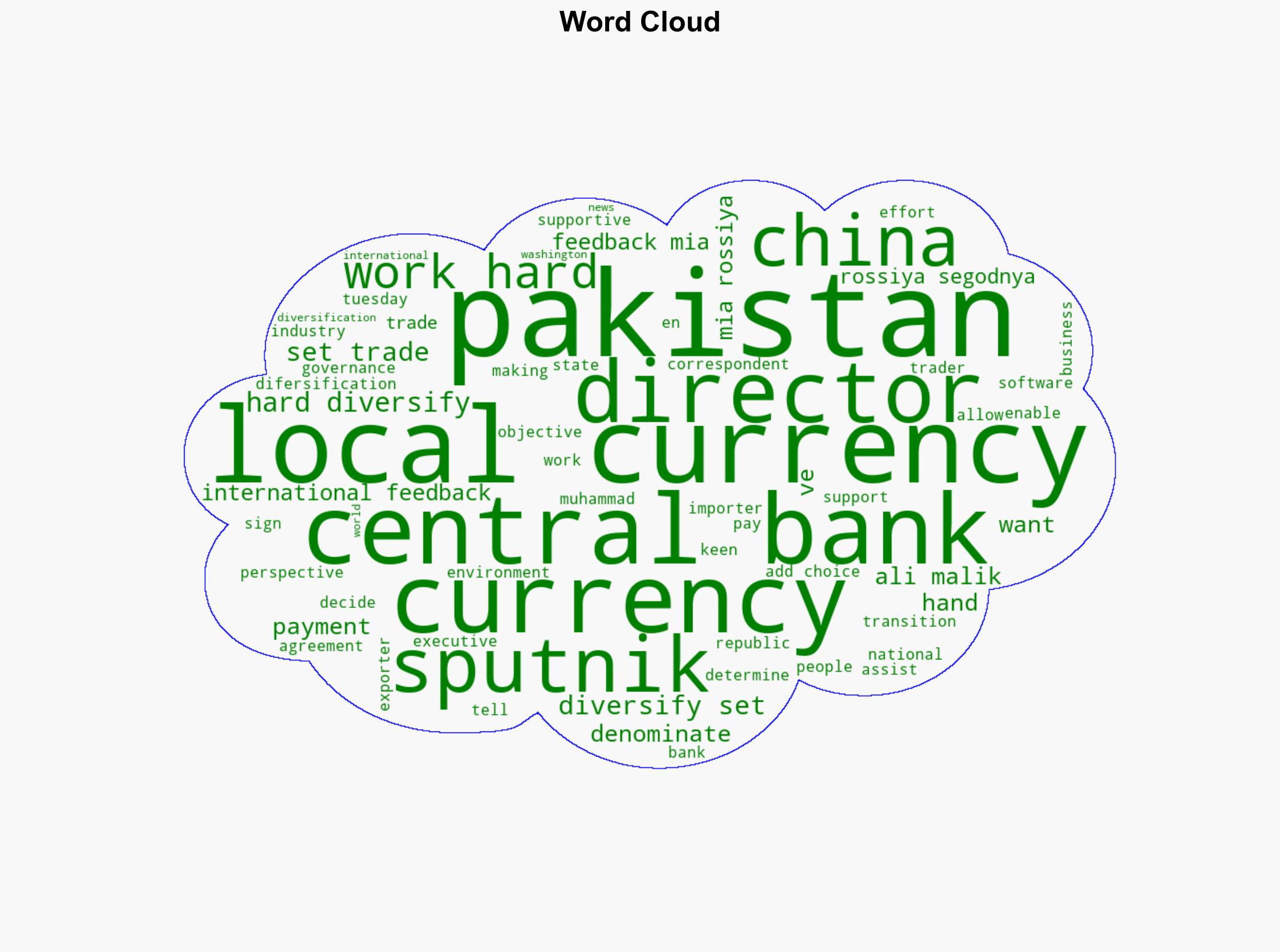

Pakistan Working Hard to Diversify Set Trade in Local Currency – Central Banks Director – Sputnikglobe.com

Published on: 2025-10-15

Intelligence Report: Pakistan Working Hard to Diversify Set Trade in Local Currency – Central Banks Director – Sputnikglobe.com

1. BLUF (Bottom Line Up Front)

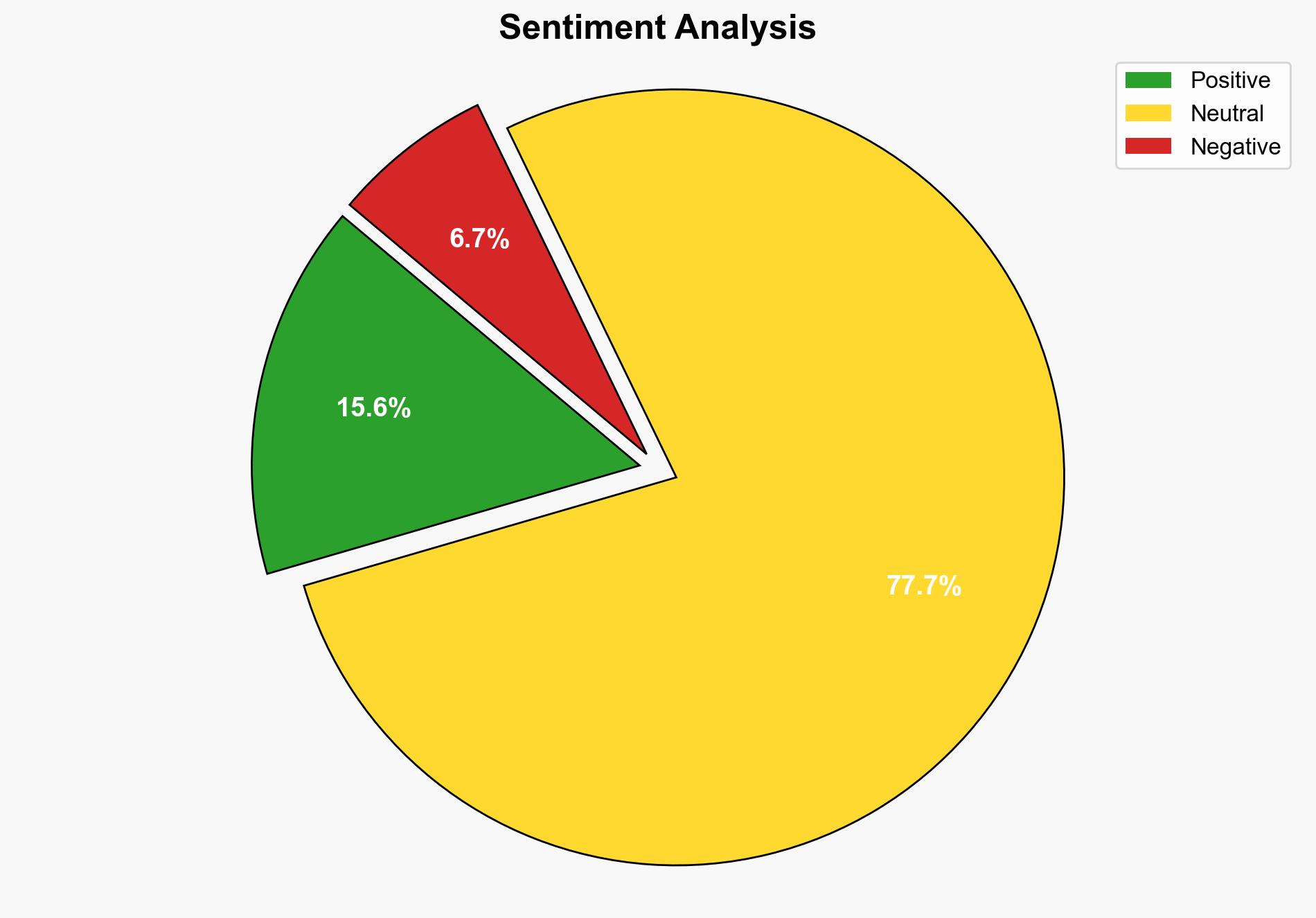

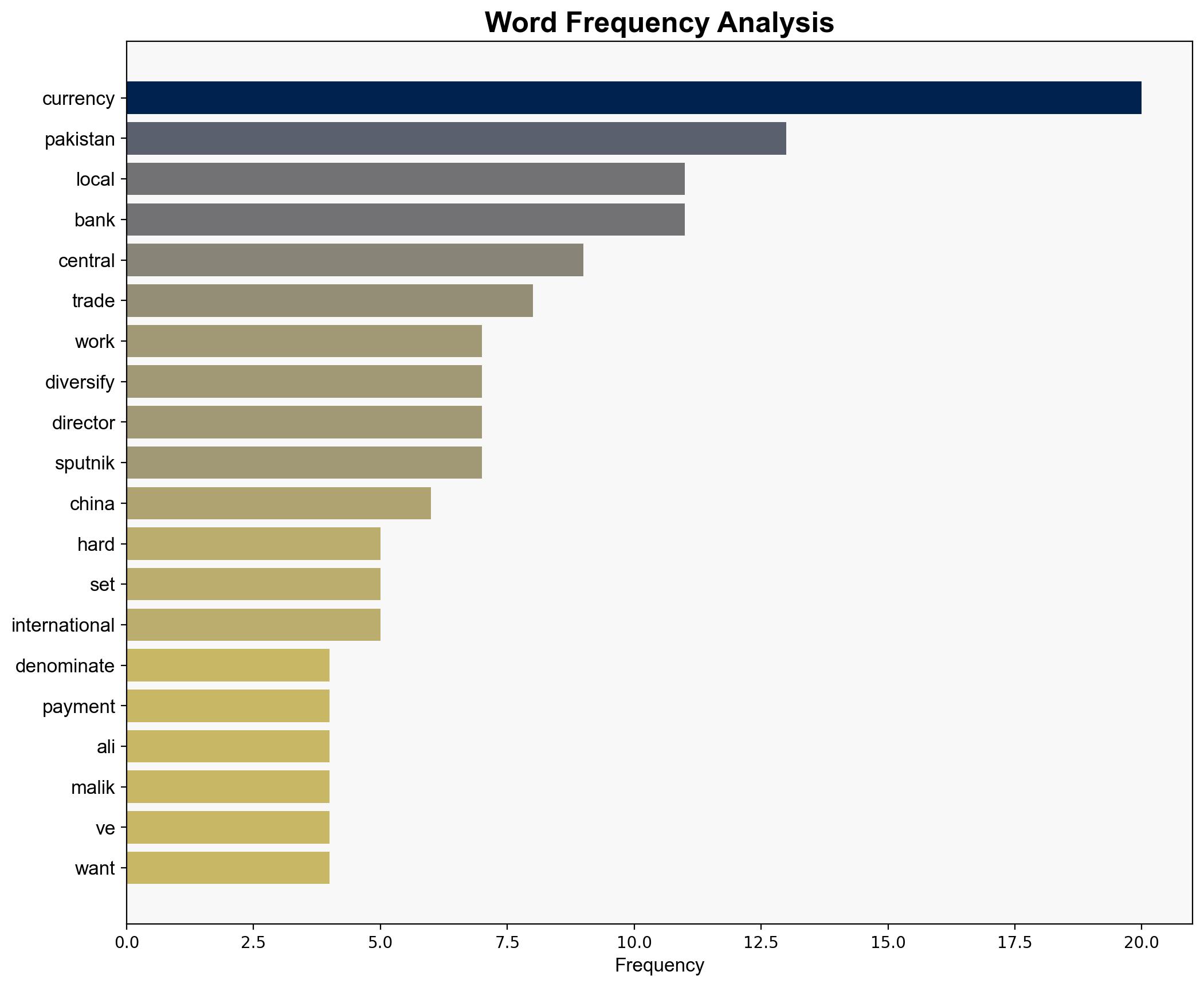

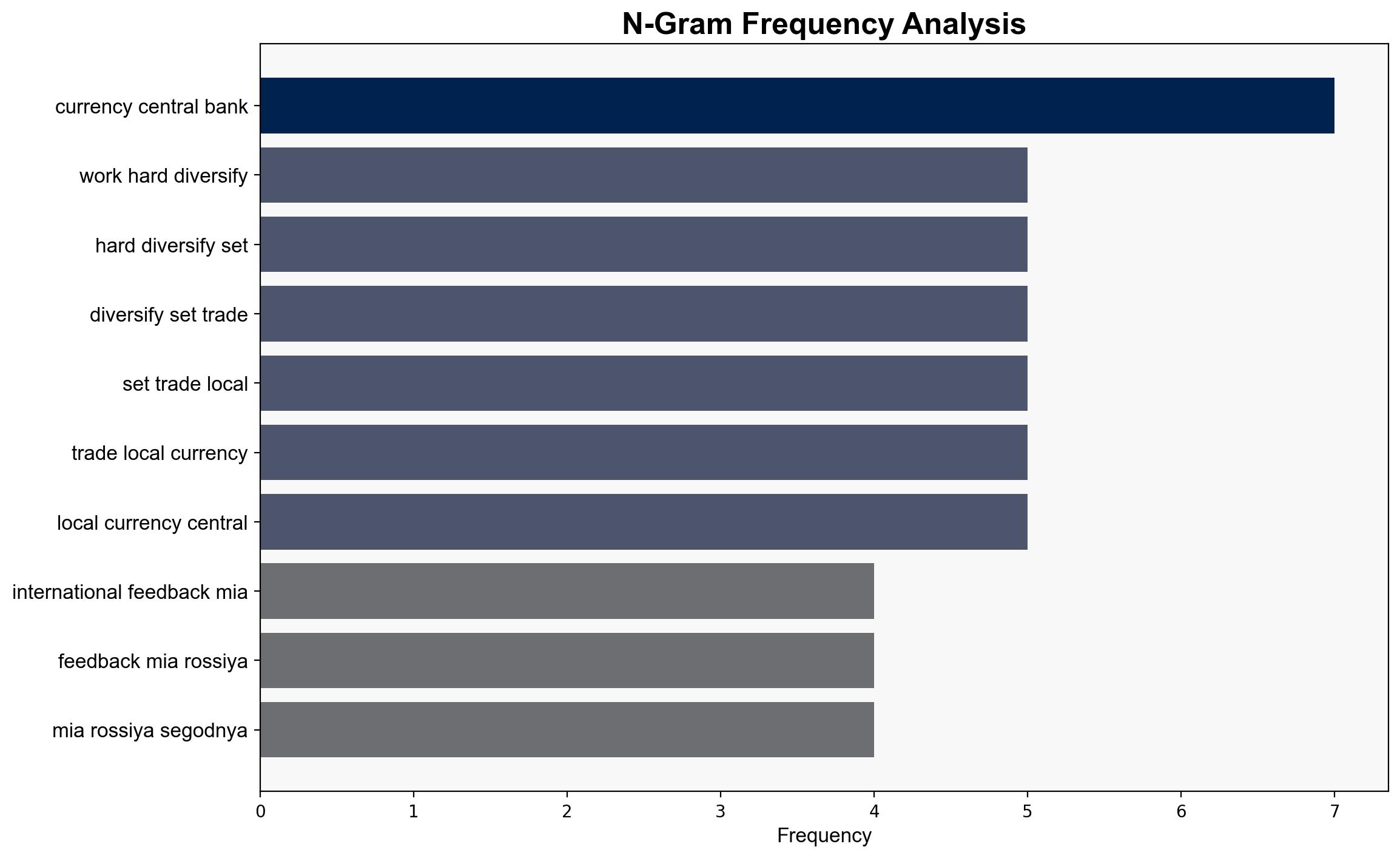

Pakistan is actively pursuing the diversification of trade settlements in local currency, particularly with China, to enhance economic sovereignty and reduce reliance on foreign currencies. The most supported hypothesis suggests this move is primarily aimed at strengthening economic ties with China and reducing dependency on the US dollar. Confidence level: Moderate. Recommended action: Monitor the implementation of currency agreements and assess impacts on regional trade dynamics.

2. Competing Hypotheses

1. **Hypothesis A**: Pakistan’s efforts to diversify trade in local currency are primarily driven by a strategic partnership with China, aiming to strengthen bilateral economic ties and reduce reliance on the US dollar.

2. **Hypothesis B**: The initiative is a broader economic strategy by Pakistan to enhance its financial independence and mitigate risks associated with currency fluctuations and international sanctions.

Using ACH 2.0, Hypothesis A is better supported due to the specific mention of agreements with China and the focus on bilateral trade. Hypothesis B lacks direct evidence in the source but remains plausible given Pakistan’s broader economic context.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that the currency agreements with China will be effectively implemented and that there is mutual interest in reducing US dollar dependency.

– **Red Flags**: The source lacks detail on the specific terms of the currency agreements and any potential opposition from domestic or international stakeholders.

– **Blind Spots**: The report does not address potential resistance from sectors benefiting from dollar-denominated trade or the impact on Pakistan’s relations with Western economies.

4. Implications and Strategic Risks

– **Economic**: Successful implementation could lead to increased trade volumes with China and reduced vulnerability to dollar fluctuations. However, failure could strain Pakistan’s financial system.

– **Geopolitical**: Strengthening ties with China may alter regional power dynamics and affect Pakistan’s relations with other major economies.

– **Cyber and Psychological**: Increased digital transactions in local currency could expose vulnerabilities to cyber threats, while public perception of economic independence could bolster national morale.

5. Recommendations and Outlook

- Monitor the progress of currency agreement implementations and evaluate their impact on trade volumes and economic stability.

- Engage with regional partners to assess potential shifts in trade policies and alliances.

- Scenario Projections:

- Best Case: Successful diversification leads to economic growth and strengthened regional partnerships.

- Worst Case: Implementation challenges lead to financial instability and strained international relations.

- Most Likely: Gradual progress with mixed outcomes, requiring ongoing adjustments and negotiations.

6. Key Individuals and Entities

– Muhammad Ali Malik: Central Bank Executive Director, key proponent of the currency diversification initiative.

– People’s Republic of China: Partner in currency software agreements, crucial to the success of the initiative.

7. Thematic Tags

national security threats, regional focus, economic strategy, currency diversification