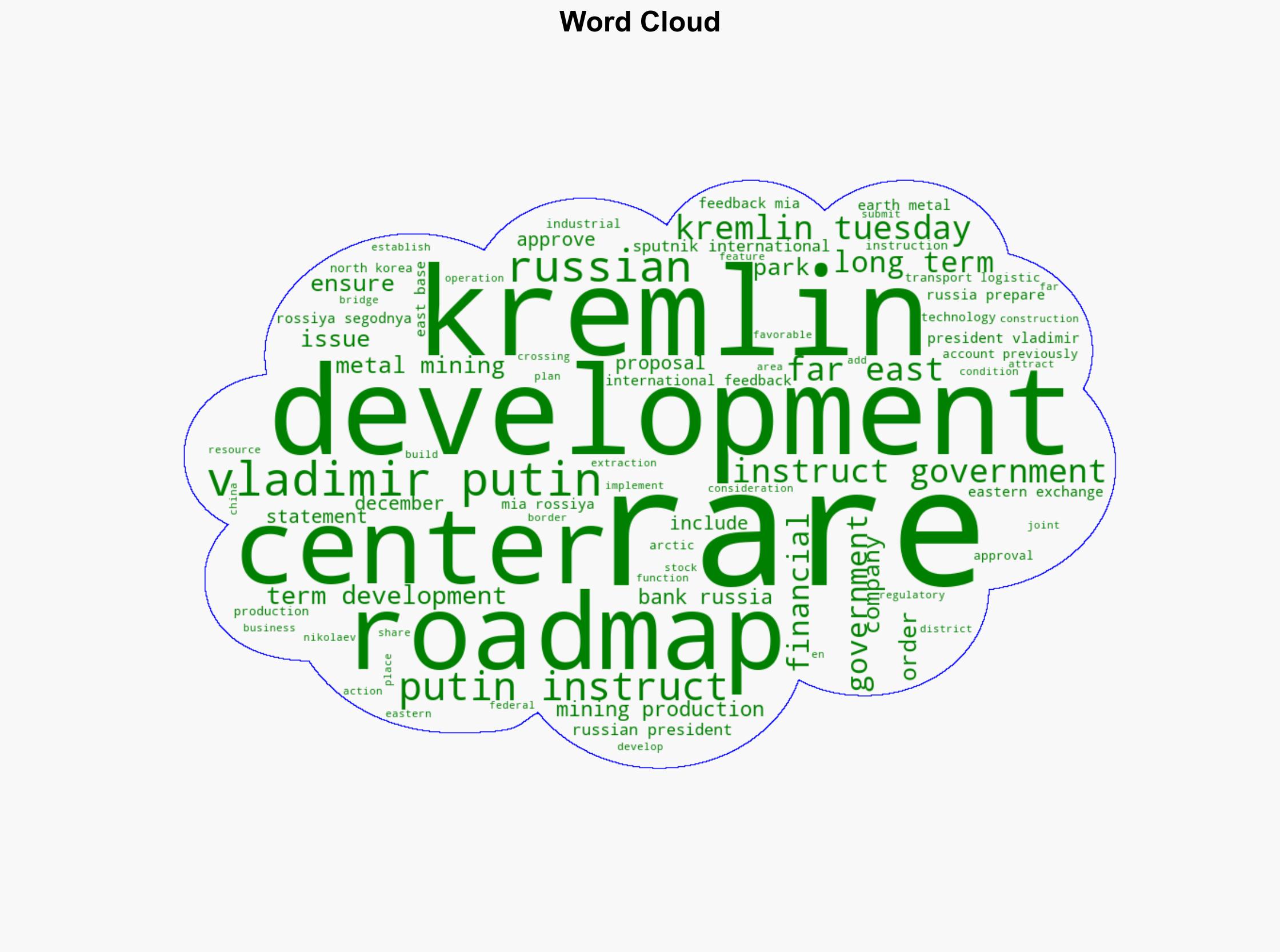

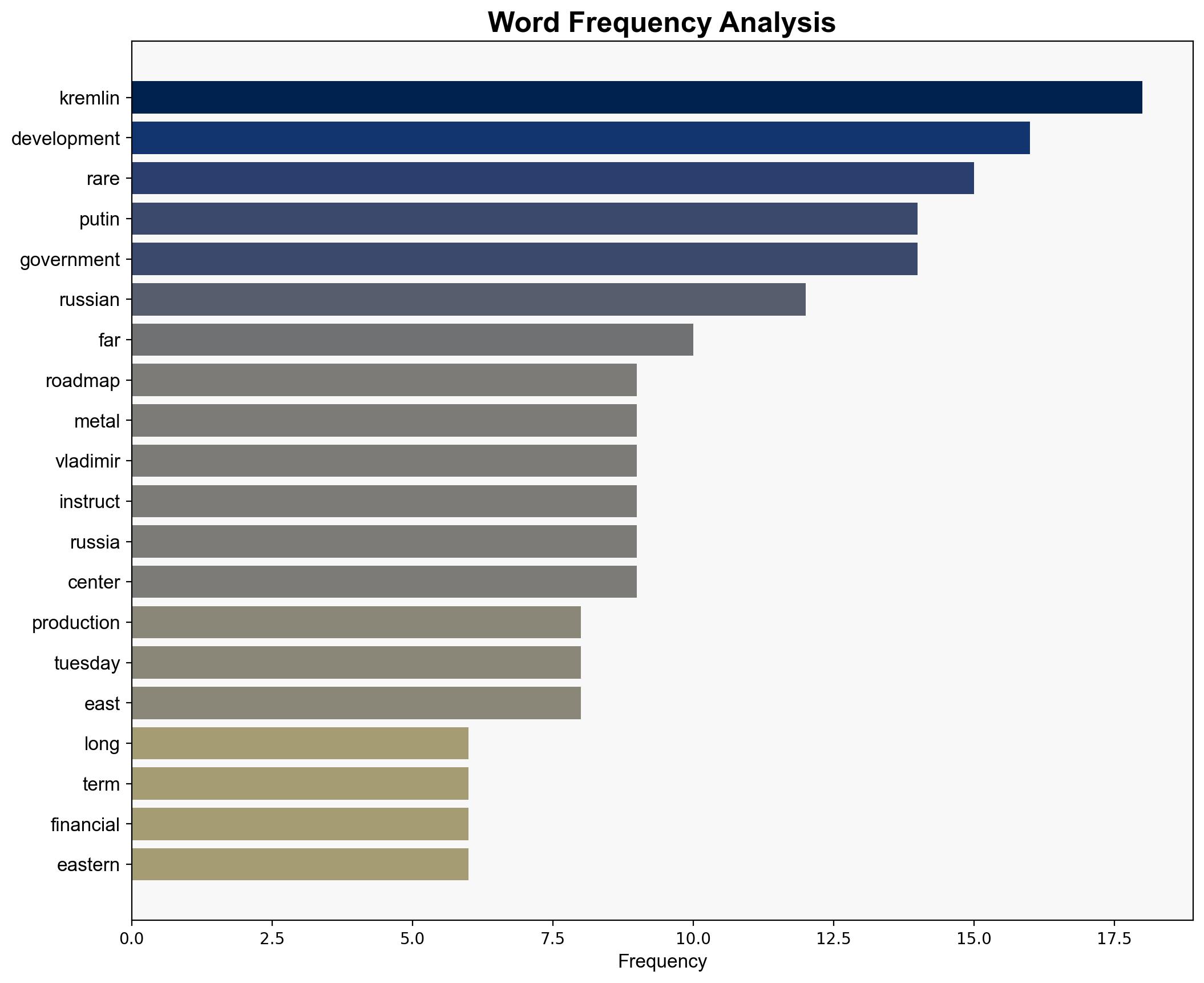

Putin Orders Approval of Roadmap for Development of Rare Metal Mining Production – Kremlin – Sputnikglobe.com

Published on: 2025-11-04

Intelligence Report: Putin Orders Approval of Roadmap for Development of Rare Metal Mining Production – Kremlin – Sputnikglobe.com

1. BLUF (Bottom Line Up Front)

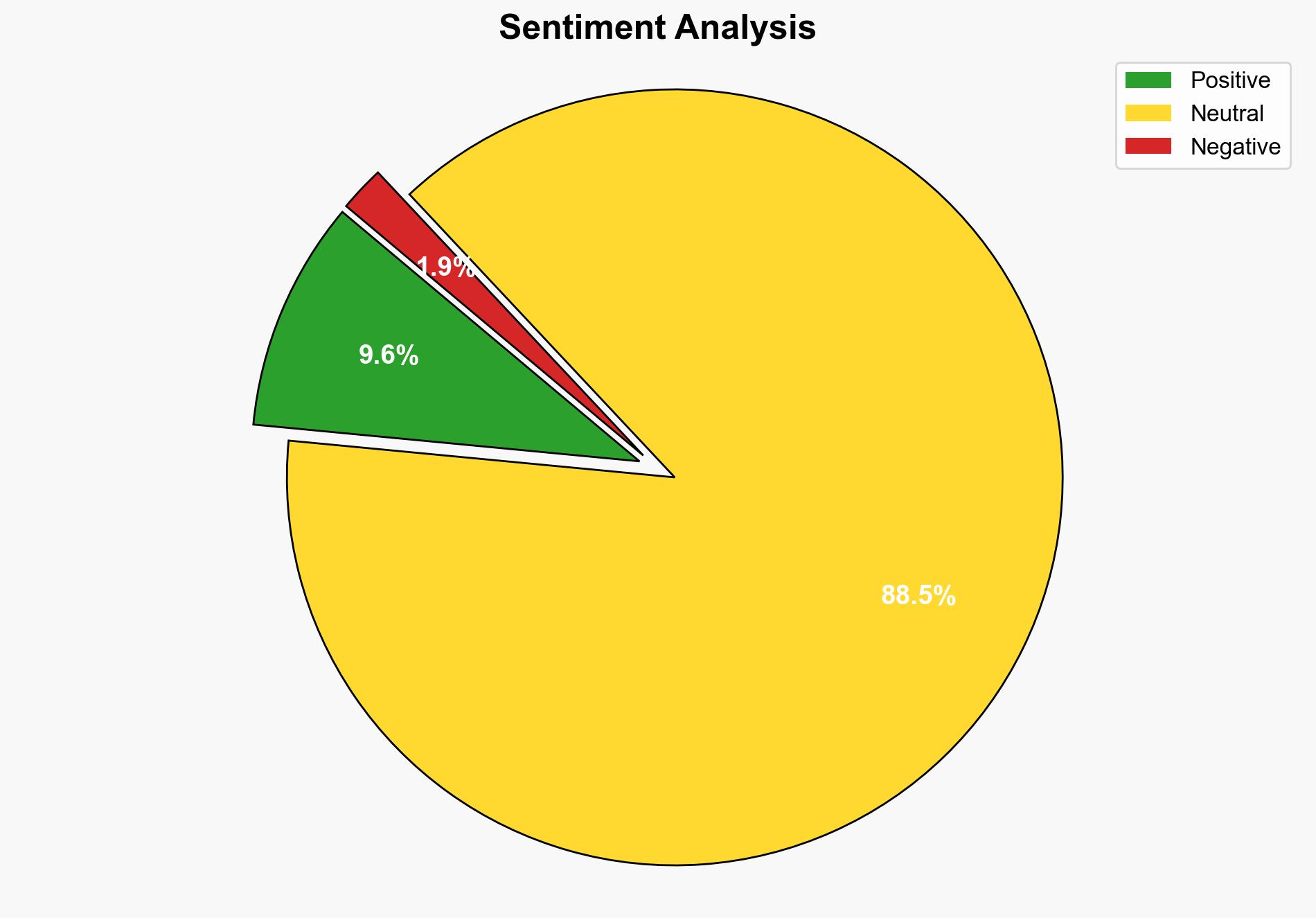

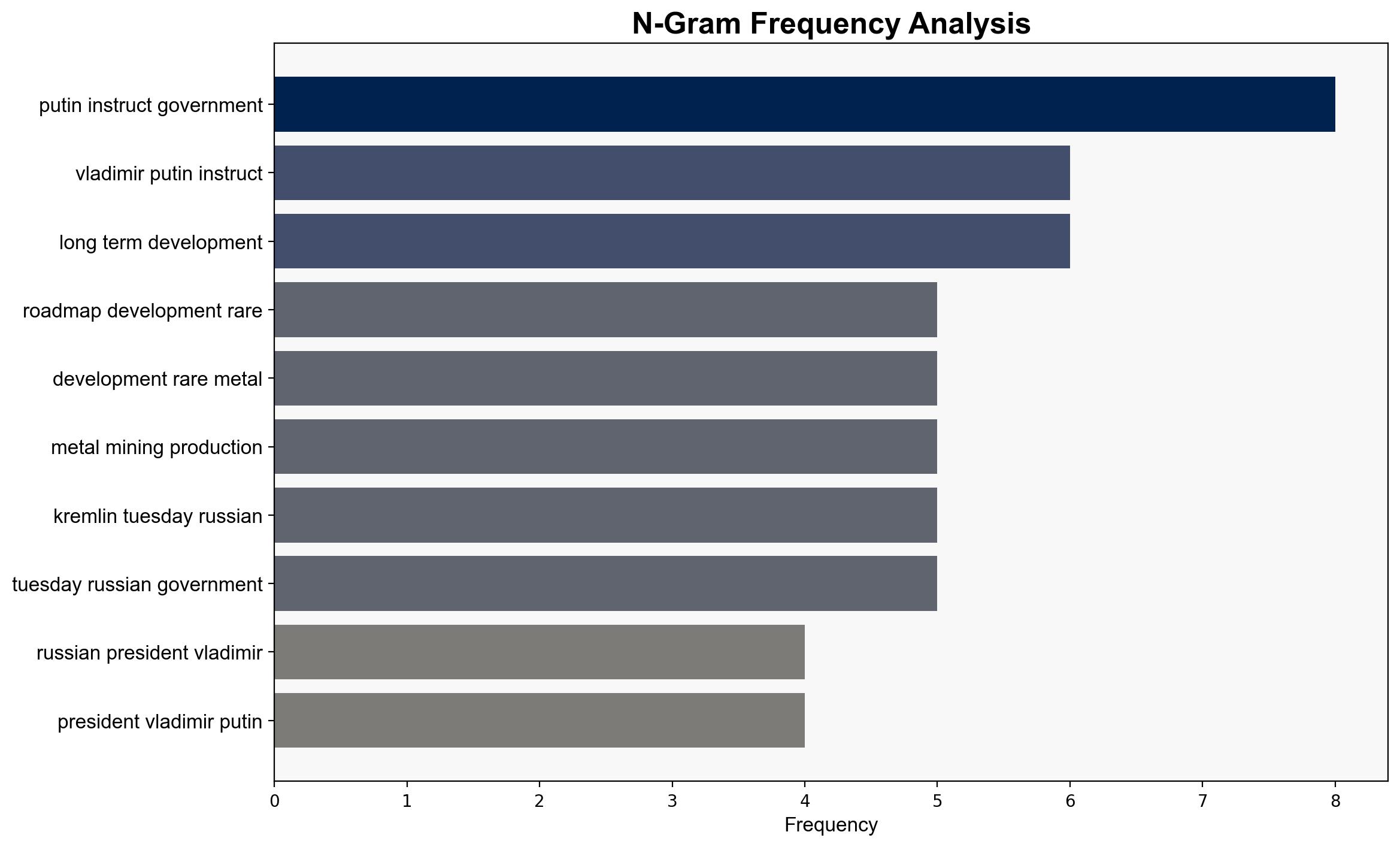

The strategic judgment is that Russia is likely positioning itself to secure a dominant role in the global rare earth metals market, with a high confidence level. The most supported hypothesis is that this initiative is primarily economically motivated, aiming to reduce dependency on foreign sources and enhance Russia’s geopolitical leverage. Recommended action includes monitoring the implementation of this roadmap and assessing its impact on global supply chains.

2. Competing Hypotheses

1. **Economic Motivation Hypothesis**: Russia aims to boost its economy by developing its rare earth metal mining sector, reducing dependency on imports, and increasing exports to strengthen its global economic position.

2. **Geopolitical Leverage Hypothesis**: The initiative is primarily driven by geopolitical motives, seeking to use rare earth metals as a strategic tool to influence other countries, particularly those reliant on these resources.

Using ACH 2.0, the Economic Motivation Hypothesis is better supported due to the detailed focus on infrastructure and financial center development, which aligns with economic growth objectives.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that Russia has the technical and financial capacity to develop the rare earth metal sector effectively. Another assumption is that global demand for these metals will remain strong.

– **Red Flags**: The lack of specific timelines and detailed implementation strategies could indicate potential overstatement of capabilities. The geopolitical hypothesis lacks direct evidence linking these developments to strategic military or diplomatic objectives.

4. Implications and Strategic Risks

– **Economic Risks**: Potential disruption to global supply chains if Russia becomes a dominant supplier.

– **Geopolitical Risks**: Increased tension with countries currently dominating the rare earth market, such as China.

– **Cyber Risks**: Potential for increased cyber espionage targeting Russian mining operations.

– **Psychological Risks**: Domestic and international perception of Russia’s intentions could lead to increased scrutiny and suspicion.

5. Recommendations and Outlook

- Monitor the progress of infrastructure and financial center developments in the Far East and Arctic regions.

- Engage with allies to diversify rare earth metal sources and reduce dependency on any single supplier.

- Scenario Projections:

- Best: Russia successfully develops its sector, leading to stable global prices.

- Worst: Geopolitical tensions escalate, leading to trade conflicts.

- Most Likely: Russia strengthens its market position, influencing global pricing and supply dynamics.

6. Key Individuals and Entities

– Vladimir Putin

– Russian Government

– Bank of Russia

7. Thematic Tags

national security threats, economic strategy, geopolitical influence, resource management