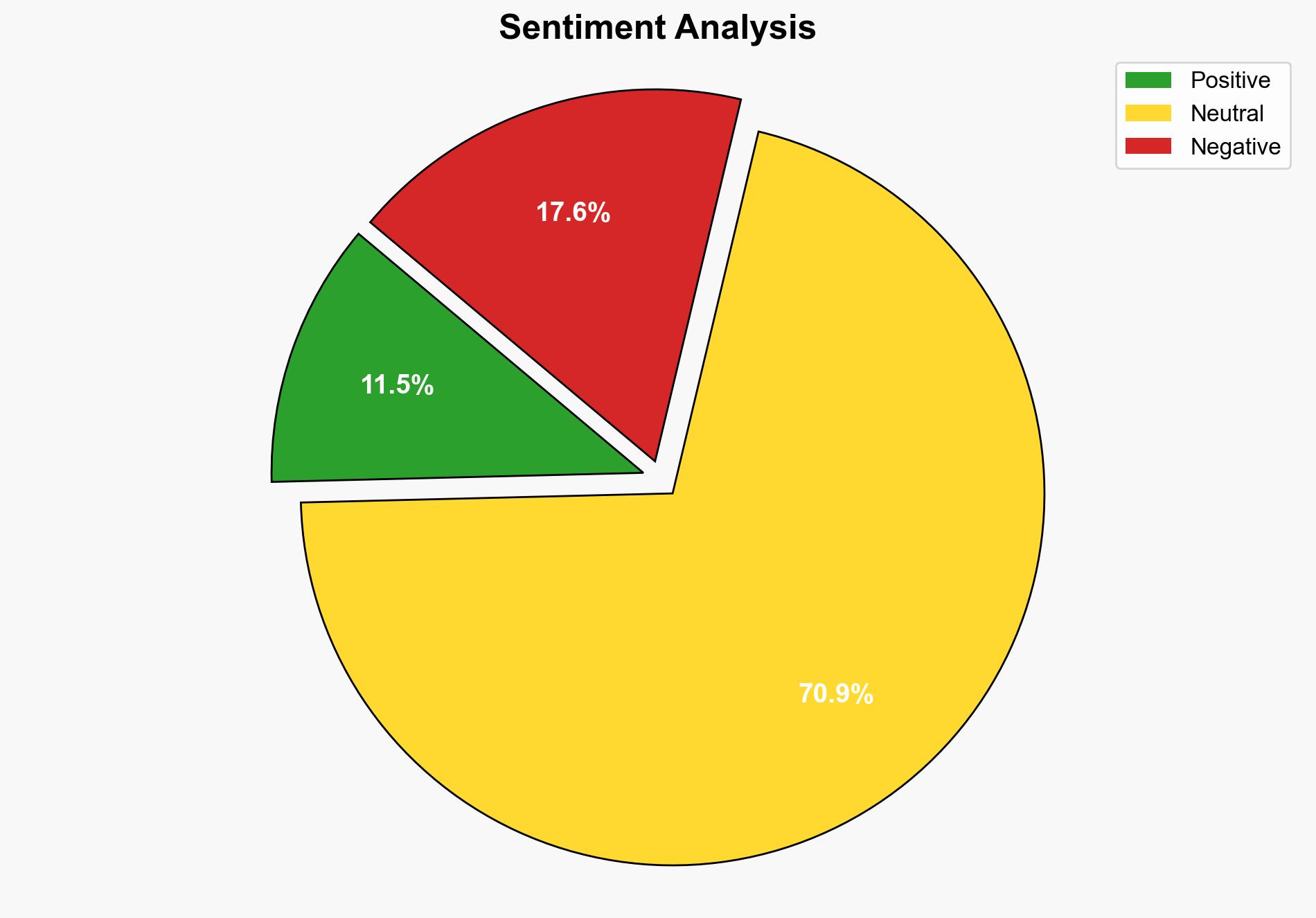

Assumptions include the belief that OPEC members will prioritize long-term market stability over short-term gains. A red flag is the potential for unexpected geopolitical developments, such as changes in sanctions or conflicts, which could alter production decisions. Additionally, media reports on production increases have been labeled as misleading, indicating possible information manipulation.

4. Implications and Strategic Risks

A significant production increase could lead to a drop in oil prices, affecting global markets and economies reliant on oil exports. Conversely, limited increases may strain relations within OPEC and with non-OPEC producers. Geopolitical tensions, particularly involving Russia, could escalate if oil revenues are impacted, potentially affecting global energy security.

5. Recommendations and Outlook

- Enhance monitoring of OPEC meetings and member state communications to anticipate shifts in production strategies.

- Develop contingency plans for both significant and minimal production increase scenarios, focusing on energy diversification and economic resilience.

- Scenario Projections:

- Best Case: OPEC’s decision stabilizes the market, leading to steady prices and economic growth.

- Worst Case: A significant production increase causes a price collapse, triggering economic instability in oil-dependent regions.

- Most Likely: A moderate increase maintains current price levels, with minor fluctuations.

6. Key Individuals and Entities

Barbara Lambrecht, Tamas Varga, Jorge Leon, Homayoun Falakshahi, Arne Lohmann Rasmussen.

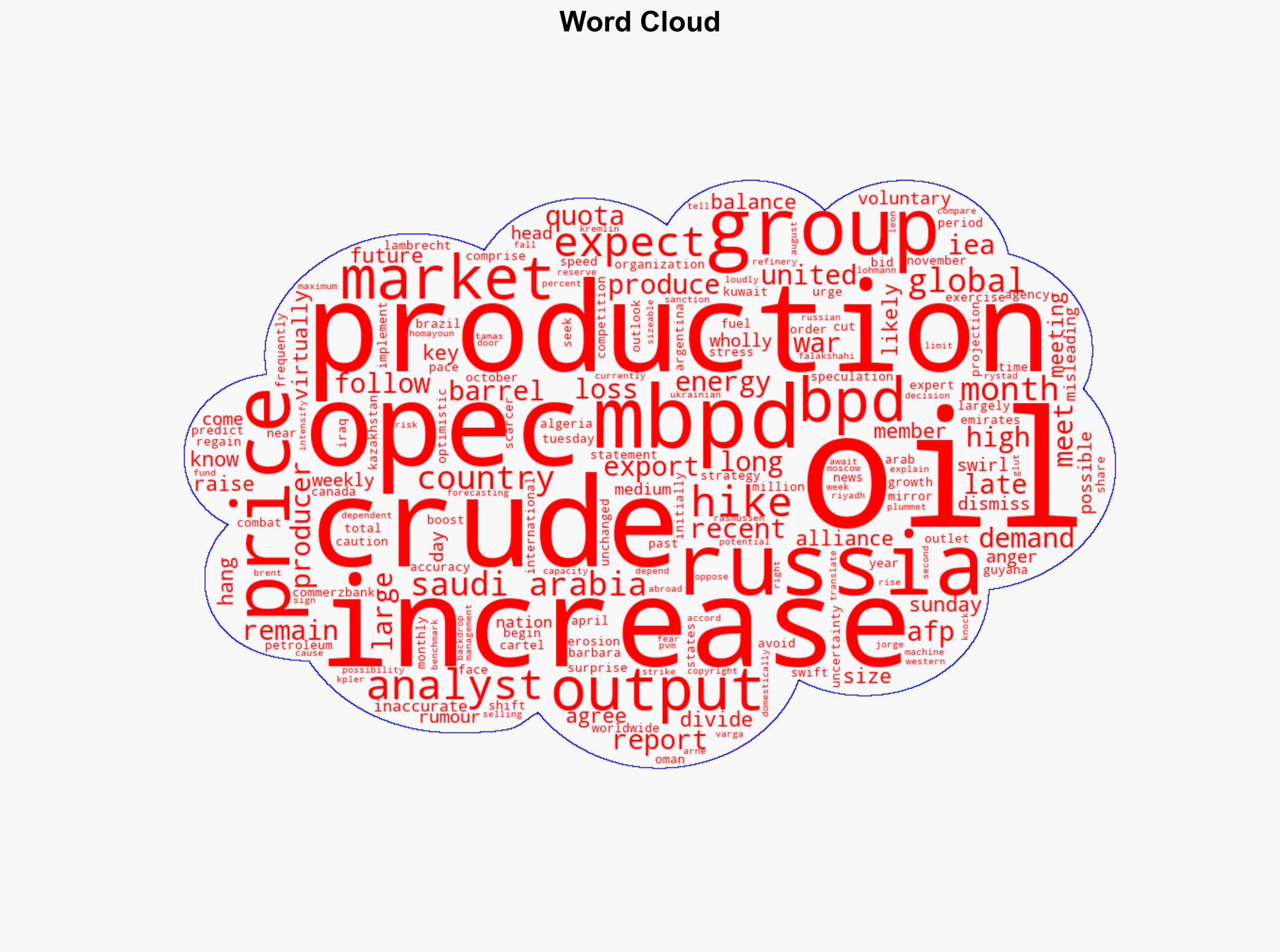

7. Thematic Tags

energy security, geopolitical strategy, market volatility, economic resilience