Preparing Your Family Office For The Second Quarter Of 2025 – Forbes

Published on: 2025-04-28

Intelligence Report: Preparing Your Family Office For The Second Quarter Of 2025 – Forbes

1. BLUF (Bottom Line Up Front)

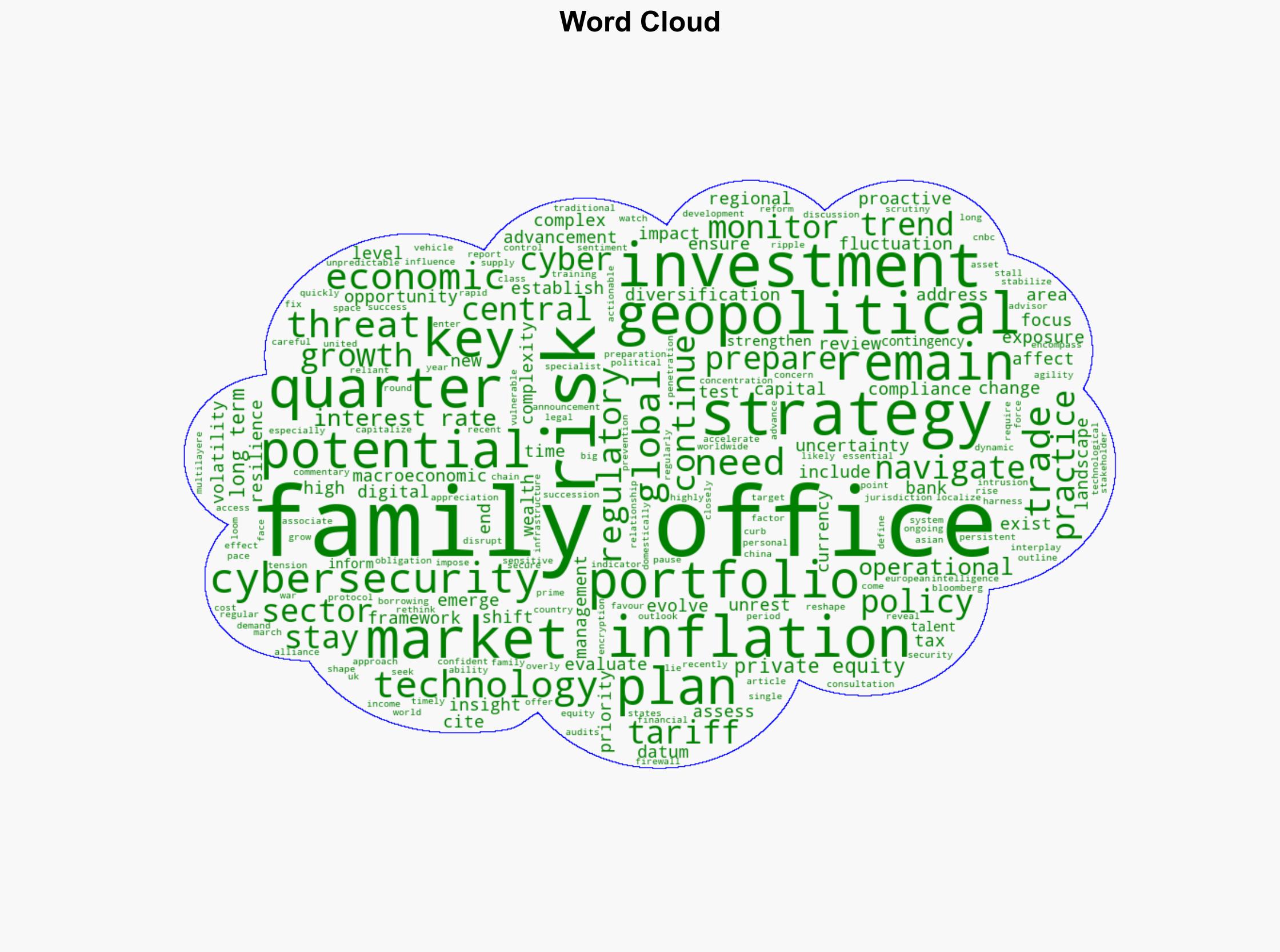

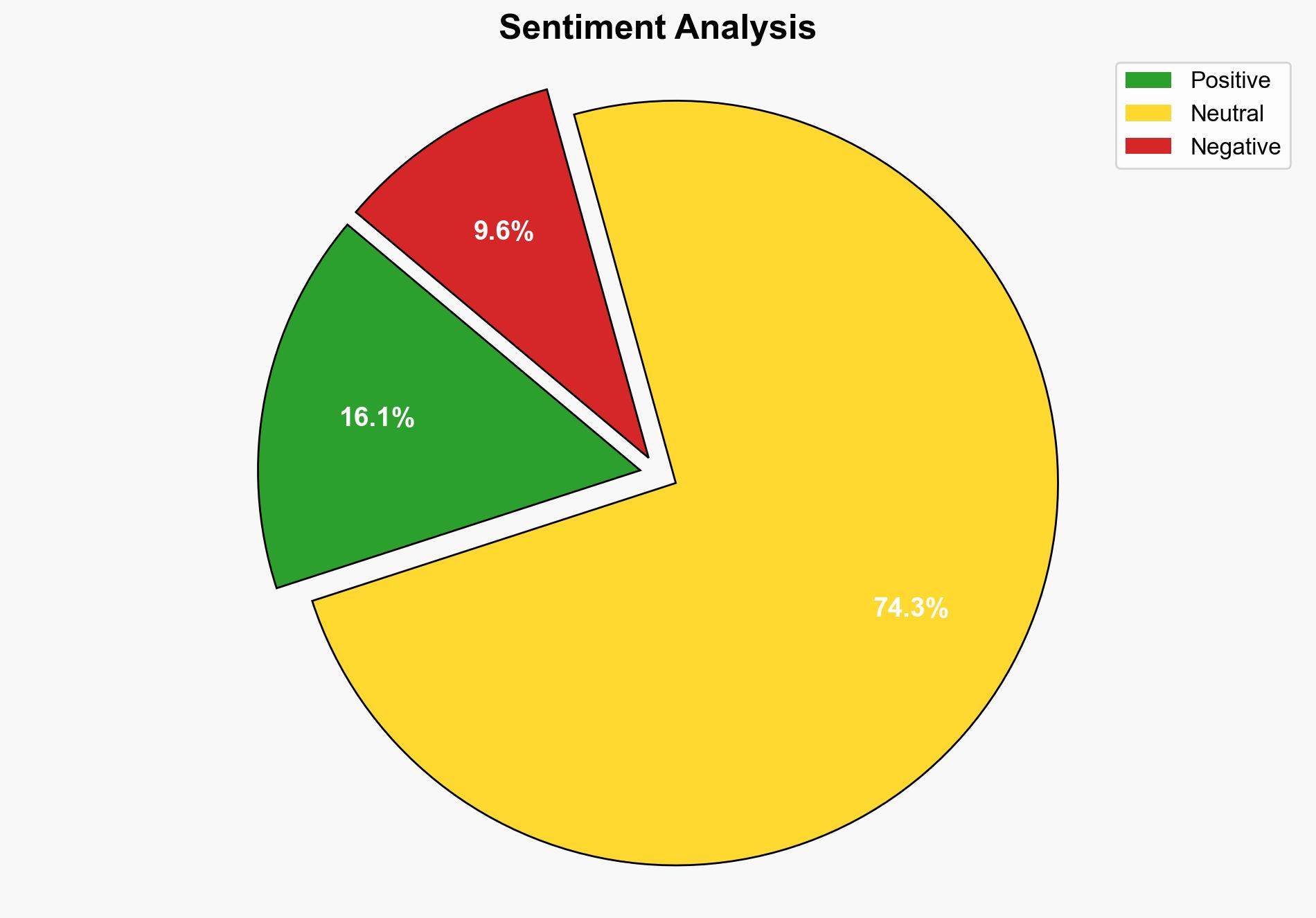

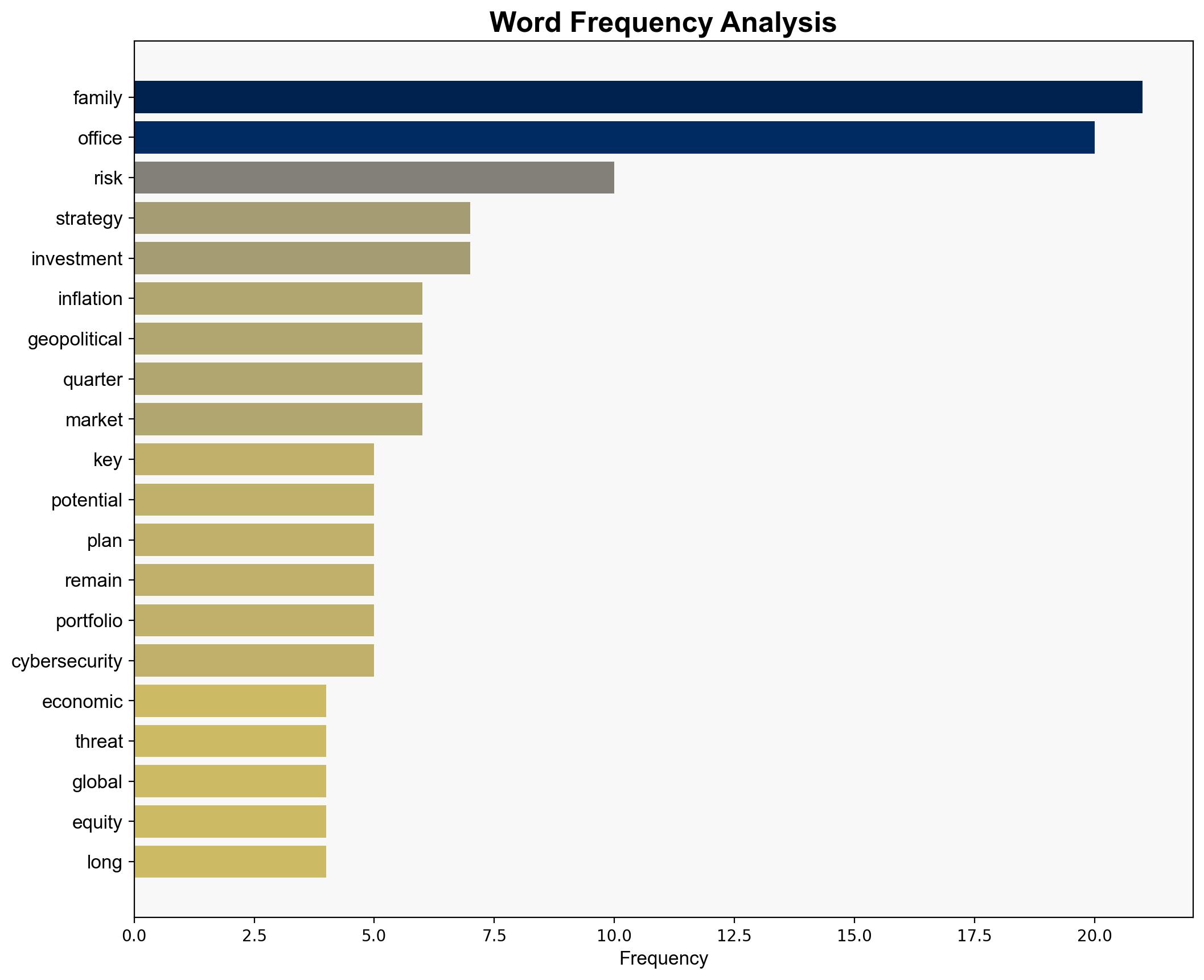

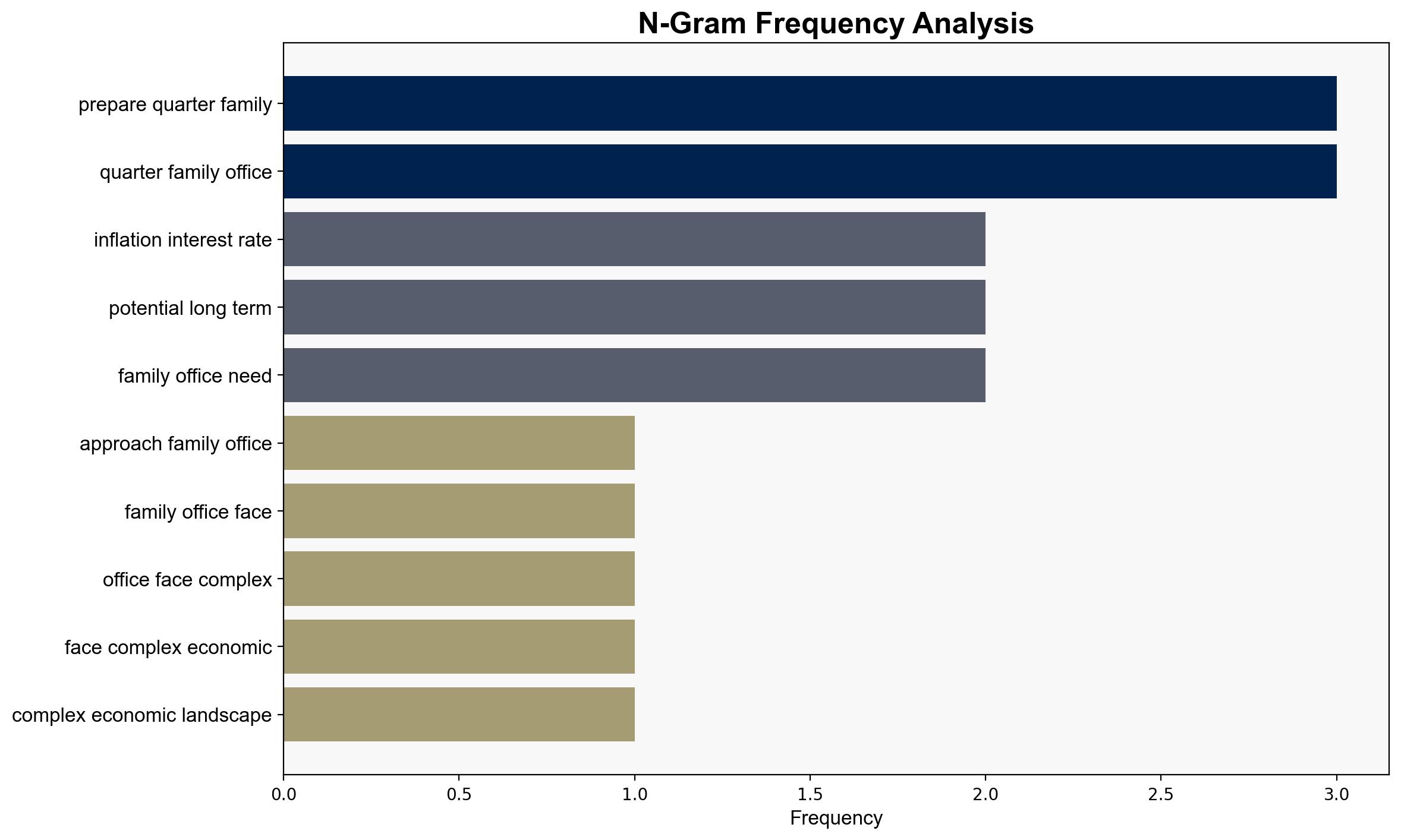

Family offices must prepare for a volatile economic landscape in Q2 2025, characterized by persistent inflation, regulatory changes, and cybersecurity threats. Strategic agility and specialist insights are crucial for navigating these challenges. Key recommendations include monitoring central bank policies, engaging in proactive legal and tax consultations, diversifying investments, and enhancing cybersecurity measures.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Analysis of Competing Hypotheses (ACH)

This technique was used to evaluate potential causes of cyber incidents affecting family offices. The analysis suggests that inadequate cybersecurity protocols are the most plausible explanation for vulnerabilities, rather than external geopolitical factors.

SWOT Analysis

Strengths include established investment portfolios and experienced advisory teams. Weaknesses involve underinvestment in operational technology. Opportunities lie in emerging markets and private equity, while threats encompass regulatory changes and geopolitical tensions.

Indicators Development

Key indicators to monitor include central bank interest rate announcements, regulatory policy updates, and signs of cyber threats such as phishing campaigns and unauthorized network access attempts.

3. Implications and Strategic Risks

The interplay of economic, regulatory, and cyber dimensions poses significant risks. Inflation and interest rate fluctuations may impact investment returns and borrowing costs. Regulatory changes could alter compliance obligations. Cybersecurity threats remain a critical vulnerability, with potential for significant financial and reputational damage.

4. Recommendations and Outlook

- Enhance cybersecurity infrastructure with advanced firewalls, intrusion prevention systems, and regular audits.

- Engage in proactive legal and tax consultations to navigate regulatory changes.

- Diversify investment portfolios to mitigate geopolitical and market volatility risks.

- Monitor central bank policies closely to anticipate economic shifts.

- Scenario-based projections suggest a best-case scenario of stabilized inflation and growth, a worst-case scenario of heightened geopolitical tensions, and a most likely scenario of moderate economic fluctuations with ongoing cyber threats.

5. Key Individuals and Entities

No specific individuals are mentioned in the source text.

6. Thematic Tags

(‘economic volatility, cybersecurity, regulatory changes, investment strategies’, ‘cybersecurity’, ‘regulatory changes’, ‘investment strategies’)