Paying Your Taxes Used to Be Patriotic – Time

Published on: 2025-04-15

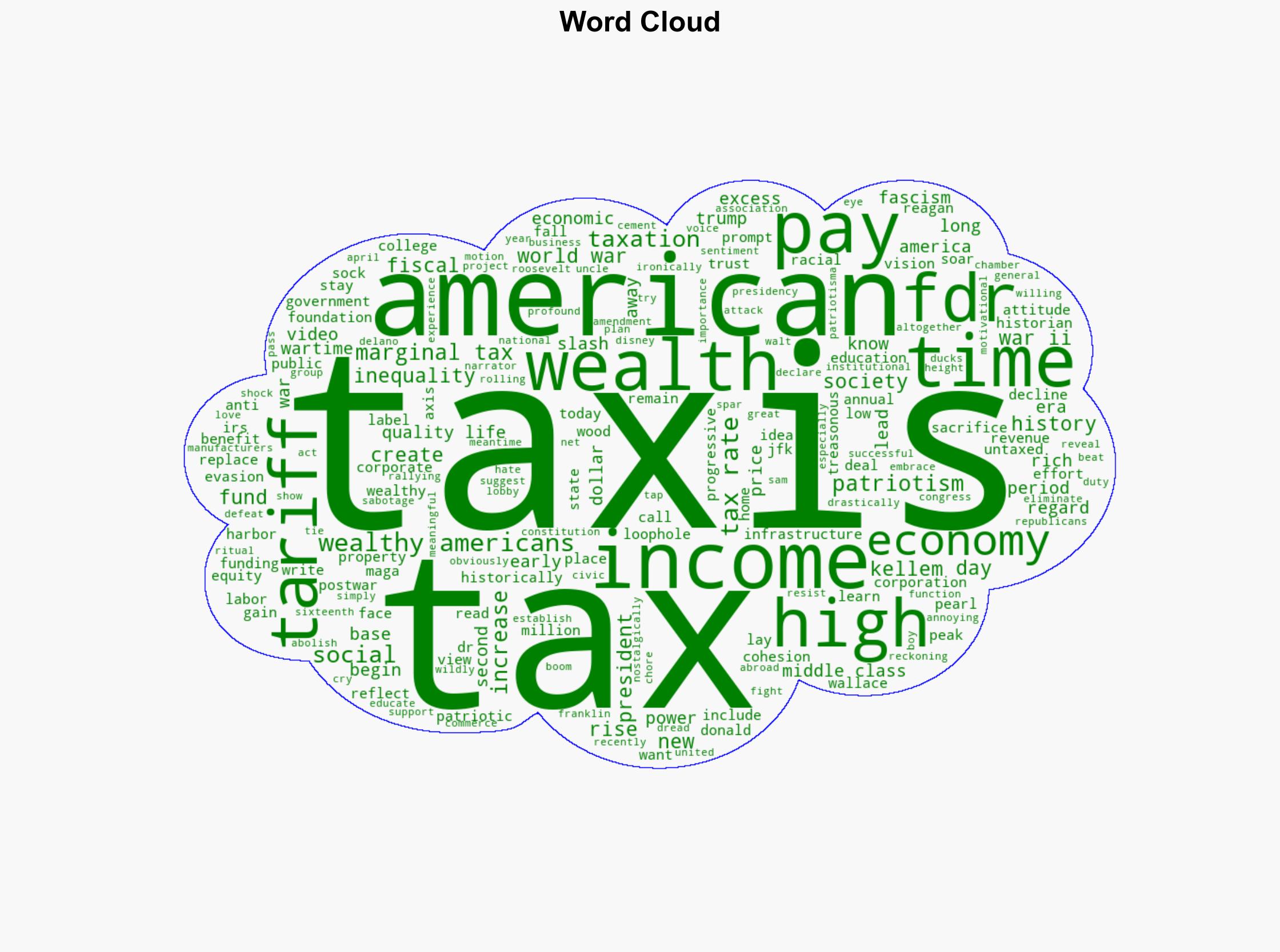

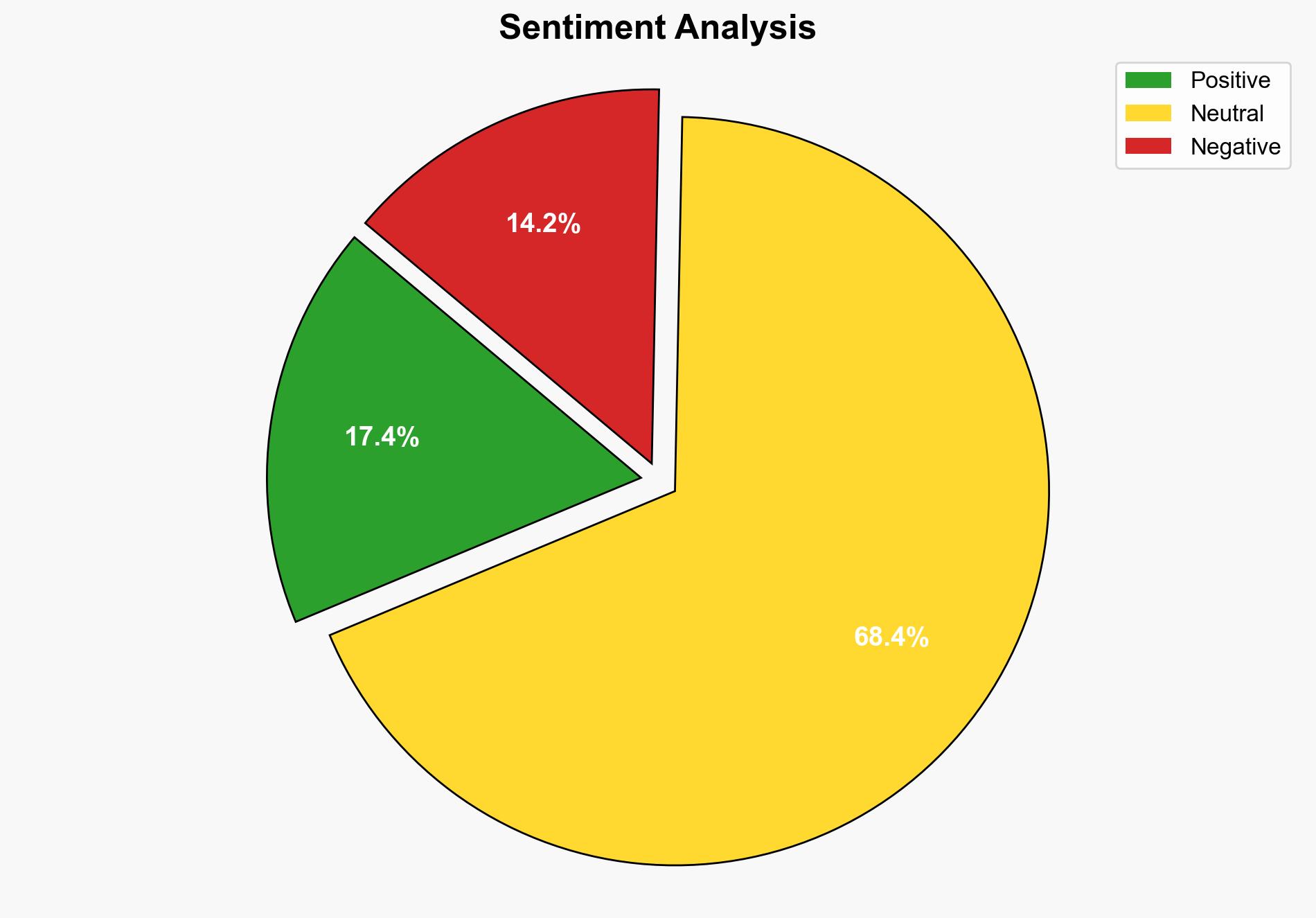

Intelligence Report: Paying Your Taxes Used to Be Patriotic – Time

1. BLUF (Bottom Line Up Front)

The report highlights a shift in American attitudes toward taxation, from a historically patriotic duty to a contemporary source of contention. The rise of anti-tax sentiment, particularly among certain political groups, poses potential risks to fiscal policy and social cohesion. Key recommendations include monitoring political developments and preparing for potential policy shifts that could impact economic stability.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

General Analysis

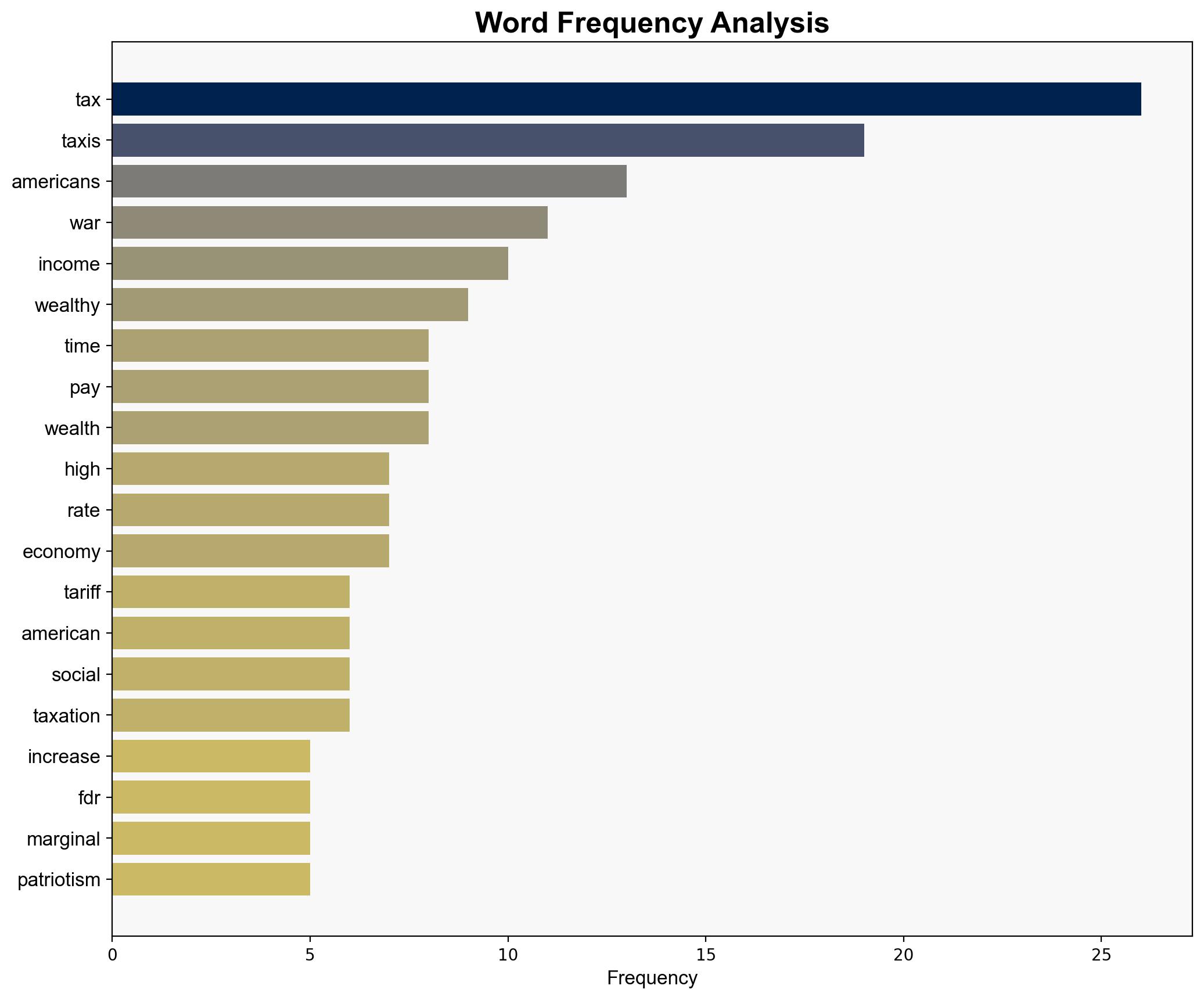

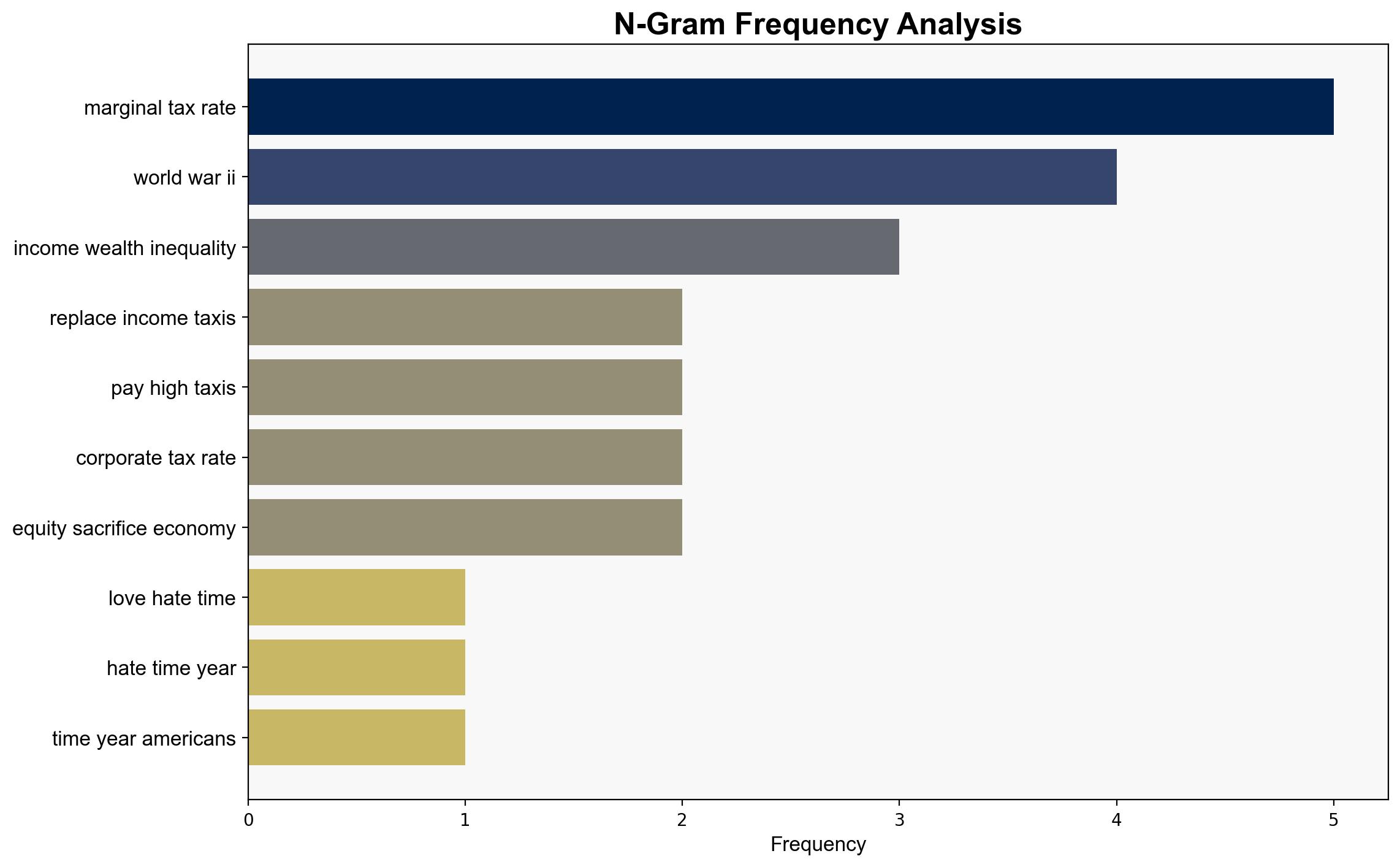

Historically, taxation in the United States has been viewed as a civic duty, particularly during times of national crisis, such as World War II. During this period, high tax rates were accepted as necessary for national security and economic stability. The current political climate, however, reflects a growing anti-tax sentiment, with proposals to eliminate income taxes and reduce corporate tax rates. This shift is influenced by political figures and movements advocating for reduced government intervention and lower taxes.

3. Implications and Strategic Risks

The increasing anti-tax sentiment and proposed policy changes could lead to significant implications for national security and economic interests. Reduced tax revenues may impact government funding for essential services and defense, potentially compromising regional stability. Additionally, the perception of taxation as a burden rather than a civic duty could erode institutional trust and social cohesion.

4. Recommendations and Outlook

Recommendations:

- Monitor political developments and rhetoric related to taxation to anticipate potential policy changes.

- Engage in public awareness campaigns to highlight the historical importance of taxation for national security and social welfare.

- Consider regulatory adjustments to ensure equitable tax contributions across different income groups.

Outlook:

Best-case scenario: A balanced approach to taxation is maintained, ensuring adequate government funding while addressing public concerns about tax burdens.

Worst-case scenario: Drastic tax cuts lead to significant reductions in government services and increased national debt.

Most likely outcome: Incremental policy adjustments with ongoing debates about the role of taxation in society.

5. Key Individuals and Entities

The report mentions significant individuals such as Donald Trump and Franklin Delano Roosevelt, as well as entities like the National Association of Manufacturers and the United States Chamber of Commerce. These figures and organizations have historically influenced and continue to impact the discourse on taxation in the United States.