Progress on share buyback programme

Published on: 2025-11-25

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Progress on Share Buyback Programme

1. BLUF (Bottom Line Up Front)

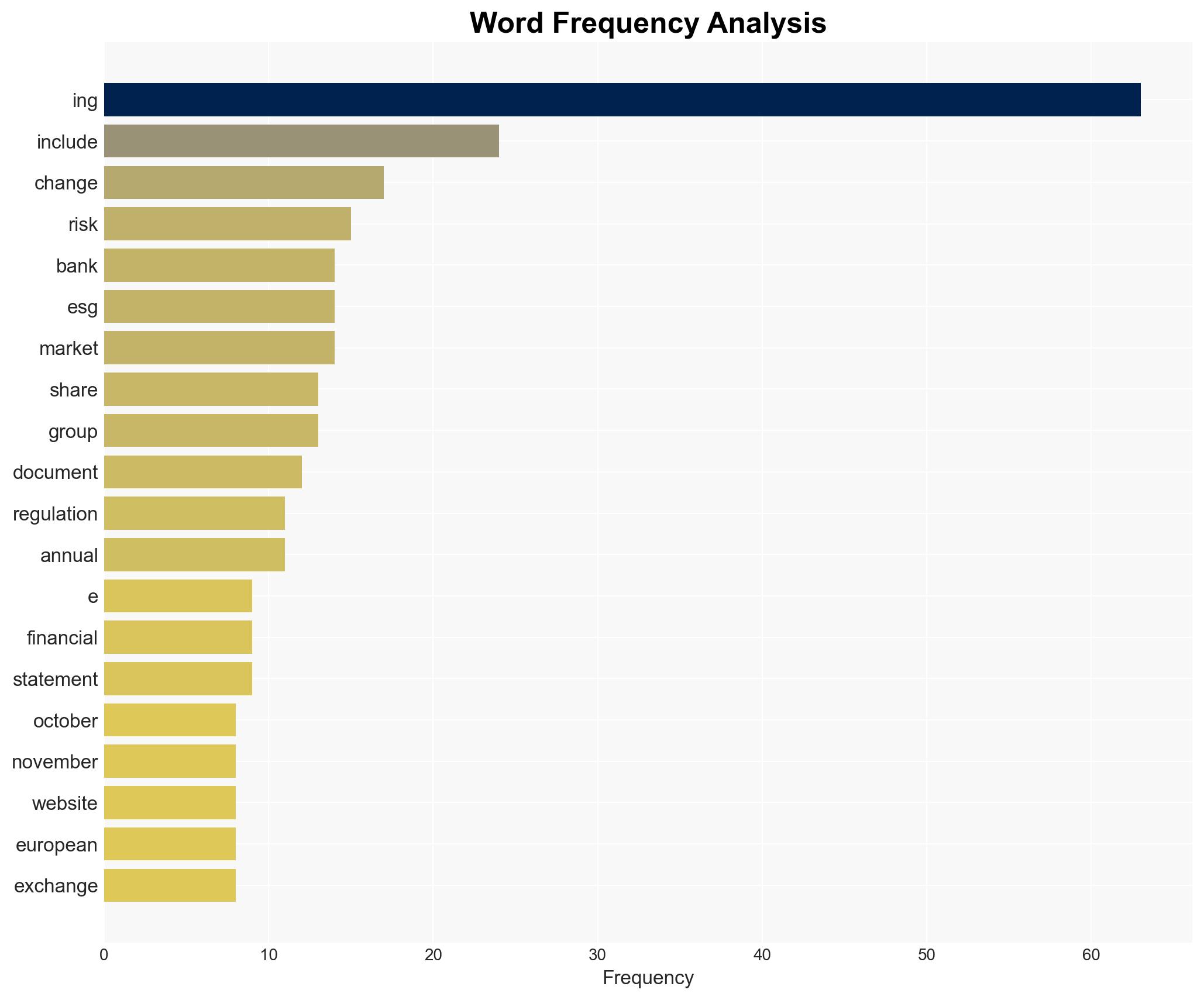

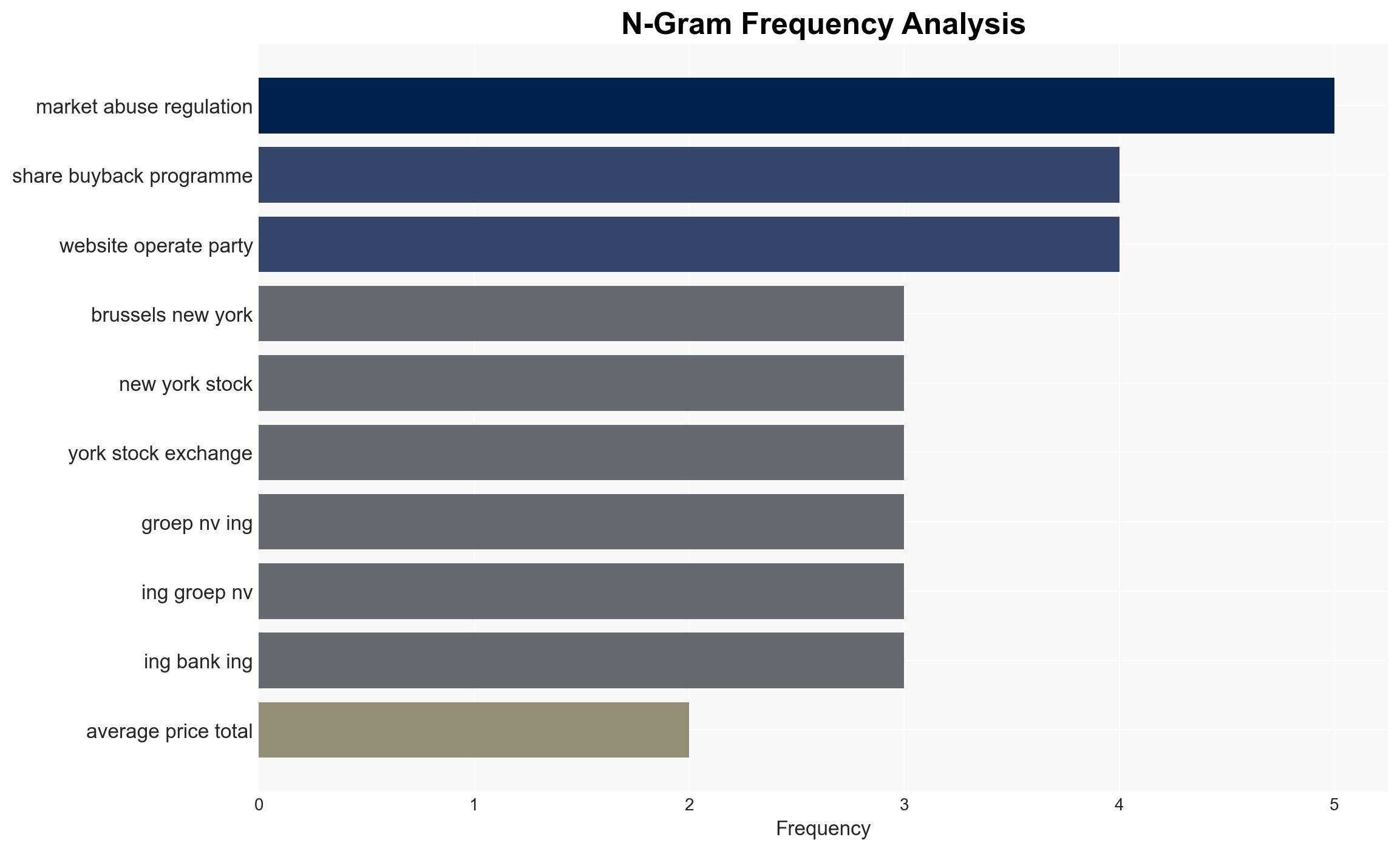

With a moderate confidence level, the most supported hypothesis is that ING’s share buyback programme is primarily aimed at increasing shareholder value and optimizing capital structure amidst favorable market conditions. Recommended action includes monitoring for potential market disruptions and assessing the impact on ING’s financial stability and ESG commitments.

2. Competing Hypotheses

Hypothesis 1: ING’s share buyback programme is a strategic move to enhance shareholder value by reducing the number of outstanding shares, thereby increasing earnings per share (EPS) and optimizing capital structure.

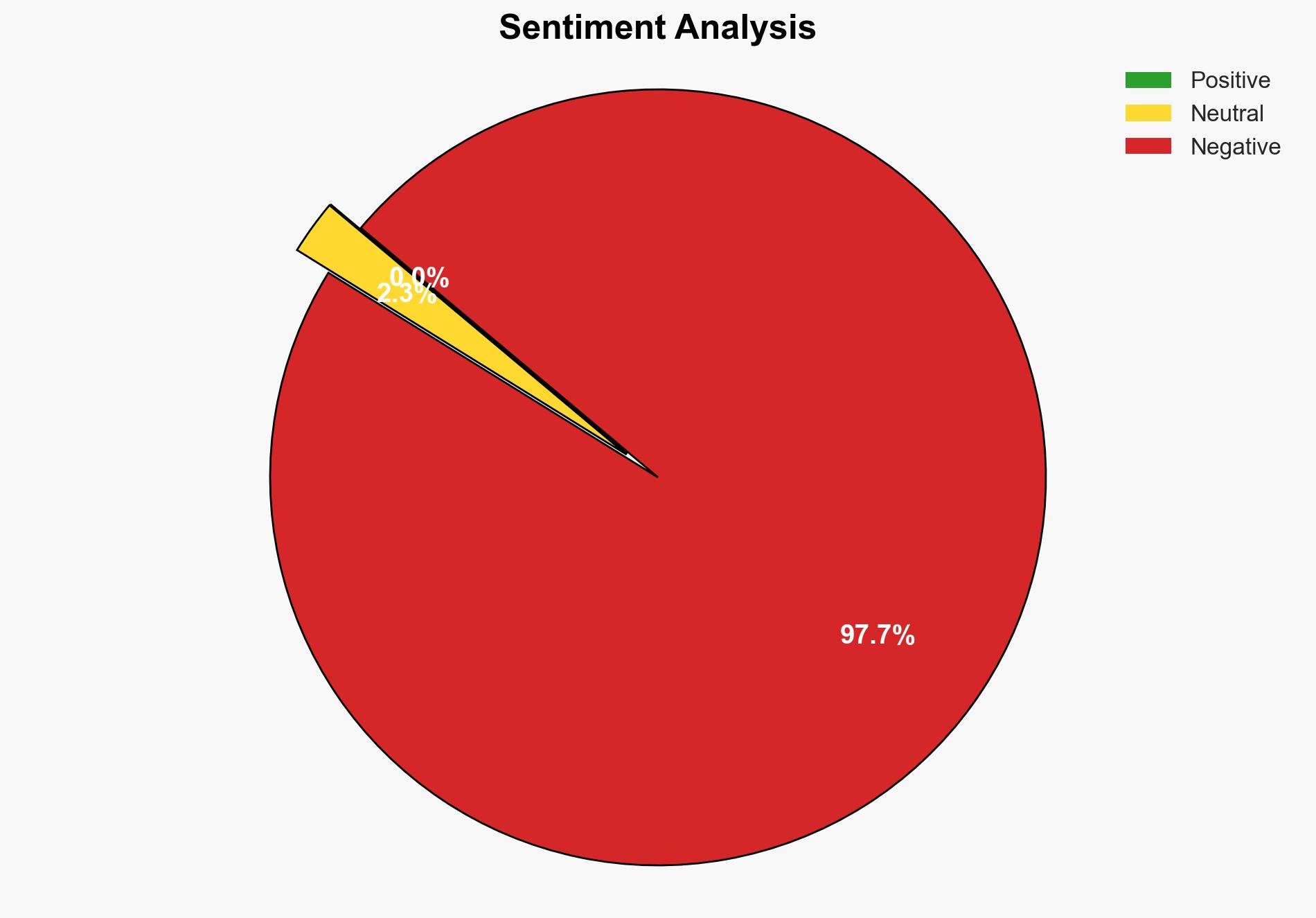

Hypothesis 2: The programme is a defensive maneuver to counteract potential market volatility and investor concerns about economic conditions, including the impact of geopolitical tensions and regulatory changes.

Hypothesis 1 is more likely given the detailed reporting of the programme’s progress, alignment with ING’s financial strategy, and the absence of immediate external threats necessitating a defensive posture.

3. Key Assumptions and Red Flags

Assumptions: The programme will proceed without significant market disruptions; ING’s financial health remains stable; investor sentiment remains positive.

Red Flags: Sudden changes in global economic conditions, unexpected regulatory changes, or significant geopolitical events could alter the programme’s effectiveness or intent.

Deception Indicators: Lack of transparency in reporting or discrepancies in financial disclosures could indicate underlying issues.

4. Implications and Strategic Risks

The programme could enhance ING’s market position but also poses risks if market conditions deteriorate. Potential threats include economic downturns, regulatory shifts, and geopolitical tensions, which could impact ING’s financial performance and ESG commitments.

5. Recommendations and Outlook

- Monitor global economic indicators and regulatory developments to anticipate potential impacts on the buyback programme.

- Engage with stakeholders to ensure transparency and maintain investor confidence.

- Best Scenario: Successful completion of the buyback programme, leading to increased shareholder value and strengthened market position.

- Worst Scenario: Economic downturn or regulatory changes disrupt the programme, leading to financial instability.

- Most-likely Scenario: The programme proceeds as planned, with minor adjustments in response to market conditions.

6. Key Individuals and Entities

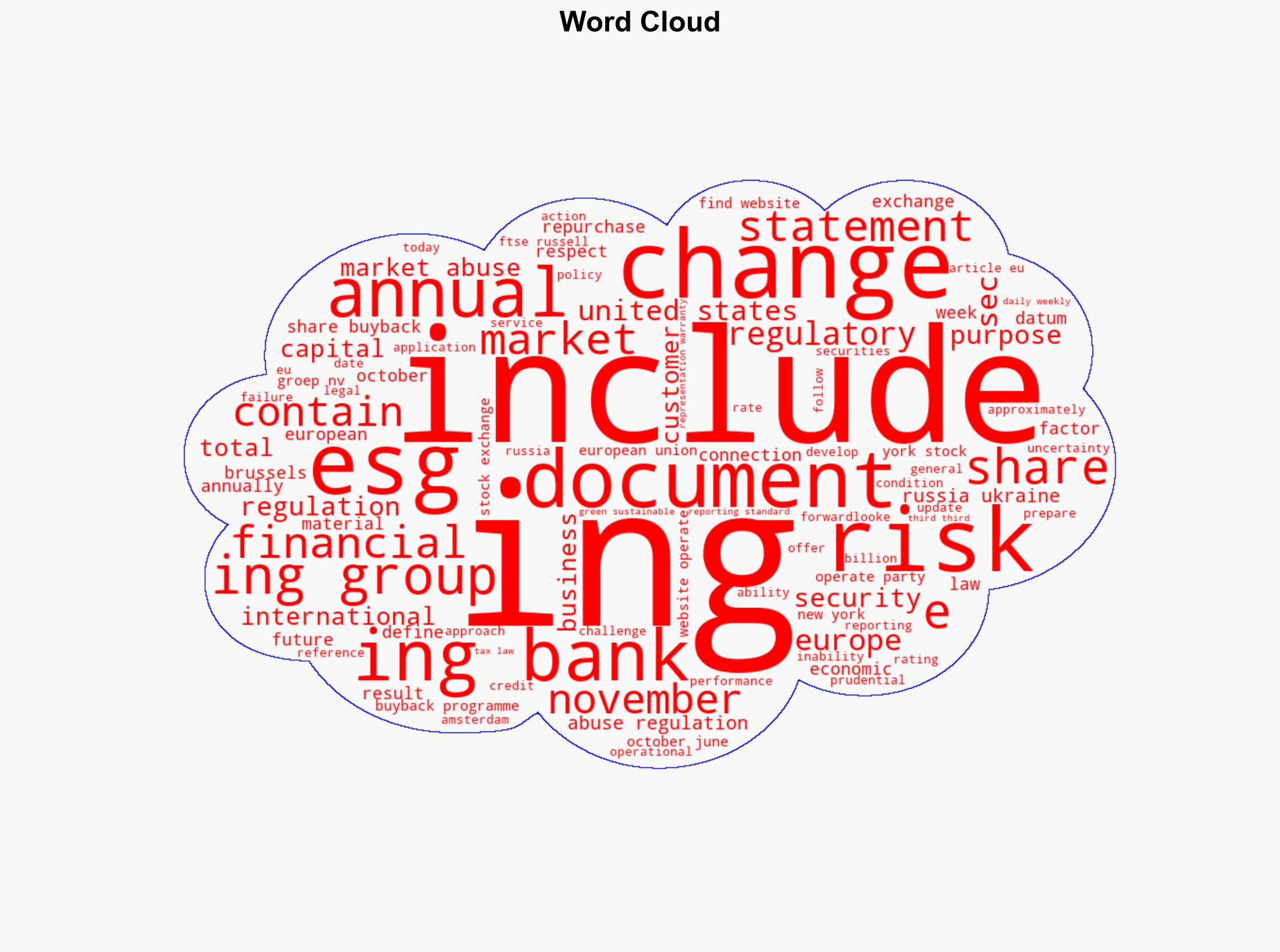

ING Group, ING Bank, MSCI, Sustainalytics, Euronext, STOXX, Morningstar, FTSE Russell.

7. Thematic Tags

Cybersecurity, Economic Strategy, Shareholder Value, Market Volatility, ESG Commitments, Financial Stability

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Support us