Pakistan’s central bank likely to hold rate at 11 on cautious inflation outlook – CNA

Published on: 2025-10-24

Intelligence Report: Pakistan’s central bank likely to hold rate at 11 on cautious inflation outlook – CNA

1. BLUF (Bottom Line Up Front)

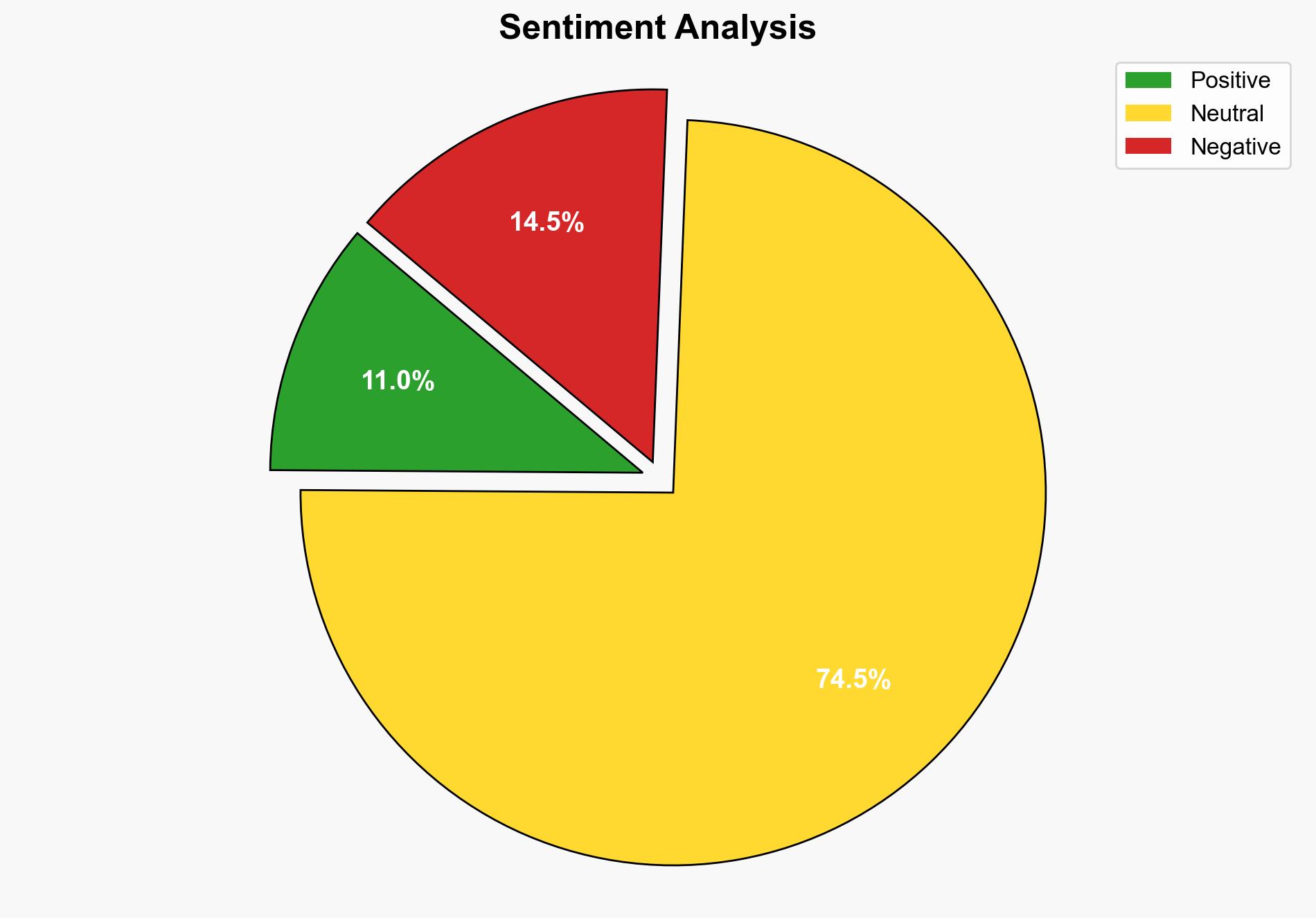

The most supported hypothesis is that the State Bank of Pakistan (SBP) will maintain the interest rate at 11% due to inflationary pressures from recent floods and geopolitical tensions affecting trade. Confidence level: Moderate. Recommended action: Monitor inflation trends and geopolitical developments closely, as these could necessitate policy adjustments.

2. Competing Hypotheses

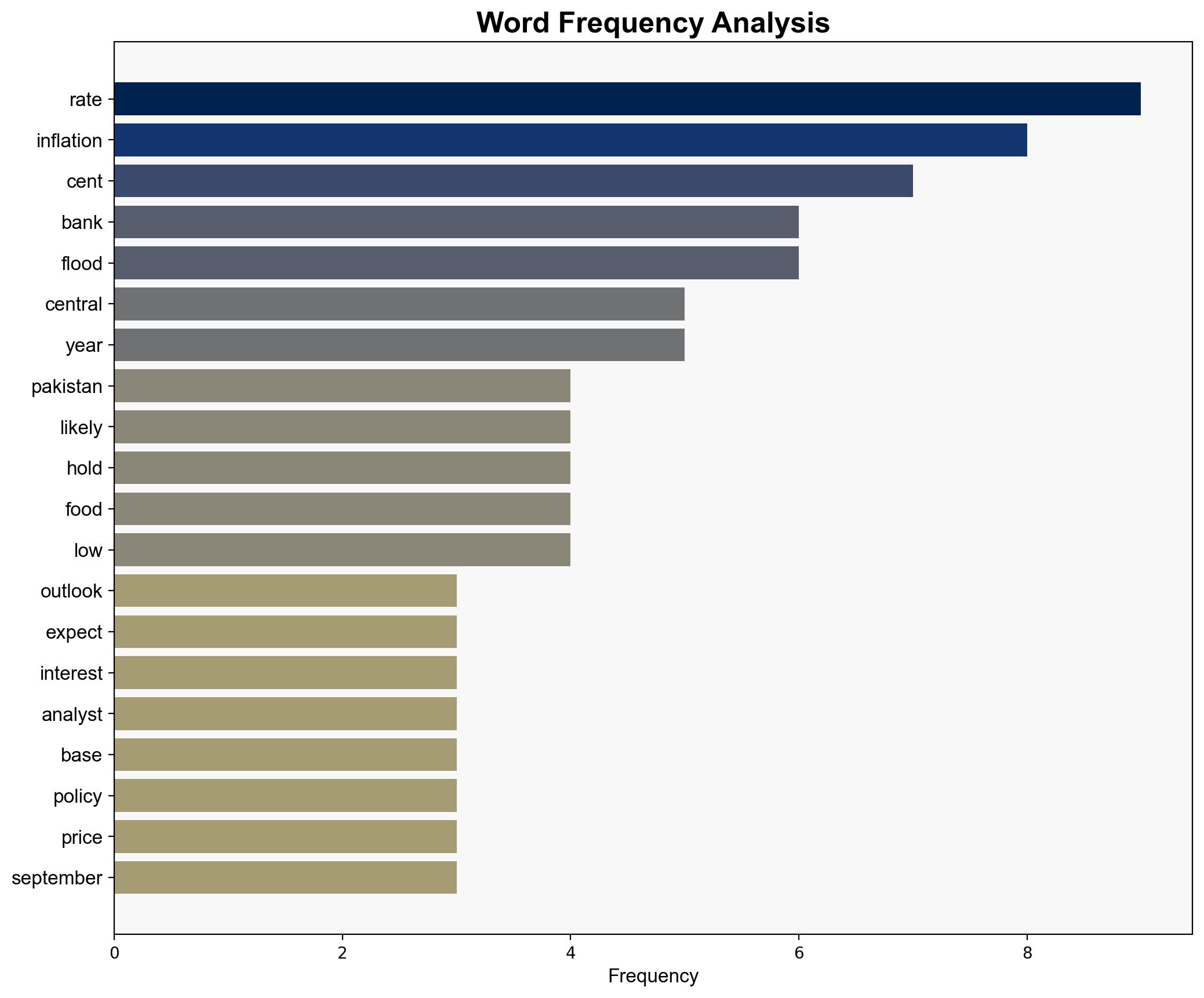

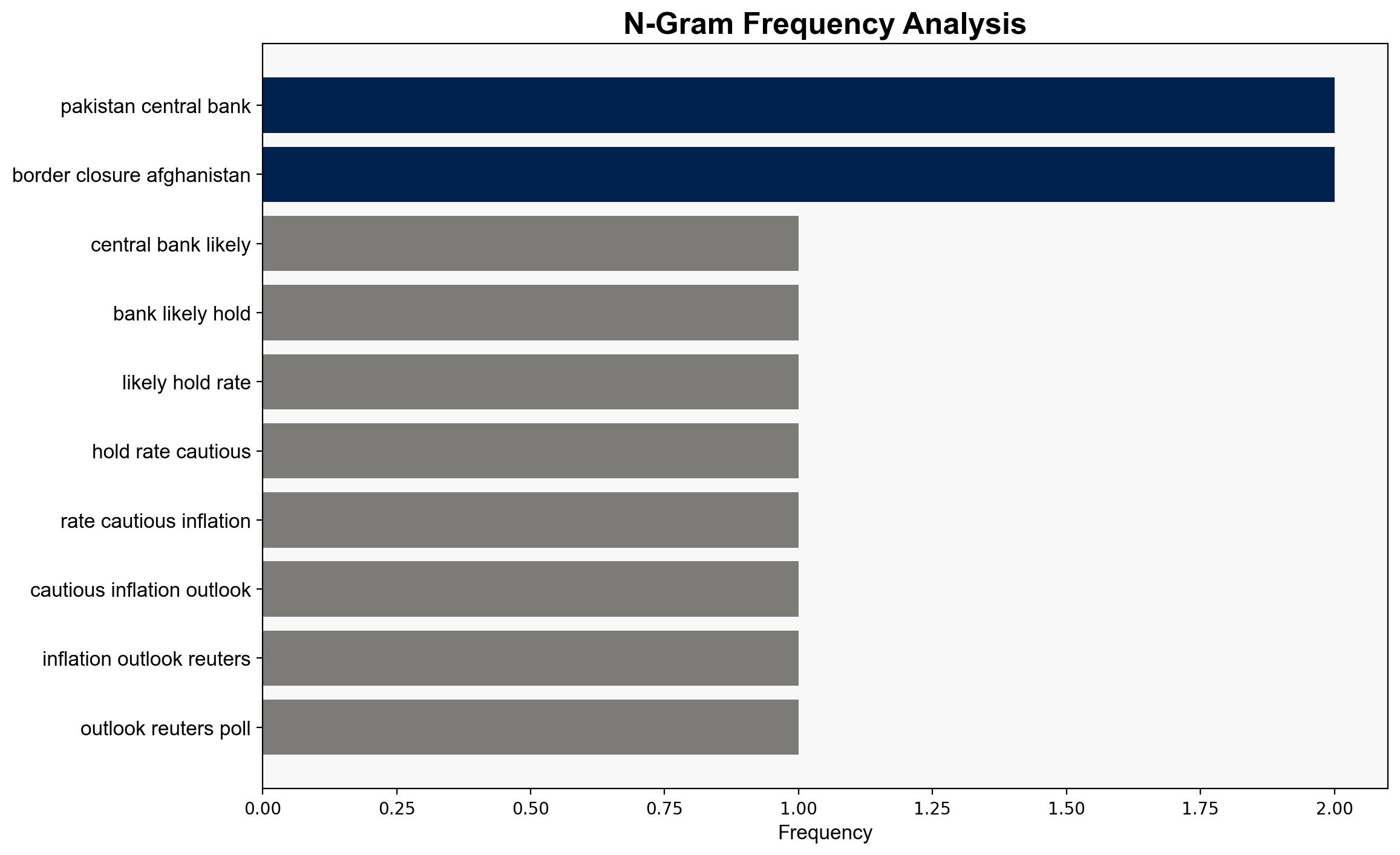

1. **Hypothesis A**: The SBP will hold the interest rate at 11% due to ongoing inflationary pressures from flood-induced food shortages and trade disruptions with Afghanistan.

– **Supporting Evidence**: Recent floods have damaged crops, increasing food prices. The closure of the Afghanistan border has disrupted trade, exacerbating inflation.

– **Structured Analytic Technique**: Using ACH 2.0, the evidence strongly supports this hypothesis, given the direct impact of these factors on inflation.

2. **Hypothesis B**: The SBP may consider a rate cut if inflationary pressures subside due to a low base effect and improving global oil prices.

– **Supporting Evidence**: Analysts suggest that easing inflation in early 2024 and low global oil prices could provide room for a rate cut.

– **Structured Analytic Technique**: Bayesian Scenario Modeling indicates a lower probability for this hypothesis, as current inflationary pressures are more immediate and impactful.

3. Key Assumptions and Red Flags

– **Assumptions**: Hypothesis A assumes that the impact of floods and border closures will persist, maintaining upward pressure on inflation.

– **Red Flags**: Potential cognitive bias in overestimating the duration of flood impacts. Lack of data on alternative trade routes or government interventions to mitigate food shortages.

– **Blind Spots**: Possible underestimation of the government’s ability to stabilize prices through subsidies or imports.

4. Implications and Strategic Risks

– **Economic Risks**: Prolonged inflation could erode purchasing power and destabilize the economy.

– **Geopolitical Risks**: Continued border tensions with Afghanistan could exacerbate trade disruptions.

– **Cascading Threats**: Inflation could lead to civil unrest if not managed effectively, impacting national stability.

5. Recommendations and Outlook

- Monitor inflation indicators and geopolitical developments to anticipate policy shifts.

- Scenario Projections:

– **Best Case**: Inflation eases due to effective government interventions, allowing for a rate cut.

– **Worst Case**: Inflation worsens, necessitating further monetary tightening.

– **Most Likely**: The SBP maintains the current rate while closely monitoring inflation trends. - Encourage diplomatic engagement to resolve border issues with Afghanistan, reducing trade disruptions.

6. Key Individuals and Entities

– Fawad Basir

– Amreen Soorani

7. Thematic Tags

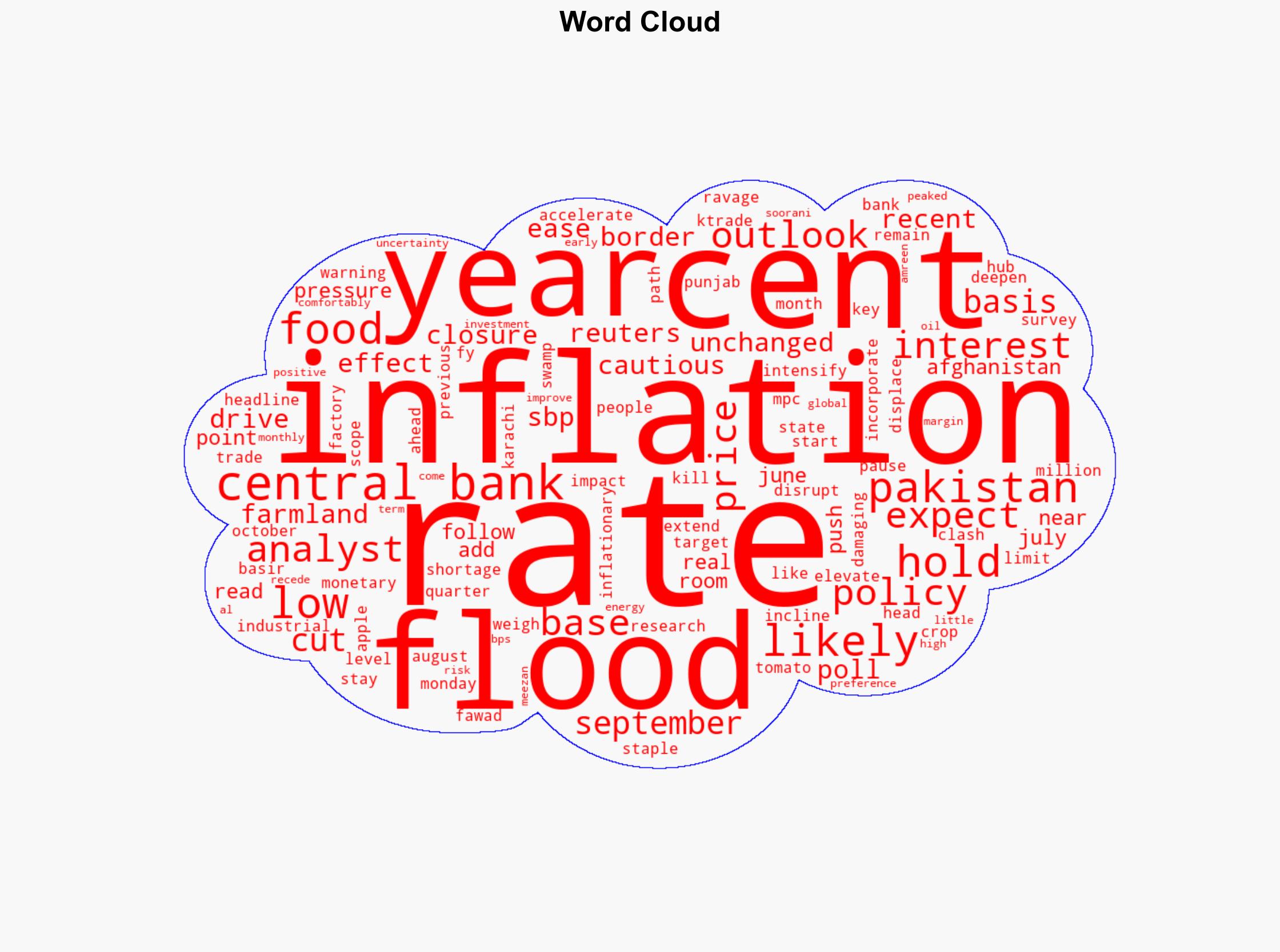

national security threats, economic stability, regional focus, inflation management