Peter Thiels Founders Fund makes bold 200 million investment in Bitcoin and Ethereum – Techpinions.com

Published on: 2025-08-23

Intelligence Report: Peter Thiels Founders Fund makes bold 200 million investment in Bitcoin and Ethereum – Techpinions.com

1. BLUF (Bottom Line Up Front)

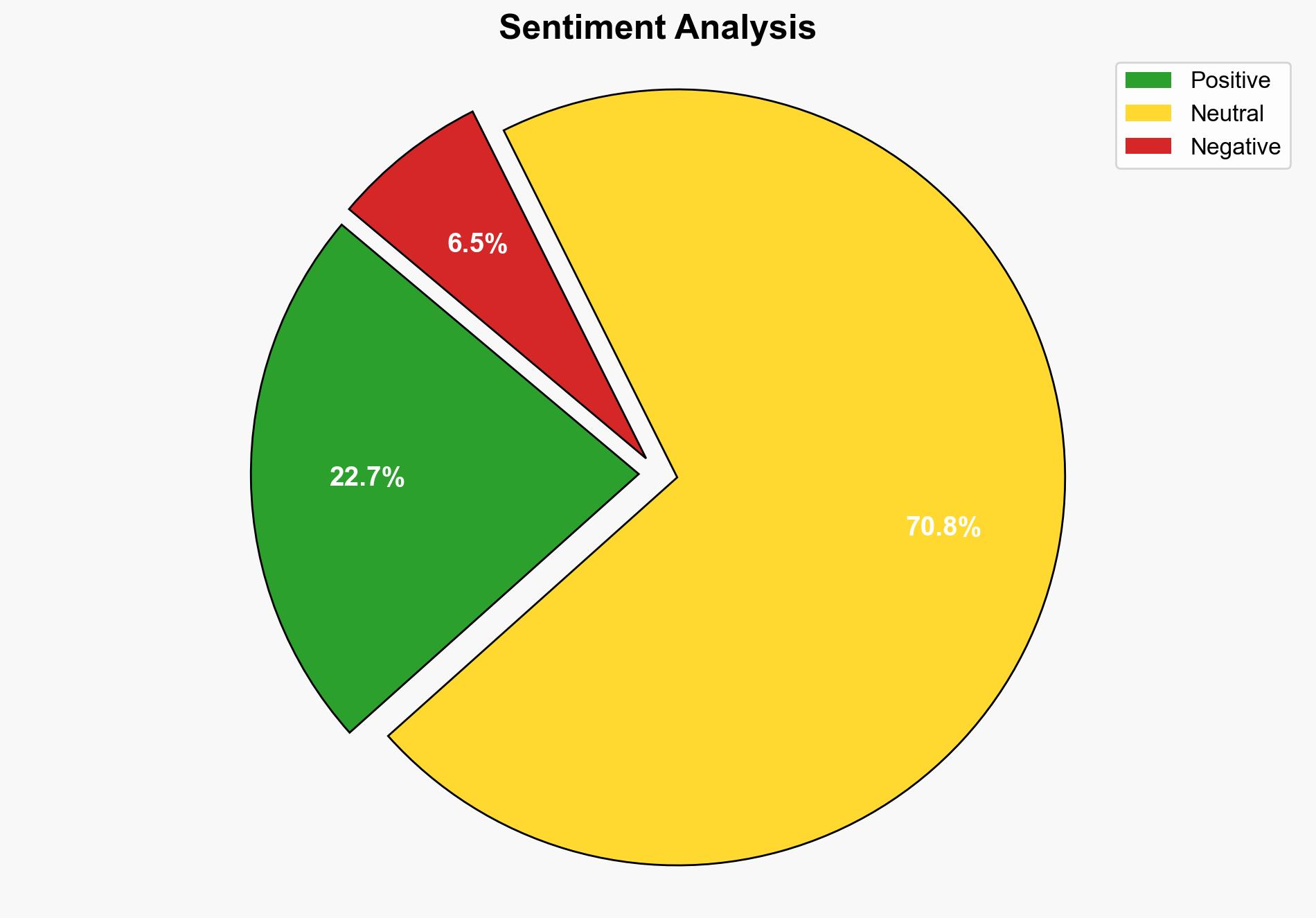

The Founders Fund’s $200 million investment in Bitcoin and Ethereum signifies a strategic positioning in the digital asset market, potentially indicating a broader institutional adoption of cryptocurrencies. The most supported hypothesis is that this move is a calculated bet on the long-term growth and integration of blockchain technology in financial markets. Confidence level: Moderate. Recommended action: Monitor Ethereum’s network developments and regulatory changes closely, as these will significantly impact the investment’s success.

2. Competing Hypotheses

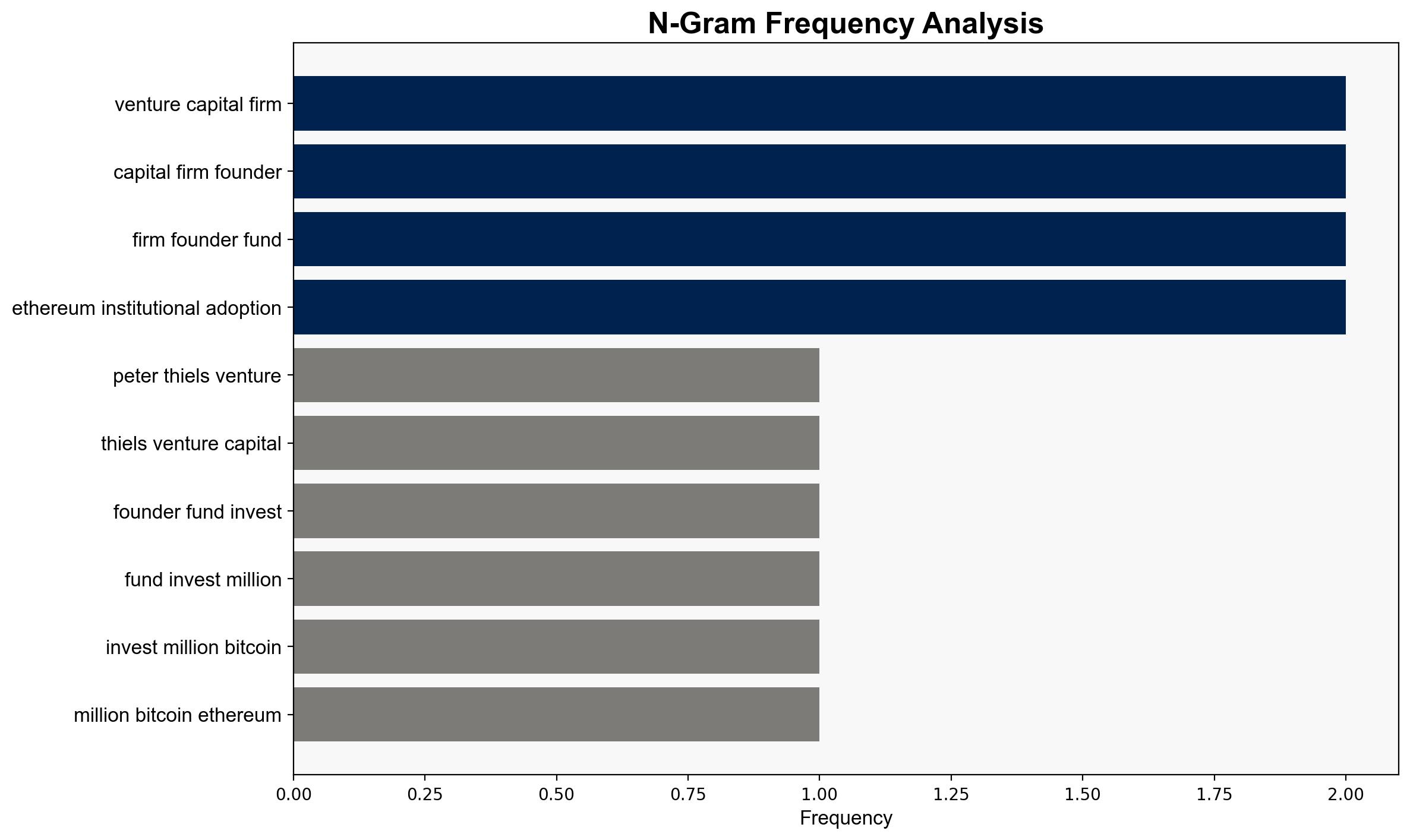

1. **Hypothesis A**: The Founders Fund’s investment is a strategic move to capitalize on the anticipated long-term growth of blockchain technology and its integration into traditional financial systems.

2. **Hypothesis B**: The investment is primarily speculative, driven by short-term market dynamics and the recent surge in cryptocurrency values, rather than a fundamental belief in blockchain’s future role.

Using ACH 2.0, Hypothesis A is better supported due to the involvement of key figures like Peter Thiel, who has a history of advocating for digital assets, and the strategic nature of the investment in Ethereum, which is increasingly used for financial products.

3. Key Assumptions and Red Flags

– **Assumptions**: The investment assumes continued growth and adoption of blockchain technology and that regulatory environments will become more favorable.

– **Red Flags**: Potential overestimation of Ethereum’s ability to handle large-scale financial activities and underestimation of regulatory risks.

– **Blind Spots**: Lack of detailed information on the Founders Fund’s risk management strategies and how they plan to mitigate potential losses.

4. Implications and Strategic Risks

– **Economic**: Increased institutional investment could stabilize cryptocurrency markets, but also lead to greater volatility if large positions are liquidated.

– **Cyber**: As Ethereum’s network activity grows, it may become a more attractive target for cyberattacks, including phishing and network spam.

– **Geopolitical**: Regulatory responses could vary significantly across regions, impacting the global adoption of cryptocurrencies.

– **Psychological**: The investment may influence public perception, either bolstering confidence in digital assets or raising concerns about market manipulation.

5. Recommendations and Outlook

- Monitor regulatory developments closely, particularly those affecting Ethereum and Bitcoin.

- Engage with blockchain technology experts to better understand potential technological risks and advancements.

- Scenario-based projections:

- Best: Regulatory clarity leads to widespread adoption of Ethereum-based financial products.

- Worst: Regulatory crackdowns and cyber threats undermine confidence in cryptocurrencies.

- Most Likely: Gradual increase in institutional adoption with periodic regulatory challenges.

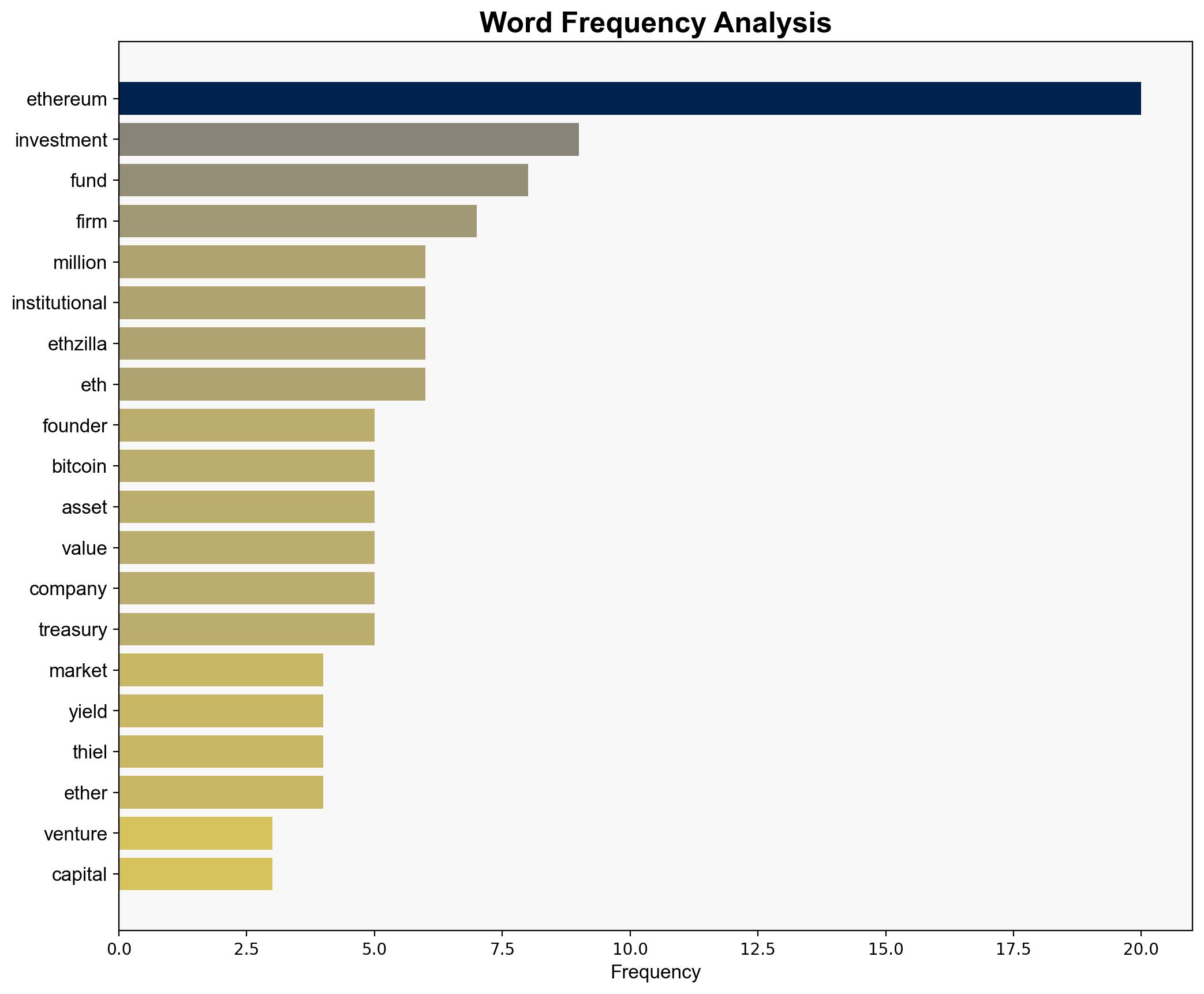

6. Key Individuals and Entities

– Peter Thiel

– Joey Krug

– Ethzilla

– Pantera Capital

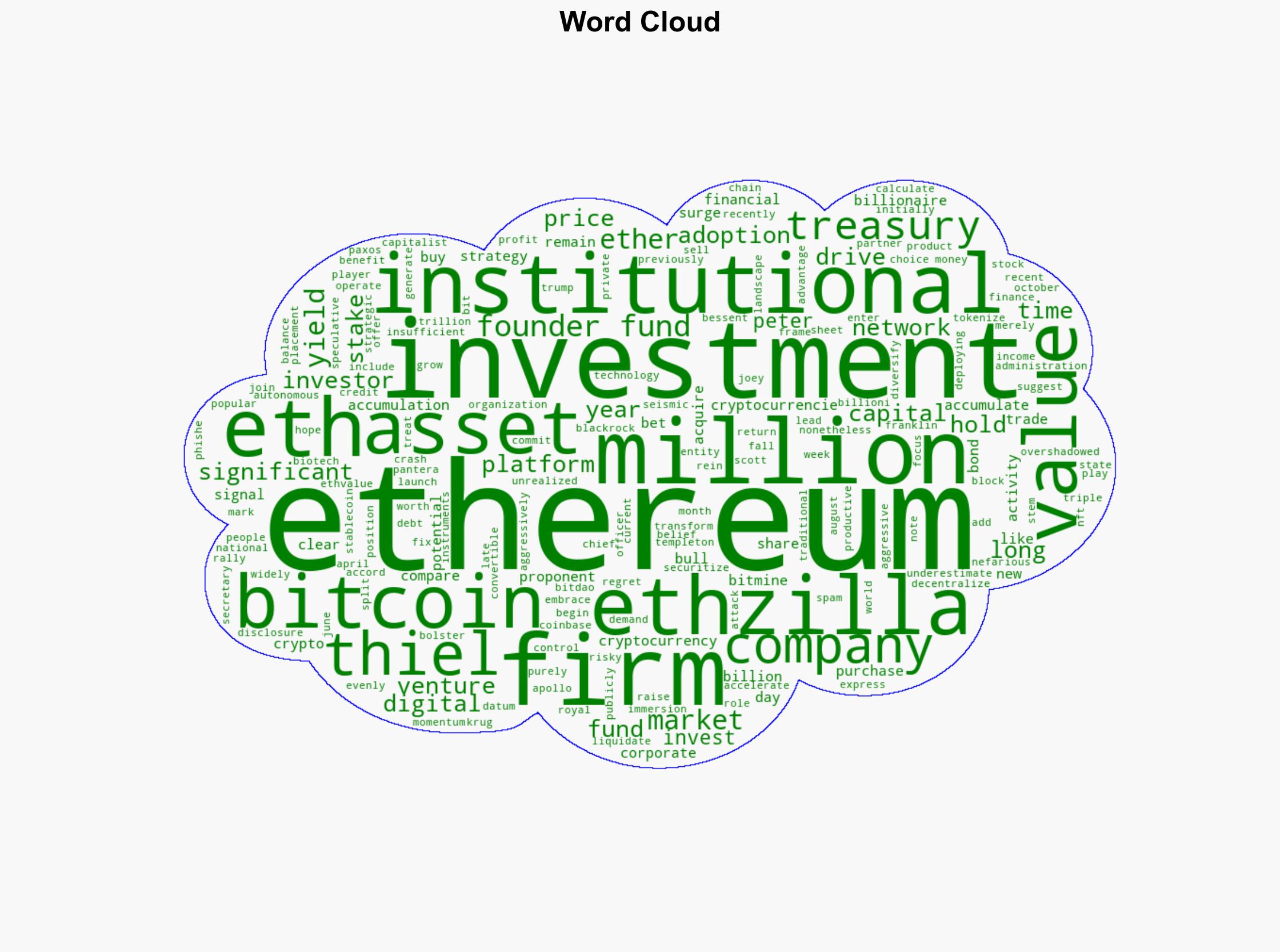

7. Thematic Tags

national security threats, cybersecurity, financial technology, blockchain adoption