Pine Labs IPO opens today Check GMP subscription review and other details – The Times of India

Published on: 2025-11-07

Intelligence Report: Pine Labs IPO opens today Check GMP subscription review and other details – The Times of India

1. BLUF (Bottom Line Up Front)

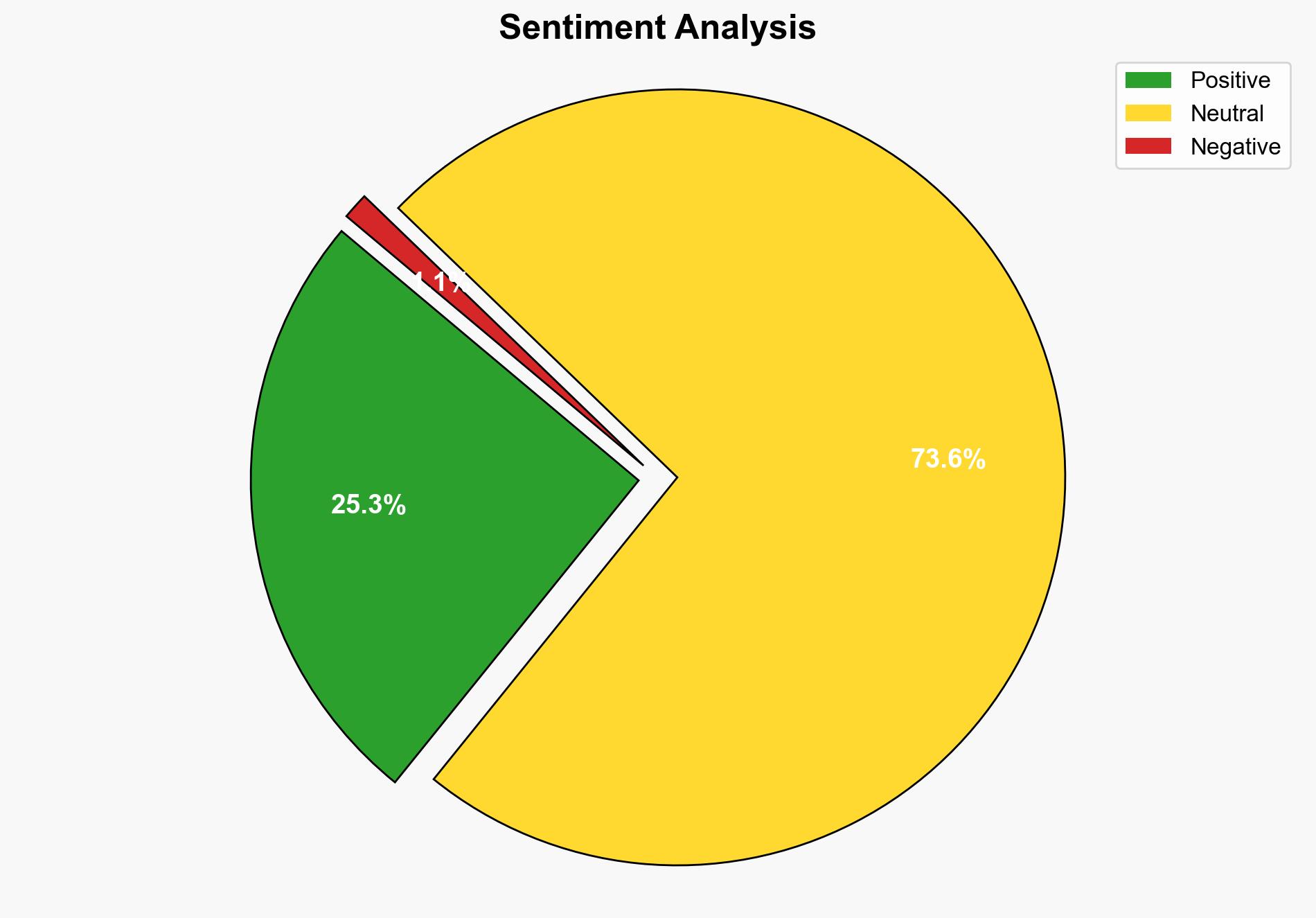

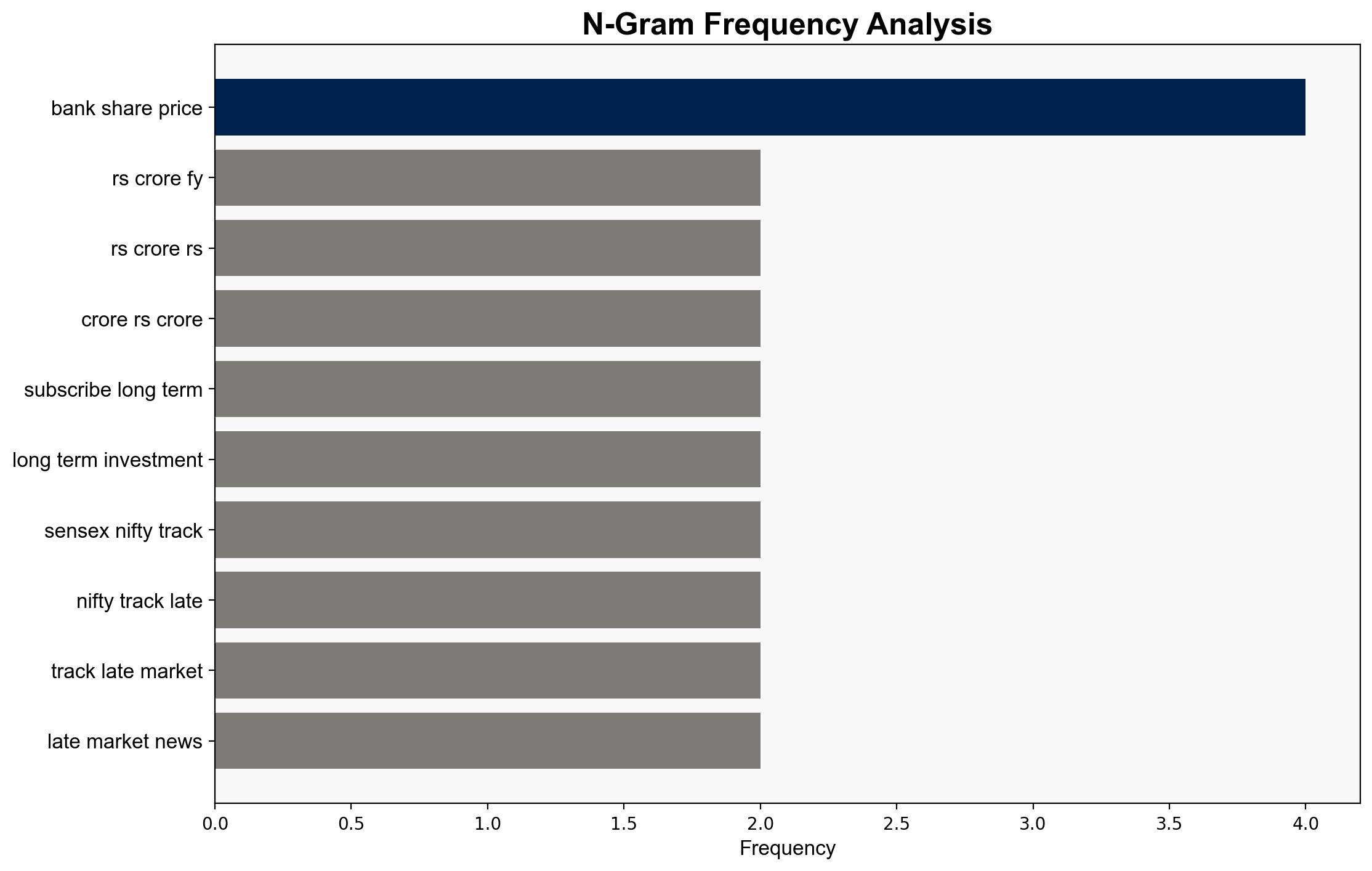

The Pine Labs IPO represents a strategic opportunity for investors, with a moderate confidence level in its long-term growth potential. The hypothesis that Pine Labs will capitalize on the expanding digital payment market in India and Southeast Asia is better supported. Recommended action includes monitoring the IPO’s performance and evaluating the company’s ability to sustain growth and profitability.

2. Competing Hypotheses

1. **Hypothesis A**: Pine Labs will successfully leverage its strong market position and partnerships to achieve sustained growth and profitability, capitalizing on the burgeoning digital payment landscape.

2. **Hypothesis B**: Pine Labs may face challenges in maintaining its growth trajectory due to increased competition, regulatory changes, or operational inefficiencies, potentially leading to underperformance post-IPO.

3. Key Assumptions and Red Flags

– **Assumptions**:

– The digital payment market will continue to expand at the projected rate.

– Pine Labs’ partnerships with major brands will remain stable and beneficial.

– The company’s operational efficiencies will continue to improve.

– **Red Flags**:

– Over-reliance on a few key partnerships could pose risks if they falter.

– The modest expected listing gain might indicate market skepticism.

– Potential regulatory changes in the fintech sector could impact operations.

4. Implications and Strategic Risks

– **Economic**: Successful IPO could enhance Pine Labs’ financial stability and market influence, but failure to meet growth expectations could deter future investments.

– **Cybersecurity**: As a fintech entity, Pine Labs must safeguard against cyber threats that could undermine trust and operational integrity.

– **Geopolitical**: Expansion in Southeast Asia and the Middle East requires navigating diverse regulatory environments and potential geopolitical tensions.

5. Recommendations and Outlook

- **Mitigate Risks**: Enhance cybersecurity measures and diversify partnerships to reduce dependency risks.

- **Exploit Opportunities**: Focus on expanding technological infrastructure to support growth and international expansion.

- **Scenario Projections**:

– **Best Case**: Pine Labs achieves high growth, leveraging its market position and partnerships, leading to significant shareholder returns.

– **Worst Case**: Regulatory hurdles and competitive pressures lead to stagnation or decline in market value.

– **Most Likely**: Moderate growth with incremental improvements in profitability and market share.

6. Key Individuals and Entities

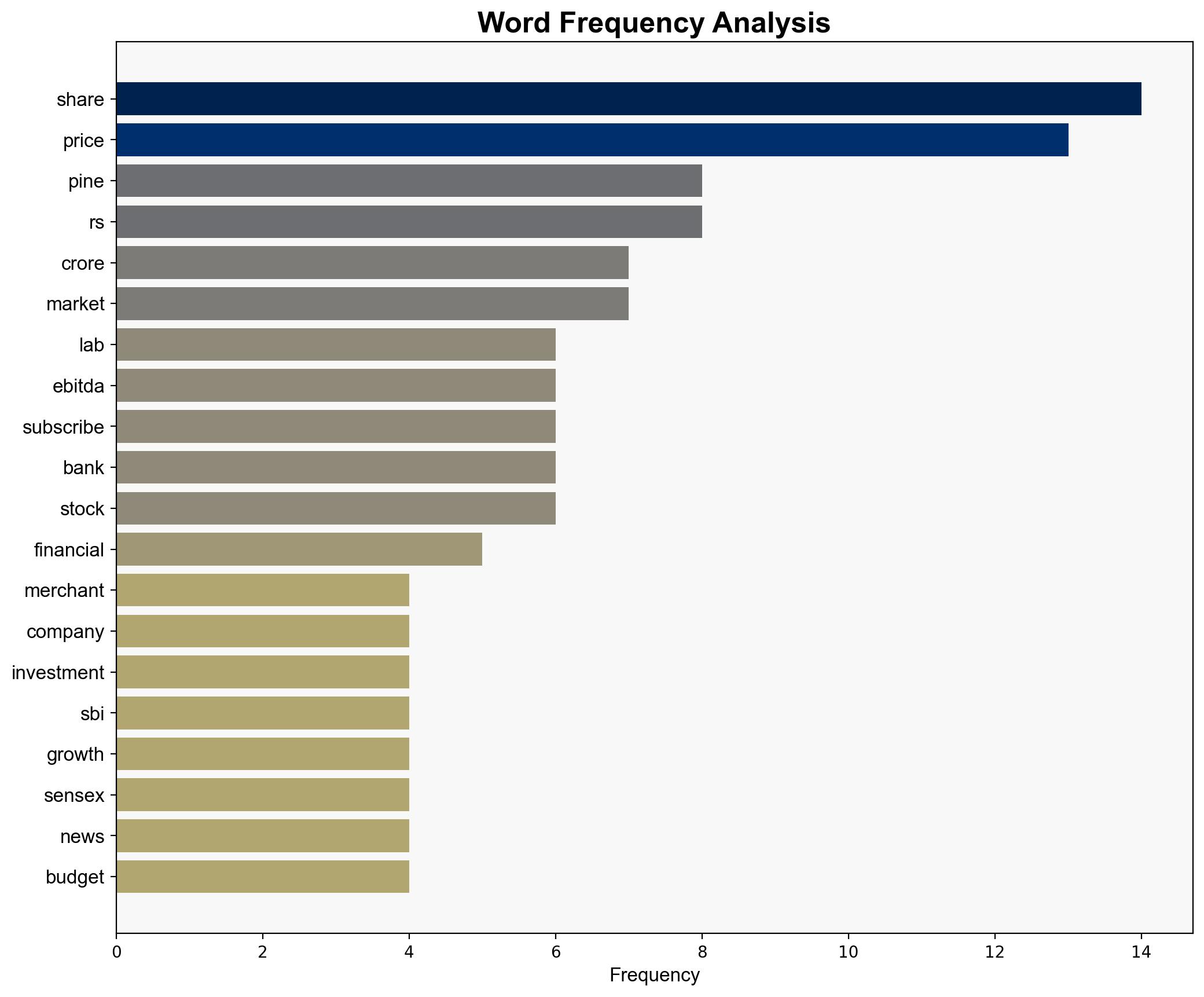

– Pine Labs

– Croma

– HDFC Bank

– LG Electronics

– Apollo Pharmacy

7. Thematic Tags

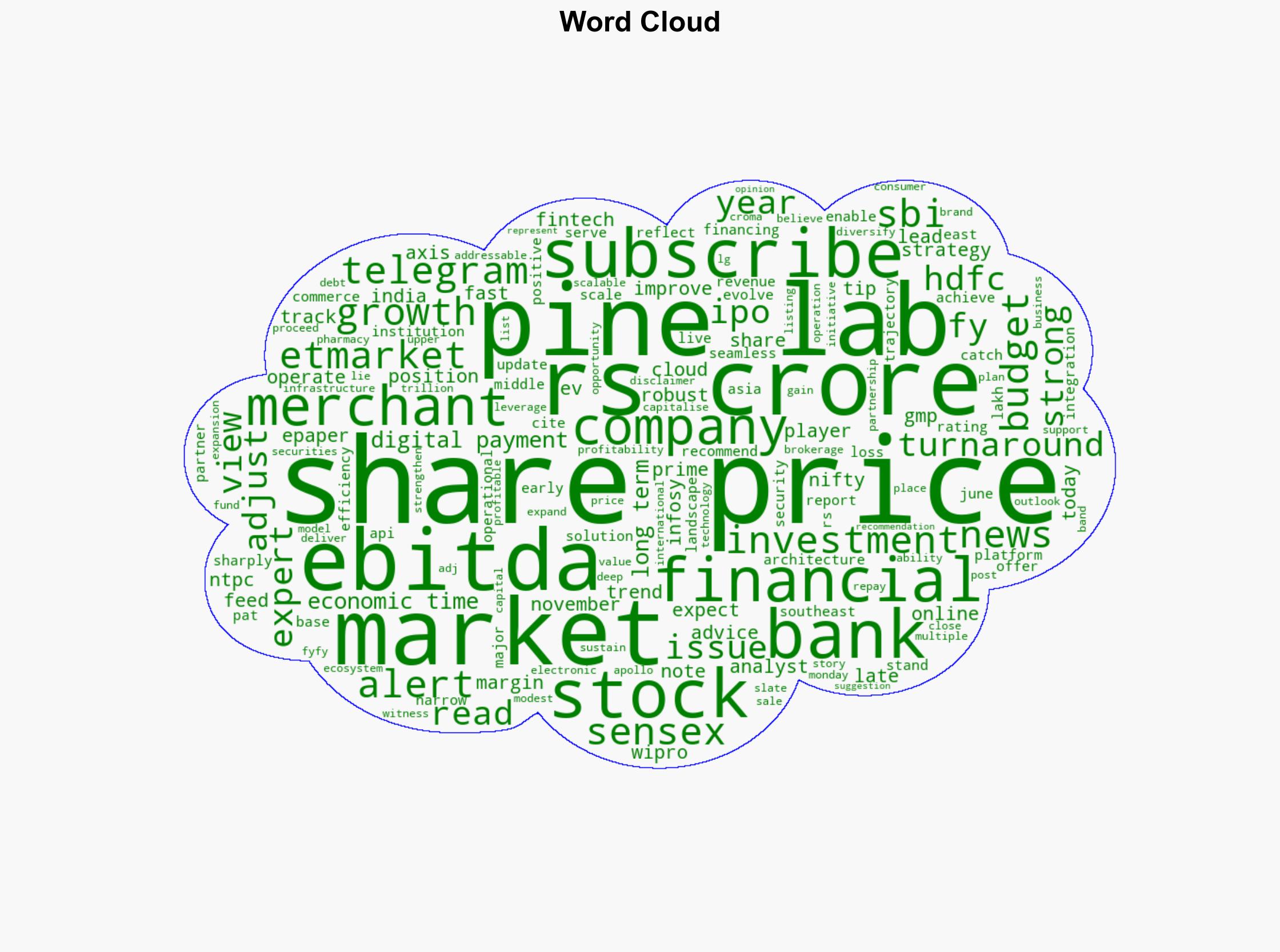

economic growth, fintech, digital payments, market expansion, investment strategy