Q3 earnings, US-Iran tensions, and FII trends among key factors impacting D-St this week

Published on: 2026-01-18

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Q3 earnings US-Iran conflict FII action among 9 factors to move D-St this week

1. BLUF (Bottom Line Up Front)

The current geopolitical tensions between the US and Iran, combined with Q3 earnings announcements, are expected to create volatility in the markets this week. The most likely hypothesis is that market sentiment will remain weak due to geopolitical risks and bearish technical indicators. This will affect investors, financial institutions, and policymakers. Overall confidence in this judgment is moderate.

2. Competing Hypotheses

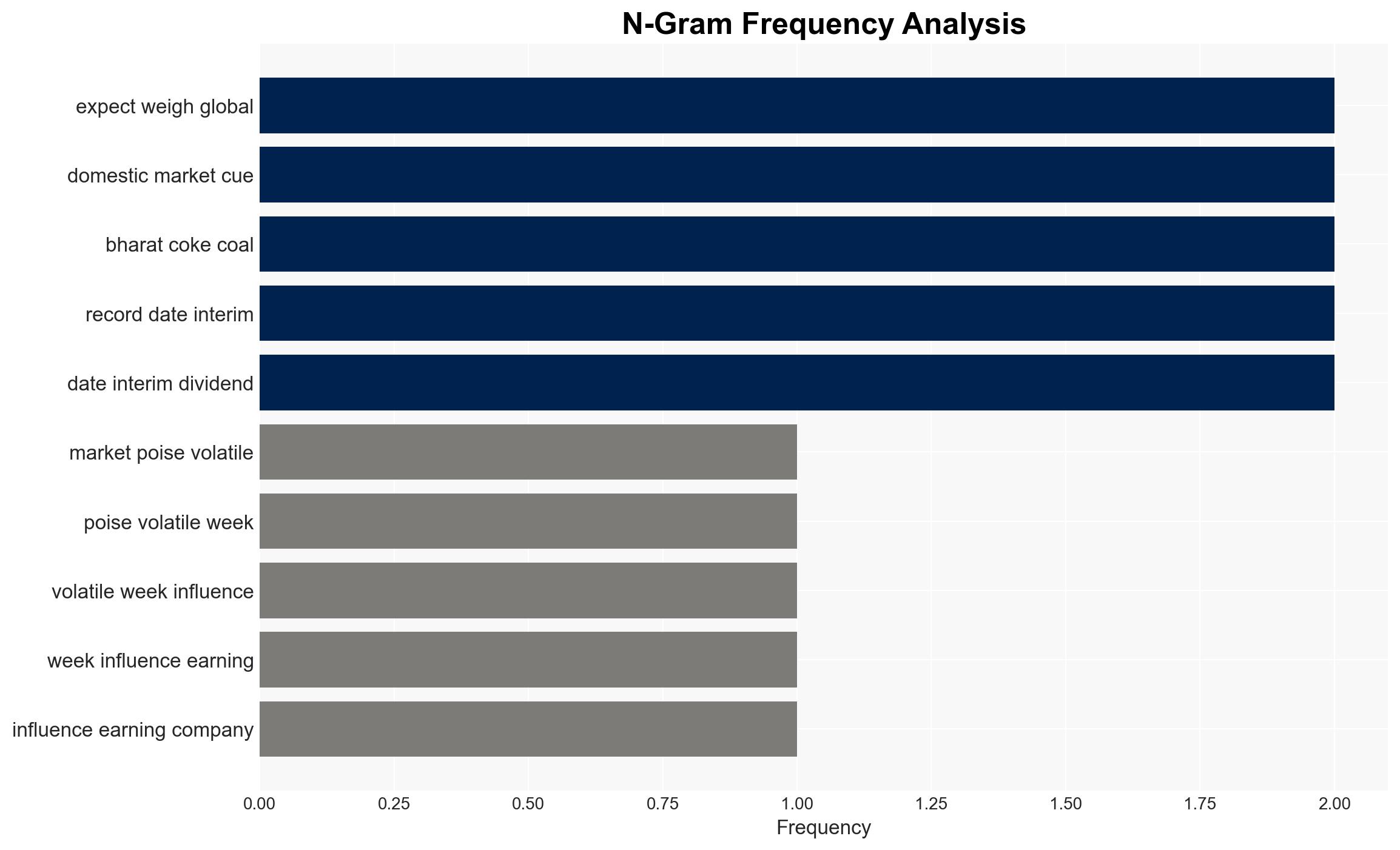

- Hypothesis A: Market volatility will increase due to heightened US-Iran tensions and weak technical indicators. Supporting evidence includes the deployment of US military assets to the Middle East and bearish market signals. Key uncertainties involve the potential for diplomatic resolutions or de-escalation.

- Hypothesis B: Markets will stabilize as Q3 earnings provide positive surprises, offsetting geopolitical concerns. This is supported by the potential for strong earnings from key companies. Contradicting evidence includes ongoing FII outflows and geopolitical risks.

- Assessment: Hypothesis A is currently better supported due to the immediate impact of geopolitical tensions and technical market indicators. Indicators that could shift this judgment include significant positive earnings reports or de-escalation in US-Iran relations.

3. Key Assumptions and Red Flags

- Assumptions: The US-Iran tensions will not de-escalate rapidly; Q3 earnings will be mixed; FII outflows will continue; technical indicators will remain bearish; geopolitical risks will outweigh positive earnings surprises.

- Information Gaps: Specific details on US-Iran diplomatic engagements; comprehensive data on FII flows; complete Q3 earnings results.

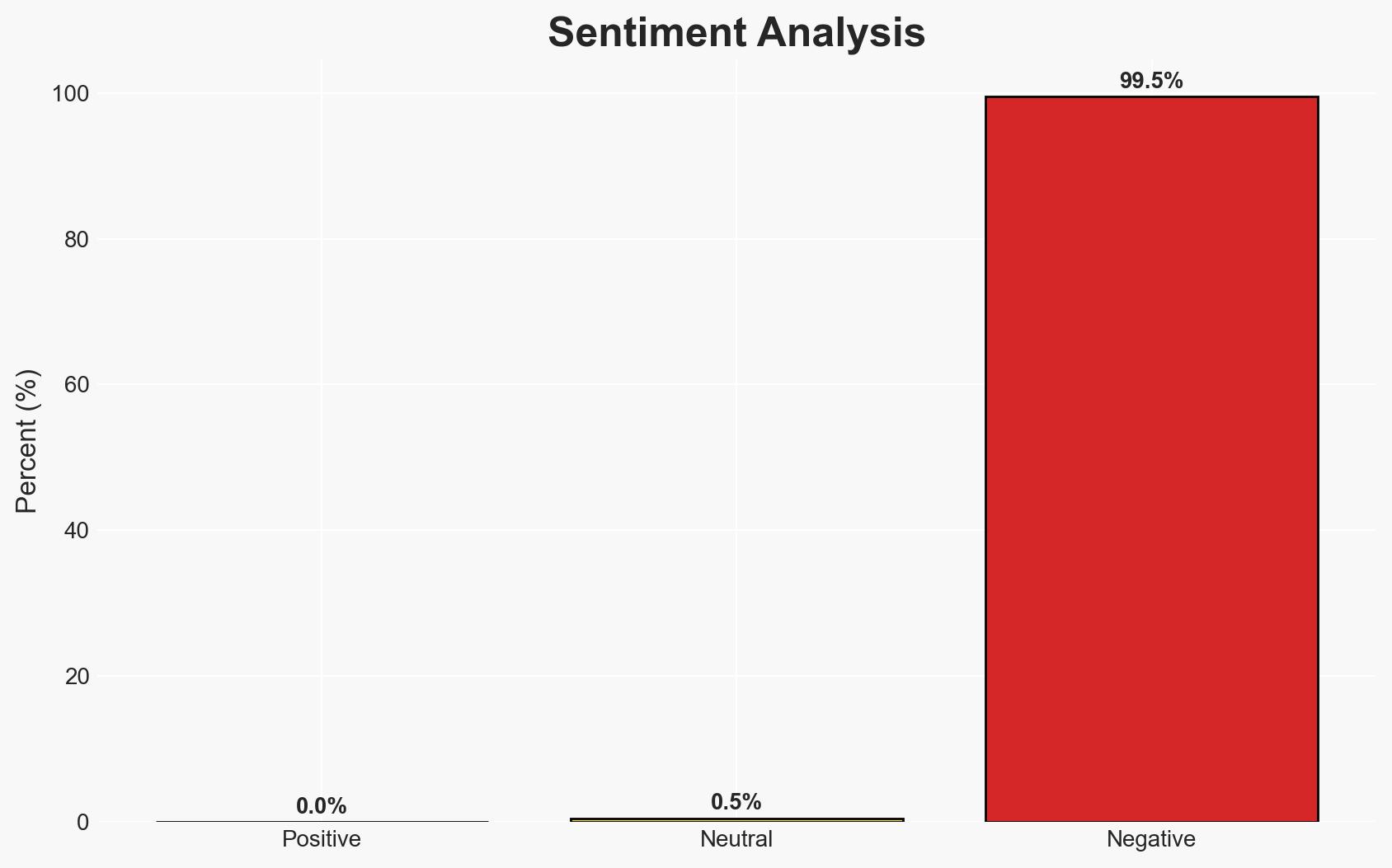

- Bias & Deception Risks: Potential confirmation bias in interpreting technical indicators; source bias from media reports on US-Iran tensions; possible manipulation of market sentiment through misinformation.

4. Implications and Strategic Risks

The interplay between geopolitical tensions and market performance could lead to prolonged instability, affecting investor confidence and economic forecasts.

- Political / Geopolitical: Escalation in US-Iran tensions could lead to broader regional instability and impact global diplomatic relations.

- Security / Counter-Terrorism: Increased military presence in the Middle East may heighten regional security risks and potential for conflict.

- Cyber / Information Space: Potential for cyber operations targeting financial institutions or misinformation campaigns affecting market sentiment.

- Economic / Social: Market volatility could impact economic stability and investor confidence, with potential social unrest in affected regions.

5. Recommendations and Outlook

- Immediate Actions (0–30 days): Monitor geopolitical developments closely; enhance market surveillance for unusual trading patterns; engage in diplomatic channels to reduce tensions.

- Medium-Term Posture (1–12 months): Develop resilience measures for financial markets; strengthen partnerships with allies to manage geopolitical risks; invest in cyber defense capabilities.

- Scenario Outlook: Best: De-escalation in US-Iran tensions leads to market recovery. Worst: Escalation results in regional conflict and market crash. Most-Likely: Continued volatility with mixed earnings results and persistent geopolitical risks.

6. Key Individuals and Entities

- Not clearly identifiable from open sources in this snippet.

7. Thematic Tags

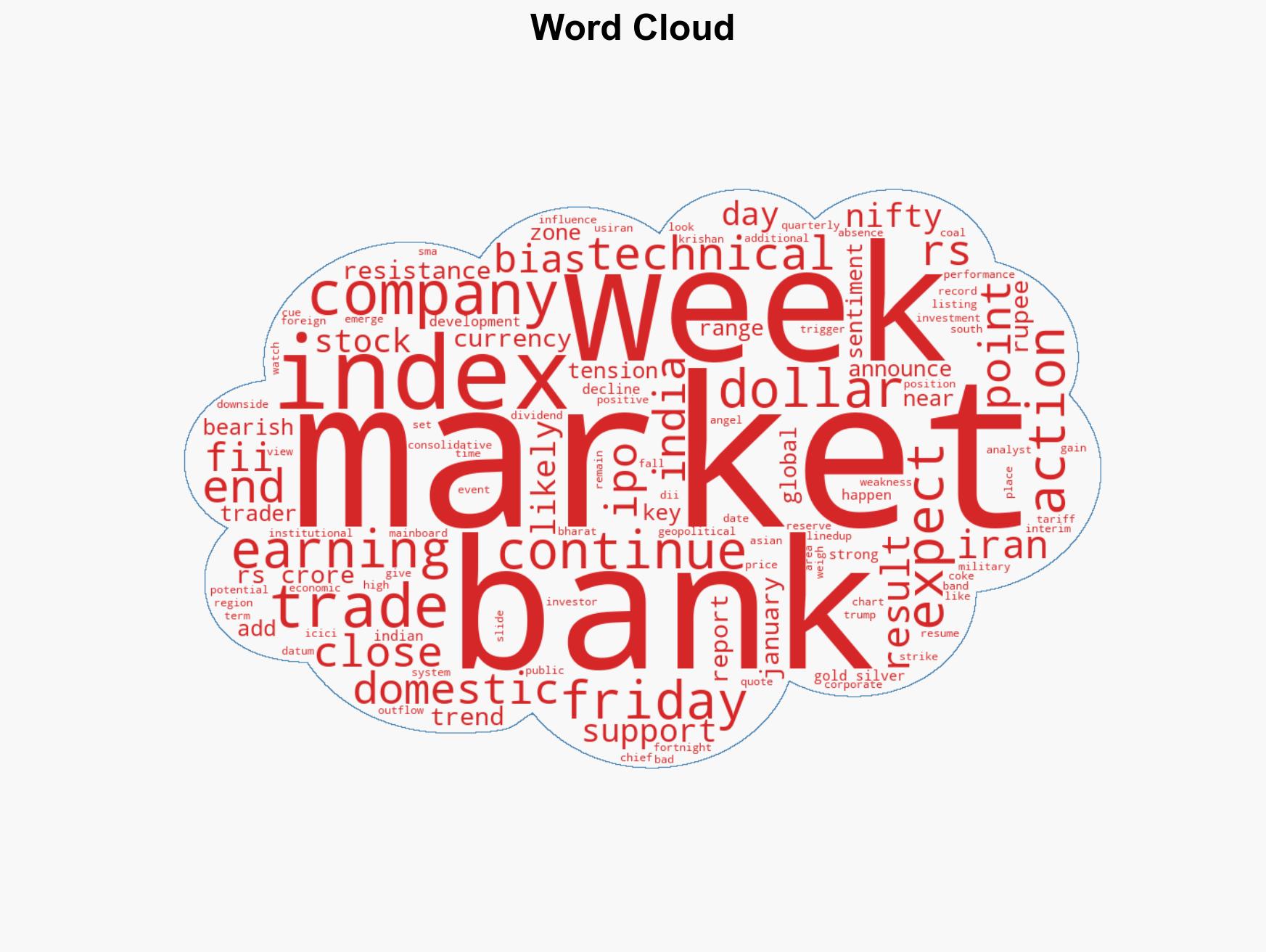

regional conflicts, geopolitical tensions, market volatility, Q3 earnings, US-Iran relations, financial markets, FII outflows, technical analysis

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

- Cognitive Bias Stress Test: Structured challenge to expose and correct biases.

- Narrative Pattern Analysis: Deconstruct and track propaganda or influence narratives.

Explore more:

Regional Conflicts Briefs ·

Daily Summary ·

Support us