Owning One Bitcoin Is the New American Dream Says Bitwise Portfolio Manager – CoinDesk

Published on: 2025-06-15

Intelligence Report: Owning One Bitcoin Is the New American Dream Says Bitwise Portfolio Manager – CoinDesk

1. BLUF (Bottom Line Up Front)

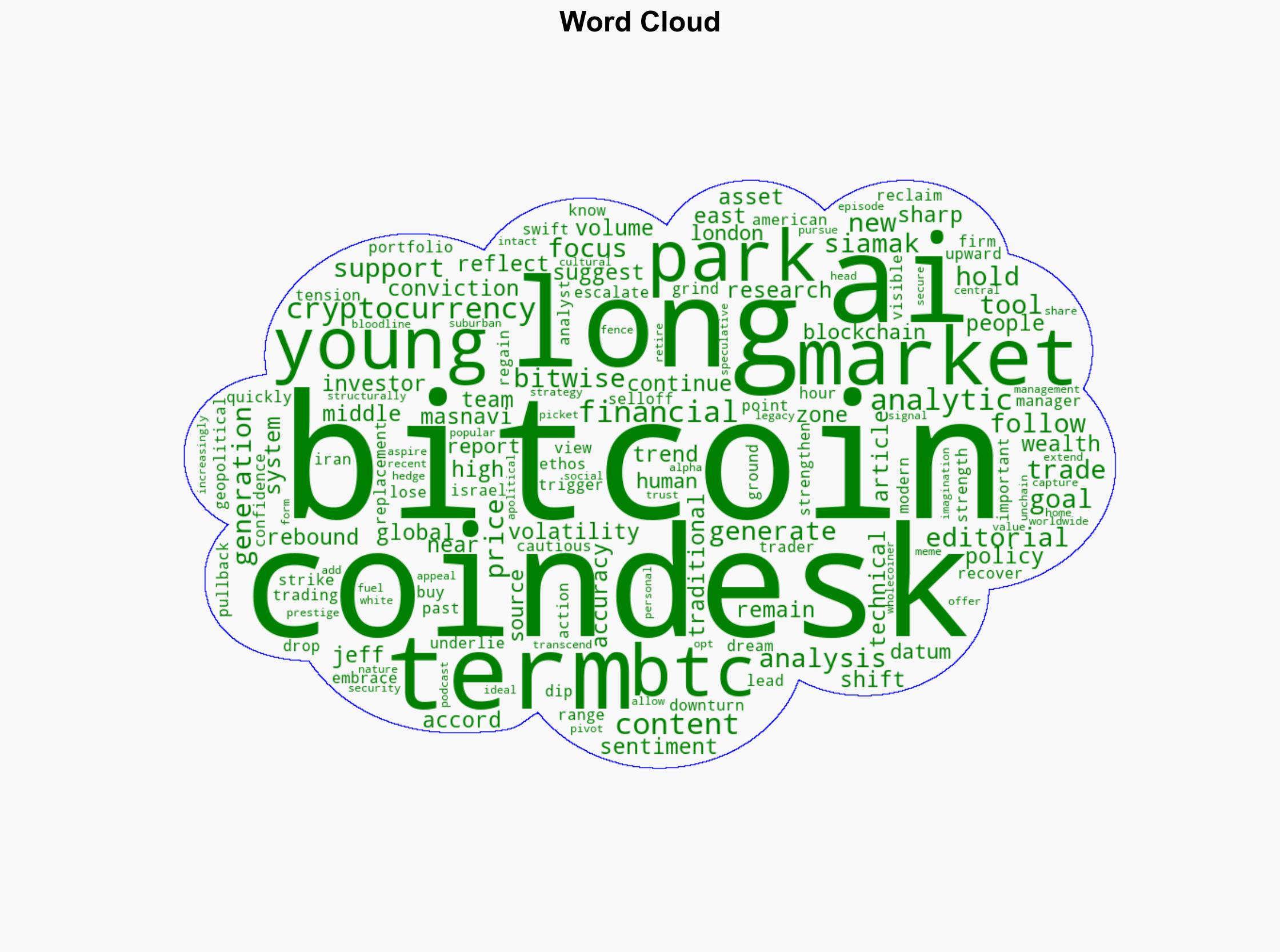

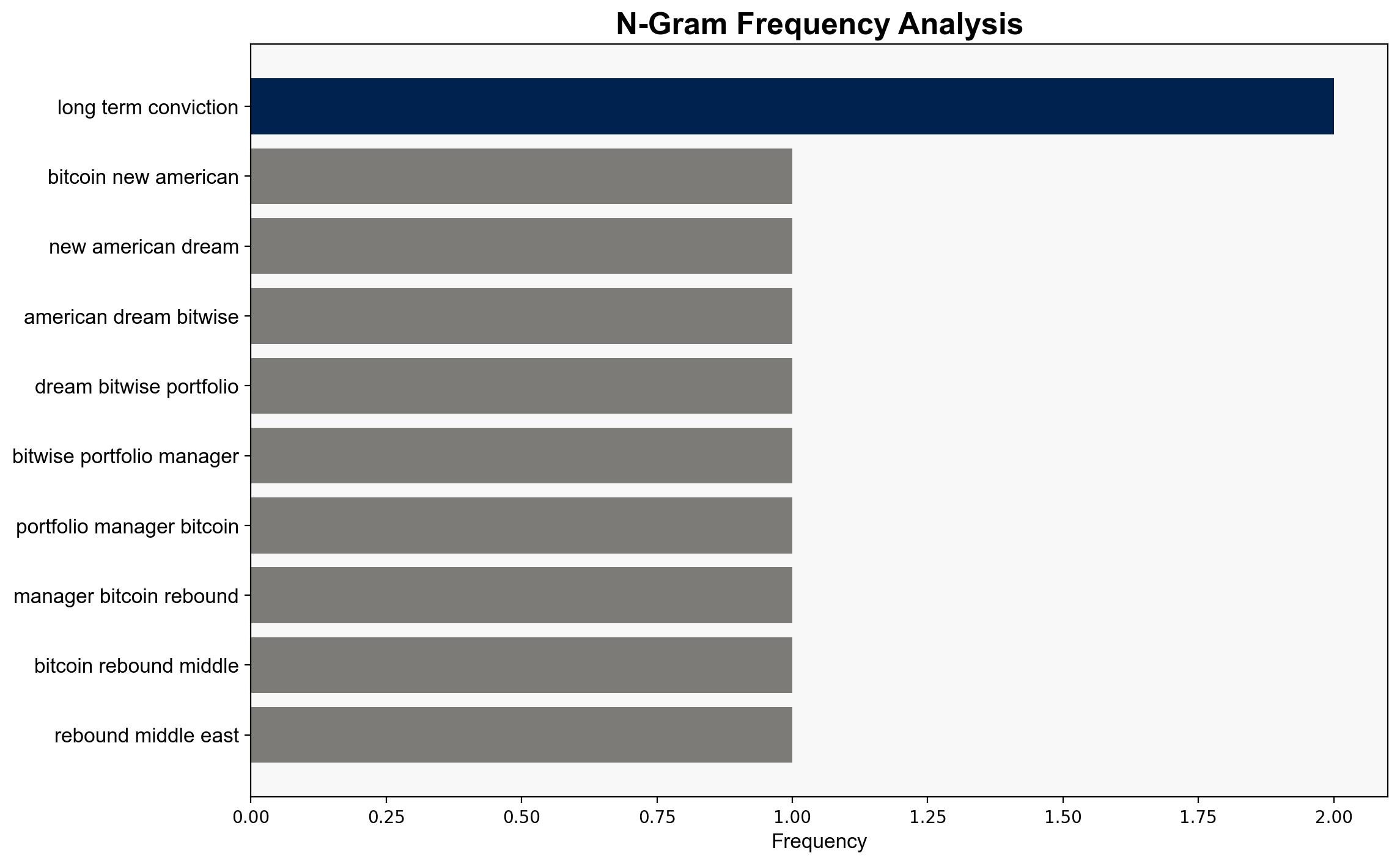

The narrative that owning one Bitcoin represents a new form of the American Dream is gaining traction, particularly among younger investors. This trend reflects a shift from traditional wealth goals to digital assets as a symbol of financial independence and security. The recent rebound in Bitcoin’s value following geopolitical tensions in the Middle East underscores its perceived resilience and potential as a long-term investment. Strategic recommendations include monitoring the evolving perceptions of Bitcoin and its implications for financial markets and global economic stability.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Causal Layered Analysis (CLA)

The surface event of Bitcoin’s rebound is linked to systemic structures such as global economic uncertainty and shifting investor demographics. The worldview is changing from traditional wealth accumulation to digital asset ownership, with myths surrounding Bitcoin as a hedge against economic instability gaining popularity.

Cross-Impact Simulation

Bitcoin’s value fluctuations can influence regional economic stability, particularly in areas with high cryptocurrency adoption. Geopolitical conflicts can trigger market volatility, impacting investor confidence globally.

Scenario Generation

Potential futures include increased mainstream adoption of Bitcoin, regulatory challenges, or technological advancements enhancing its utility. Each scenario presents unique opportunities and risks for stakeholders.

3. Implications and Strategic Risks

The growing acceptance of Bitcoin as a financial goal poses risks such as regulatory scrutiny and cybersecurity threats. Economic dependencies on digital assets could lead to systemic vulnerabilities, particularly if geopolitical tensions escalate. The cultural shift towards digital wealth may also influence traditional financial institutions and economic policies.

4. Recommendations and Outlook

- Encourage regulatory frameworks that balance innovation with security to mitigate potential risks associated with cryptocurrency adoption.

- Monitor technological advancements and market trends to leverage opportunities in digital asset investments.

- Scenario-based projections suggest a best-case scenario of increased stability and integration of Bitcoin into mainstream finance, a worst-case scenario of regulatory crackdowns and market volatility, and a most likely scenario of gradual acceptance with periodic fluctuations.

5. Key Individuals and Entities

Jeff Park

6. Thematic Tags

national security threats, cybersecurity, economic stability, digital assets, financial independence