Quants Rally Draws Attention As Bulls Eye 103 Liquidity Zone – BeInCrypto

Published on: 2025-09-28

Intelligence Report: Quants Rally Draws Attention As Bulls Eye 103 Liquidity Zone – BeInCrypto

1. BLUF (Bottom Line Up Front)

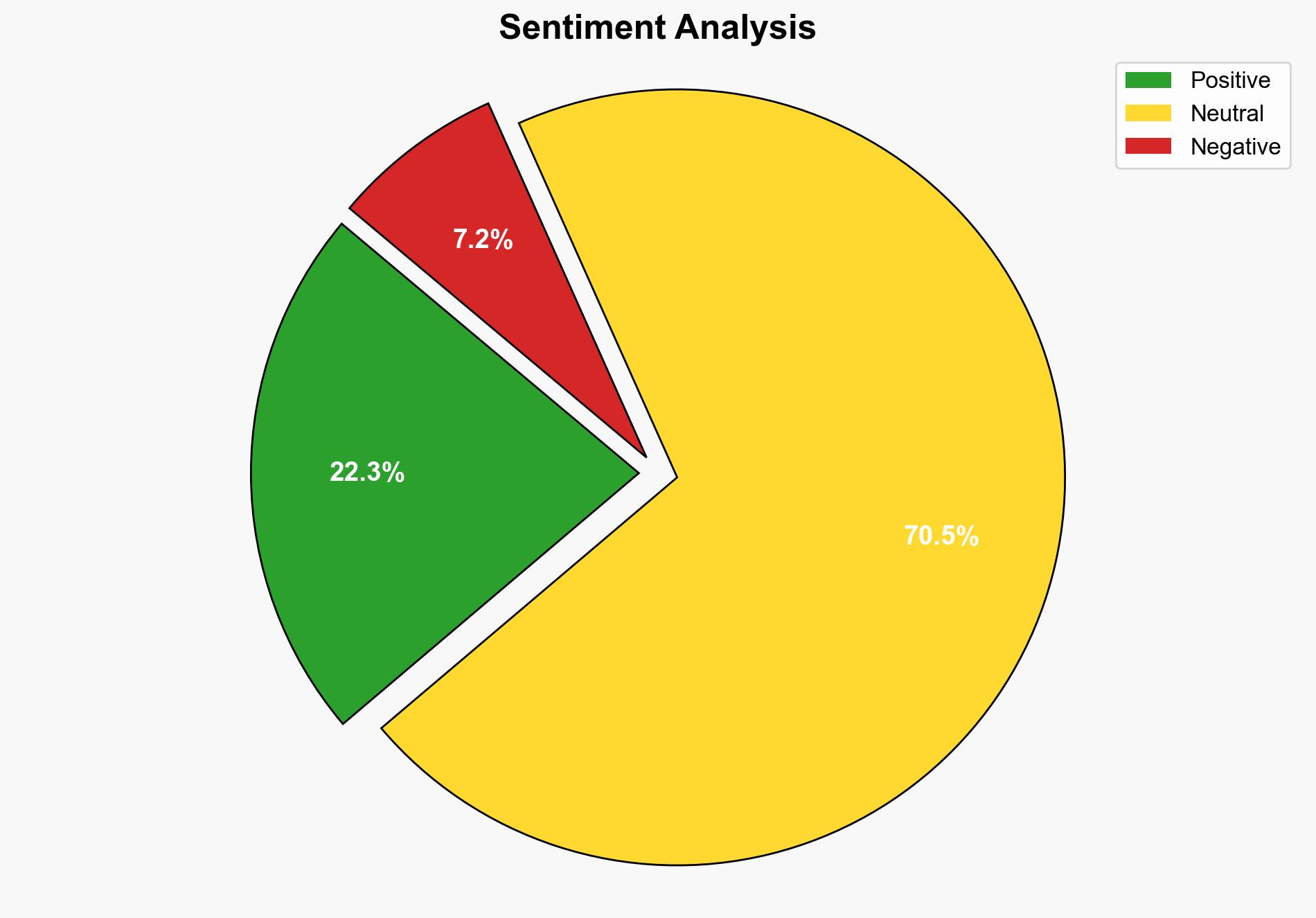

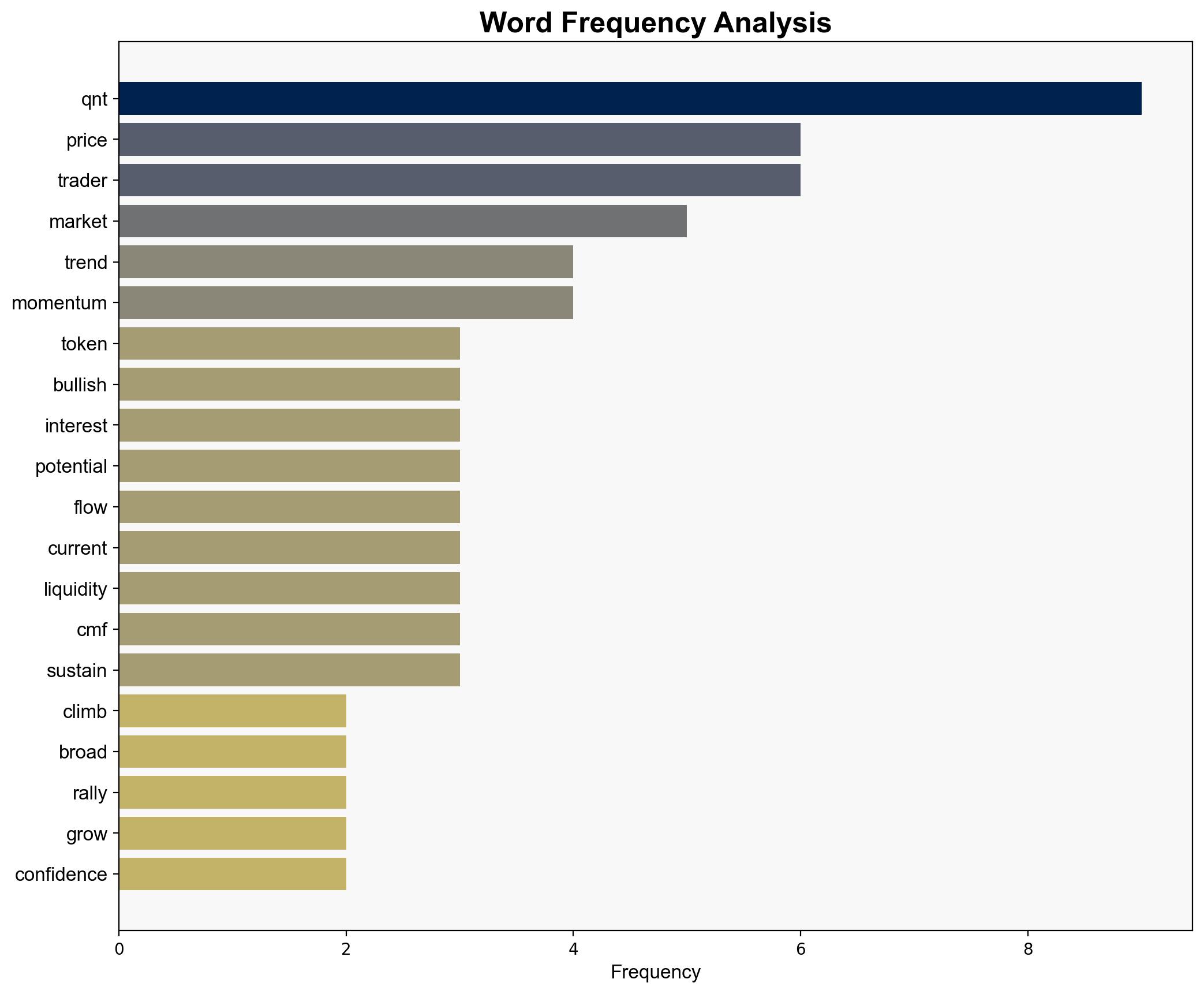

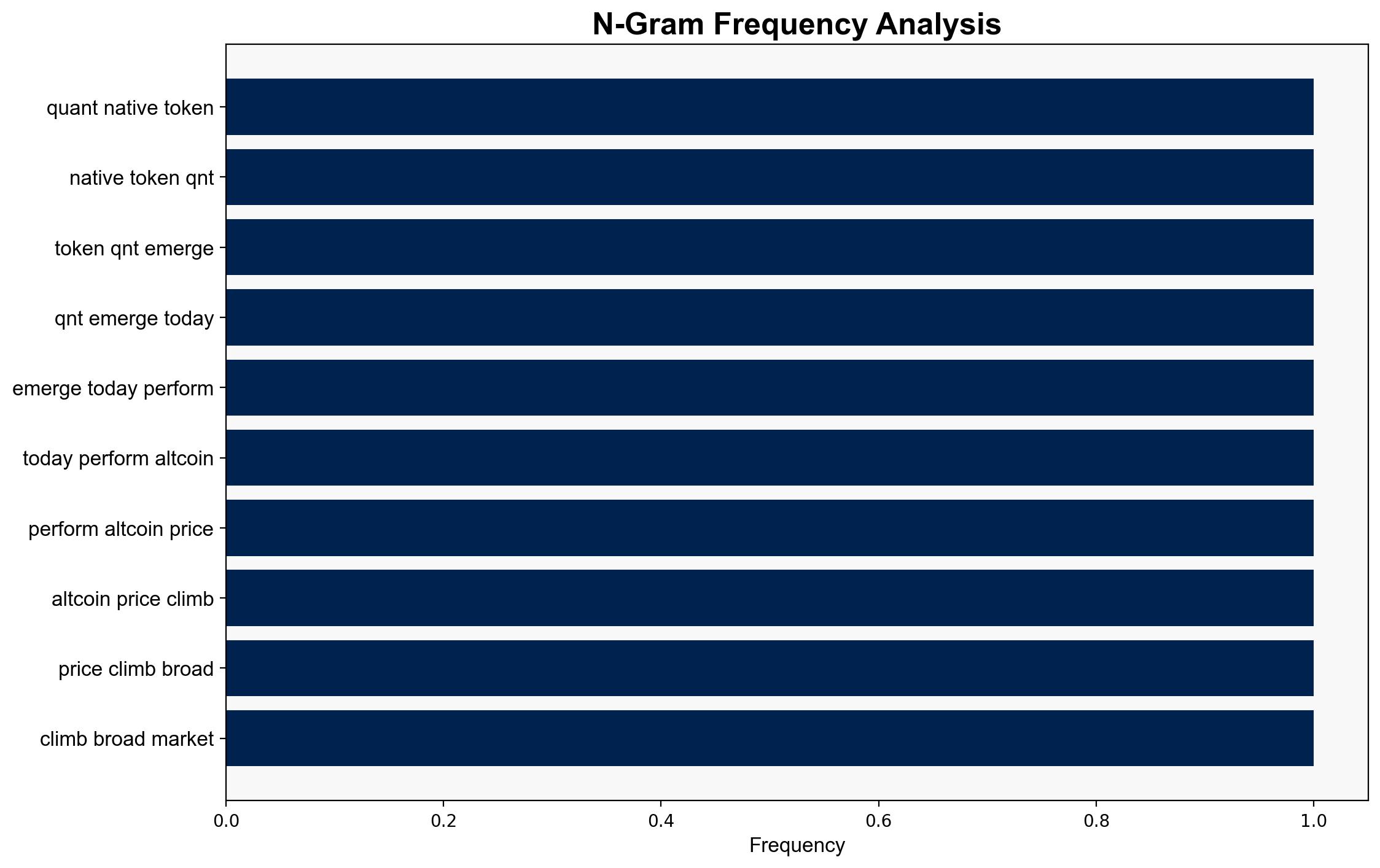

The most supported hypothesis is that the Quant (QNT) token’s recent rally is driven by increased trader confidence and strategic positioning around key liquidity zones. This is supported by a rise in open interest and bullish momentum indicators. Confidence level: Moderate. Recommended action: Monitor liquidity clusters and trader sentiment to anticipate potential market shifts.

2. Competing Hypotheses

Hypothesis 1: The QNT rally is primarily driven by genuine market confidence and increased demand, as indicated by rising open interest and bullish momentum indicators like the Chaikin Money Flow (CMF).

Hypothesis 2: The rally is a result of speculative trading and manipulation around liquidity zones, with traders exploiting potential squeeze setups, which may not reflect genuine market strength.

3. Key Assumptions and Red Flags

Assumptions:

– Hypothesis 1 assumes that the increase in open interest and CMF accurately reflects genuine trader confidence and market demand.

– Hypothesis 2 assumes that traders are primarily motivated by short-term gains and are exploiting liquidity zones for speculative purposes.

Red Flags:

– Lack of broader market support could undermine the sustainability of the rally.

– Potential over-reliance on technical indicators without considering broader economic factors.

4. Implications and Strategic Risks

– If Hypothesis 1 holds, sustained demand could lead to a prolonged uptrend, attracting further investment and solidifying QNT’s market position.

– If Hypothesis 2 is correct, a sudden reversal could occur if speculative positions are unwound, leading to increased volatility and potential market destabilization.

– Broader market weakness could exacerbate risks, leading to a rapid decline in QNT’s value.

5. Recommendations and Outlook

- Monitor liquidity clusters and trader sentiment closely to anticipate potential market shifts.

- Scenario-based projections:

- Best Case: Sustained rally with increased market confidence and broader market recovery.

- Worst Case: Rapid unwinding of speculative positions leading to significant price correction.

- Most Likely: Continued volatility with potential short-term gains followed by stabilization.

6. Key Individuals and Entities

– Harsh Notariyas (mentioned as an editor in the source text).

7. Thematic Tags

national security threats, cybersecurity, counter-terrorism, regional focus